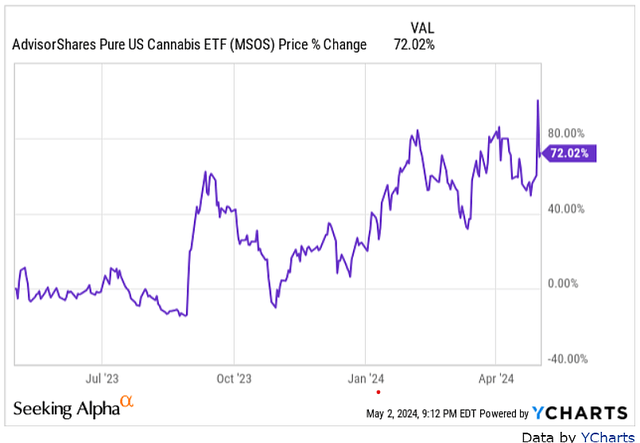

This week the Associated Press reported that the US Drug Enforcement Administration will reschedule cannabis from a Schedule 1 drug to Schedule 3. Without exaggeration, this is the most important development in the US for cannabis in recorded history. Investors recognized the importance of the reports, and many cannabis stocks made a one day jump of 25% to 50%. Some of that was given back the next day, but multi-month uptrend is still intact. Cannabis has been in a bull market since last August, with a solid trend of higher highs and higher lows that has driven share prices higher. The Advisorshares Pure US Cannabis ETF (MSOS) is a good proxy for larger US cannabis companies. MSOS is up 72% over the last 12 months.

YCharts

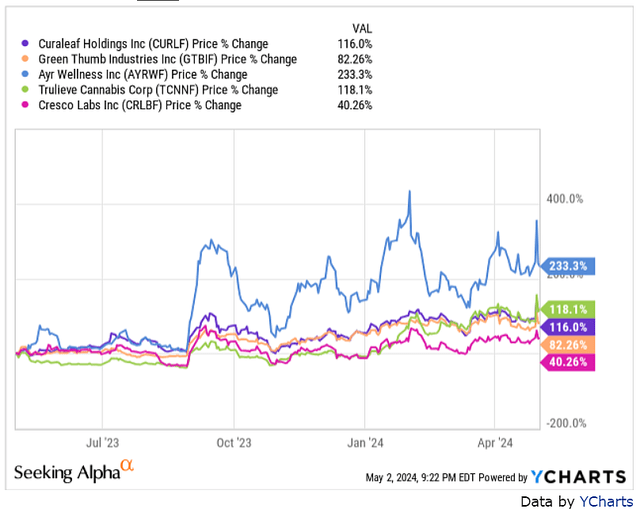

Some of the larger MSOS holdings are up even more, which is very gratifying to long-suffering cannabis investors.

YCharts

Rescheduling supports the growing status of cannabis

There are two important ways that rescheduling improves the outlook for cannabis: the financial and the societal. We will look at the societal effect first, as it’s the most significant for the long term.

Cannabis has been gaining acceptance since at least 1986, when medical use was legalized in California. While the number of Americans in favor of legal cannabis has consistently risen for decades (a recent Pew Research Center poll showed approval at a stunning 88%), progress on the ground been piecemeal and erratic, hamstrung by the fact that cannabis is still federally illegal. With this week’s news, cannabis has turned the corner. When rescheduling is complete, cannabis will be recognized as a legal therapeutic substance by the federal government. This is the first affirmative national development in the history of cannabis in the US, reversing centuries of punitive laws like the 1970 Controlled Substances Act. It’s the first major step in a more permissive federal position, a sea change that investors need to recognize and act on. The process of acceptance will take years, as anyone who has followed the industry knows, but it is now inevitable. Rescheduling is more than a single event – it’s a substantive sign of the future of the cannabis industry in America.

