Dear readers/followers,

Oftentimes, you’ll get businesses that have a specific niche and appeal in a very particular field, and because they excel in that specific field, believe they can excel in other fields easily. Sometimes this works out – but more often, as I’ve experienced, it does not. AMSC ASA (OTCQX:ASCJF), a ship financing company, has seen a significant bounce in its stock price and offered a 16%+ yield – but this is now changed, which we’ll go into in this article. It’s also a company I’ve been covering for some time, with my latest article about the business one that you can find here.

In my last article, I made a case for why this company should be avoided due to elevated risk and a change to its business model that could impact its overall appeal in a fairly major sort of way.

Since that time, the company has underperformed the S&P500 on a capital appreciation basis and barely outperformed on the basis of inclusive of dividends.

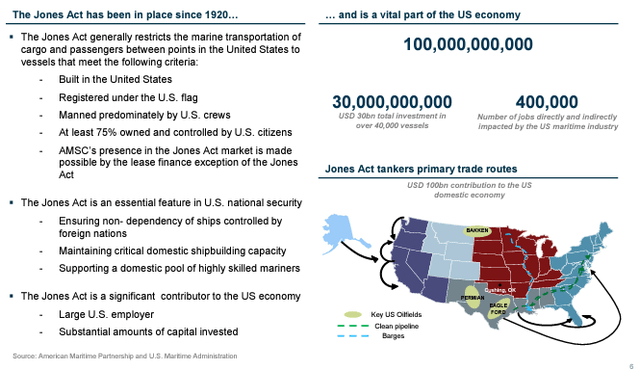

One of the major things that happened during the last quarter was that the company moved away from what I believe made one of its appeals – namely the business segment with the Jones Act.

In this article, I’ll be updating you on AMSC ASA, and show you why I still believe this company to not be great investment potential at this time.

AMSC ASA – more uncertainty following 4Q, not less

So, the company already announced and confirmed the dividend cut during the last period. That means that, unlike other high-yield shipping investments, AMSC ASA Is now a business that offers a yield of 6.65%.

Now, there are different types of investors. There are investors that are looking for yield and investors that are interested in capital appreciation. Different stocks make sense for different people at different points in their lives. Someone in retirement could focus on something like a high-income but high-safety portfolio to make sure that enough cash for bills and expenses is always there, since they wouldn’t be working anymore. Younger investors would then instead focus on something like a portfolio with more growth because they still have plenty of time to grow their fortune.

I’ve always favored a diversified approach. I have both growth and income investments and know enough to differentiate between the two. When you have an income investment, you also need to make sure that that income investment makes sense from a risk perspective; i.e., if you’re taking an extraordinary amount of risk to get a yield that you could get from far safer sources.

I mention this because I believe it’s relevant – because I in fact believe that this is what AMSC represents following the change of direction and the dividend cut.

There was an argument to be made with the company when it was Jones-act focused, and when there was a 16%+ yield. Because at the time, the company was a clear income investment that outstripped many others. Even from a risk-reward profile, it could be argued that AMSC ASA suited some portfolios, depending on the investor risk tolerance.

It’s my view that this is now a difficult argument to make.

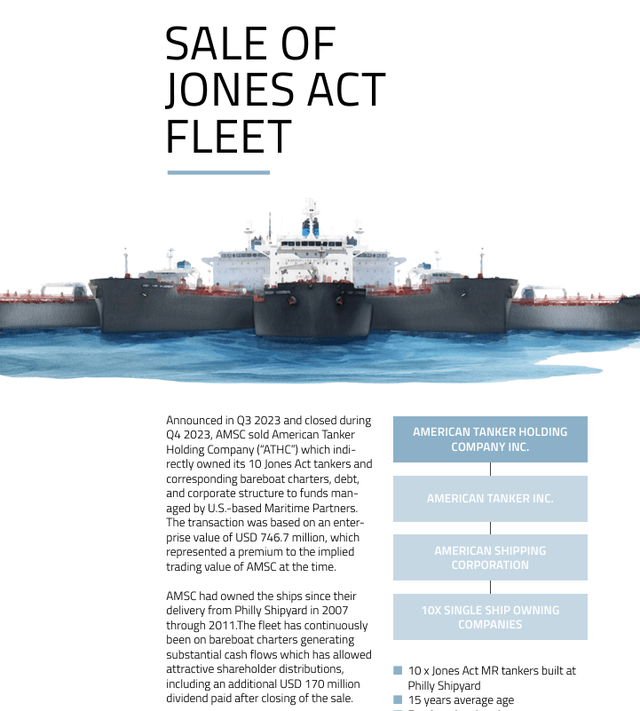

The last report we have is the annual one so far, or 4Q. The company approved the new dividend of 5 cents quarterly, refinanced some leases, and completed a sale totaling almost 750M USD.

These are only the last news items, though – not the ones I believe that one should focus on with the company. If you’re to believe the company’s own material before this transaction, then the Jones Act was one of the primary reasons that you wanted to invest in AMSC ASA.

AMSC IR (AMSC IR)

These restrictions significantly benefitted AMSC, and while the rationale behind moving away from it makes sense to some, it does not to me – not if the company wanted to maintain its appeal as an investment. The sale of the Jones Act tanker fleet, and the sale of the Normand Maximus, all of these mark this change from one form of the company to another.

ASMC IR (ASMC IR)

So what remains after this move, and where is the company going? For now, the outlook seems to be that AMSC will try to grow based on its 21.1% shares of Solstad Maritime (though these will be diluted yet again with the Solstad Maritime equity raise later this year), and that AMSC based on current information, will be trying to “grow through accretive transaction and focusing on distributing dividends to shareholders”.

Color me somewhat uncertain of where this exactly means that the company is going.

