Elevator Pitch

I rate Atour Lifestyle Holdings Limited (NASDAQ:ATAT) as a Hold.

Previously, I wrote about the Lunar New Year holiday travel-related data and the relevant read-throughs for ATAT’s Mainland Chinese hotel business in my February 21, 2024 article.

My current update is focused on Atour Lifestyle’s Q1 2024 financial results which were recently announced on May 23. I have made the choice to keep my existing Hold rating for ATAT unchanged. Although the revenue outlook for Atour Lifestyle’s hotel and retail businesses is favorable, I have concerns about the increase in the company’s selling and marketing costs and the uncertainty regarding future capital return.

Core Hotel Business’s Growth Outlook Is Positive

ATAT’s top line grew significantly by +90% YoY to RMB1,468 million in the first quarter of 2024 as disclosed in its earnings announcement. The company’s latest quarterly revenue beat the sell-side analysts’ consensus forecast of RMB1,370 million by +7%.

Atour Lifestyle’s revenue generated from its hotel business, including both its manachised hotels and leased hotels, increased by +58% YoY to RMB1,004 million. The core hotel business contributed 68% of the company’s recent first quarter top line.

In my view, it is likely that ATAT’s core hotel business will continue to register robust top line growth in the future, taking into account two key factors.

The first key factor is that Atour Lifestyle’s hotel business has room for further top line expansion considering its mix of travelers and the potential rebound in business travel demand.

In a June 27, 2023 research report issued by Chinese research firm CMB International, it is noted that ATAT boasts “a higher sales mix from the business related travelers” vis-a-vis leisure travelers.

At its Q1 2024 earnings call, Atour Lifestyle indicated that “experience-driven leisure tourism during holidays and weekends maintained its growth momentum” and also mentioned that “the recovery of business travel was relatively subdued due to macro uncertainties.”

In other words, ATAT managed to grow its hotel business’ revenue in a significant manner and achieve a +7% top line beat for Q1 2024, even though business travelers haven’t returned in a big way. As such, it is realistic to think that Atour Lifestyle’s hotel business could witness revenue growth acceleration going forward in the event that business travel demand gets better in the future.

The second key factor is that the company’s Atour Light brand boasts favorable growth prospects.

In its FY 2023 20-F filing, ATAT refers to Atour Light as a “midscale hotel brand” focused on “young urban travelers seeking the best value and experience” which introduced “the upgraded hotel model” Atour Light 3.0 in February last year.

Atour Lifestyle highlighted in its Q1 2024 earnings presentation slides that it has recently rolled out “special platinum (member) privileges” and a “co-branded collaboration with a fashion clothing brand” to differentiate the Atour Light 3.0. ATAT’s efforts have paid off, as over 15% of the hotel business’ recent quarterly new signings were contributed by Atour Light 3.0. Looking ahead, the company’s goal is to increase the number of Atour Light 3.0 hotels from 36 as of end-Q1 2024 to 100 by the end of this year.

Retail Business Is A Key Growth Engine

Atour Lifestyle noted in the company’s FY 2023 20-F filing that its retail business sells private-label “sleep-related” and “personal care and fragrance” products to the travelers who stays at its hotels.

The retail business and other businesses accounted for 28% and 4% of Atour Lifestyle’s most recent quarterly revenue, respectively. Apart from the core hotel business, ATAT’s other key growth driver is its retail business. Revenue and GMV (Gross Merchandise Value) for Atour Lifestyle’s retail business rose by +269% YoY and +277% YoY to RMB417 million and RMB495 million, respectively in Q1 2024.

ATAT has revised its full-year FY 2024 top line growth guidance from +30% previously to +40% now, as part of its Q1 2024 results release. Atour Lifestyle explained at its Q1 2024 results briefing that “the outstanding performance in the first quarter, especially in our retail business (my emphasis)” was the key reason for the upward revenue guidance revision.

