Scorpio Tankers (NYSE:STNG) is up 94% over the last year and the company reported strong financial performance for Q1-2024 back in May. The company’s future outlook assumes a continuation of rising contract prices and increased demand for oil transport. Scorpio Tankers used its increased earnings to pay down debt and lower its daily break-even operating costs per vessel. The move aims to make higher profits on future earnings. The company expects elevated conditions to remain for energy transport. I rate the company as a Hold and recommend revisiting the company again after Q2 and Q3. Even though the stock price is undervalued, I think larger market volatility may keep it down in the short-term.

Operations and Current Synergies

Scorpio Tankers transports refined petroleum products worldwide and operates a fleet of 109 vessels. The fleet consists of 39 LR2 (long range 2) tankers, 56 MR (medium range) tankers, and 14 Handymax tankers. The average age of the fleet is 8.2 years and about 85% of it is fitted with scrubbers. The fleet is fit for stricter environmental regulations. (Company covers fleet size and items below in its Q1 Press Release.)

The company’s revenues have been elevated over 2022 and 2023 due to certain circumstances and disruptions in the oil transport market, including the Ukraine War, the Israel-Hamas Conflict, and the overall tightening of oil supply. Each issue is causing longer travel routes and higher spot contract rates.

The Ukraine War has interrupted Europe’s reliance on Russian oil. Nations have to import their oil from other locations, which are more distant. In the Red Sea, vessels cannot cross safely because of missile attacks from Yemen-based Houthi rebel groups. In return, oil transport must go around the Cape of Good Hope at the southern tip of Africa, which makes for longer voyages.

In addition to these issues, oil refineries in Europe, US, Australia, and Asia have decreased output, which requires more imports from distant lands. Nations in the Middle East have increased production and export of oil products. Meanwhile, the global demand for oil products has increased. Scorpio Tankers predicts a YoY demand increase of 500K barrels per day. With this increased demand, there is in particular an increase in demand for seaborn transported oil. (Demand for oil outlook may be found in the company’s Q1 transcript.)

Scorpio Tankers does not see any immediate end to these issues. Geopolitical conflict has no end in sight and, when things do change, oil supply will still remain disrupted and unbalanced. Oil transport will continue to be in high demand and contracts will be elevated in price. The company has paid off a large amount of its debt from the elevated revenues and will take advantage of higher contract rates with a lower per day break-even rate per vessel.

Q1-2024 Results

The company reported earnings back in May. Scorpio Tankers reported revenues of $391.3 million representing a 1.8% increase YoY and 16.3% increase QoQ. Gross Profit of $311.6 million represents a 2.7% increase YoY and a 24.6% increase QoQ. Operating income was $233.6 million. Net income equaled $214.2 million, representing a 10.8% increase YoY and a 77.1% increase QoQ.

During Q1-2024, the company made $262 million in unscheduled debt repayment and plans to make an additional payment of $118 million in Q2-2024. The company reports total debt of $1.4 billion and net debt of $811 million. Scorpio Tankers is negotiating another debt payment of $223 million to cover total payments between Q3-2024 until 2026.

The company is rapidly paying down its debt so that its daily breakeven per vessel lowers to $12,500 per vessel. Scorpio Tankers feels that lower debt / break-even amount will position it for better profit since its fleet is already updated for environmental regulations.

The average vessels employed during Q1 was 110.9. Seven vessels were drydocked for the quarter. For Q2-2024, the company has nine vessels drydocked. Its estimate for Q3 drydocking is sixteen and Q4 is fifteen. (This information and the slides below may be found in the company’s Q1 press release)

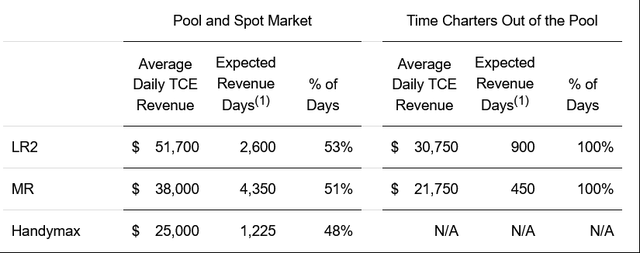

The company does not give its revenue prediction for Q2. The market estimate is $364.17 million, which represents a decline YoY and QoQ. The company shares insight into current Q2 contract prices per vessel. Q2-2024 contracts remain strong at an average of $38,600 per day. The company says at $30,000 per day per vessel it can generate $547 million in cash flower per year. Here are its current average contract prices per vessel for Q2-2024 as of May 2024:

Q1-2024 Press Release

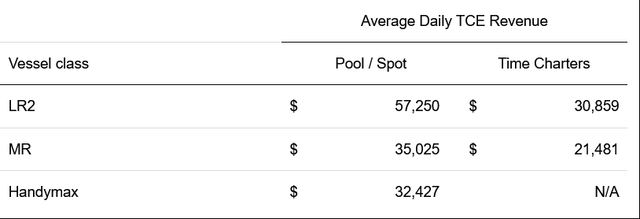

Below are the average contract prices per vessel for Q1-2024:

Q1-2024 Press Release

Scorpio Tankers foresees higher spot contract rates for the rest of the year. The company says lower operating costs per vessel will produce higher margins. It is unclear whether the company expects higher revenues through the rest of 2024. The company says in its earnings transcript that it is bullish on higher oil demand and higher transport prices, i.e. it sees the current trend to continue.

The company issues a quarterly dividend. For 2024, it is paying $0.40 per share per quarter, which is an increase from 2023. The company plans to continue increasing dividends with its higher net income.

