The Q1 Earnings Season for the Silver Miners Index (SIL) is underway with Coeur Mining (CDE) reporting last week and other names like Hecla (HL) and First Majestic (AG) set to report later this week. And while most of the silver continues to struggle with a strong Mexican Peso that remains at 5-year highs vs. the US Dollar (UUP), MAG Silver (NYSE:MAG) is fortunate given that it has one of the highest-margin silver assets globally even if Juanicipio (44% owned by MAG) is located in Mexico. In fact, the asset’s recently released 2023 LOMP has pegged all-in sustaining costs [AISC] below $12.50/oz, translating to ~53% AISC margins at spot silver prices.

In this update, we’ll dig into MAG Silver’s Q1 2024 production results, recent developments, and how the stock’s valuation looks after its recent rally:

Juanicipio Mine Operations – Company Website

MAG Silver Q1 2024 Production

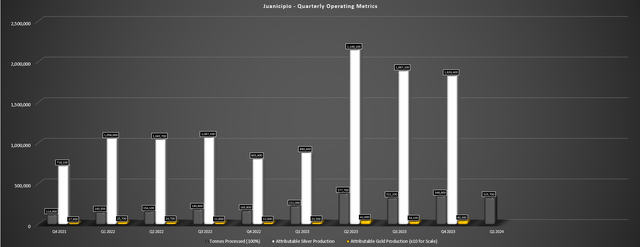

MAG Silver released its Q1 2024 production results last month, reporting quarterly production of ~4.4 million ounces of silver, ~9,900 ounces of gold, ~8.7 million pounds of lead and ~14.7 million pounds of zinc. This translated to a 98% increase in silver production and 64% increase in gold production vs. the year-ago period, benefiting from higher throughput that came in near nameplate capacity (~325,700 tonnes processed or ~3,980 tonnes per day) in the quarter vs. the prior period when processing relied on Fresnillo’s (OTCPK:FNLPF) Saucito and Fresnillo plants during the ramp-up phase for Juanicipio. These production results were down slightly from the more comparable Q4 2023 period (1% lower silver production, 6% lower gold production), with this primarily due to slightly lower throughput with maintenance completed in Q1, offset by higher silver grades (476 grams per tonne of silver).

Juanicipio Quarterly Throughput & Payable Production – Company Filings, Author’s Chart

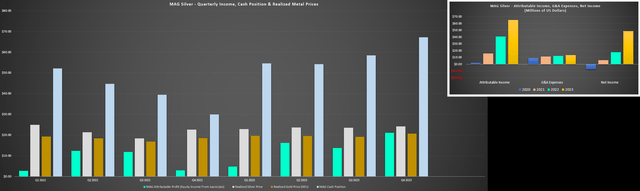

The strong Q1 performance saw silver grades come in above the annual range of 380 to 460 grams per tonne of silver and has placed Juanicipio well on track to have a 20.0+ million ounce year from a silver-equivalent standpoint on a 100% basis and average just shy of 4 million payable silver ounces per quarter. And with the benefit of higher realized gold and silver prices, we should see a very strong 2024 on deck for MAG Silver, with the company set to report new records for new records for free cash flow and equity income if metals prices continue to cooperate. As shown below, this would continue a trend in record performance already witnessed in 2023, with net income of ~$49 million. Let’s take a look at the recently released Juanicipio updated life of mine plan [LOMP].

MAG Silver Quarterly Equity Income, Cash Position & Realized Metals Prices – Company Filings, Author’s Chart

Updated Juanicipio Technical Report

MAG Silver and its partner Fresnillo (operator of Juanicipio) released an updated Technical Report for the Juanicipio Mine in the state of Zacatecas and declared initial reserves for the asset. This included a proven and probable reserve base of ~15.4 million tonnes at 248 grams per tonne of silver, 1.58 grams per tonne of gold and ~7.4% zinc/lead, or ~630 grams per tonne silver-equivalent, translating to ~122 million ounces of silver, ~781,000 ounces of gold, ~406,000 tonnes of lead and ~736,000 tonnes of zinc, with 44% of this attributable to MAG Silver. The result is that the current reserve base supports a 13-year mine life, suggesting that even with no further resource conversion, Juanicipio will remain in production until 2035.

