The Pitch

As more companies use AI models to understand their markets, customers, and competitors, they will need increasingly vast amounts of recent data. One obvious source for this data is the internet. But to use that data, companies need IP proxy networks (IPPNs) to get around bot-blockers, and they need a software interface to gather, aggregate, and format the data. This is not an easy task, but it is also well worth the money for many companies. This is why Alarum Technologies (NASDAQ:ALAR), an Israeli microcap, has been growing revenue at 75% CAGR for the last five years. Today, Alarum has little debt, a growing cash pile, and is finally profitable.

I heard about Alarum from Shareholdersunite and bought shares at $28. Below, I outline my investment thesis. I think investors still underestimate the competitive advantages held by Alarum and the two other leaders in the IPPN space, and that these advantages will make their growth more sustainable than people think. Alarum has been growing by 75% per year, but it’s priced as if growth is going to immediately slow to 25%. I think Alarum can beat these expectations and drive its share price higher.

Industry: two large incumbents

Recent SeekingAlpha articles go over the business in more detail, so I’ll assume that readers are basically familiar with the business model. Alarum operates in one market and is expanding into a second adjacent one. The first, for IPPNs, provides businesses with IP proxies so that they can anonymously transmit and scrape data from the web. It has a SAM of several hundred million dollars. The second, the automated data collection and labeling (ADCL) market, provides an add-on service to Alarum’s IPPN business. After Alarum helps companies scrape data, they are now beginning to provide tools to aggregate, process, and analyze it. This industry has a TAM of $2 billion and is projected to grow at almost 30% per year until 2030, according to a GrandView Research report cited by Alarum management.

In the first market, I estimate that Alarum’s main subsidiary, NetNut, has a mid-single-digit (i.e. around 5%) market share. According to a SeekingAlpha article from earlier this year, NetNut had only around 1% market share in 2018. But since its main competitors, namely OxyLabs, Bright Data, and SmartProxy, are all private, it is difficult to estimate how this has changed.

There are several ways to make estimates. According to industry reviews, the two main players are Bright Data and OxyLabs, both of which are listed as having 201-500 employees on LinkedIn. NetNut, by contrast, has 11-50 employees. According to a 2022 interview, Bright Data had over $100 million in revenue and over 15,000 customers in 2021. By contrast, today NetNut has around 1,000 customers. On a recent earnings call, the Alarum CEO said that Bright Data and OxyLabs are both “doing more than $100 million a year” in sales. Based on this admittedly very fragmentary data, here is my estimate for the current market share distribution:

|

Bright Data |

OxyLabs |

NetNut |

Other |

Total |

|

|

Employees |

~350 |

~250 |

~40 |

~175 |

~815 |

|

2024 Revenue |

~$200m. |

~$150m. |

$35m. |

~$140m. |

$675m. |

|

Market Share |

40% |

30% |

6% |

24% |

100% |

This table implies an overall market size of around $600 million, a number which fits with the fact that one of its main components – the residential IPPN market – is currently worth $115 million according to Valuates. It also fits with the relative number of employees: Bright Data has about 8x the number of employees and 8x the amount of revenue as NetNut. The $200 million revenue figure for Bright Data also suggests a plausible growth rate of 26% CAGR since 2021, somewhat faster than estimated growth for the overall market (estimated to be in the low double digits). There are probably about a dozen smaller players dividing up the remaining 24% share.

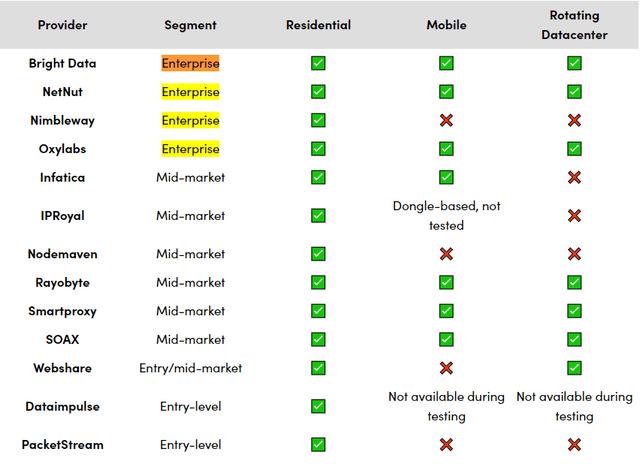

A similar picture emerges from the ProxyWay 2024 report, which helpfully divides up the market into its component segments (residential, mobile, and data center proxies, each divided between enterprise and mid-market) and evaluates competitors within each one.

