Overview

I’ve always been a bit cautious when it came to investing in companies that operate within the food and restaurant category. This was because of the terrifying stats around their success. According to the National Restaurant Association, 80% of restaurants will fail within the first 5 years opening. However, Texas Roadhouse (NASDAQ:TXRH) remains as a highly profitable outlier to this data. TXRH operates as a casual dining restaurant. The company was founded in 1993 and has exposure throughout the US. As of the last quarterly report, there are 753 locations in operations.

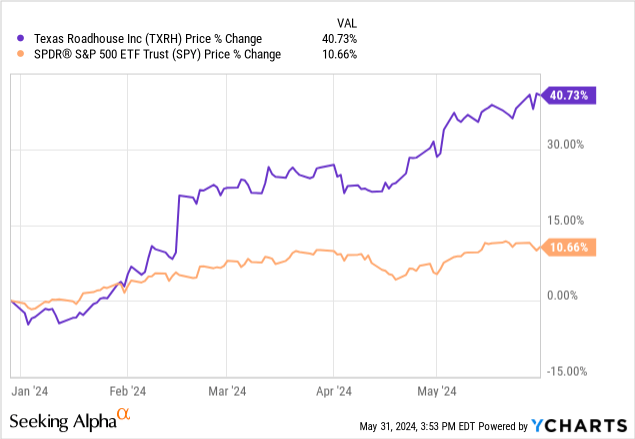

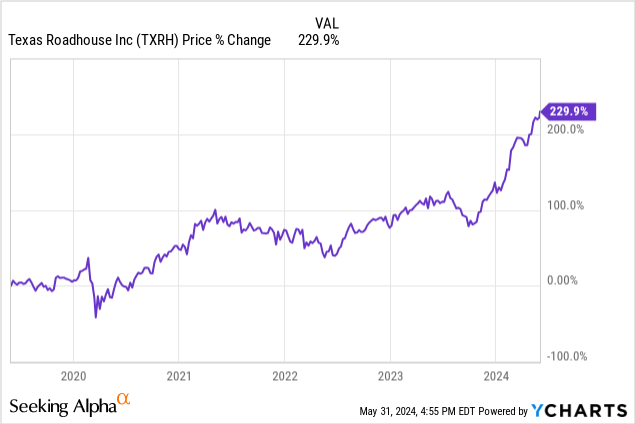

Texas Roadhouse has provided excellent growth on a YTD basis and outperforms the S&P 500 (SPY) by a wide margin. I believe this has been achieved through excellent earnings growth, limited debt, and efficient capital management that has fueled continued expansion. However, it can be a bit scary to start a position in a stock that currently sits at all-time high levels. Therefore, I will also be conducting a dividend discount calculation to gauge how much potential upside there is still.

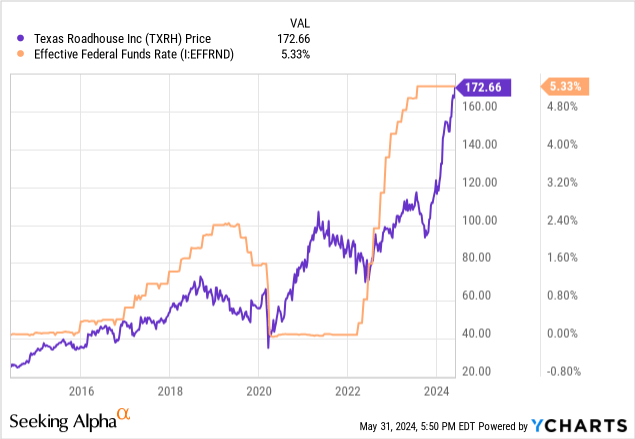

Texas Roadhouse has maintained such a strong performance despite all of the headwinds we’ve faced throughout the last few years. Despite Covid shaking the markets, record high inflation, and rapidly rising interest rates, TXRH has been able to maintain a strong level of performance and liquidity to navigate. This is something that must be commended and the very strong history is a testament to this company’s efficient management when it comes to capital management, pricing strategies to maintain volume, and ability to reward shareholders through buybacks and dividend increases.