The only other information we have is that AMSC believes that its investment in Solstad Maritime means that it can benefit from years and years of low investment levels into offshore oil services, which currently is expected to continue at a high level, with high utilization rates for both offshore oil and offshore wind.

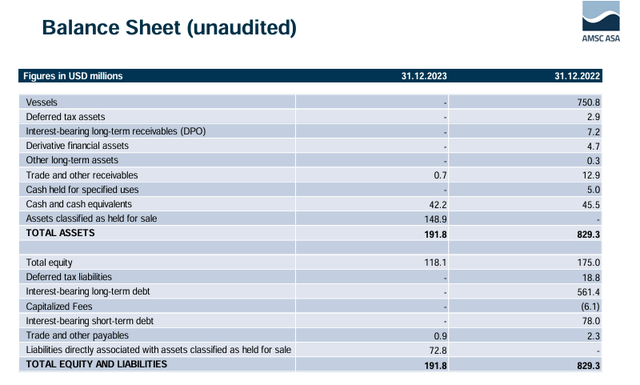

So what you’re investing in is a company that doesn’t really own anything anymore – except 21.1% – subject to dilution – of Solstad Maritime.

This is also expressed in the change in the balance sheet.

AMSC IR (AMSC IR)

So – a new company with new goals, and very little concrete as to what the company is going to do, beyond managing its assets in Solstad and trying to find accretive transactions in what I would characterize as a very inflated sort of market on an overall basis. One of the reasons I maintain, at this particular time, over 12.5% in cash, where I am usually below 6%.

I say the following: AMSC ASA now yields 6.5%. This is not a high yield nor an attractive one in the context of risk/reward when you consider what else is available on the market today.

What do I mean by this?

I mean that one of the largest Telcos in Sweden, Telia (OTCPK:TLSNF), yields over 7%. I mean that Fortum (OTCPK:FOJCF), a large utility, is at over 9% I mean that British American Tobacco (BTI) is almost at 10%. I mean that Enbridge (ENB) is at over 7%. I mean that Enel (OTCPK:ENLAY), despite massive growth, is still at 6.3%.

I mean, collectively there are many companies with attractive dividends, and because my portfolio yield on an overall basis is currently at 5.1224%, you’ll know that dividends are important to me. I live off my dividends, and I mean to continue doing so for the rest of my life. So, a good dividend investment – I’m on board.

I do not believe AMSC ASA constitutes a good dividend investment or a good or safe investment at this particular time, because of the uncertainty as to what exactly the company is going to do on a forward basis.

I will show you the valuation here, but a fair warning, there’s a lot of uncertainty about the valuation and prospects of this company at this time.

AMSC ASA – Plenty to like, but the valuation and uncertainty are not one of those things.

I was actually close to, at this article, going to a “SELL” for the company here. The reason behind this is the massive changes in the company’s fundamentals, without more than a few sentences worth of public plan and ambition where to go from here, and clearly expecting investors to somehow be accepting or fine with this on an overall basis.

Well, that is not the case for me. I don’t find the information sufficient to base a convincing thesis.

When I previously wrote about AMSC as a business, I considered the company a “HOLD”, fulfilling only 2 out of 5 of my investment criteria despite a significant, 16%+ yield. This was also at a significantly expensive P/E, but this wasn’t only the reason that I went neutral or “HOLD” on this company. The reason was also that there were quite a few more attractive shipping businesses out there. I also considered the size prohibitive.

Then the company did this in 3Q23, and now we have 4Q23 and FY results, with not much more clarity than before. What this means is that it’s now hard to even use the same metrics to evaluate the business here.

Despite everything, AMSC ASA still has a negative 5-year RoR, if not an excessively negative one – less than negative 15%. The extraordinary dividend has really pushed this up as well.

Analysts now, as of May of 2024, have the company at an updated target range of around 20-22 NOK, lowered from around 45-60 NOK back in early 2023. So most analysts would agree with the assessment that the company is worth around half now that this latest set of measures has gone through, and that it’s likely to go through.

It’s also worth noting that as of this news, all but one analyst has now left coverage of the company behind. (Paywalled Source, TIKR.com)

This in itself need not mean anything, but I still believe it is indicative of the risk/reward ratio that analysts consider this company now being operating under.

I do not consider AMSC ASA to be an attractive business to invest in at this time. I will lower my PT to 15 NOK because the book value calculations do not make sense when the company’s equity and assets are just stakes in other investments that are going to be subject to dilution, in the company’s own words, due to an incoming capital raise.

I therefore would not pay more than 1x Book value, and I consider even that to be a potentially rich valuation, given some of the risk/reward here.

I do not lower my target to SELL – but unless the company reveals some more concrete plans in the 1Q24 period, then I may do so in the next quarter. Holding here is not something that I consider to be relevant with what else is available in the current stock market environment.

Here is my updated AMSC thesis.

Thesis

- AMSC is a recently transformed company, once a play on the conservative US-based Jones Act, now your standard shipping leasing company with a fleet of potentially attractive vessels with a hopeful upside generating a dividend yield of about 6.5%.

- For that reason, I’m careful here. I wouldn’t buy the company at today’s valuation but would wait, if interested, for a bit of a drop.

- My PT for the company now comes to 15 NOK/share, which is where I move my 2024E coverage here.

- The likelihood of the company dropping to this level without macro impacts is potentially low – but this signifies just what I’m looking for before I would be willing to “BUY” a spec stock like this here. Especially one that as of 4Q23 has materially changed its risk/reward factor, and not for the better, as I currently see it, with no change in forward clarity from the company that I can see either as of the AGM or the annual report.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company fulfills 1 out of my 5 criteria, making it a “HOLD” here, bordering on a “SELL”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here