IPPN market (proxyway)

As the table shows, only Bright Data, OxyLabs, and NetNut provide a full range of proxy services in the enterprise segment. They rate OxyLabs the best, with Bright Data as #2 and NetNut as #3. The rest of the report makes clear that these are the three market leaders, although Smartproxy has also been a longstanding and successful player. OxyLabs and NetNut had the highest proxy success rates, whereas Bright Data was a surprising underperformer. The report suggests that Bright Data’s “attention has moved on to other things.” I don’t feel equipped to provide a detailed breakdown of the segments of this industry, but the general picture is of three key leaders and around ten smaller new entrants. It may also be possible that the market leaders are not competing to the degree they focus on different market segments.

In short, NetNut is the #3 player in the IPPN industry. Its share remains small, but it is clearly the largest and most successful of the challengers. It is one of only four or five main players with a full range of products, and its performance is already comparable to that of its larger competitors.

Competition Advantages: scale, reliability, IP

I think that NetNut’s competitive position is stronger than most analysts are currently giving it credit for. Competition has been increasing in the last two years as new companies enter the industry, according to the ProxyWay report. And from the report, it appears that prices per GB of data are fairly even across the industry. Since most of Alarum’s customers have monthly subscriptions, I think that switching costs between competitors are probably quite low. And yet, this has not led to pricing pressure within the industry. Why? While it may not be that difficult to set up an IPPN company (NetNut was able to get off the ground with less than $1 million in revenue), I believe that there are increasing benefits to scale that have given Bright Data, OxyLabs, and NetNut first-mover advantages.

According to Competition Demystified, there are two key types of evidence for the presence of competitive advantages in an industry: market share stability and high returns on invested capital. For the last five years, Bright Data and OxyLabs have kept their top spots, according to ProxyWay, even if there has been some movement among the smaller players. Since they are both private, it is impossible to estimate ROICs for either. But if Alarum earns the expected $1.77 per share in 2024, its ROIC will be over 30%. Alarum’s gross margin is also almost 80%. This is strong evidence that, even if they don’t have much pricing power, they are succeeding in earning economic profits.

Let’s take a look at what Alarum CEO Shachar Daniel has said in recent quarters about the company’s competitive position. For starters, the NRR is around 150, indicating strong customer retention. And informally, he’s reported that churn is about half what it was two years ago. Midway through last year, he started speaking of the company’s competitive advantage having “crystallized.” Here’s the explanation:

“I think our biggest competitive advantage in this space is the fact that we have a very solid network. We are — we have a global coverage, more than 1,000 locations. And it gives our customers a very good success rate when they are trying to collect data. And this is the most — besides of the features and the support and everything, this is what makes our customers to be very satisfied. This is what increases the retention. This is what makes our brand to be one of the best brands in this space, and this is our biggest competitive advantage about most of the players in this space.” (2023 Q1 Call)

“in our space, customers…are very sensitive. So to the performance, to the speed, to the downtime, et cetera., so the size of our network, the stability of our network, allowing us now to work with big customers with huge demand, and that’s what made us to be a leader in this space together with additional two or three companies.” (2023 Q3 Call)

“I am proud to say that today our network and infrastructure are one of the most experienced and reliable in the market, serving hundreds of customers. In recent months, we redesigned our scalable infrastructure in order to meet growing demand and continue to scale as we expand with our partners and customers. We recently announced that our network doubled its usage volume within one month with more than 36 billion requests [processed] [in?] the latest spike in usage.” (2023 Q3 Call)

“…I can tell you that the barriers, the entry barriers for our market and I see it in the real life when the new players are trying to come in is the fact that beside of our technology and software, one of our major intellectual property is the network. This network, it took us — you can see also in the results of NetNut, we lost money in the beginning, not that we lost, we invested a lot to bring talents, experts in DevOps which are very hard to hire and we built a global network with thousands of servers that can serve petas of data, which is a huge amount of data in — with concurrent customers to give a full global — to provide a full global coverage with high success rate, high performance, zero downtime. It’s something that it takes years and a lot of know-how to achieve and to build. And the customers, by the way, are very sensitive to these KPIs, as I just described, the performance to the global coverage to the downtown to the support. So I think the best protection is the fact that it’s a know-how that takes years to build.” (2023 Q4 Call)

Customers care about reliability and speed, and both of these are improved by having a larger, more robust network. According to company websites, NetNut already has the same number of IP addresses (around 100 million) as Bright Data and OxyLabs, giving it the scale to provide this consistency.

In addition to the benefits of experience and scale, there are two other factors which make Alarum’s network special compared with those of its competitors. First, it is vertically integrated with its IP provider DiviNetworks, which buys IP addresses directly from ISPs, rather than the P2P networks usually used. According to a TechRadar review, this gives NetNut “a major advantage.” According to a more extended discussion from the MultiLogin’s blog:

While most proxy providers use peer-to-peer (P2P) networks to source their residential IPs, NetNut works with a company called DiviNetworks to acquire them directly from over 100 ISPs globally. Regular proxies are dependent on normal people’s internet connections, which might be sluggish and unreliable. NetNut solves this problem by connecting directly to internet service providers (ISPs). This direct connection is like having your own private internet highway, guaranteeing that everything operates swiftly and efficiently, even when dealing with a large workload… Essentially, you get the stability and performance of data center IPs combined with the resilience and stealth of residential IPs.