Historical Financial Performance and Valuation

|

Amounts in $US Millions* |

Q1-2024 |

Q4-2023 |

Q3-2023 |

Q2-2023 |

Q1-2023 |

|

|

Revenues |

391.3 |

336.3 |

291.2 |

329.3 |

384.4 |

|

|

Cost of Revenues |

79.7 |

86.2 |

81.1 |

80.6 |

80.9 |

|

|

Gross Profit |

311.6 |

250.1 |

210.1 |

248.7 |

303.5 |

|

|

Total Operating Expenses |

78.0 |

82.8 |

75.8 |

77.9 |

72.3 |

|

|

Operating Income |

233.6 |

167.3 |

134.3 |

170.8 |

231.2 |

|

|

Net Income |

214.2 |

120.9 |

100.4 |

132.4 |

193.2 |

|

|

Cash & Short-Term Investments |

369.5 |

355.6 |

364.9 |

313.9 |

612.7 |

|

|

Total Receivables |

234.1 |

203.5 |

192.5 |

201.6 |

233.6 |

|

|

Total Current Assets |

653.4 |

577.1 |

585.3 |

559.2 |

864.3 |

|

|

Total Assets |

4,209.3 |

4,228.7 |

4,309.4 |

4,320.4 |

4,692.8 |

|

|

Total Current Liabilities |

408.5 |

510.4 |

706.4 |

460.9 |

508.5 |

|

|

Total Liabilities |

1,453.1 |

1,674.9 |

1,864.5 |

1,896.0 |

2,139.0 |

|

|

Free Cash Flow |

137.1 |

160.7 |

182.8 |

174.2 |

223.4 |

|

|

Book Value Per Share |

$53.68 |

$51.20 |

$49.93 |

$47.67 |

$45.00 |

|

|

Current |

||||||

|

Market Cap |

4,283.67 |

3,568.68 |

2,977.10 |

2,671.97 |

2,485.51 |

3,171.96 |

|

Total EV |

5,288.64 |

4,801.42 |

4,378.06 |

4,169.97 |

3,925.46 |

4,727.19 |

|

NTM Total EV / Revenues |

3.97x |

3.49x |

3.67x |

3.69x |

3.06x |

3.40x |

|

Price Per Share |

$81.20 |

$71.55 |

$60.80 |

$54.12 |

$47.23 |

$56.31 |

|

Median Target Price |

$90.00 |

|||||

Data from Seeking Alpha and TIKR

The company operates in a cash-rich environment. It consistently reports profit and net income, as well as free cash flow. Costs of revenues and operating expenses remain low for the company and allow for higher profits. The company’s assets far outweigh its liabilities. Its enterprise value is higher than its market capitalization. I argue that the stock price at value compared it the company’s metrics and financial performance.

In May, the company said in its earnings transcript that its stock was trading below NAV per share. The last article covering Scorpio Tankers on Seeking Alpha also observed that the stock price was trading under NAV. That article set the discount at 0.9x NAV. If we calculate the NAV per share in the more traditional way, the stock price is above its NAV per share of $53.70 (4209.3-1453.1/51.34). According to its forward multipliers, like NTM Total EV / Revenues, its trading about 4x its value. The stock price is above its book value, but remains just below its median target price.

Stock Price Movements

www.stockcharts.com

Scorpio Tankers’ stock price increased 92% over one year, 35% over six months, and 14% over one month. It is currently trading above its 200/50/20 moving-day averages. A large amount of the company’s stock is held by large institutions (65%). As with other tanker stocks, this stock has low trading volume and low momentum. The average 50-day trading volume is 692K. Although the stock has undergone a long uptrend, low volume can bring the price down. Larger market volatility may bring the price down regardless of the company’s valuation and performance.

Risk and Investment Strategy

Scorpio Tankers’ is rapidly paying down debt and consistently reporting free cash flow. The company’s current strategy is to lower operating costs per vessel in order to increase margins. The company is fit to fulfill its business strategy. The company’s large debt is normal for seaborne shipping companies because of the high cost of vessels. Vessels are then used as collateral on future loans.

The company is at low risk of poor financial performance. There is a moderate risk that a change in global oil conditions will change the company’s revenues. Scorpio Tanker’s addresses this concern in its May earnings release. It feels that contracts will remain high regardless of geopolitical disruption or an end to such disruption. The company shows in its slide show presentation that current global vessel building cannot keep up with contract demand. This metric helps the company know about its future potential.

A long-hold strategy with Scorpio Tanker comes at a moderate to high risk. The company’s financial performance and current sector conditions are promising for future profits. Investors are concerned that spot contracts will drop when global conflict subsides. This concern itself may drop the stock price regardless of actual outcomes. The low trading volume of the stock also produces some risk, since stock prices can change rapidly, especially due to greater market volatility. An investor would want to keep these things in mind when holding such positions. I rate the company as a Hold for now and recommend that you check in on the company’s earnings over 2024. Larger market volatility may keep the company’s stock price down in the short-term.

Conclusion

Tanker stocks are worth considering right now because of geopolitical disruptions and tightening supply. New longer trade routes translate into higher contract prices for transport. The global demand for oil is increasing and causing more oil shipments. Scorpio Tankers is well-positioned to benefit from these circumstances. The company has rapidly been paying down its debt so that its operating costs per vessel remain low. The company has excellent financial performance and stewardship. Its stock price remains undervalued and at the same time has been on a one-year uptrend. Although there are some risks, I rate the company as a Hold.

Read the full article here