While the stock market is making new highs and those of us who are recently retired or are soon to retire are enjoying a healthy income stream from high yield investments such as those described in my recent Income Compounder portfolio update, it may be prudent to consider risk management. If the market sentiment shifts this summer as some are predicting and we experience a correction of 5% or more, it may be wise to raise some cash or at least hold a portion of your investment portfolio in relatively “safe” lower yielding securities.

I realize that this topic may not garner as much attention as some of my recent posts which tend to highlight opportunities to generate massive amounts of cash flow from high yielding funds such as Oxford Lane Capital (OXLC), a CEF that I recently reviewed that now yields about 20% after raising their dividend in May. The tendency to “chase yield” as some like to say, may be exciting and opportunistic but can also lead to capital losses when the market turns. On the other hand, buying those high yield funds during a market correction can lead to even stronger returns over time. In that case, it may make sense to hold some “dry powder” in the form of cash or liquid funds that can be easily and quickly converted to cash to take advantage of those buying opportunities.

In this article, I would like to suggest another fund that invests in CLOs but carries less risk of substantial capital depreciation in the event of a market downturn. Of course, lower risk also comes with lower returns and unlike OXLC the yield from Janus Henderson B-BBB CLO ETF (BATS:JBBB) currently amounts to about 7.8%. I consider JBBB one example of a cash-like fund that offers a higher yield than most money market funds and carries relatively low risk of capital losses.

In my own IC portfolio, I currently hold about 10% of my total portfolio value in several funds that carry less risk than the high yielders that I typically cover but still offer higher yields than the typical money market funds that yield about 5%. As the market continues to make new all-time highs, I am starting to take profits from some of my investments that have large unrealized gains and putting those profits into cash (including Fidelity’s money market sweep account, SPAXX, 4.95% yield) and lower risk holdings including SGOV (5.2%), IBHF (7.4%), and JBBB. My intent is to increase my cash and lower risk holdings to closer to 20% of my total in anticipation of a market correction.

Why JBBB and Why Now?

From the website, this is the About JBBB description of the fund:

An ETF with floating rate exposure to CLOs rated from B to BBB and seeking to deliver investors access to securities with low default risk, low correlations to traditional fixed income asset classes and yield potential.

The inception date for JBBB was January 2022 and it has about $920M in total net assets.

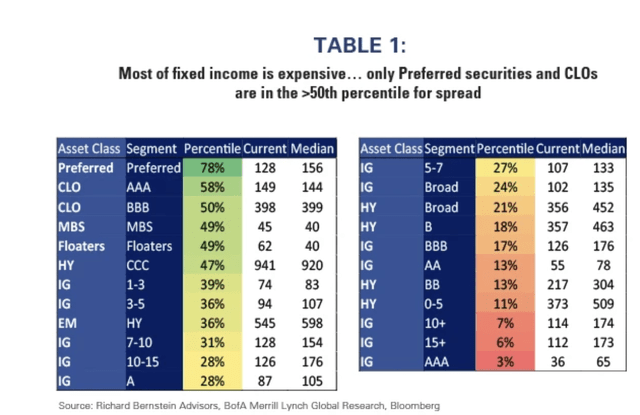

As explained in this recent insight from RBA the best risk-reward in fixed income investments is in Preferred Securities and CLOs.

At the top of the list are those sectors that currently trade with a reasonable yield spread from a historic percentile basis, suggesting reasonable risk-reward. Preferred Securities, AAA and BBB CLOs, and agency mortgage-backed securities lead the pack in terms of their attractiveness. On the bottom resides longer duration and high-quality investment grade corporates and short duration high yield corporates.

RBA

In general, CLOs offer an attractive risk-reward with higher yields at lower relative risk than other fixed income investments such as senior loans or corporate bonds. This discussion by Van Eck titled, CLOs: Too Good to be True? explains some of the advantages of CLOs in terms of high yield and some of the structural protections that make them low risk.

High yielding collateral: CLOs are backed by a pool of leveraged loans, which are non-investment grade and produce high levels of income that gets distributed to CLO tranche investors. As of February 29, 2024, leveraged loans yielded 9.2% versus 5.5% on investment grade corporate bonds.