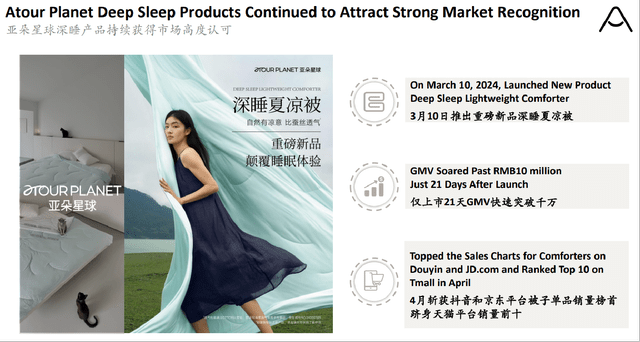

An Overview Of The Retail Business’ New Offering Known As The “Deep Sleep Lightweight Comforter”

Atour Lifestyle’s Q1 2024 Results Presentation Slides

As indicated in the chart presented above, the retail business’ latest offering called the “Deep Sleep Lightweight Comforter” has recorded robust sales on leading Chinese online platforms last month. Moving forward, ATAT revealed at its recent quarterly analyst call that the retail business will be “launching the next-generation of Deep Sleep pillows or Deep Sleep temperature control quilt in the next coming quarters.”

The positive growth momentum for Atour Lifestyle’s retail business is most probably going to be sustained thanks to aggressive new product launches.

Sharp Increase In Selling And Marketing Costs Is A Concern

In contrast with the company’s impressive +7% first quarter revenue beat, ATAT’s Q1 EBIT margin of 22.11% was -36 basis points lower than the consensus projection of 22.47% (source: S&P Capital IQ).

Atour Lifestyle’s operating profitability for the latest quarter might have come in below expectations due to a substantial increase in the company’s selling and marketing expenses.

In specific terms, selling and marketing costs for ATAT jumped by +212% YoY from RMB56 million in the first quarter of 2023 to RMB175 million for the first quarter of the current year. The selling and marketing costs-to-sales ratio went up by +4.7% percentage points YoY from 7.2% for Q1 2023 to 11.9% for the recent quarter.

ATAT cited “the enhanced investment in brand recognition” as a major reason for the spike in its selling and marketing expenses for the latest quarter. Therefore, there are valid reasons to be concerned that higher-than-expected investments and expenses could affect ATAT’s future financial performance.

Uncertainty Over Future Shareholder Capital Return

Shareholder capital return is a key investment consideration for two reasons. Firstly, companies which actively return capital to shareholders are typically more disciplined with respect to capital allocation because of the need to set aside capital for buybacks or dividends. Secondly, share repurchases and dividends can provide investors with steady returns unaffected by market volatility and share price movements.

In the case of Atour Lifestyle, the company doesn’t pay out a regular recurring dividend and it doesn’t have an active share repurchase program.

A sell-side analyst questioned whether “the management has any plans in terms of the returns to shareholders” at the company’s latest earnings briefing on May 23. In response, ATAT highlighted that it “announced a one-time dividend” in August 2023 and will “consider plans to increase shareholder returns, including dividends.” However, the company stopped short of providing specific details regarding potential shareholder capital return initiatives for the future.

In a nutshell, there is uncertainty relating to Atour Lifestyle’s capital return approach and moves for the future.

Final Thoughts

My decision is to maintain a Hold rating for Atour Lifestyle after analyzing ATAT’s revenue, expenses, and shareholder capital return.

The market is now valuing ATAT at a consensus next twelve months’ EV/EBITDA ratio of 9.7 times (source: S&P Capital IQ). This is relatively lower than its peers Shanghai Jinjiang International Hotels’ [600754:CH] and BTG Hotels’ [600258:CH] forward EV/EBITDA multiples of 10.0 times and 11.2 times, respectively.

But I think that Atour Lifestyle deserves some form of valuation discount due to its shareholder capital return approach and size. ATAT doesn’t pay a dividend unlike Shanghai Jinjiang International Hotels and BTG Hotels. Also, Shanghai Jinjiang and BTG Hotels are roughly five times and twice as large as Atour Lifestyle based on the respective companies’ most recent fiscal year top line as per S&P Capital IQ data. Therefore, I am of the opinion that Atour Lifestyle’s valuations are reasonable and the stock warrants a Hold rating.

Read the full article here