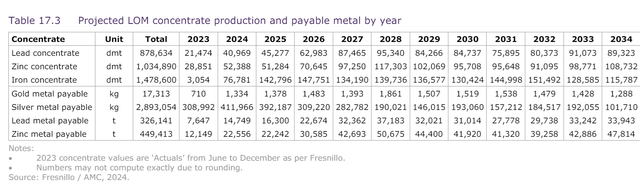

Juanicipio Mine Plan – 2024 TR

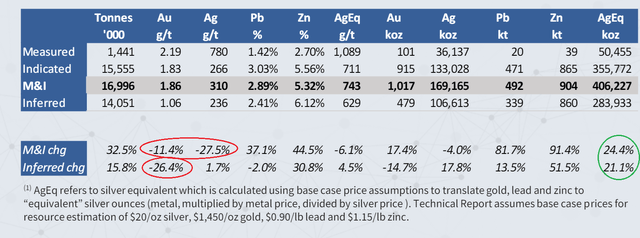

While this is certainly an impressive mine plan and Juanicipio is confirmed as a high-grade, low-cost and long life asset for its owners Fresnillo and MAG Silver, we saw a material decline in grades and mine life from the 2017 PEA. For starters, the mine life declined from 19 years to 13 years and payable silver production declined from ~183 million ounces to ~93 million ounces, besides lower payable zinc production of ~991 million pounds vs. ~1.3 billion pounds. This was related to the 2017 PEA including inferred resources into the mine plan while the updated 2023 LOMP was based on solely measured and indicated ounces, and we saw a decline in M&I silver grades from ~427 grams per tonne of silver to ~310 grams per tonne of silver. Unfortunately, we also saw a decline in gold grades, which now sit at 1.86 grams per tonne of gold vs. 2.10 grams per tonne of gold previously.

M&I + Inferred Resource Base vs. Prior Report – Company Website

While this might appear a little disappointing on the surface, there are a few important points worth highlighting. For starters, ~1.5 million tonnes of high-grade silver have already been mined, which impacted overall silver grades which were higher earlier on in the mine life. Second, we saw a lift in base metals grades, with lead and zinc grades increasing by ~37% and ~45% respectively, with additional drilling in the more base metal rich portion of the deposit. Plus, while reserves and payable production came in well below the 2017 mine plan assumptions, this is typically what we see as there’s a much higher hurdle for conversion from resources to reserves. However, we saw a 32.5% increase overall in M&I tonnes and this resulted in a ~24% increase in M&I silver-equivalent ounces using the company’s slide deck, pointing to a larger (albeit lower silver/gold grade) resource at Juanicipio.

Finally, as for the inferred ounces, we saw lower gold grades here as well, offset by 2% higher silver grades and ~31% higher zinc grades. The result was a 21% increase in silver-equivalent ounces [SEOs] to ~284 million SEOs and ~690 million SEOs in total at Juanicipio or ~303 million SEOs attributable to MAG Silver. Obviously, not all of this will make it into a mine plan, as resources (and especially inferred ones) do not convert to reserves at anywhere near a 1:1 basis. Still, there looks to be a significant upside to this mine plan from a life of mine standpoint, and I don’t think it’s unreasonable at all to assume a total mine life of 18 years (13 currently) even without the benefit of any new discoveries on the property.

So, what does the new mine plan and economics look like?

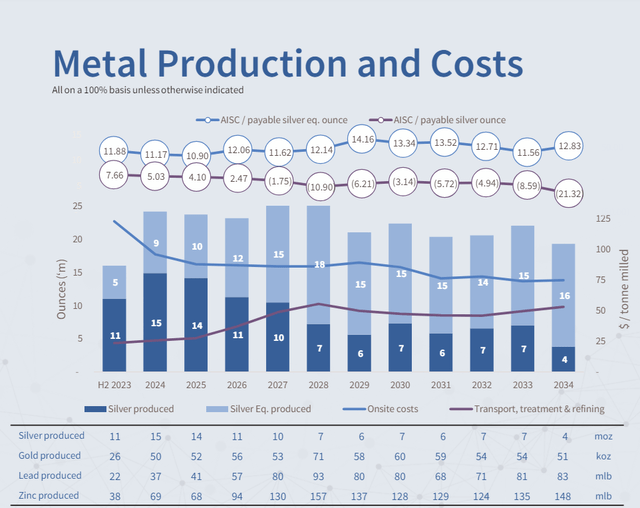

Under the updated mine plan, payable silver production is ~7.2 million ounces per annum on average while Juanicipio will also see average payable production of ~43,000 ounces of gold, 55 million pounds of lead and ~76 million pounds of zinc. This translates to average annual payable production of ~18 million SEOs or ~7.9 million SEOs attributable to MAG Silver at metals prices of $24.00/oz [AG], $2,250/oz [AU], $1.30/lb [ZN] and $1.15/lb [PB]. As for cost performance, Juanicipio’s all-in sustaining costs [AISC] are expected to come in well below the industry average at ~$12.40/oz and the project’s NPV (5%) comes in at ~$1.22 billion at $1,750/oz and $22.00/oz silver or ~$1.75 billion at $26.00/oz silver, $2,000/oz gold and when factoring in a further mine-life extension.

If we translate this to MAG’s share, this translates to ~$770 million [US$7.35 per share] for Juanicipio in the higher metals price and longer mine life assumption at a 1.0x multiple.

