Those who read my work regularly might know that I am not a fan of certain investment products. Late last year, in September, as an example, I wrote a bearish article about the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD). For many investors, this ETF is an attractive way to generate yield. It is also clear that it is an ETF that many investors love. Because while I received plenty of positive comments about that article, I also received plenty of comments from readers who disagreed with my decision to rate it a ‘sell’.

When I rate an investment opportunity a ‘sell’, it’s not a statement that I expect shares to decline in value. That is reserved for a ‘strong sell’ rating. Rather, it’s my belief that the stock, or in this case the ETF, will underperform the broader market for the foreseeable future, and by a rather material amount. My assessment then was based on the composition of the ETF, as well as on its historical performance. While I caught some flak for some of the investments that I suggested as alternatives to this, it is worth noting that they overwhelmingly outperformed the ETF from the time of the publication of that article through today.

In order to do my readers justice, I do like to keep up to date on the performance of the investments that I write about. Considering how much time has passed from the time that article was written, I think it is only appropriate to revisit the picture now with an open mind. I went into analyzing SCHD with the hopes that my mindset would change. But if anything, my findings only reaffirmed my bearishness for it. At the end of the day, I fear that this might be a perpetual ‘sell’ prospect, with only one caveat that might make it acceptable for market participants.

A fresh look

If you read the prospectus put out by the team that oversees SCHD, you will know that the purpose of the ETF is to track, as closely as possible, the Dow Jones U.S. Dividend 100 Index. The goal here is to invest in large companies that have stable distributions. In fact, the prospectus even says that ‘all index eligible stocks must have sustained at least 10 consecutive years of dividend payments’ to be included in the aforementioned index. They also must have a minimum float adjusted market capitalization of $500 million. There’s also other criteria as well related to liquidity. At the end of the day, this is about prioritizing safe distributions above all else.

While this is fine, I believe that this kind of emphasis leaves a lot of money on the table. For somebody in retirement, for instance, there are ways to capture higher yields than the 3.45% that SCHD currently offers. For instance, investing in REITs, MLPs, and BDCs in a diversified manner can achieve yields of 5%, 6%, or even higher. In addition to this, an overemphasis on the payout can neglect total return. And that is perhaps my biggest concern for investors who buy into SCHD.

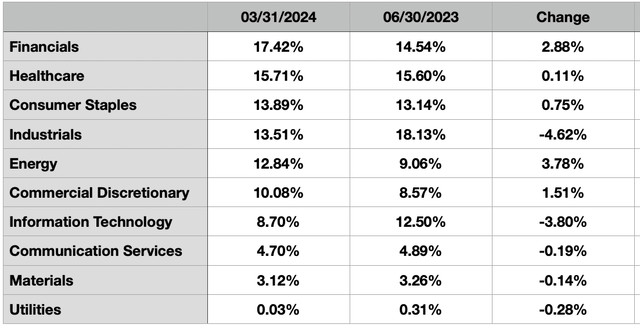

Author – Schwab Asset Management Data

Before I get into why SCHD represents such a subpar opportunity, I would like to note some interesting observations that I made regarding the ETF. In the table above, you can see the composition of the ETF as of the end of March of this year. This is the most recent period for which data is available. That table also shows the composition when I last wrote about it. There have been some noticeable differences. In particular, financial firms have become a much larger portion of the ETF. The same is true of energy stocks. Over the same time, industrial stocks have become less significant, and the same can also be said of information technology firms. This almost certainly has more to do with the performance of different aspects of the market than it does anything else. But it is interesting to see this is a barometer of the performance of the market more broadly.

