Japan’s private sector growth ground to a halt in June, according to early flash PMI indications. A renewed manufacturing output expansion was offset by lower services activity, marking an end to the growth streak that commenced at the start of 2024.

Of additional concern is the rise in cost pressure for Japanese firms across both the manufacturing and service sectors. This has resulted in an intensification of profit margin pressures, especially for service providers, simultaneously affecting sentiment in the latest survey period.

Japan’s flash PMI slips to six-month low

S&P Global PMI, au Jibun Bank

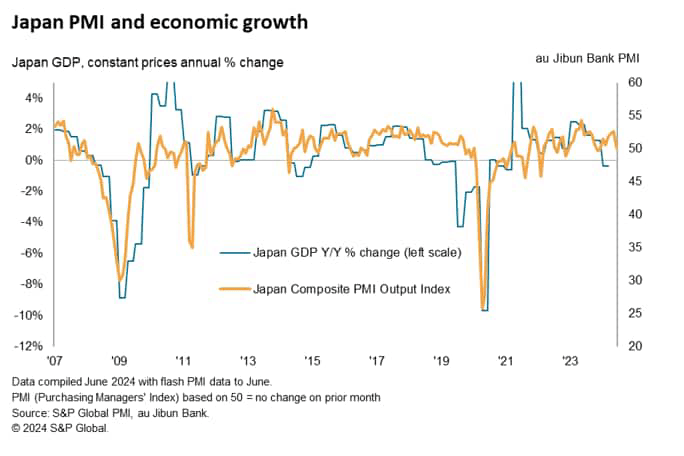

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, fell to the neutral 50.0 mark in June, down from 52.6 in May. The flash reading, based on approximately 85%-90% of typical PMI survey responses each month, indicated that Japan’s private sector conditions were unchanged during June after improving in May at the fastest pace in nine months.

Despite the PMI falling in June, the second quarter average remained marginally above that seen in the first quarter and also that of the final quarter of 2023. Overall, the latest composite output reading – covering both manufacturing and services – is historically consistent with GDP growing at an annual rate of just under 1% in the second quarter.

Manufacturing output rises while services activity declines in Japan

S&P Global PMI, au Jibun Bank

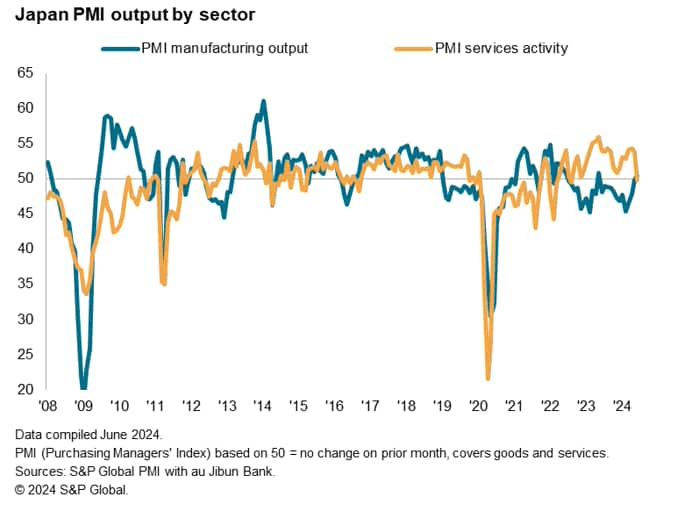

For the first time since April 2022, manufacturing output performance surpassed that of services. This was brought about by a renewal of factory production growth, with output rising for the first in just over a year. Although marginal, this is only the second time that manufacturing output has expanded in Japan over the past two years. Higher headcounts in the manufacturing sector supported the expansion in production. Meanwhile, incoming new orders into factories fell marginally again in June, but optimism among manufacturers rose to the highest level in the year-to-date to reflect anticipation for rising sales and production in the next 12 months.

On the other hand, services activity declined for the first time since August 2022, albeit only fractionally. Detailed PMI data, alongside anecdotes from survey respondents, revealed that, while the slowdown in new business growth played a part in the reduction of services activity, labour constraints contributed to the fall in June. This was despite service providers expanding their staffing levels for a ninth successive month. Some firms noted that there were difficulties hiring in a tight Japanese labour market.

