When I last covered British American Tobacco (NYSE:BTI) the major tobacco player had just recently announced a substantial write-down in some of its businesses leading to a fairly steep decline in the share price. Since then, the share price has only improved marginally and remains quite low as concerns remain over the future of tobacco and the persistent decline in volumes in its traditional cigarette business. However, BTI has continued to see strong growth in its new generation products segment and recent indications of a more concerted effort to enforce regulations could see this segment witness even greater growth in the longer term.

Earnings and growth drivers

At the time of my previous coverage, I noted that BTI and its peers were increasingly dependent on price increases to maintain revenue growth in its core traditional combustible cigarette business. I also indicated that it was seemingly becoming more difficult to sustain revenue growth through price increases in light of an uptick in consumers switching to cheaper brands or who quit smoking as a result of price increases. In its most recent trading update, BTI warned that it expects revenues to come in lower in the first half of 2024 in light of the continued decline in cigarette volumes in the US market as well as the continued proliferation of illegal vapes across the US.

Nevertheless, at a group level BTI saw an increase in its volume share, showing that it has managed to maintain market share even as volumes decline. Again, this arises because the decline in volumes are not unique to BTI and appears unlikely to reverse in the near future. Importantly, BTI continues to expect revenue growth in the low-single-digits. Some analysts are also of the view that BTI still has further scope for price increases to maintain revenue growth in the near term. In this respect, Tidefall Capital Management recently observed that –

With a pack of cigarettes costing just $9 in the US vs higher tax countries with similar smoking rates like Australia where a pack costs $26, we feel there is still further pricing power to offset the future volume declines and continue to increase profits.”

While I agree with Tidefall that there may still be some scope for further price increases in the US market, there is also a growing number of retailers who have indicated that consumers have become more cost conscience as disposable income has declined amidst a high inflation and high interest rate environment. Nevertheless, it still seems rather rare for consumers to quit smoking entirely as a result of price pressure albeit that a shift to cheaper brands does not generally favour BTI given that it largely has premium brands.

The continued investment in new products that are less risky to consumers health will likely be key to BTI’s future. The company has a proven track record of execution in this category with BTI having seen this unit of its business reach profitability two years ahead of target. Fitch has also recently indicated that it expects profitability in this unit to increase further as BTI reaps the benefits of economy-of-scale. This has led Fitch to estimate that –

the increased NGP profitability and the more robust performance of BAT’s combustible segment in other regions together with further cost efficiencies will more than compensate the profitability pressure from the US combustible segment.”

In my view, this is an accurate assessment of BTI’s prospects. I expect BTI to maintain its current profit margins in the near term as the benefits of cost-cutting and increased profits from new generation products offset some of the pressures brought about by declining cigarette volumes in key markets such as the US.

Regulatory risk and opportunities

Tobacco remains a highly regulated sector that is exposed to a number of regulatory risks. The US proposed ban on menthol cigarettes is a clear example of the substantial regulatory risk faced by big tobacco players such as BTI. Any ban on menthol cigarettes would have a material impact on BTI’s profits given that more than 20% of its US based profits are derived from menthol cigarettes. While this ban has been delayed for the time being there is still a risk that it could be implemented at a later stage, which would likely have a materially negative impact on BTI’s profitability.

Nevertheless, there are also opportunities for big tobacco players arising from the effective enforcement of regulations. The US market has seen a substantial proliferation of illegal vapes imported from China. These vapes generally don’t comply with the same stringent safety standards that are applied by the big players and are estimated to take up as much as 60% of the US vape market. However, to date enforcement of the regulations have generally not been followed through allowing these manufacturers of illegal vapes to expand their market share at the expense of compliant players like BTI.

The Federal government has faced growing pressure to enforce the regulations and to take action against these illegal imports of vapes into the US. This has culminated in the FDA announcing its initiation of a partnership with the Department of Justice, and other major law enforcement bodies such as the Bureau of Alcohol, Tobacco, Firearms and Explosives, and the U.S. Marshals Service, to form a new task force aimed at addressing the ongoing issue of illegal vape sales. While these efforts are unlikely to have an immediate impact on BTI, the more effective enforcement of regulations certainly offer it a good opportunity to gain market share over time. Tidefall observed in this respect that –

The growth of illegal vaping not only hurt profits of big tobacco’s next generation of products but even accelerated the volume decline of its traditional cigarette business which were also coming under increasingly tough FDA restrictions…. We believe that the market is missing the potential for the removal of illegal vape devices in BAT’s key US market.”

