Investment Thesis

Apple (NASDAQ:NASDAQ:AAPL) recently announced its Q2 FY24 earnings results that beat estimates. Two straight takeaways from their earnings report were the hardware devices business not doing as badly as markets estimated and its record share buyback program, which is now on record as the largest ever share repurchase program.

This earnings announcement by Apple almost coincides with Berkshire Hathway’s (NYSE:BRK.B) own Q1 FY24 earnings results, which showed the holding company had trimmed some of its Apple position.

I believe this may be a smart move in the short term since I see some potential headwinds lurking on the horizon for Apple. I believe Apple’s share buyback announcement was a tactically astute lever pulled by management in the light of falling hardware sales and a slow innovation pipeline.

There is no doubt that over the long term, the company will demonstrate the resolve and promise to right the growth trajectory of its falling hardware sales and ramp up its innovation pipeline to better align with its long-term growth vision. Apple’s services segment may step in to keep Apple’s growth buoyant for the time being.

But, for now, I recommend a Hold rating.

Warren Buffet’s commentary on Berkshire’s Apple’s shares

I expect Apple’s shares to face immediate volatility given the news announcement of Berkshire trimming some of its Apple position, so I believe a summary of Buffet’s views would be warranted before I proceed.

From Saturday’s earnings results announcement, I note that Buffett’s Berkshire Hathway stake in Apple dropped 22%, from $174.3 billion at the end of 2023 to $135.4 billion as of March 31 this year, despite Apple’s stock falling ~11% between January and March of this year. Without Berkshire Hathway’s 13-F filing ((to be filed on May 14), it will be difficult to provide exact numbers of how many shares were sold, but market estimates currently expect Berkshire to have cut its Apple investment by about 13%. When probed further on the exact reasons why Berkshire Hathway sold Apple shares, Buffet only said “tax reasons.”

I expect this to create some volatility for Apple in the short term, but I also find it notable that Berkshire Hathway chose to reduce its stake in Apple now. Buffet has always been an advocate of companies buying back their shares to return shareholder capital. In 2018, when Apple announced their largest share buyback program at the time, Buffet said, “When I buy Apple, I know that Apple is going to repurchase a lot of shares.” In his 2020 Annual Letter, Buffet also said:

The math of repurchases grinds away slowly, but can be powerful over time. The process offers a simple way for investors to own an ever-expanding portion of exceptional businesses.

Yet, on the cusp of Apple’s new record share buyback program, Buffet appeared to liquidate his stake in Apple.

I believe Apple’s buyback program, while very much needed, is still not enough given its previous rates of share repurchase, which I will expand upon in the next section.

Apple’s buyback is great news but there are some subtle concerns

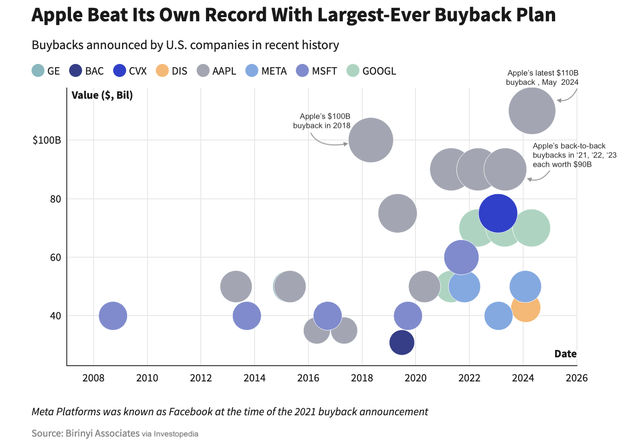

The big news to trickle out of Apple’s Q2 earnings report was its massive share buyback program. This is by far the largest share-repurchase program the company’s management has ever announced. I have added a chart below based on data compiled by Birinyi Associates going back to 1999 that illustrates the scale and magnitude of Apple’s most recent share buyback announcement, which beat its own previous record for the largest buyback program ever announced in 2018.

Apple’s May 2024 share buyback program vs previous programs (Birinyi Associates via Bloomberg)

Based on its recent quarterly filing, management still has about $30 billion in its war chest as part of all its previous buyback authorizations to repurchase shares from the market. Therefore, in total, I estimate Apple now has around $140 billion worth of funds to buyback shares. That equals ~5% of Apple’s shares outstanding at the close of business on Friday last week. So, how does the company execute on the buyback program?

