Dear readers/followers,

AF Gruppen (OTCPK:AGRUF) is another one of those “for the long term” companies that I invest in. I bought it at what, I believe, is a cheap overall level for the long term. My first article on the company was published all the way back in 2023 after summer, and since that time the company has declined about 12%. Since my former article though, which you can find here, the company has stayed mostly flat in terms of valuation. Meanwhile, the S&P500 is up 11% – so this has not been a successful investment for me thus far, and it’s not wrong to call this one a “failure” in terms of valuation investing.

At least for the time being.

Still, I invest in a far longer timeframe, and such a shorter-term downturn really does very little/nothing to faze me here. AF Gruppen is a construction and engineering company in Norway with potential for future growth, and I believe the potential of this growth and upside to still very much there. Because of this, short-term movements are only of minor interest to me, unless they are massive or because of something significant in the fundamentals.

I do not consider this to be the case at this time, or here.

Let’s update on AF Gruppen and see where and if there is some value here.

AF Gruppen – Fundamental upside in construction & engineering

I like investing in engineering and construction companies in Scandinavia – when these are cheap, at least. I’ve been working with options and common share investments in Skanska (OTCPK:SKBSY) and NCC AB, none of which however I currently own. I’ve also been looking at PEAB, another large player, at least in Sweden.

From its inception in the mid-80s, the company was initially meant to serve the burgeoning oil & gas industry in Norway, but quickly went into infrastructure and other major construction projects aside from this. Multiple large projects were under its belt early on, including the Troll Field Tunnel. However, the company went from “niche” to “major” when it included or merger with Ragnar Eversen, which effectively turned it into a major contractor for all things in Norway, and also a property manager and developer, with the acquisition of Odin later on.

Today, AF Gruppen is essentially 3000 people working in things construction and engineering across both Sweden and Norway in a myriad of segments, with a majority of exposure to Norway, which given its economic circumstances is something positive to my mind.

1Q24 is the latest set of results we have reported, about 1-2 weeks back as of the time of publishing this piece.

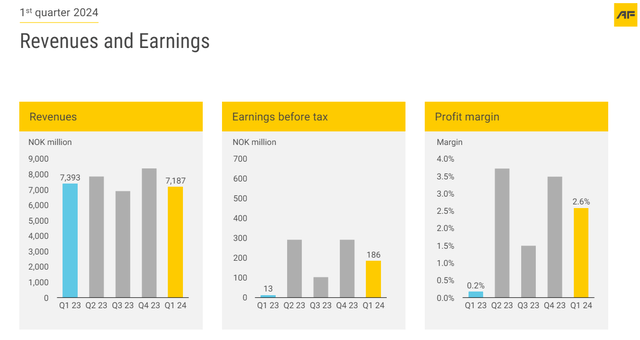

The takeaway here was stability and slight improvements. Revenues were somewhat flat, with a bit of a drop, but earnings were up, and profit was up from 0.2% to over 2.5% in terms of margins, with a positive operational cash flow of over 125 NOK for the quarter.

Order intake, however, was almost halved, continuing to showcase a very complex sort of macro situation. The backlog is affected in the way that it’s over a billion lower, and debt is out.

Also, a big set of news in this case is that the dividend has been around halved – from 6.5 NOK to 3.5 NOK, meaning a 3%-ish dividend yield. However, this has done little to faze the stock which continues to trade in line with my last article and the level there, and really the story to tell here is “stability”.

AF Gruppen IR (AF Gruppen IR)

ROCE is within target parameters, and the expense situation for the company is mostly under control. The company’s balance sheet continues to be healthy, with a roughly 22% equity share – not as good as some, but not terrible in any way either.

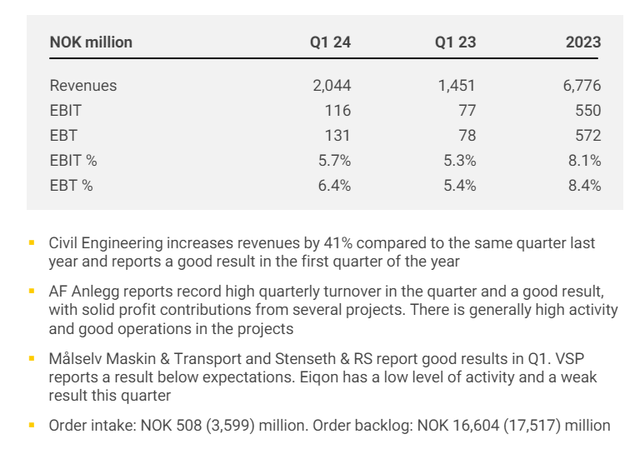

The company’s broader market shows good activity in many of the company’s sub-segments. If you recall, AF Gruppen has quite a few business segments, including but not limited to Civil Engineering, which showed very good results…