In my view, effective enforcement of the regulations offer a good opportunity for BTI to increase sales of compliant vapes and could also see an increase in profit margins in this segment as the benefits of economy-of-scale are realized.

The dividend

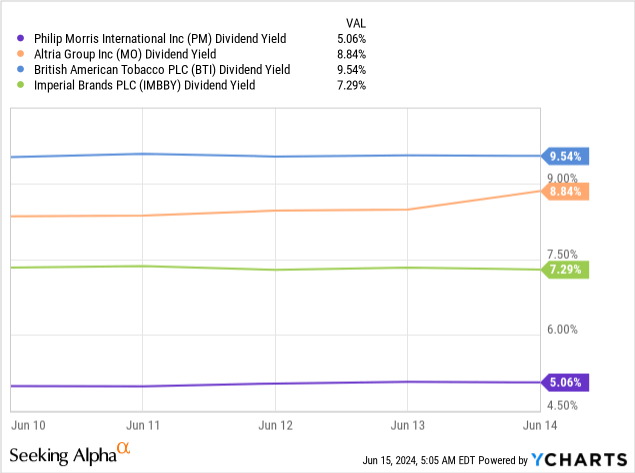

British American Tobacco currently offers a dividend yield of more than 9.5% which is the highest of the major tobacco players considered in the chart below. While this dividend has not increased substantially in recent years, with a 5-year dividend growth rate of just under 3%, it remains an attractive dividend that appears unlikely to be reduced in the near term given the strong cash flows at BTI.

Nevertheless, investors should not expect the dividend growth picture to change in the near term. While the new generation products offer scope for earnings growth, the continued decline in traditional cigarettes will limit the scope for earnings growth at the company as a whole. Therefore, I view BTI as a stable dividend payer albeit one with limited dividend growth.

Valuation

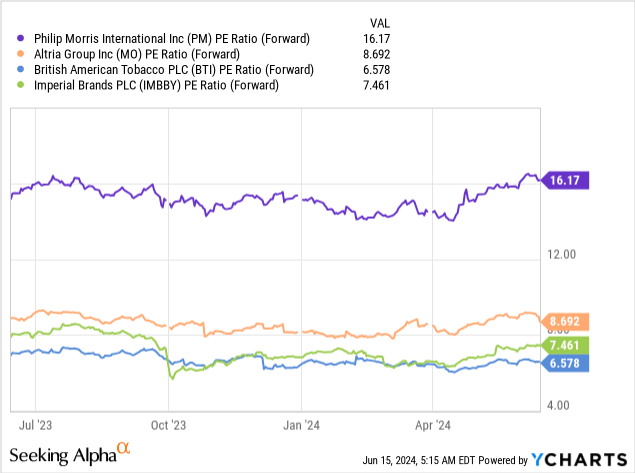

British American Tobacco is trading at a highly attractive valuation with its forward P/E ratio of just under 6.6 being the lowest of the major tobacco players compared in the chart below. This is also around 20% below its 5-year average forward P/E ratio of 7.9.

The regulatory uncertainty surrounding a potential menthol ban and continued declines in the traditional cigarette business may justify some portion of the lower valuation. However, in my view, the potential for further growth in new generation products both organically and through benefitting from regulatory action creates scope for improved multiples at BTI.

Conclusion

Despite the lingering uncertainties surrounding the future of the tobacco industry and the decline in traditional cigarette volumes, BTI presents a relatively attractive investment opportunity. The company’s strong growth in new generation products provides a solid foundation for future growth while the recent efforts by U.S. regulatory bodies to clamp down on illegal vape sales could further enhance BTI’s market position, potentially boosting its profitability in this segment. This coupled with its attractive valuation, substantial dividend yield, and the potential for increased profitability from new generation products, I currently assign a buy rating to BTI.

Read the full article here