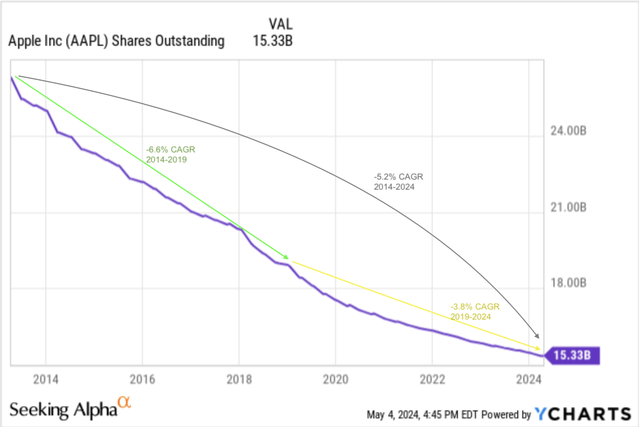

Over the last ten years, management has bought back shares at a compounded growth rate of ~5.2%. However, management bought back shares at a quicker pace before the pandemic than after the pandemic, as seen in my annotations in the chart below.

Apple’s management has executed more buyback volumes before the pandemic than after (yCharts)

As seen above, management has executed share repurchases at a compounded growth rate of ~3.8%, far lower than their pre-pandemic buyback repurchase compounded rates of ~6.6%. I believe part of the reason why Apple’s management is constrained is due to its debt load and net-cash positions that conflict with its share buyback programs.

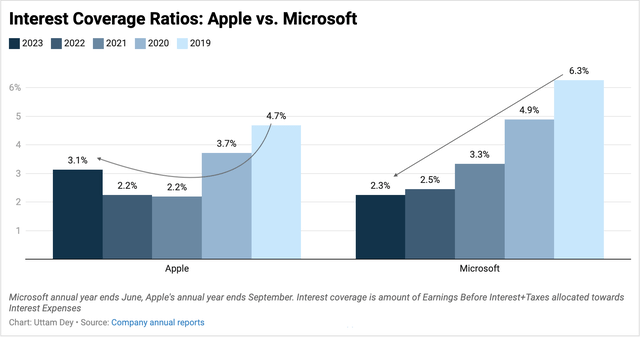

To illustrate some of the constraints that Apple’s management has, I have compared the interest coverage ratio of Apple versus Microsoft (NASDAQ:MSFT). The reason I have chosen Microsoft despite Microsoft being in slightly different businesses is because these two of the highest quality technology companies in the world compete for capital allocation, and I believe these two companies will constantly be compared against one another on a relative basis.

Apple’s interest coverage ratio is much higher than its peer (Company annual reports)

From the chart above, I note that Apple spends a relatively higher amount on servicing its debt versus its peer, Microsoft (MSFT), which can be seen in Apple’s interest coverage ratios. Interest coverage is essentially the amount of earnings before interest and taxes (EBIT) that Apple spends on interest expenses such as debt servicing. Since 2019, Apple’s interest expenses have grown 2.4% CAGR, while Microsoft’s interest expenses have declined by ~7% on average. Also, on a y/y basis, I note that Apple’s interest expenses have grown by 34% in its 2023 filing versus the previous year.

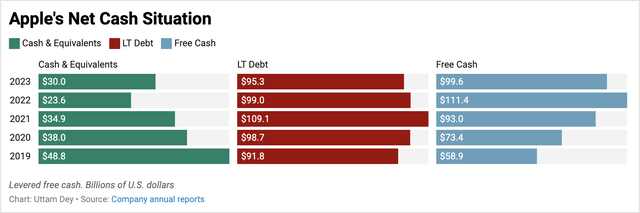

At the same time, I also see that Apple’s cash position has been declining over the years, as seen in the chart below. Per their latest second quarter figures, Apple’s cash & equivalents position is now at ~$32.7 billion, up 9% from the ~$30 billion reported in 2023, as seen above, while their Q2 books currently carry ~$91.8 billion, a -3.6% decline from their 2023 numbers posted above.