Metal Production & Costs 2023 LOMP – Company Website, 2024 TR

Recent Developments

The most significant recent development for MAG Silver is the higher gold and silver price, which has improved its free cash flow outlook for 2024. However, zinc also appears to be waking up as of Q1 and the result is that MAG Silver has the potential to generate upwards of $80 million in free cash flow this year if metals prices continue to cooperate. This improved outlook should see MAG Silver finish the year with over $100 million in cash & cash equivalents even after a busy year of drilling at Deer Trail and Larder, or ~US$1.00 per share in cash on its balance sheet by year-end. And as for what it plans to do with this cash, the company shared the following in a recent interview in terms of M&A potential:

“Now as we starting to build up cash, we’re starting to look at are there any accretive opportunities out there where maybe there’s another access to a cash-flowing stream that gives up some political diversity from just Mexico. We’re now in a rush, but we want to build ourselves – take the wonderful asset that Juanicipio is and the cash that’s going to contribute and build ourselves into a mid-tier robust precious metals producing company.”

– Recent Kitco Interview, George Paspalas, MAG Silver President & CEO

As for what the company might be looking at if it were to pursue M&A, the company noted that there’s a there’s a “premium attached to silver that it would like to protect that as much as it can”, suggesting the focus would likely be on silver assets if it were to consider adding a fourth project or mine.

Finally, on exploration, the company had a busy year in 2023 at Larder (Ontario, Canada) with ~17,500 meters drilled and MT work completed during the year, and mineralization extended to depth at Bear and Cheminis. That said, I was hoping for some better intercepts, but the highlight hole at Larder was 5.1 meters at 4.6 grams per tonne of gold (North Bear Zone) and 11.1 meters at 3.2 grams per tonne of gold (Cheminis Zone). While these are not bad intercepts by any means, I would hope that this year’s results will be more promising. MAG noted that it plans to double its drill program to at least 35,000 meters this year with further geophysical work to be completed, suggesting we should get a better sample size this year and more chances at some high-grade hits at depth at Larder.

Valuation

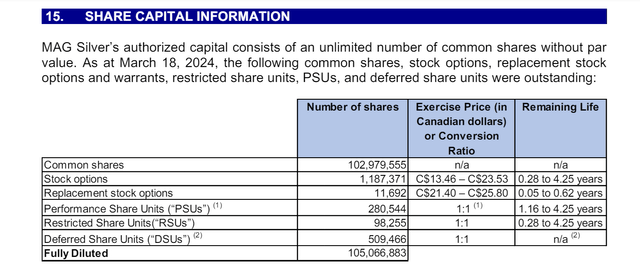

Based on ~105 million shares and a share price of US$12.30, MAG Silver trades at a market cap of ~$1.29 billion and an enterprise value of ~$1.22 billion. This leaves MAG Silver trading at ~1.23x P/NAV vs. an estimated net asset value of ~$1.05 billion. Meanwhile, MAG trades at over 14x FY2024 free cash flow estimates, based on an estimated $85 million in free cash flow relative to its current enterprise value. And while these aren’t unreasonable multiples for a company with a minority interest in one of the best silver assets globally, it’s hard to argue that there’s much of a margin of safety at current levels. In fact, Hecla Mining (HL) trades at a lower P/NAV multiple today as a more diversified silver miner (most of its operations are silver-lead-zinc mines, similar to Juanicipio’s operations) with Hecla having four operations in solely Tier-1 ranked jurisdictions (Idaho, Alaska, Yukon, Quebec).

MAG Silver Share Count – Company Filings

MAG Silver’s estimated net asset value includes $240 million in attributable exploration upside at Juanicipio (30 million silver-equivalent ounces at $8.00/oz) on top of its NPV (5%), $100 million for Deer Trail/Larder combined, and higher metals prices assumptions plus a longer life for its updated mine plan of $2,000/oz gold and $26.00/oz silver.

So, what’s a fair value for the stock?

Using what I believe to be a fair multiple of 1.40x P/NAV for MAG Silver given its favorable position as the minority owner of a world-class mine in Zacatecas (Mexico) that is operated by Fresnillo, I see a fair value for the stock of US$1.38 billion or [US$13.40] per share. This points to an 8% upside from current levels, suggesting limited upside for the stock here unless it sees meaningful multiple expansion or higher metals prices. That said, there are few quality silver miners out there, and the list shrinks even further when adjusting for those with the bulk of revenue coming from silver. Hence, with MAG Silver being arguably a top-5 name in the silver space, I would not be surprised to see MAG Silver overshoot this fair value estimate and trade above US$14.00 per share in the next 12 months.

Summary

MAG Silver had a decent start to 2024 and has de-risked Juanicipio further with the declaration of an updated mine plan, maiden mineral reserves, with the 2024 TR highlighting a ~$1.22 billion NPV (5%) on a 100% basis for Juanicipio using conservative metals prices. That said, production is lower and the mine life has shortened from the 2017 PEA (19-year mine life) and, not surprisingly, costs have increased materially, partially offsetting the higher metals prices. Meanwhile, MAG Silver has rallied sharply off its lows, pushing it back to a premium to P/NAV vs. when I highlighted the stock as a Buy on any pullbacks below US$9.30 in my December update.

So, with a reduced upside to fair value for MAG after its recent rally (8% upside vs. current levels), I remain focused on other opportunities elsewhere in the sector where I see 80% to 120% upside to fair value.

Read the full article here