While TXRH may not typically be known as a dividend growth stock, I believe that it has very strong potential. To be fair, the dividend was cut in 2020 to preserve capital and take a defensive stance because of the pandemic. However, the company now maintains a dividend much higher than its pre-pandemic level and it remains well-covered with a low payout ratio. The dividend growth has averaged in the double digits and has the compounding power to eventually grow into a large stream of tax-friendly income.

Financials

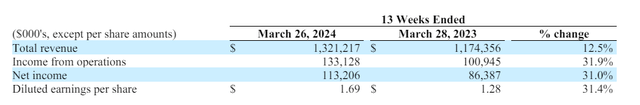

TXRH reported their Q1 earnings at the beginning of May and the strong results continued. Revenue grew by 12.5% year over year, totaling $1.32B. We can see that income from operations increased by 31.9%, resulting in higher earnings per share. EPS came in at $1.69 for Q1 and beat expectations by $0.08. This increase was accompanied by a rise in comparable restaurant sales of 8.4%. TXRH saw an increase in volume, which led to average weekly sales totaling $159k for Q1, compared to the $148k of the prior year.

TXRH Q1 Earnings

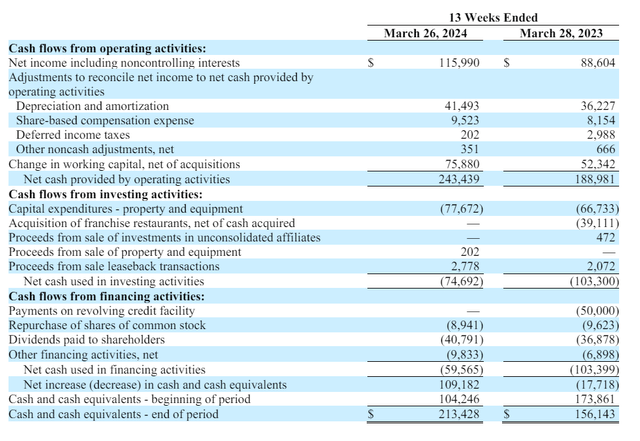

Liquidity remains strong with $213.4M in cash and equivalents available while simultaneously having no long term debt. In addition, the company is pulling in a total of approximately $620M in cash from operations. Year over year revenue has grown at an average rate of 13.92% over the last five year period. Similarly, year over year EBITDA increased at an average rate of 21.6% over the last five year period. This strong cash management gives me a lot of confidence that TXRH is able to ride out any potential headwinds, as they have already. Despite higher inflation rates, higher interest rates, and suppressed consumer spend, TXRH is able to consistently grow revenues year after year due to slight price increases of about 2.2%.

The fact that TXRH has no long term debt really helps mitigate any vulnerabilities to the rise in interest rates. We can see that this helps with the ability to use cash to reinvest back into the business rather than having to use it to maintain debt. We can see that capital expenditures increased year over year, as well as the amount of proceeds from sale leaseback transactions.

TXRH Q1 Earnings

They are able to consistently grow revenues due to their healthy profit margins. For instance, restaurant margins increased 23%, up to a total of $228.4M. This is an increase over the prior year’s margin amounting to $185.7M. These margins have increased due to higher sales that have been captured through marginal price increases and higher average check amounts. As a result, free cash flow sits near all time high levels, totaling over $260M.

This free cash flow can be used to growth the business even faster through additional store openings. Over Q1 there were nine company restaurants opened and three franchise restaurants opened. This growth can continue since management has committed $77.7M in capital expenditures throughout the quarter. These additional restaurants will likely increase net income and total revenues. Management has shared that total capital expenditures are estimated to total between $340M to $350M.