AF Gruppen IR (AF Gruppen IR)

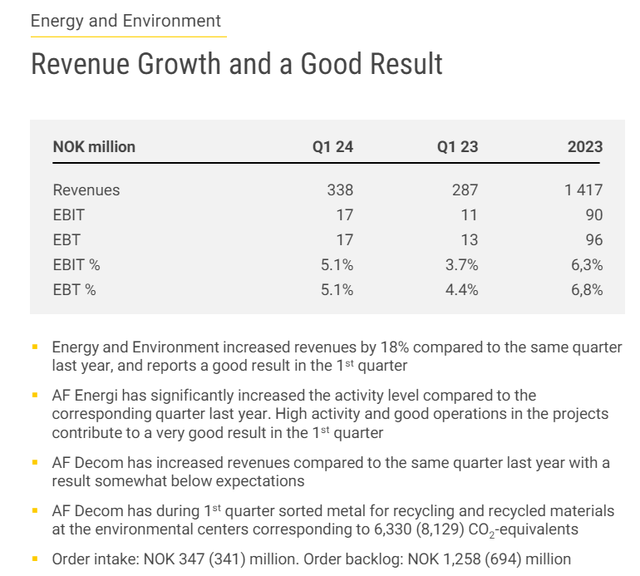

…and improvement in the Construction sector with increased margins despite a lower revenue. Some segments, like Betonmast, were so-so with declines in revenue as well as profitability. Company EBIT margins in this segment went negative, and the property segment is complex to say the least, due to continued negative trends in sales and the uncertainty in overall market sentiment. High interest rates further complicate this picture to a degree where sales for all the property segment amounted to 19 residential units – which was all, with AF’s share at 8 of those. The company still has a high number of residential units under development. Sweden, meanwhile, managed a break-even result, which is not all that impressive, but compared to what the company has managed prior with a negative EBIT margin, is still very impressive. The company’s legacy segments and environments of energy and offshore remain an attractive play here, with revenue increases and very solid results in terms of margins.

AF Gruppen IR (AF Gruppen IR)

The company’s order backlog, despite overall declines, remains robust overall – and mostly engineering-focused, but with a very good balance of Construction, engineering, Betonmast, and Sweden-related orders. Profitability is okay, with a company-wide profitability EBIT margin of 5.1%, and an EBIT of 17M NOK on an overall revenue of 338M NOK.

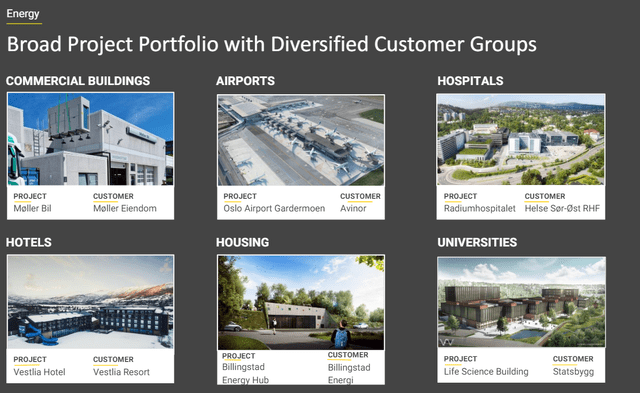

There are many “Flagship” projects here that are worth mentioning, both in and outside of Scandinavia, but many of them in Norway.

AF Gruppen IR (AF Gruppen IR)

Despite its cyclical sectors, AF Gruppen is rated very high in terms of safety and profitability. Benchmarking and analytical services, such as GuruFocus or Morningstar, give the company higher points than you might expect. GuruFocus is at 93/100 in total, showcasing high profitability with an absolutely stellar RoE of almost 30%+.

So, even if the dividend is down, there are a lot of things to like about this company and how it works. The company is also moving into new fields such as Bioenergy, with ETA Norge A/S as the leading provider of Bioenergy – which through a recent move, the company now has in its portfolio.