The second feature increasing the speed and reliability of NetNut’s network is their patented reflector technology. This is described in the 2023 20F filing:

“Our reflection technology is patent protected in the United States…Unlike conventional anonymous proxies, where proxy service client requests would be rerouted through an intermediate proxy device, thus potentially slowing down the connection and exposing a device’s local network to security risks, NetNut’s “reflector” method achieves the same end-result without such detour. It cleverly uses the IP address of an intermediate device to initiate the connection, and after this initial step, client requests are sent directly to the target server. This method retains the benefits of using a proxy, while masking the original IP address and avoiding the usual bottleneck of channeling all traffic through a third-party device. The result is a secured, faster, more efficient, and streamlined method of connecting to the internet, with all the advantages of a proxy but none of the traditional drawbacks.”

The results of these advantages are beginning to show up in the data. TrustPilot reviews for NetNut and its competitors are all around 4.5 stars. ProxyWay ratings still rank OxyLabs, Bright Data, and SmartProxy ahead of NetNut, but hundreds of customer reviews on G2 rank NetNut first.

While I lack the technical expertise required to evaluate these claims in detail, I think the quantitative data shows that the leading IPPN providers do have competitive advantages. There are clear economies of scale in this industry, and they have enabled the first movers to maintain their dominance over the last five years. NetNut’s successful (it seems) challenge to Bright Data and OxyLabs shows that their dominance is not insurmountable, but I don’t think any competitor can easily replicate the IPPN infrastructure that NetNut has built up over the last decade. Since Alarum has a favorable 12% tax rate in Israel if it invests a certain percentage of revenue in R&D, I think they will make the investments required to sustain their competitive advantage. This is why Alarum is so profitable, despite its relatively competitive pricing and the rise of new entrants to the industry in the last two years.

Management: founders with skin in the game

Alarum is led by a highly competent team of executives with significant skin in the game. According to the 2023 20F, last year’s executive compensation was around $2.5 million, a level I find reasonable given the company’s size. The CEO, Shachar Daniel, is one of the company’s cofounders, and has served as CEO of 2016. He owns 2.9 million shares, worth around 20x his annual salary. Together, senior management owns 10.6% of the company. This gives me confidence that Daniel and his team are invested in Alarum’s success.

I was initially very skeptical of Alarum’s seemingly abrupt transitions from cybersecurity to residential proxies to enterprise IPPNs, but after hearing more from Daniel in recent earnings calls and interviews, I’ve become convinced that this is a considered strategy. As Daniel explained in a recent YouTube interview, their plan was to test many products and then narrow the lineup down to the winners. This is exactly what they have done over the last 18 months, exiting the cybersecurity and consumer businesses to focus on NetNut. In the interview, Daniel explains that cybersecurity got “crowded” and emphasizes the importance of focusing on a specific niche, which explains Alarum’s recent divestments. I encourage interested readers to watch the interview. I was impressed with Daniel’s vision and perspective.

Growth

Alarum is a founder-led company with competitive advantages operating in a fast-growing industry. Given its strong financial position and high margins, the key question driving valuations will be revenue growth. Annualized revenue growth has been over 75% for the last five years. Is this sustainable?

There is one analyst covering the stock, and he predicts revenue growth slowing in the latter half of this year, producing a FY2024 YOY growth rate of 38%, and then this dropping to 25% in 2025. Since the 2025 expectation is exactly 25.00%, I guess that this is just a shot-in-the-dark guess. The analyst, Brian Kinstlinger of Alliance Global Partners, is an experienced technology analyst, but has only a 43% success rate and 1.3% average return according to TipRanks. We should not put too much stock in analyst estimates for Alarum. Over the past 11 quarters, revenue has beaten estimates 10 times, by an average of 10%. This would give us a growth rate estimate for 2025 of 37% (1.25×1.1), a number which seems more in line with recent results.

In addition to growing NetNut’s core IPPN business, Alarum is also expanding into the adjacent data collection and labeling market. As noted above, this market is expected to grow at almost 30% CAGR from 2023 to 2030, from $2.2 to $17.1 billion. I think that Alarum’s integration of IPPN services, which provide the network infrastructure for data collection, with its ADCL software offerings will provide a compelling value proposition to its customers.

Given the large and growing TAM of this market, I think NetNut’s growth is sustainable at somewhere between 20-50% over the next 3-5 years. Although Bright Data and OxyLabs are also developing comparable tools, I see no reason to think that Alarum will not be able to compete with them successfully as the industry expands. Right now, it seems that this growing pie can be shared among multiple winners.