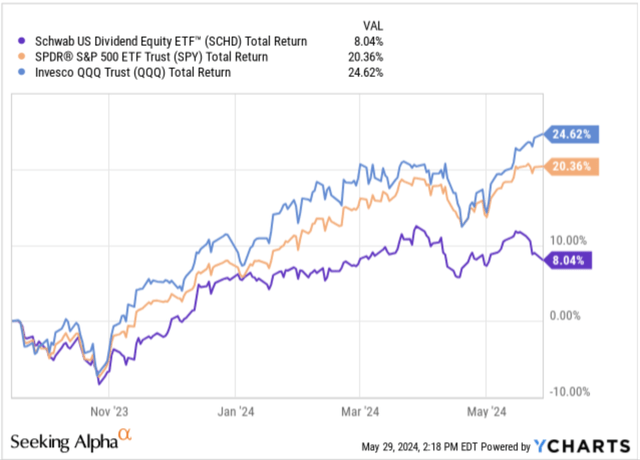

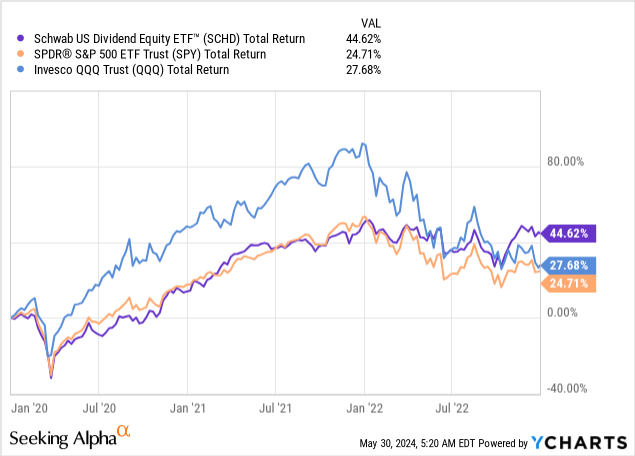

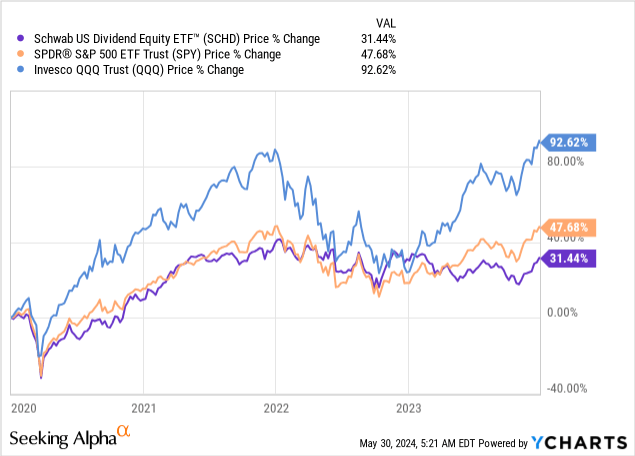

Seeking Alpha – YCharts

Moving on to the performance side of matters, it is necessary that I note that, from the time I wrote about SCHD last year through today, the ETF has seen upside of only 8%. This is the total return, which includes the distribution. In my prior article on the company, I mentioned that if investors wanted to own an ETF, that ones that track the broader market might make a lot more sense. Although it pays a much lower yield of only 1.27%, the SPDR S&P 500 ETF Trust (SPY) has been a far better option. Upside over the same window of time of roughly 20.4%. That’s inclusive of the aforementioned yield. Even more impressive was the Invesco QQQ Trust ETF (QQQ). This is an ETF that tracks the performance of the NASDAQ-100 Index. Inclusive of the 0.53% yield that it currently offers, it saw upside of 24.6%. As a value investor, I am always wary of the NASDAQ. That is because of how speculative the market can get when it comes to growth opportunities. But it is undeniable that its performance has been impressive during this window of time.

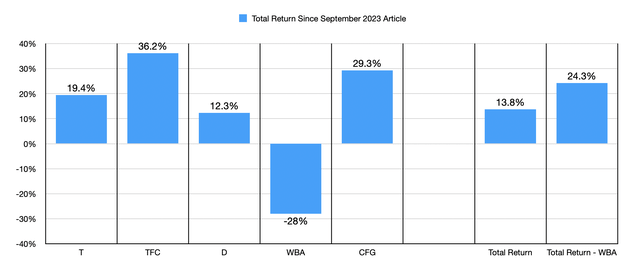

In my prior article on SCHD, I also propose shares of five other companies that were worth considering as an alternative to those who insist on attractive yields. Collectively, these five companies performed exceptionally well. Four of the five saw share price increases, with those increases ranging between 12.3% and 36.2%. The only loser was Walgreens Boots Alliance (WBA), which plunged by 28%.

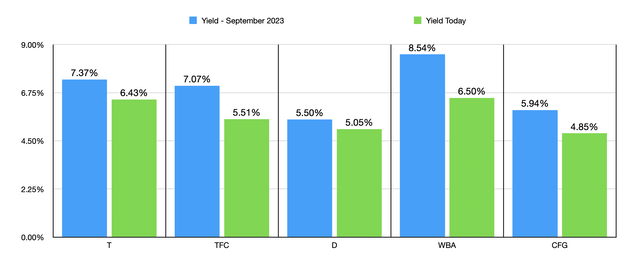

Author

As the chart above shows, the yields of all of these companies declined during this time, with much of that drop driven by their share price appreciation outpacing dividend increases. Though in the case of Walgreens, its yield fell because of management’s decision earlier this year to cut the distribution by a whopping 48%. Even though it proved to be a loser, a portfolio split evenly between those five companies would have generated a total return of 13.8%. And had it not been for Walgreens, the upside would have been 24.3%.

Author

Over the long run, SCHD has consistently underperformed the market by a rather significant amount. But this is not to say that it never makes sense for investors to buy into. In any case, where you think the market is going to be flat or moving higher, I would argue that investing in a diversified portfolio of higher dividend stocks, or buying one of the aforementioned ETF’s, makes a lot more sense. In the latter case, you may not have the yield that SCHD offers. But in this environment, a 3.45% yield is far from impressive. The reason why I say that SCHD could make sense in one particular case is because the company has demonstrated itself to be a bastion of safety.

You can cherry-pick any data points that you like. But if you were to look during the COVID-19 pandemic, starting at the end of 2019 and ending at the end of 2022, you would see that SCHD actually outperformed both the SPY and the QQQ. This is likely for two reasons. For starters, you have the benefit of the companies in the ETF being large and stable companies. Such firms tend to see less volatility during difficult times. And the second reason is that the modest yield paid out by the ETF is money in your pocket that can’t be taken out by a market decline. But if your investment horizon is longer than a couple of years, it is almost certain that SCHD will be a loser compared to most other opportunities. This is because, even if you extend that timeline to the end of 2023, both alternative ETFs that I pointed out would have performed better than SCHD did.

Takeaway

I fully expect a number of angry comments in response to this article. But at the end of the day, my only defense is that the data speaks for itself. From what information is available, SCHD appears to be a subpar place to allocate capital. There are plenty of other alternatives for investors focused on total return. Admittedly, if you are forecasting a plunge in the market, this might be one of the better places to put your funds if you insist on keeping said funds in stocks. But in any other scenario that I can think of, you can bet on the ETF significantly underperforming other opportunities.

Read the full article here