Lastly, TXRH was able to reward shareholders by implementing share repurchases throughout the quarter, totaling $8.9M. This was supported by $240M in operating cash flow that also funded the dividend payments. Additional share repurchases would provide further confidence in management’s ability that their stock price will continue to go up in value, despite trading at all time highs.

Performance & Valuation

Texas Roadhouse’s price now trades around its all time high. Therefore, it can be a bit scary to enter here and while I do agree, valuation indicates that there may be additional upside to be captured. For reference, TXRH has moved up nearly 230% in price throughout the last five year period. During this time, we’ve seen the Covid driven pandemic happen, massive interest rate cuts, slowing consumer spend, and higher inflation rates. Despite these challenges, TXRH has thrived.

When compared against the sector medians, most valuation metrics would state that TXRH is massive overvalued. However, the business consistency is so strong that we should expect it to trade at a premium against the rest of the sector. For instance, the current price to earnings ratio sits at 34.83x, compared to the sector median’s price to earnings ratio of only 17.86x. However, the current P/E of 34.83x sits below Texas Roadhouse’s five year average P/E of 44.35x.

Additionally, the average Wall St. price target sits at $172.45 per share. This would indicate that the current price level sits around fair value. For reference, the highest price target sits at $190 per share and the lowest is around $140 per share. However, I wanted to run a dividend discount model here to get another point of reference to an estimate fair value.

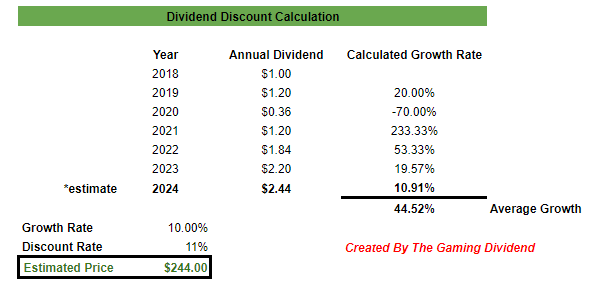

I first started by compiling the annual dividend payout amounts dating back to 2018. Since the dividend was stopped in 2020 and the resumed in Q2 of 2021, we missed out on some growth. However, the dividend has increased at an average rate of 44.52% since 2018. In addition, I wanted to stay conservative with my growth estimated here so I thought that 10% was achievable. For reference, the year over year revenue growth averaged nearly 14% over the last five years. Additionally, free cash flow growth per share grew at an 10% while EPS growth amounted to 14% year over year. With this in mind, an estimate of 10% is realistic and accounts for any unforeseen headwinds.

Author Created

Even with a conservative estimate, we can see that the estimated air price sits at $244 per share. This would indicate a potential upside of a massive 40% from the current levels. Growth levels could be even higher if TXRH has a stronger year than anticipated. We saw inflation cool over the course of April and if inflation continues in this direction, we may see even larger increases in volume for their restaurants. As inflation cools, families across the country may see an increase in their disposable income and might result in more frequent visits to TXRH.

Additionally, management’s guidance estimates that store week growth may rise by 8%, as a result of positive sales growth through the menu pricing increases. The way that TXRH’s fiscal calendar works is that their Q4 consists of 14 weeks, opposed to the typical 13 weeks for other quarters. They estimate that this extra week in Q4 will benefit full-year 2024 earnings growth by a whole 4% by itself.

Dividend

As of the latest declared quarterly dividend of $0.61 per share, the current dividend yield sits at 1.4%. The dividend remains well supported with a reasonable payout ratio of 45.75%. While this is above the sector median dividend payout ratio of 33.69%, Texas Roadhouse’s dividend payout has averaged a rate of 49.7% over the last five years. Therefore, the growth in free cash and earnings has actually helped further cement the safety of the dividend. There is no threat to the dividend at the moment and the strong projected growth may even indicate that we see additional growth.