Apple’s net cash position (Company sources)

I believe since the company laid out its net-cash neutral goals in 2018, its management has prioritized re-distributing cash via share buybacks and dividends to its shareholders, but the rate of those repurchases has reduced. I believe a huge priority for Apple would be to balance its net cash and debt positions to cancel out one another, which is appropriate in the elevated interest rate environment it operates in today. In fact, when asked about its net-cash goals vs. whether management was ready to take on leverage in the future to expand its share buyback programs, here is what Apple’s CFO had to say:

I would say one step at a time, we have put out this target of getting to net cash-neutral several years ago and we’re working very hard to get there. Our free cash flow generation has been very strong over the years, particularly in the last few years. And so as you’ve seen this year, we’ve increased the amount that we’re allocating to the buyback. For the last couple of years, we were doing $90 billion, now we’re doing $110 billion. So let’s get there first. It’s going to take a while still. And then when we are there, we’re going to reassess and see what is the optimal capital structure for the company at that point in time.

I believe that without any significant improvement in Apple’s net cash position, the company will be constrained by carrying a heavy debt load on its books, putting it in a less favorable position to execute on their massive $110 billion buyback program. I’m quite sure management is aware of this, and I expect them to err on the side of caution when executing their share buyback authorizations.

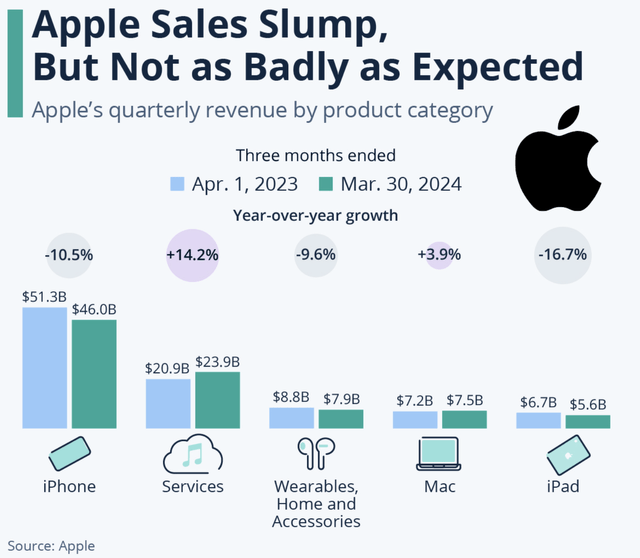

Simultaneously, Apple will also be looking to infuse growth back into the sales of its hardware devices, which have been decelerating for a while. As seen in the chart below, in every device category, barring Mac products, sales declined versus last year. The biggest decline was seen in its iPhones, which declined over 10% versus the previous year’s Q2.

Apple’s devices revenue declined considerably versus last year (Company sources via Statista)

Management has been adamant about its AI projects and how it eventually ties its AI ambitions into its iPhone. So far, the only tangible AI feature is unofficial news pointing to some sort of embedding of Google’s Gemini into the iPhone. Apart from that, management has continued to do the most Apple-esque thing it can do by being secretive about its AI projects. The most management said on the Q2 earnings call was to expect some more announcements in the future:

I think AI, Generative AI and AI, both are big opportunities for us across our products. And we’ll talk more about it in the coming weeks. I think there are numerous ways there that are great for us. And we think that we’re well-positioned.

Therefore, until investors get a clear direction of product strategy from management in today’s backdrop of AI, there will be some overhang on the stock’s price. Then, there are also the added headwinds from China that are casting a shadow over the company’s device sales in the region, which now account for ~18% of the company’s total sales, down from ~18.8% of total sales China accounted for four quarters ago.

Therefore, I believe there are some short-term headwinds that Apple faces as it navigates through the second quarter. Management will have to do more to demonstrate how it can re-accelerate device sales. At the same time, management will have to navigate its shareholder capital return goals as well as its net-cash neutral goals carefully.