Significant financial benefits of rescheduling

Investors are justifiably excited about the financial benefits of rescheduling. Companies who sell a Schedule 1 drug (heroin and LSD are also Schedule 1), are unable to deduct most business expenses from income taxes. This is the infamous Section 280E of the Controlled Substances Act. It mandates a punitive tax rate far higher than any other industry, which will go away with rescheduling. A look at financials from an established cannabis company illustrates the impact. Verano, used in this example, is typical of companies in the industry. Some minor line items are removed for readability.

| Line item (million $$) | Dec 2023 | Dec 2022 | Dec 2021 | Dec 2020 | Dec 2019 | Dec 2018 |

| Revenues | 938.5 | 879.4 | 737.9 | 228.5 | 66 | 31.1 |

| Cost Of Revenues | 463.2 | 456.4 | 406.8 | 93 | 29.9 | (15.8) |

| Gross Profit | 475.2 | 423.1 | 331 | 135.6 | 36 | 46.9 |

| SG&A Expenses | 316.1 | 344.3 | 270.9 | 43.3 | 36.8 | 9.6 |

| Deprec. & Amort. | 15.8 | 12.3 | – | – | 2.3 | 1 |

| Total Operating Exp. | 331.9 | 356.6 | 270.9 | 43.3 | 39.1 | 38.6 |

| Operating Income | 143.3 | 66.5 | 60.1 | 92.3 | (3.1) | 8.3 |

| Net Interest Expenses | (59.8) | (49.4) | (24.3) | (10.5) | (0.4) | (3.1) |

| EBT | 27.8 | (163.4) | 49 | 82.5 | (8.5) | 5.5 |

| Income Tax Expense | 145.1 | 105.5 | 104 | 42.3 | 10.3 | 1.8 |

| Earn. fr Continuing Operations | (117.3) | (268.9) | (55.0) | 40.2 | (18.8) | 3.7 |

Verano had sales of $938.5 million in 2023, and paid taxes on gross profit of $475.2 million. If they had been able to deduct all operating expenses, taxable income would drop by $331.9 million to $143.3 million. If this 70% reduction in income is applied to taxes, income tax expense would be reduced from $145.1 million to $45.3 million. Their 2023 loss of $117.3 million would become a much more manageable $17.5 million. Losses in some earlier years would have turned into profit.

This example only a general picture of how eliminating 280E changes financial results. Actual deductions and tax savings will be lower, probably significantly so, and depend on things like final tax brackets and which expenses are actually deductible. But beyond annual reports, the benefits of having millions of dollars of extra cash extend far beyond one year’s results. It gives a company more flexibility in managing debt, operations, capital expending, and so on.

There are still many questions about how rescheduling will affect the bottom line. For example, can a company engaged in an officially illegal business still deduct ordinary business expenses? The answer according to CCH is “yes:”

All businesses, including illegal businesses, are required to pay federal taxes on their gross income. Likewise, in most illegal businesses, the taxpayer may deduct all other ordinary and necessary business expenses, as long as the expenditures themselves are not illegal. For example, a bookmaker was entitled to deduct expenses, including wages and rents. The IRS permitted the deductions even though his business was illegal under state law, its employees were acting in violation of the law, and its premises were being illegally used.

Many other questions are as yet unanswerable. For example, what will it take for companies to meet the requirement that controlled substances have FDA approval before sale? We know cannabis will be subject to the same complex and demanding regulations as any other Schedule 3 drug. Company operations may have to be thoroughly altered to be compliant with new rules. Some firms will be better positioned and more capable of adapting to the new challenges. Investors are well-advised to watch progress in addressing these questions.

Cannabis investing implications

The rescheduling announcement this week changed the cannabis industry, a lot. It has not changed my recommended strategy for investing in the sector, but rather reinforced it. This strategy has been consistent through numerous cannabis articles on Seeking Alpha since 2019, most recently in My 5-Year Cannabis Investing Plan, Updated. It’s simple, easily understood and easily followed:

1. Think long term: I have been saying since 2019 that cannabis investing is a long-term proposition. My timeline is five years – enough time to smoothe out the ups and downs and allow the robust growth in cannabis to be reflected in stock prices. In my view, long-term thinking is essential for investing in any emerging growth industry. It’s what prevents one from irrationally reacting to exuberance and pessimism – buying high and selling low. Long-term thinkers did not sell at lows in 2023, they held on to get 100% gains or more in many cannabis stocks. They also did not sell after sudden gains last September, and obtained even more gains between then and now. In my experience, people become wealthy through investing, not frequent trading. They do it by identifying the best companies and holding them for the long run. This is particularly important in emerging industries like cannabis, where achieving business success takes many years and stock prices are volatile.

2. Focus on the US: The US is the biggest and most dynamic cannabis market in the world. As halting as progress sometimes seems, we are far ahead of most other countries when it comes to legalization and access, and will continue to be. Companies operating in other countries are still trying to figure out how to do business under relatively new regulatory regimes that are almost always more restrictive than in the US. This makes business more difficult in most foreign countries. American companies have years of experience learning how to succeed under relatively stable and well-established state laws and regulations. Legal sales in 2023 surpassed $30 billion, but robust growth is still expected for the rest of the decade. Simply put, the US has the most developed, most stable cannabis business environment in the world. It’s an environment that fosters growth and success.