Margin pressures intensify

S&P Global PMI, au Jibun Bank, Japan Statistics Bureau, S&P Global Market Intelligence

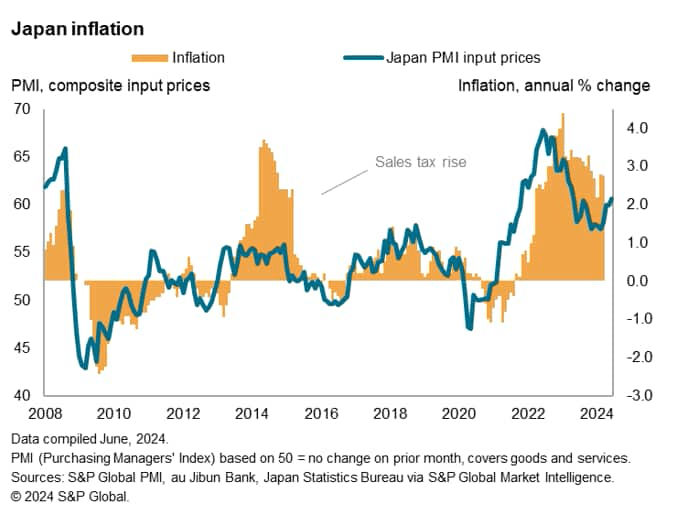

Perhaps more noteworthy than the stalling of business activity is the heightening of cost pressures into the mid-year. Average input prices across manufacturing and services rose in June at the fastest pace since April 2023. This was attributed to the rates of cost inflation accelerating to 14- and two-month highs in the manufacturing and service sectors, respectively.

While manufacturers were able to pass on some of these cost increases to clients by raising output prices at a more pronounced pace, service providers opted to partially absorb costs. The consequent reduction in selling price inflation in the service sector brought the overall rate of inflation – across manufacturing and services – to a three-month low. The amalgamation of faster cost increases and falling charge inflation highlighted an intensification of margin pressures for Japanese private sector firms.

Although businesses have opted to rein in the rate at which average selling prices rose to support sales for now, the sustained increase in input prices may eventually result in higher selling prices and inflation rates for consumers. Overall, the latest PMI price indications are consistent with headline CPI sustaining above the 2.0% level. This lends some support to the Bank of Japan’s (BoJ) rate hike considerations, but the matter is nevertheless complicated by the stalling of economic growth in June.

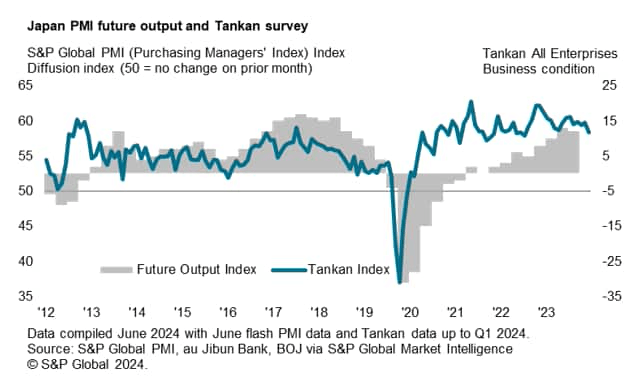

Meanwhile, business confidence has also been affected by the rise in cost pressures, with inflation often mentioned as a source of concern. The PMI Future Output Index notably slipped to the lowest level in nearly one-and-a-half years in June to reflect the reduction in optimism among private businesses.

S&P Global PMI, au Jibun Bank, BOJ, S&P Global Market Intelligence

PMI data tally with Japanese equity market taking a breather

Turning to the Japanese equity market, the latest decline in the au Jibun Bank Flash Japan Composite PMI is therefore exhibiting congruence with the recent shedding of gains for the Nikkei 225 index.

After seeing the Nikkei 225 having been on a tear since late 2023, the broad Japanese equity index and the PMI index have converged again near the neutral mark to suggest that the recent rally may be taking a breather amidst the amassing of uncertainties in the market.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here