Innovative Industrial Properties (NYSE:IIPR) (“IIP”) represents an interesting way to seek exposure to the cannabis industry: through rent. As a REIT, IIP allows investors a chance to generate income from such exposure, as many of the cannabis producers and vendors themselves do not offer dividends.

IIPR Full Price History (Seeking Alpha)

With cannabis being still something of a novelty, the company only dates as far back as 2016. It’s been enough time for them to get established, but as the price chart above indicates, it’s also been enough time for the market to change its mind on these shares wildly. I think the current decision by the market is a fair one, not enough to dive in, but good enough to be rated a Hold.

Financial History

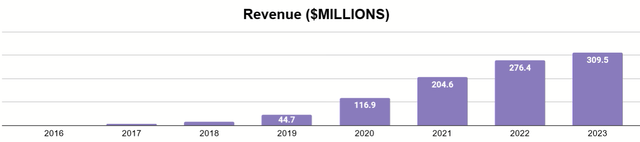

Despite its brief history, the company has seen significant growth since inception.

Author’s display of 10K data

Starting from nothing, revenues reached $309M in 2023. The growth continued, even amid the challenges of COVID, the War in Ukraine, and inflation. This was due, in large part, to the resilience of their tenants. Chairman Alan Gold reflected in the Q4 2020 earnings call:

And as the country and the world as a whole has suffered through not only a health crisis but also one of the quickest and deepest economic contractions in recent history, the United States regulated cannabis industry continued on its tremendous growth path, growing over 50% annually from just over $13 billion in sales in 2019 to an estimated $20 billion in 2020. And while the vast majority of businesses were retrenching in this unprecedented time, experienced, well-positioned regulated cannabis operators continue to expand their footprints and deepen their operations.

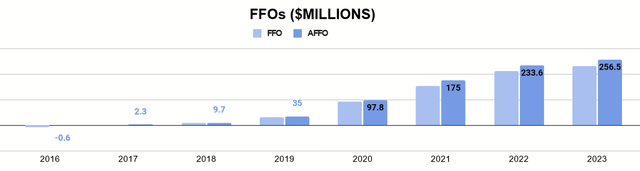

Still, let’s look at how IIP has grown from a cash flow perspective.

Author’s display of 10K data

Funds From Operations (and adjusted) have both seen similar rates of growth during this period, not facing significant setbacks during COVID.

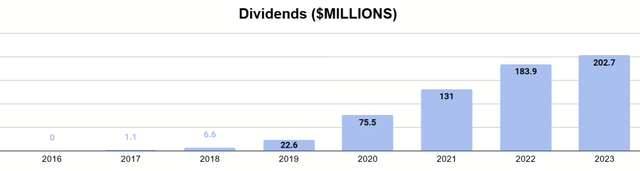

Author’s display of 10K data

Consequently, the company has been able to pay growing dividends to shareholders.

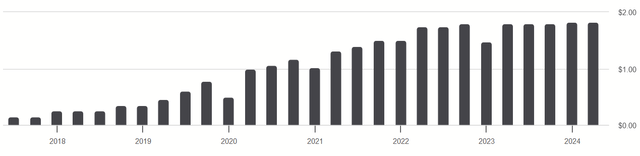

Dividend History (Seeking Alpha)

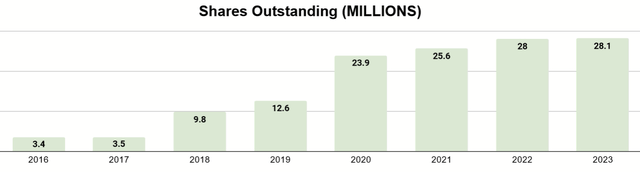

The dividend per share has not been increased quite as much, but it has been paid every quarter since 2017 and generally increased, with its December distribution typically being smaller than the other ones throughout the year. Part of the reason the dividend per share has not increased as much is because of the dilution that occurred in 2020 (2020 Form 10K, pg. 61). Most of the new shares sold were in the early half of 2020.

IIPR Share Price 2020 – 2021 (Seeking Alpha)

With the period spanning 2020 to 2021 above, we see that not very many of those prices were attractive for IIP to sell. With $1 billion raised, that suggests the average price per share sold was about $88 per share.

Author’s display of 10K data

2020’s dilution almost doubled the number of shares, and very little has been done in equity raises since.

Business Model

The company primarily builds its portfolio of cannabis-focused real estate through sale-leaseback transactions. These leases are typically done as triple-net leases.

March 2024 Company Presentation

These leases are typically long-dated and at high yields. IIP notes that their customers, described as “cannabis operators,” typically agree to such favorable leases because they have limited access to capital, due to the heavily regulated nature of the industry, and such transactions free up their capital for future growth.

March 2024 Company Presentation

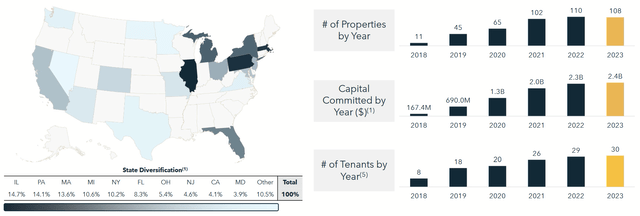

IIP’s assets span 108 properties, 19 states, and 30 customers. In the Q1 2024 Form 10Q (pg. 24), the company reported a weighted-average remaining lease term of 14.8 years on this portfolio.

