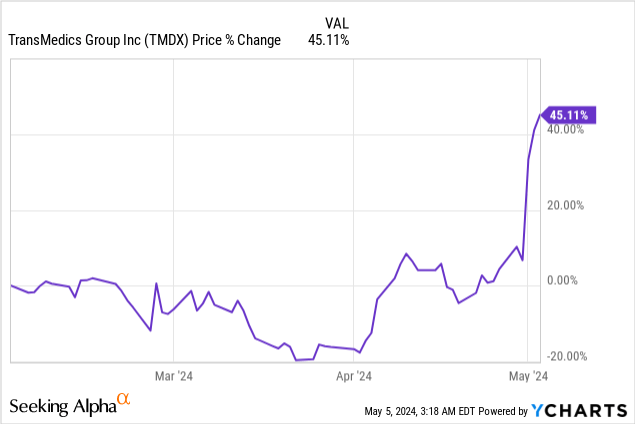

TransMedics Group, Inc. (NASDAQ:TMDX) is up over 50% since my March article, following remarkable first-quarter results that came way ahead of expectations, both on top and bottom line.

The company’s execution is borderline perfect, but the current valuation might be prohibitive.

Let’s look at this disruptor’s road ahead.

Introduction

I wrote an article about TransMedics in early March, initiating coverage with a Strong Buy rating. I first learned about the company from Jonah Lupton, so I should give credit when credit is due.

In the article, I covered TransMedics’ huge opportunity to disrupt the organ transplant industry, with its patent-protected technology that improves patient outcomes, and increases organ utilization.

I showed that the company’s commercial entry into the market resulted in a huge rise in the number of transplants, taking the industry’s growth to low double-digits, a level it hasn’t seen in a very long time.

Moreover, I discussed the company’s strong leadership, its clear path to profitability, and the lack of competition, which is my main worry when I look into pharma or medical device companies.

So far, we’ve done pretty well, thanks to great first-quarter results. Let’s dive into the report.

First Quarter Highlights

TransMedics’ first-quarter results were better than expected across every line item, exceeding even the most optimistic expectations.

Revenues were $97 million, up 133% Y/Y, surpassing consensus estimates by $13 million, or 16%. Growth was driven by more transplants, and increased penetration of the company’s logistics arm, which generated $14.5 million in the quarter (compared to zero in the prior year period).

Product revenue (77% gross margins) grew 80% to $61 million, and services revenue (36% gross margins) grew 4.7x, to $36 million.

Liver revenues grew nearly 3x Y/Y, reaching $67 million in the U.S., and driving 9.7% market transplant growth based on data until April 26th.

Heart revenues grew 1.5x Y/Y, reaching $20.2 million in the U.S., with flat market transplants growth. Management has a detailed plan to accelerate their penetration in heart, which they expect to launch by the end of this year and in 2025.

In lung, revenues grew 3.3x Y/Y, reaching $4.7 million, with 4.7% market transplant growth.

In addition to the impressive revenue beats, the company reached profitability way earlier than expected, as EPS came in at $0.35, compared to estimates for -$0.01.

This was driven primarily by operational leverage, as revenues are growing much faster than operating expenses. R&D expenses as a percentage of sales declined to 11.8%, compared to 14.1% a year ago and 13.3% in Q4’23. SG&A declined to 37.3%, compared to 60.1% a year ago and 42.6% last quarter.

Despite the impressive profitability numbers, operating cash flow came in at a negative $3.4 million, although it was primarily due to working capital.

Free cash flow was a negative $47.5 million, or $54.5 million if we adjust for SBC, as the company continues to invest in its aircraft fleet.

Looking at the balance sheet, they ended the quarter with $157 million in net debt.

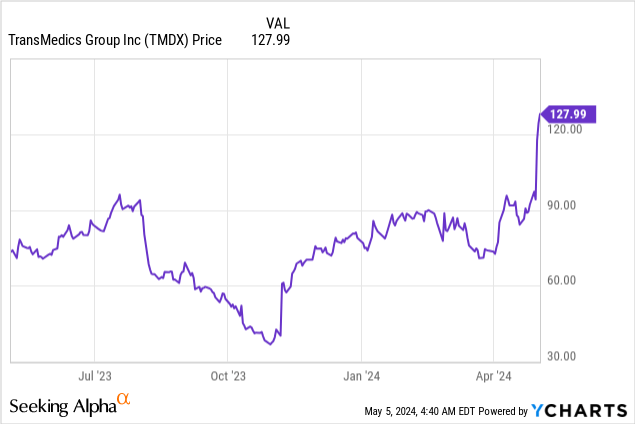

Dissecting Recent Volatility

TransMedics is a mid-cap stock, with a market cap of $4.2 billion and an enterprise value of less than $4.4 billion. Based on Seeking Alpha’s compilation, there are only 7 sell-side analysts who are covering the stock. Its short float is almost at 20%. On top of that, it’s a medical devices company, which means its products are subject to FDA approvals, and usually attract regulatory scrutiny.