The dividend growth has helped TXRH become a solid dividend growth stock for investors that may be looking for a reliable source of growing income. For instance, the dividend has increased at a CAGR (compound annual growth rate) of 16.05% over the last decade. Even on a smaller time frame of five years, the dividend has increased by a CAGR of 16.57%. This strong dividend growth has translated to a very high yield on cost of 4.3% for a five year holding period.

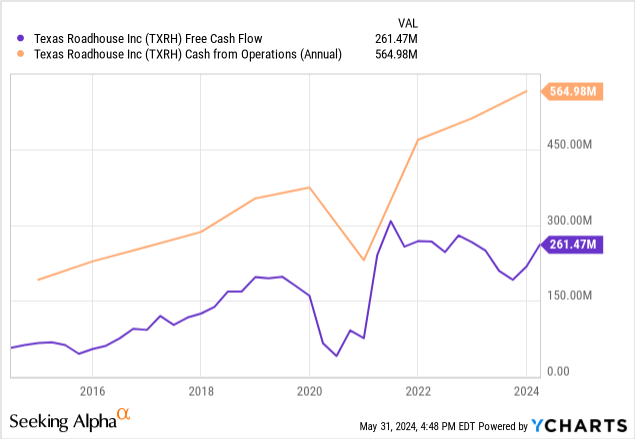

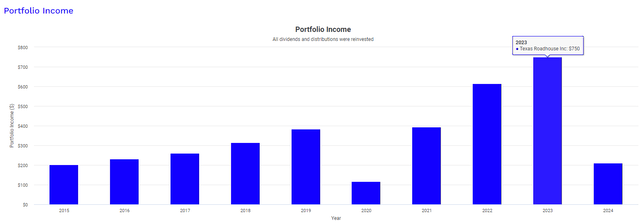

This dividend growth can also be displayed when taking a look at what $10,000 would have yielding you. We can put a graphic to this with Portfolio Visualizer. This calculation assumes an original investment of $10,000 in 2015. It assumes that all dividends were invested but no additional capital was ever added throughout the holding period. Not only would your original $10,000 investment now be worth nearly $60,000, but your dividend income would have also nearly quadrupled.

Portfolio Visualizer

In 2015 your dividend income received from TXRH would have totaled $203. Fast forward to 2023 and your total annual dividend received would have grown to a total of $750. While this is nowhere near enough income to support you during retirement, this serves to demonstrate how the dividend has compounded over time. Not to mention, the dividend received from TXRH would be classified as a qualified dividend, which has the best tax treatment regardless of what kind of account to hold it in.

Risk Profile

Texas Roadhouse seems unstoppable in nature. Even against the scary interest rate levels, the price of TXRH has still crossed into an all-time high territory. Therefore, I believe that future interest rate cuts shouldn’t affect their ability to continue growing revenues. This is especially true because TXRH holds now long term debt so they aren’t affected by this much. However, I do believe that if we find ourselves in a scenario where interest rates get increased further, TXRH will experience lower customer counts and lower average transactions.

Higher rates would likely put more strain on consumers and may limit spending on dining out as people try to dial back their expenses further. While TXRH is able to offset any decreases in volume with price increases, I fear that raising the prices too high or too frequently would upset lots of customers. The business also remains vulnerable to rises in raw materials, such as beef. If interest rates remain higher or increase, TXRH will continue to spend higher levels of capital on these goods. Higher prices all around may cause a ripple effect and may even slow the opening of additional restaurants.

Takeaway

Texas Roadhouse has a strong balance sheet with no long term debt and huge year over year increases in revenue. Despite the price being at all time highs, my valuation indicates that a large upside potential still remains while even using conservative growth estimates. As TXRH continues to open more restaurants, revenue should continue to rise. Additionally, the company has additional value when viewed as a dividend growth stock. Their dividend growth has averaged rates in the double digits and with a long term outlook, you have the opportunity to compound your dividend income. While the company may remain vulnerable to lowered volume in restaurants, they can offset this with marginal price increases.

Read the full article here