Structural protections: Each tranche of a CLO has varying degrees of subordination, which insulates investors from default losses. Active management, collateral requirements, and overcollateralization provide additional protection. Combined with the lower loss rates on senior secured loans relative to high yield bonds, the risk of default in investment grade CLO tranches is negligible. The average CLO portfolio would need to experience default rates several multiples of the historical average, for 5 or more consecutive years, for the first dollar of loss even in BBB and BB rated tranches. There has never been a default in AAA rated CLOs.

What are the risks to CLOs? As further explained in the Van Eck post, CLOs are subject to credit risks similar to other fixed income investments:

Although default risk is not the primary risk of CLO tranche investing, CLO tranche investing is not risk-free. In particular, spread and downgrade risk need to be carefully monitored. Deterioration in the underlying loan market can result in downgrades of CLO tranches, which can drive prices lower. And like any credit investment, wider spreads will impact market values.

The risk of BB-rated CLOs defaulting is likely even less than the ratings firms would have you believe. CLO ratings are assigned by the ratings firms such as Moody’s, Fitch, and Standard & Poor based on the underlying ratings of the CLOs loans. This explanation from Flat Rock Global dives into the details of the investment grade ratings of CLO BB Notes and why they believe that they are structurally underrated.

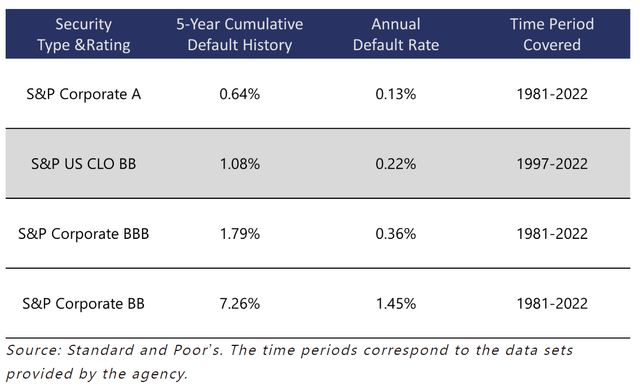

NRSROs rate many different types of securities: loans, corporate bonds, government bonds, Commercial Mortgage-Backed Securities, CLOs, etc. Each rating is standardized to reflect an assessment of credit quality meant to be comparable across all asset types. In other words, a BB rated CLO note should have the same credit quality as a BB rated corporate note. However, a comparative review of real-world default performance suggests that CLO securities are structurally underrated. CLO BB notes exhibit a 0.22% annualized default rate, which is significantly lower than the 1.45% annualized default rate for Corporate BB notes – by a factor of 6.6x! As shown below, CLO BBs have a default experience that is more similar to corporate credits rated investment grade (BBB or A).

Flat Rock Global

Middle market CLO BBs begin their lives with 12% equity and are therefore highly resilient to loan defaults. Assuming a 70% recovery rate, middle market CLO BBs would survive at almost 2.0x the default rate of the GFC and could withstand such an elevated default rate for a duration of nine years.

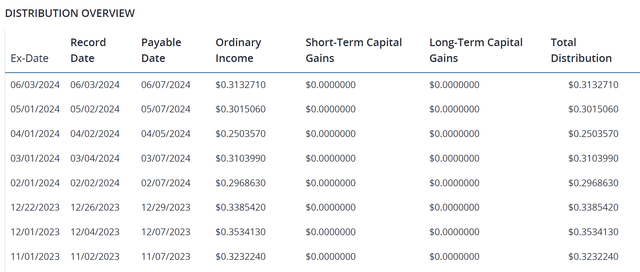

JBBB Distribution History

While JBBB has now been public for a little over two years, the distribution history has been relatively consistent. The distribution paid every month varies slightly but has averaged around $0.32 per share (100% classified as ordinary income) for the last 8 months as shown on the fund website.

