Investment Thesis

I previously covered Keysight (NYSE:KEYS) where I talked more in depth about the business model and the implied quality I think it has. In that article, I decided that the best thing was to hold at the moment and since then, the company has fallen 11% compared to the 2% appreciation that the S&P500 has had.

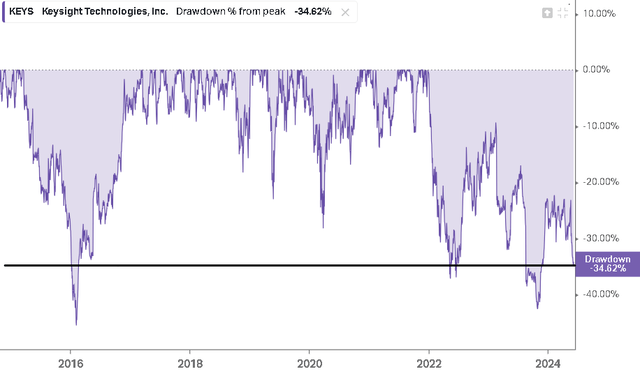

While this may not seem like a big drop, the current drawdown of 33% from the last peak is one of the largest in Keysight’s history, and only 3 times has it had a larger drawdown. Considering this and adding the fact that on May 20 the company presented Q2 2024 results, I would like to delve into what has changed in the company since then.

KEYS Drawdown (Koyfin)

Q2 2024

The summary of the results was that the company modestly exceeded expectations, but considering that we are currently in a very negative economic environment for the company, exceeding the guidance provided by management itself a quarter ago is something worth noting.

Given Q1 core orders of $1.14 billion, we expect second quarter revenue to be in the range of $1.190 billion to $1.210 billion, and Q2 earnings per share to be in the range of $1.34 to $1.40

CFO Neil Dougherty during Q1 2024 Earnings Call

The not so positive aspect that has caused the market to be so cautious with Keysight is that during Q2 2024 revenue decreased 12.5% (even considering that expectations were exceeded) and the initial guidance for Q3 would imply a decrease of almost 14%, so it shouldn’t surprise anyone if this fiscal year ends with a double-digit decline in sales.

| Estimate | Actual | Beat/Miss | |

| Revenue | $1.20 Billion | $1.22 Billion | 1.0% |

|---|---|---|---|

| EBITDA | $327 Million | $332 Million | 1.4% |

| EPS | $1.39 | $1.41 | 1.6% |

Author’s Compilation

We expect third quarter revenue to be in the range of $1.180 billion to $1.200 billion and Q3 earnings per share to be in the range of $1.30 to $1.36 based on a weighted diluted share count of approximately 175 million shares.

CFO Neil Dougherty during Q2 2024 Earnings Call

| FY2023 | FY2024 | Revenue change | |

|---|---|---|---|

| Q1 | $1,381 | $1,259 | -8.8% |

| Q2 | $1,390 | $1,216 | -12.5% |

| Q3 | $1,382 | $1,190 | -13.9% |

| Q4 | $1,311 | ? | ? |

Author’s Compilation

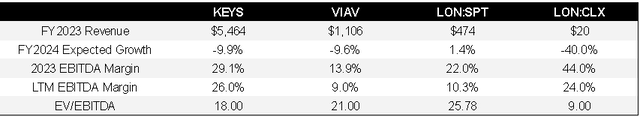

One thing worth making clear is that this problem isn’t unique to the company and doesn’t appear to be caused by a loss of market share or competitive advantages. To visualize what I mean, I made this comparison table with companies similar to Keysight but of different sizes.

We can quickly notice that Keysight isn’t the only one that’s having problems this year, both in growth and margins. Smaller companies, like Calnex Solutions, reported a brutal decline of 40% this year. So although no one likes their company to decrease its revenue by 10%, at least it can be considered that it is caused by a general impact on the industry derived from the fact that the clients of these companies (semiconductor companies, telecoms, among others) are also resenting the high-interest rate environment and therefore are postponing their investments in capex.

Author’s Compilation

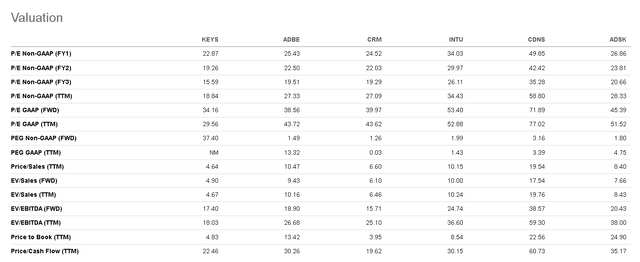

Valuation

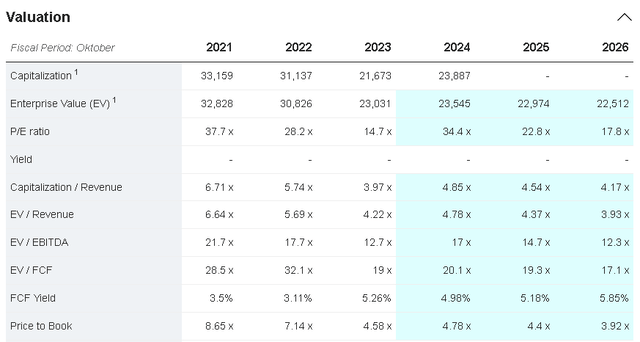

Keysight is currently trading at a P/E of 34 if we use 2024 earnings as a reference. This doesn’t seem cheap, but it’s because this year a compression of margins and lower income is expected, as can be seen in the net margin, which went from 19% in 2023 to 15% in the last twelve months.

Estimating that there’ll be a recovery in 2025, which can already begin to be noticed in sectors such as semiconductors, then the P/E would go from 34 to 23 thanks to the recovery of profit margins.

In semiconductor, the industry outlook is improving with projections of recovery in 2025. Inventories are coming down to more healthy levels and demand is picking up in certain areas such as high bandwidth memory.

CEO Satish Dhanasekaran during Q2 2024 Earnings Call

Market Screener

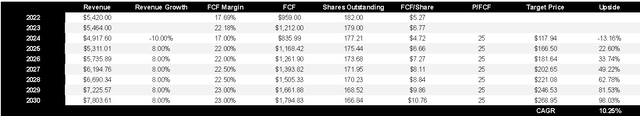

I estimate that this year the Free Cash Flow will suffer a greater drop than revenue this year, but this low comparable base would cause that in future years the growth of FCF/Share will be greater than in past years, in my estimate, 12% annually, which would be somewhat higher than the 10% annually that it presented between 2014 and 2023. With this estimate, Keysight would generate close to $12 per share in 2030 and would represent a return of 12% if buying at current price.

Valuation Model (Author’s Compilation)

I chose the multiple of 25 times Free Cash Flow according to what can be seen in other software companies. It’s not a dirty cheap ratio, but it is difficult to find a software company trading at less than 20 times, unless they are presenting structural problems or something that deserves a low valuation.

Valuation Ratios (Seeking Alpha)

The Bottom Line

As I mentioned during the article, I don’t think Keysight is having problems that will affect its future. It’s not losing market share and the economic slowdown should be temporary, since its services are essential to customers. Therefore, now that the valuation looks better than a few months ago, I’m finally interested in buying.

The biggest risk is that the company benefits from operating leverage, maintaining its fixed costs. This is positive in a growth scenario, but causes profits to fall more than revenue in a downturn, which can lead to the issuance of debt to finance itself and could cause my FCF decrease estimate to fall short. In that case, perhaps the stock will remain flat for longer than expected., but I think that if your time horizon is longer than 2 years, then the stock should do well as an investment.

Read the full article here