All that is to say this should be a volatile stock, and it is.

Over the last year, we can observe a 25% upswing, a 58% drawdown, followed by a 150% rise, then another 15% drop, and an 80% increase.

The majority of these swings have justified catalysts. For example, in H2-23, the company’s acquisition of Summit Aviation generated fear among investors, and rightfully so, as it took quite the imagination to understand the benefits, and it brought uncertainty.

Then, the stock rose following a good earnings report, just to then give up all its gains due to general market pessimism, as well as reports about NASH drugs that could reduce the need for liver transplants.

Later, the announcement of Johnson & Johnson’s (JNJ) acquisition of Shockwave Medical (SWAV) at 13x EV / Sales sparked excitement in the med-tech sector, resulting in a rise heading into earnings.

Now, following a magnificent report, the stock is at all-time highs.

As TransMedics matures, and due to the fact it already reached profitability, I think it’ll become less volatile. However, there will be a lot of bumps in the road.

The Road Ahead

Management raised their sales guidance for the year, from a range of $360-$370 million to a range of $390-$400 million. They maintained their gross margin outlook in the low-to-mid 60s and said they expect positive operating cash flow over the next several quarters.

When asked about it on the call, management was reluctant to say how conservative this guidance is, but in my view, the market is expecting the company to beat & raise every quarter in the near term, a feat it can achieve, but it won’t be easy. Actually, I think that even a beat & a small raise won’t cut it.

Looking ahead, there are several questions that need to be asked. In 2023, they already held a 17% share in the liver, a 16% share in the heart, and a 4% share in the lung. Based on my estimates, they will reach almost 30%, 20%, and 7%, respectively, this year.

While they’re able to drive overall market growth, it has slowed down.

International is still a big uncertainty, as they’re working to build a commercially viable reimbursement framework that will allow them to operate there. In case they can get it, it will most likely require significant investments, especially if they want to build a logistics arm there as well.

In my view, TransMedics already showed it can transform the U.S., market, and there’s still a significant runway for growth, but I think investors should acknowledge and expect growth will materially decelerate in 2025.

In the near term, I expect continued margin expansion through the year, and I estimate they’ll generate sales of approximately $420-$450 million this year, which at the mid-point, is almost 10% above the high-end of management’s guidance.

Valuation

When we were here two months ago, TMDX traded at a 125x EV / EBIT, a 191x P/E, a 0.4x PEG, and 7.8x EV / Sales, all based on consensus estimates at the time.

We’ll use my estimates and their guidance for the current multiples because consensus estimates are not yet fully aligned with the recent results.

TMDX now trades at ~11x EV / Sales, and 82x EV / EBIT. Assuming a normalized tax rate of 16%, they’re trading at a 94x P/E, and a 0.8x PEG.

For comparison, SWAV is being acquired for ~13x sales, ~57x EBIT, and ~68x P/E. It’s also expected to generate 2.5x as much revenue as TMDX, with 20% profit margins, but growing much slower at 20%.

In my opinion, this shows that TransMedics is no longer attractively valued. The company is growing fast, it’s doing so profitably, and I wouldn’t necessarily sell it here because the outlook remains strong.

However, continuing from the volatility discussion, I think this level is an attractive trimming spot, which is what I’m doing.

I think there’s no longer a fundamental justification for the stock to go up in the near term, and I don’t view it as a long-term compounder which I wouldn’t trim no matter the valuation.

If it traded back to below the $100 mark, I might consider increasing my position once again. If not, I’d be waiting for the back half of the year, for more clarity about sequential growth, and the necessary investments they’ll need to make to support the acceleration of their lung and heart programs.

Conclusion

TransMedics is an exceptional company that truly improves people’s lives. Led by a mission-driven, dedicated founder, they are transforming an industry that was asleep for a long time, and they’re doing so efficiently, achieving profitability sooner than many expected.

Following a 50% increase in the span of two months, I no longer view TransMedics as a Strong Buy, and downgrade it to a Hold, entirely due to valuation.

I expect the stock to be volatile, and I see no fundamental reason for the stock to go up in the near term, as the market now expects a beat & a significant raise as soon as next quarter.

If a short squeeze occurs or other non-fundamental catalyst happens, the stock could continue to go up, but I’m not willing to base my thesis on that.

If the stock drops to around $100, I would consider increasing my position once again.

Read the full article here