The stock of Upstart Holdings, Inc. (NASDAQ:UPST) tanked 6% after the fintech presented its financial results for the first quarter on May 7, 2024.

Upstart Holdings with its AI lending focus has fallen on hard times lately as the central bank’s aggressive push to hike short-term interest rates ate into the company’s sales growth and resulted in the fintech reported substantial losses.

In 1Q24, Upstart Holdings, however, returned to double-digit sales growth and with the central bank sooner expected to lower rates, I think it will be only a question of time until the fintech is going to see a favorable change in fundamentals.

My Rating History

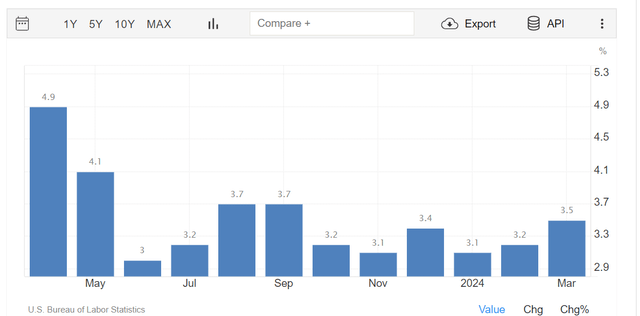

Inflation and short-term interest rates are key decision parameters when it comes to investment decisions concerning Upstart Holdings. The fintech has a defined, AI-supported lending focus, so the company is set to benefit from lower short-term interest rates.

The recent uptick in inflation has set the investment thesis back a couple of months, but I think that the risk/reward relationship remains particularly compelling now that we are nearing the point of no return: the point at which the central bank initiates its rate-cutting cycle.

Double-digit sales growth in 1Q24

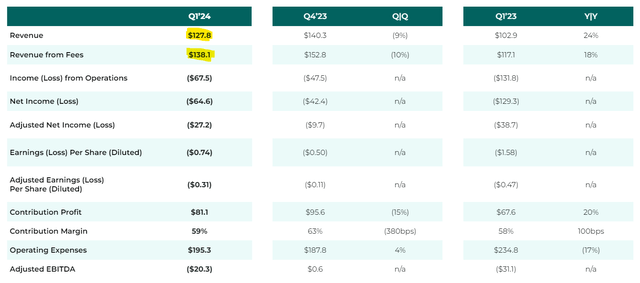

Upstart Holdings’ 1Q24 sales skyrocketed 24% YoY to $127.8 million in 1Q24, while its fee-derived revenues skyrocketed 18% YoY to $138.1 million.

Sales started to stabilize for Upstart Holdings in the last quarter when it became increasingly apparent that the central bank would soon start to lower key interest rates, a fact that has helped demand for credit product.

As an AI-focused lending startup that utilizes artificial intelligence technology to make the lending process as easy and as straightforward as possible, lower short-term interest rates are poised to be a potent catalyst for the fintech’s lending business.

Though Upstart Holding is not profitable (and not expected to be in 2024), I think the fintech has a good shot of returning to profitability in 2025 which is when the central bank should be way into the next rate-cutting cycle.

Revenue From Fees (Upstart Holdings)

Recently, the investment thesis got set back a bit because of a resurgence of inflation in the early months of 2024 which caused the central bank to delay short-term interest rate cuts. Inflation data showed that consumer prices edged up 3.5% YoY in March, which made it the second consecutive month of growth in 2024.

Inflation (U.S. Bureau Of Labor Statistics)

Loan Demand Set To Grow

Naturally, Upstart Holdings makes money when customers request more loans, which is usually the case in an environment with low interest rates. With short-term interest rates likely already peaking, there is a strong chance that Upstart Holdings will see growing demand for personal loans in 2024 and 2025.

In 1Q24, the number of personal loans originated through Upstart Holdings soared a whopping 45% YoY to 118.7K, and I anticipate this momentum to continue throughout the rest of the year, with the central bank potentially pouring fuel into this fire.

The fintech also disclosed that it received a subpoena from the SEC last year about AI disclosures with which Upstart Holdings will comply. The company has not provided additional info and I don’t see how this subpoena changes the investment thesis in any way, shape or form.