JBBB website

JBBB Portfolio Characteristics

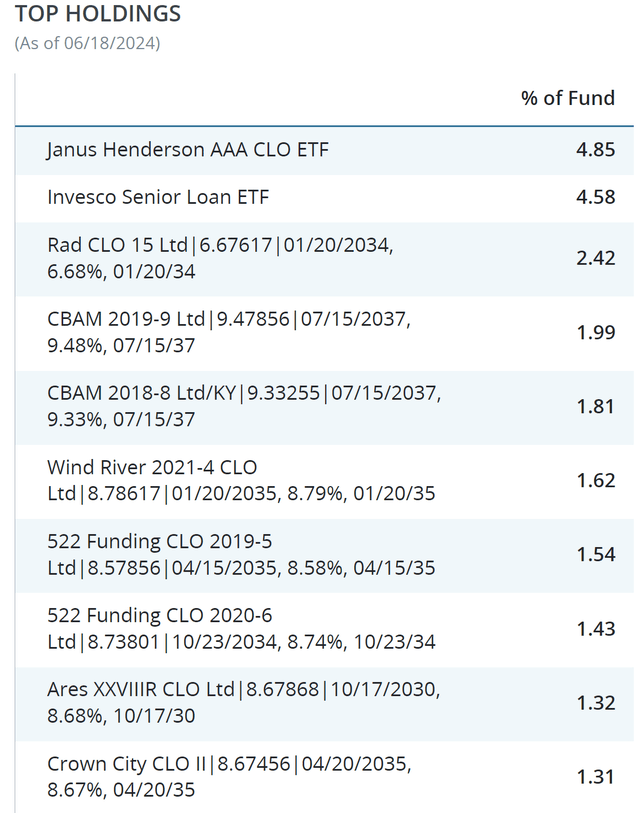

As of June 18, 2024 the fund had 226 holdings with a turnover rate of about 30%. The weighted average maturity is about 5.5 years with a yield to worst of 8.94% (easily covering the 7.8% distribution). One of the top holdings in JBBB includes the sibling ETF from Janus Henderson, JAAA, representing nearly 5% of the fund.

JBBB website

Another top holding is Invesco Senior Loan ETF (BKLN), which offers a current yield of 8.8%. BKLN holds senior loans and those have mostly benefited from rising rates, although BKLN may still be ok to buy even after the Fed begins to reduce rates according to fellow SA analyst Juan De la Hoz.

Current State and Outlook for Senior Loans and CLOs

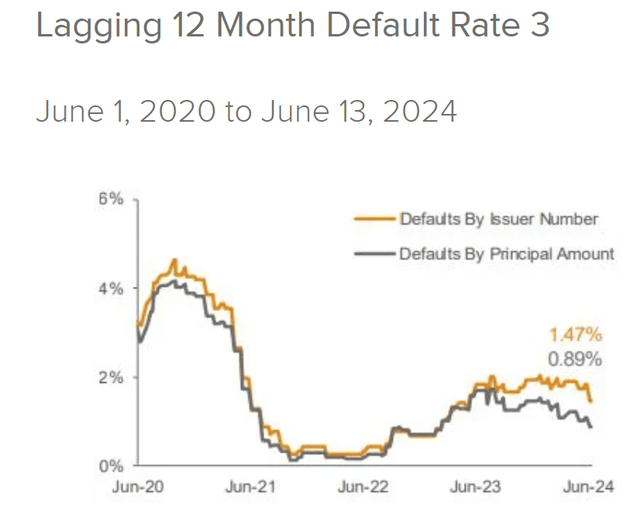

According to this recent update from Voya on Senior Loan Talking Points, the loan default rate is currently less than 1.5% by Issuer and less than 0.9% by Principal Amount and dropping as of June 13.

Voya

The CLO market got off to an excellent start in 2024 and with the economy remaining healthy midway through the year the outlook for the remainder of 2024 is optimistic. According to this recent post from Deutsche Bank, the CLO market remains broadly constructive. In fact, the rising interest in new CLO ETFs that have recently come to the public market adds to the positive risk-reward aspect of funds like JBBB as explained in that DB post:

In addition, the rapid growth of US CLO ETFs (exchange-traded funds) over the past year is bringing in new investors to the most senior, safest tranches. In addition to making the product available to retail investors, the liquidity and transparency of ETFs makes this a highly suitable vehicle for institutional investors to become acquainted with the benefits of investing in CLOs. The first actively-managed CLO ETF vehicle (Janus AAA) has grown to almost US$10bn in size and could easily act as the anchor buyer of the AAA portion of primary deals.

Summary: Buy JBBB for a Risk-Adjusted, Better than Cash Alternative

If you are an income investor interested in a relatively low risk but higher yielding than cash investment, you may want to consider JBBB. If you are even more conservative and prefer even lower risk and are happy to collect only a 6% yield then JAAA might be an even better choice. While the market is hot and everyone is focused on the AI revolution, it is a good time in my opinion to take some profits from those high flyers and build a position in cash and lower risk cash-like alternatives like SGOV, JAAA, and JBBB. Good luck and stay safe out there!

Read the full article here