Apple’s Valuation and Outlook

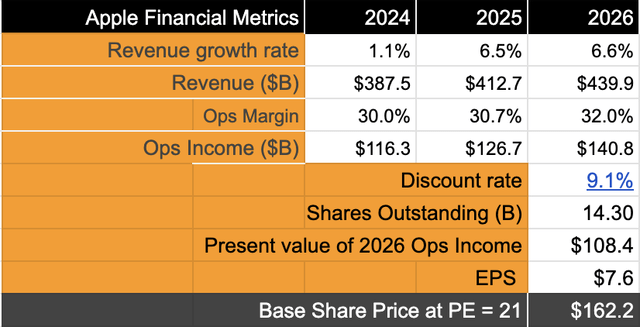

To value Apple’s target price, here are my assumptions:

- Apple launches a widely-anticipated AI phone this year with a robust feature roadmap ahead that should be able to encourage people to upgrade their iPhones. This should be able to move the needle on Apple’s sales growth rates to mid-single-digit growth rates on a compound basis over the next 3 years.

- Over a similar investment horizon, I expect management to continue optimizing its operational leverage, which should see the company grow its operating income in line with the S&P 500’s long-term averages for earnings growth.

- Discount rate of 9.1%, based on these assumptions.

- Finally, its shares outstanding have a dilution of 4% per year. I see that Apple’s outstanding shares as of 2023 are ~15.8 billion. Taking a 4% dilution rate, I expect ~14.3 billion shares in FY26. If management is able to progress faster towards their net-cash goals, expect more shareholder capital to be returned in the form of share buybacks down the road.

Apple’s stock has some downside risk (Author)

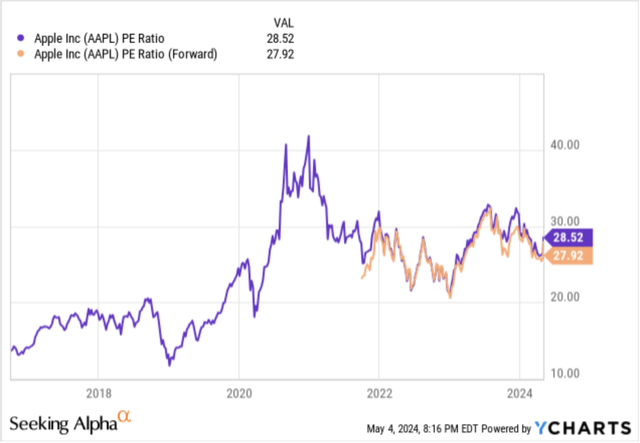

Given these assumptions, Apple is expected to grow its income in line with the S&P 500. But given long-term multiples, I believe a PE of 21 is warranted at the moment.

Apple’s long term valuation multiples (yCharts)

This gets me to a target of ~162, implying about 11–13% downside. At these levels, however, I believe the company will start to look attractive once again, given my long-term outlook on Apple.

Other factors to look for

Apple faces several challenges at the moment. Chief among some of the endogenous headwinds that it faces is the notion that Apple is late to the AI game. Investors may be losing patience as Apple prefers to stay mum about its AI ambitions despite other Big Tech peers such as Microsoft and Alphabet demonstrating progress. Personally, I believe Apple is doing the right thing by taking time. Hardware devices are hard to correct if something goes wrong, and were Apple to face dissatisfied customers with its new in-phone AI features, it would hurt its device margins. Rabbit’s R1 and Humane’s AI pin are some examples of how AI devices can go wrong.

In addition, Apple also has other exogenous challenges to iron out, such as antitrust legal battles and falling demand from certain geographic regions like China. These are some key issues management will need to navigate the company through in the midterm.

However, on the plus side, there is also its annual WWDC developer conference in June, which should point to how the company plans to push AI into its devices. There is also a product launch event this week, May 7th, which is supposed to showcase the next iPads.

Down the road, I expect management to better align their net-cash neutral and shareholder return goals together. It may at some point this year, if that happens, Buffet could start picking up shares in the iPhone maker’s stock again.

Takeaways

Apple has some near-term headwinds and challenges that are surrounding the company’s outlook. As pointed out earlier, expect management to carefully navigate Apple through its headwinds over the long term, as it usually has. For now, the record share buyback program it announced looks very promising and welcome. Management has shown it is taking the right steps, but the next few months should add more clarity to my hold thesis on Apple.

For now, I recommend being neutral on Apple.

Read the full article here