Valuation

Alarum is fairly valued given current uncertainty about its growth trajectory, but as that trajectory becomes clearer and the company demonstrates consistent profitability, share prices should rise accordingly.

Alarum is not cheap relative to its competitors, but it wouldn’t surprise me if the multiples expanded even further. Right now, Alarum is growing revenue 400% faster than the 57 small software companies I used as a comparison set (using Morningstar data). And according to SeekingAlpha, its gross margin is 1.5x the average, and its EBITDA margin is 2.3x the average. In other words, Alarum is about twice as profitable as its competitors. At the same time, it is 400% more expensive relative to sales and book. Its P/E ratio is only 13% above average, which seems ridiculous except for the facts that Alarum only just became profitable, and the average P/E of the comps is already around 30. I think this relatively low P/E ratio says that the market thinks Alarum’s growth will slow. The market is probably uncertain about this future and discounting it accordingly.

If current growth rates are sustained, I could easily imagine a world in which the P/E rises to 60 or 70. One catalyst for this expansion could be the arrival of new KPIs. According to the Q1 call, Alarum is developing “some new KPIs that we will present to the market maybe in the next quarter also related to, of course, retention, churn, amount of customers…” But since these valuations would be much higher than industry or market averages, I will not assume multiple expansion below.

There are several reasons to think that recent margin expansion will be sustainable. First is that, as the consumer business is wound down, the costs associated with it will also decrease, and Alarum will consolidate its operations around NetNut. This process is mostly complete as of the last quarter, but I think it will probably continue to drive improved YOY results for the next few quarters. Another short-term factor is the end of goodwill write-downs. Alarum wrote off $6 million in goodwill last year, eating up all the operating profits. There is now only $4 million left, and even if this is progressively written off over the next few years, it will not have nearly as large of an impact on profitability. The third and strongest reason that I expect Alarum to sustain recent margins is that its IPPN network is already at scale: NetNut has 85 million IPs globally, a number comparable to that for Bright Data and OxyLabs. This suggests that Alarum could triple its revenue without significantly increasing the fixed costs of its network. It supports management’s claims on recent earnings calls that gross margins of 75% and operating margins of 25% are sustainable going forward.

Given that I expect multiples and margins to stay basically flat, my price target is a function of revenue growth. And since this is difficult to quantify, I don’t think it’s meaningful to provide the usual set of detailed valuation cases. But for the sake of transparency, here are sketches of three possible outcomes which seem plausible to me given the analysis presented above.

- Bear: In this case, Alarum’s growth contracts to around 20% to increased competition. A tougher landscape generates more pricing pressure and compresses margins. Given that margins are currently so high, and growth would probably still be double digits in this scenario, the stock would probably drop somewhat in this scenario before going sideways.

- Base: My default expectation is that growth gradually tapers down from 75% down to the industry average of 30%, meaning that cumulatively, revenue would triple in the next three years. With flat margins and multiples, this would yield a 2027 target price of $140.

- Bull: In this scenario, Alarum is able to sustain its five-year trajectory of explosive revenue growth for a few more years, leading to a cumulative 4x increase in revenue. This would justify a higher valuation – perhaps a P/E of 50 or so. In this scenario, my 2027 target price would be $250.

Risks

As the competitive analysis offered above should make clear, this is by no means guaranteed. Alarum has little institutional ownership, and its stock is quite volatile. This means that, even if things go well, it is likely to be a bumpy ride. But they might not: this is a fast-moving industry in which Alarum is not the leader and does not have significant pricing power. Many of its recent products are based on commonly available technology and are also being offered by NetNut’s competitors. There is no guarantee that Alarum will be able to continue taking market share, or even that it will continue growing at the rate of the industry. Indeed, the entire AI-fueled race for data could evaporate. One particularly notable risk here is regulation or competition around data privacy. If major websites can find a way to block Alarum from scraping data, their business model will become much less profitable. Indeed, the arms race is already beginning: Cloudflare just launched an AI bot and scraper blocker. They may be able to do this in the courts, by arguing that their publicly facing web data is their corporate property. Such arguments have not held up in recent years, but there is no guarantee that this won’t change. This would be an existential threat to Alarum’s business model.

Over the coming years, I would encourage investors to keep an eye on margins, pricing, and other signs of increased competitive pressure. Given Alarum’s extraordinary profitability, they are all but guaranteed to attract competition, and it will require fierce work on their part to fend it off. There is no guarantee that they will succeed.

Conclusion

Alarum is the #3 player in the IPPN business, and they’re using this position to expand into the rapidly growing business of collecting and labeling web data. The company has experienced explosive growth in recent years, and the additional tailwind of AI training should help them sustain it going forward. Product reviews and customer retention suggest that Alarum is taking market share. If they continue to succeed against their larger competitors and new entrants, then there is significant additional upside from current prices.

Read the full article here