Personal Loan Growth (Upstart Holdings)

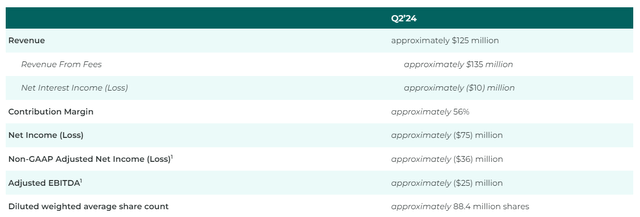

Light Guidance For 2Q24

What was not great with Upstart Holdings’ earnings was its guidance for 2024. The fintech anticipates having sales of $125 million, which is less than what Upstart Holdings brought in last quarter. I don’t think that the light guidance for 2Q24 is a dealbreaker for the fintech, but it explains the weakness in the stock price we have seen after earnings.

Q2-24 Guidance (Upstart Holdings)

Cheap Sales Multiple

Upstart Holdings is selling for a low sales multiple and I don’t think that the 1Q24 earnings selloff was justified (and the stock has since fully recovered) as the company is seeing rather substantial sales growth, even in a market defined by high interest rates.

I also think that the investment thesis is broadly intact here, particularly if future inflation data reveals that consumer prices are trending down. This, in my view, would be the strongest indication that the central bank is headed for actual rate cuts which should allow Upstart Holdings to reboot its lending business.

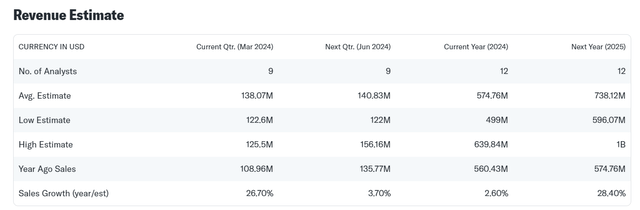

The market presently models $575 million in sales this year which, using a market valuation of $2.0 billion, equates to a leading sales multiple of 3.5x. Based on next year’s sales of $738 million, the implied sales multiple is 2.7x.

This is the same sales multiple that fast-growing SoFi Technologies, Inc. (SOFI) is getting as well: 2.7x. Affirm Holdings, Inc. (AFRM) is selling for 3.6x 2025 sales.

I think top fintechs are deserving of a 5x sales multiple if they are profitable and business fundamentals keep improving. Specifically, Upstart Holdings could attract considerably more investor attention if it continues to grow its sales at double digits, on the back of lending-boosting rate cuts, while the achievement of profitability could be an important inflection point for the fintech. Upstart Holdings was valued at a 5x sales multiple earlier this year as investors started to price in the possibility of rate cuts.

A 5x sales multiple equates to an intrinsic value of $33, which is about 43% above Upstart Holdings’ present stock price. I anticipate a re-rating to take place as soon as the central bank announces its first rate cut and therefore helps return the focus to Upstart Holdings’ core lending performance.

The central bank is widely expected to lower its short-term interest rates in the back half of the year. While Upstart Holdings may not immediately return to profitability, the fintech could be profitable again in 2025 if the central bank slashes rates aggressively.

Revenue Estimate (Yahoo Finance)

Why The Investment Thesis Might Disappoint

The biggest wild card here is the central bank and its potential reluctance to embark on a rate-cutting cycle in 2024 if future inflation data reveals that consumer prices keep going up. This would create a strong incentive on the part of the central bank to postpone rate cuts to 2025 which in turn may prevent a reboot of Upstart Holdings’ lending business.

Upstart Holdings also has a high short-interest ratio of 34% which could potentially result in a short squeeze scenario should the fintech potentially beat investor expectations moving forward. On the flip side, a high short-interest ratio can put further selling pressure on Upstart Holdings’ stock.

My Conclusion

Upstart Holdings’ 1Q24 earnings were not bad, given the circumstances. The fintech did profit from double-digit growth in both sales and fee-derived sales, further indicating that Upstart Holdings’ business is stabilizing. The company did remain unprofitable, however.

The recent surge in consumer prices has sort of weighed on Upstart Holdings’ valuation, as the market rightly anticipates the central bank to slash short-term interest rates in the latter half of 2024.

With that being said, though, I think that the investment thesis is broadly intact and that the fintech has a good chance of returning to profitability in 2025, if the central bank starts to slash short-term interest rates.

The outlook for 2Q24 is not a deal-breaker for me and given that the stock has re-rated sharply lower in 2024, I think that the risk/reward relationship looks promising.

Read the full article here