3. Focus on the largest, strongest companies: The largest, strongest companies have numerous competitive advantages. Large companies will have more resources in technology, marketing, finance, human capital, and other areas that they can use to increase the distance between them and their smaller competitors. In just one example, during the pandemic demand increased for “value” products at a lower price point. It was easier for the larger companies to identify this trend, get the products on the shelves and market them effectively because of the talent, financial resources and business capabilities that were available.

In addition, perhaps the most important criterion for business success is quality of management. One important way we evaluate management is by looking at their record. Growth has been a dominant strategy since legalization started gathering momentum. If we accept the idea that in cannabis, generally speaking, size is one measure of success, superior managements are those that implemented this strategy most successfully.

According to Largest cannabis companies by market cap, as of April 2024 the largest public US companies are:

|

Company |

Market Cap |

Sales 2023 |

|

Curaleaf (OTCPK:CURLF) |

$4.12 billion |

$1.35 billion |

|

Green Thumb Industries (OTCQX:GTBIF) |

$3.15 billion |

$1.05 billion |

|

Innovative Industrial (IIPR) |

$3.06 billion |

$0.28 billion |

|

Trulieve Cannabis (OTCQX:TCNNF) |

$2.28 billion |

$1.13 billion |

|

Verano Holdings (OTCQX:VRNOF) |

$2.25 billion |

$0.94 billion |

|

Cresco Labs (OTCQX:CRLBF) |

$0.73 billion |

$0.76 billion |

|

Glass House Brands (OTC:GLASF) |

$0.73 billion |

$0.16 billion |

|

Ayr Wellness (OTCQX:AYRWF) |

$0.28 billion |

$0.46 billion |

|

Ascend Wellness (OTCQX:AAWH) |

$0.27 billion |

$0.52 billion |

|

WM Technology (MAPS) |

$0.20 billion |

$0.20 billion |

Note: As a REIT, IIPR in many ways is not comparable to other companies in the industry.

The definition of successful growth is more complicated than this, of course. Both Verano and Cresco had large failed mergers, which reflected poorly on management, and Cresco hasn’t come close to a net profit in seven years of existence. Furthermore, I have never been a fan of Curaleaf’s extreme “merge and acquire” approach to growth, although admittedly their strategy has been very successful.

Every new industry begins with a large number of small companies, which over time is winnowed down to a few dominant names. A look at the list above hints that this may be starting in cannabis, as the four largest MSOs and IIPR distance themselves from the rest of the pack. If so, investors will be well-served by paying attention to the winners.

Summing up and investment guidance

The importance of the rescheduling news this week cannot be overstated: It is the biggest step forward in the history of cannabis in the United States. Some cannabis investors may be reluctant to get their hopes up after many false steps in Washington and poor investment results over the past few years, but this change is concrete and substantive. It is consistent with every trend in cannabis since the first successful legalization referendum in California in 1986, including legalization and access across the states, the many pro-cannabis bills filed in Congress and steadily rising support among the citizens. It’s not a “done deal” yet, but the ultimate boss of every federal agency involved is the same person: President Biden. He is the force behind rescheduling, and with an election coming up will certainly be motivated to get it across the finish line before November.

Rescheduling is a game changer for all cannabis companies in a number of ways, not least because of the elimination of Section 280E income taxes. It will mean hundreds of millions of dollars added to the bottom line of the industry as a whole. Most companies will see substantial benefit, but as investors we have to make decisions about where we put our money. This article emphasizes the US operators, who do business in the largest, most dynamic cannabis market in the world. (Canadian operators had some of the largest gains on April 30, but I consider this a temporary artifact of a small, not widely followed investment sector.) The strategy also points to the largest operators, who have a record of success and the resources to take full advantage of coming industry changes.

Finally, a long-term investing horizon is most appropriate for cannabis. Without it, many disillusioned investors left the sector at its lows and missed the eight month runup since August. A simple buy and hold strategy during that period meant gains of 100% or more in less than a year, better than any trading strategy and with a fraction of the effort. Thanks to recent developments, the environment is still positive. Enjoy the bullish trend we are currently experiencing and have faith in the long term growth of cannabis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here