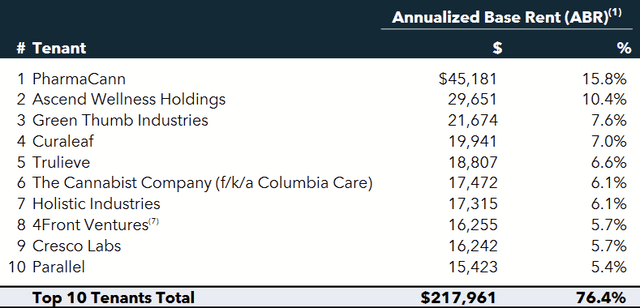

Top 10 Customers (March 2024 Company Presentation)

Their top ten customers account for 76.4% of rents. Most of these are publicly traded companies, too. With the exception of 4Front (OTCQX:FFNTF) all of those public companies reported positive operating cash flows for 2023 and showed trends of growth in their cash generation.

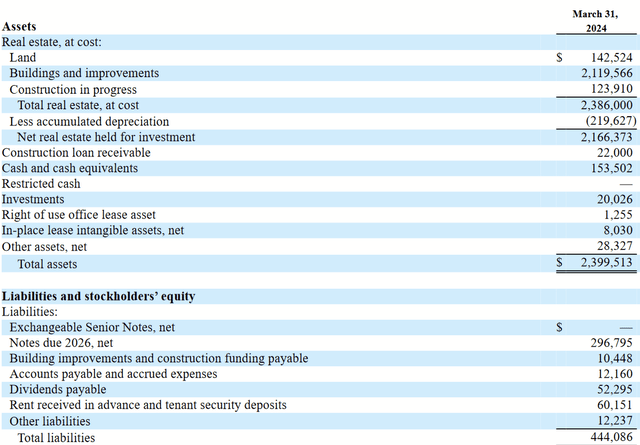

Balance Sheet (Q1 2024 Form 10Q)

The balance sheet is healthy, with very little debt. $296.8M of senior notes are due in 2026, however.

Future Outlook

I perceive a mix of benefits and downside in the future. I’ll discuss each of those and then give my valuation based on it.

280E & Rescheduling

During Q1 earnings, management shared their thoughts on the impacts of the federal government’s plans to reclassify marijuana as a Schedule III controlled substance, which would benefit businesses under Section 280E of the tax code and thus improve their cash flow. CEO Paul Smithers had to say:

…we don’t see any significant risk to our operations should rescheduling go forward. The opposite is true. Because remember, we still — if we rescheduled the three, there’s still a federal disconnect between state law and fed. So it’s still state’s operating license. State operators would still be in conflict with federal law because they’d be selling cannabis without a prescription.

They believe the near-term horizon will remain favorable, as improving the cash flow does not improve tenants’ access to capital without a legislative overall at the federal level. It also suggests that such a tipping point could have some downsides for IIP.

Slower Growth

Going forward, I don’t expect growth quite as high as we saw in the formative years. At this point, I expect the game to be more one of managing an existing portfolio and finding good fits. While they did speak optimistically about new leases in Q1 earnings, I don’t think we can assume this will apply for the next decade like it did over previous years. Certainly, the last couple of years’ results indicate that growth is slowing down.

Dilution

Given what I said before about dilution, it’s possible that peculiar timing by management on the issuance of new shares could impair long-term returns. Given the amount of dilution in 2020 and the lack of opportunism on issuing shares in 2021, I worry that management does not have a very price-sensitive taste for their own shares, even if they underwrite leases effectively.

One possibility comes from the senior notes due 2026. There was a class of notes due 2024 that management issued stock to repay. While those notes were exchangeable, all that really adds is the step of management selling to the market and using the proceeds to repay the holders. Considering how large the principal is versus the annual AFFO, I expect at least some of this to occur to avoid a dividend cut.

Valuation

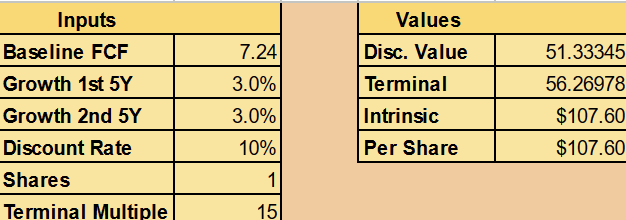

Altogether, there are positive signs for the cannabis industry but a lack of the same growth opportunities. With that, I can do a Discounted Cash Flow calculation, using the dividend per share as a substitute for free cash flow. I’ll use the following assumptions as well:

- 3% average annual growth the next decade

- Terminal multiple of 15

3% is to allow for modest assumptions, with much around the cannabis industry (and its financing) remaining uncertain for a long stretch of time but feeling certain enough in the current portfolio’s long-dated leases. A multiple of 15 also prices in a similar future dividend yield to the present day.

Author’s calculation

At a 10% discount rate (comparable to the return of a broad market index), a fair value stands at about $107, close to the current price. This suggests that long-term investors are not getting a bad price, but there isn’t much of a margin of safety in this valuation either.

Conclusion

Cannabis continues to be a popular search among stocks for outsized returns on waves of legalization. With IIP, a honeymoon of vertical growth rates seems to be behind it, and there are no obvious catalysts to this company taking off. Rather, it will be a game of managing the current portfolio and working with tenants to improve the properties, while incrementally adding new tenants as more layers of legalization come down and bring more growth into the industry. The pace of this process, split across many states and having a federal component, is not easy to predict, and that affects what investors should consider a fair price.

With a yield around 7%, it’s not a bad investment to have income that can keep up with inflation, but there is nothing wrong with waiting for a margin of safety. For now, that’s why it’s just a Hold for me.

Read the full article here