AF Gruppen IR (AF Gruppen IR)

Overall, I want to characterize 1Q24 as a positive quarter. I say this because the company improved its results and has a strong financial position, and despite the lower order intake and lower dividend. AF Gruppen, like other companies in this field, is a cyclical construction and engineering business. Stability is, as inferred here, not part of its M.O. – so I won’t punish it for trends outside of its sphere of responsibility or control.

With that said, I’m moving to valuation for the company, and saying as follows.

AF Gruppen – Plenty to like, but with a somewhat less certain upside here.

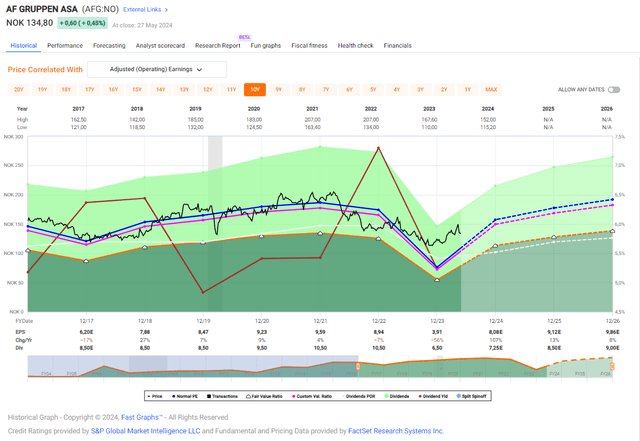

There is a dip going on here – but the company will be reversing its fortunes in 2024 – of that I am certain. Because of that, and due to the fact that I consider further slight growth likely to the levels where we saw the company trading in 2020-2021, I would consider it valid to remind readers of the premium this company often commands.

FAST Graphs Upside AF Gruppen (FAST Graphs Upside AF Gruppen)

AF Gruppen is the sort of company where you can strategically find low points of entry due to excessive volatility, and follow the exuberance up to higher levels. That is what I plan on doing, and that is also how I handle other Scandinavian construction businesses. Both Skanska and NCC AB are like this – I buy them below X, then sell them above Y, and I have been doing this for a number of years – successfully, I might add.

For that reason, I consider the company to be fairly simple to evaluate here. The company trades at what I consider to be a normalized P/E that is well below the average of what the company is capable of. At today’s numbers it may look like 24-25x, but in a few years, it will be below 17-18x P/E. I am willing to wait that long for a company that has less than 20% long-term debt/capital and a market cap of nearly 15B NOK even today, combined with the fundamental position this company has in the markets where it operates.

I forecast AF Gruppen at its long-term 5-10-year premium of around 19x P/E, which comes to a long-term upside of around 18-19% annualized for the next few years, at around 19x P/E. Even at a substantially longer sort of valuation of 15-16x, the company still maintains a double-digit, dividend-inclusive sort of upside at this price of around 135 NOK.

The company is without a doubt a cyclical business, with all the risks and potentials that come with such a business – but I view the overall upside as one that is beyond doubt if the company manages the current forecasted earnings and upsides.

Unfortunately, AF Gruppen remains relatively underfollowed. A few years ago, the company had a number of analysts following and giving targets, some as high as 190 NOK – now it’s down to 1 analyst from S&P Global with a 100 NOK price target. It evidently means that the company isn’t considered that interesting, to which I can only say that I do not agree with such an assessment.

I have clarified before, and I continue to, say that I expect AF Gruppen to outperform somewhat over time. This is not a triple-digit investment, with portfolio-beating RoR potential; otherwise I would clearly state that I view it as such.

I view it more as a mixed-income/reversal investment, where I take advantage of sector weakness and good longer-term trends. I am frankly surprised that the construction sector in Sweden has held up as well as it has for now, and that companies here are still trading at share prices as high as we’re seeing.

I view the company as a “BUY” with my previous price target of 165 NOK/share.

Thesis

- AF Gruppen is a company that combines attractive overall yield with an attractive overall reversal upside, now that the share price is down from over 180 NOK/share, and touches upon levels of 125 NOK. This implies a yield of over 3% currently and over 7% normalized and an upside of over 15% per year even on a very conservative 16-18x P/E forward basis.

- I recently added more AF Gruppen to my portfolio and will continue to add as the company experiences weakness in terms of share price. The company trades on the native ticker AFG on the Oslo exchange.

- I give the company a rating of “BUY” here” and consider a fair target for this company at least 165 NOK/share in the long term based both on reversal and growth.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every single one of my criteria, making it relatively clear why I view it as a “BUY” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here