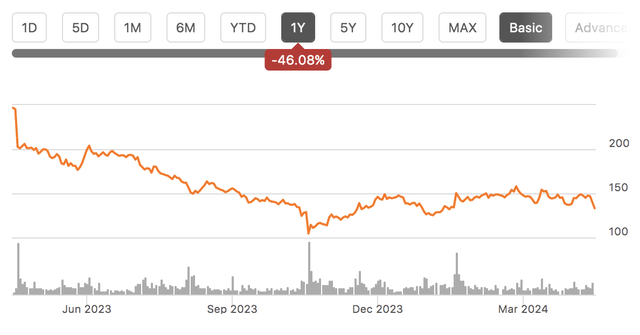

Shares of Estée Lauder (NYSE:EL) have been a poor performer over the past year, losing nearly half of their value. That pain continued on Wednesday morning as shares dropped a further 10% following weak guidance. I last covered EL in October 2022 when I urged investors to sell shares, and since that call, the stock is down 37% while the S&P 500 has rallied by 38%, a dramatic level of underperformance. At some point, valuation can reflect the bad news, making now an opportune time to revisit EL. Unfortunately, shares still appear expensive.

Seeking Alpha

In the company’s fiscal third quarter, Estée Lauder earned $0.97 in adjusted EPS, which was actually $0.47 ahead of consensus as revenue rose by 5% from last year. However, this beat was overshadowed by very weak guidance, as it expects $0.18-$0.28 in adjusted EPS in Q4, well below the $0.75 expectation. Back in late 2022, I expressed concern about ongoing weakness in China and its overseas business in general, and those pressures have still not abated. Organic net sales rose 6%, led by strength in Europe and the Middle East, and Asian travel demand turned positive. Still, sales have not rebounded sufficiently to create a meaningful uptick in profitability.

It is critical to note that EL is largely an international business, as such it is more directly tied to the global consumer than the American one. The Americas represent just 28% of sales, with the United States just a fraction of that, and sales rose by 3% from last year. Additionally, the Americas continues to run a loss, though it improved to $6 million from $93 million last year – this was mainly due to better intercompany royalty payments. North American sales were flat, while Latin America grew.

Developed markets underperforming emerging ones was a theme. Europe and the Middle East (EMEA) sales rose 12% to $1.65 billion. Within EMEA, emerging countries were strong while developed countries were flat, weighed down by weakness in the UK, though Germany and Norway were stronger. Given more generous stimulus capacity, developed countries often bounced back more quickly from COVID-19 in 2021-2022 whereas EM took longer to recover, which is why we are seeing EM now outperforming DM. Its EMEA business was modestly impacted by Israeli/Middle East disruptions, which reduced results by a penny.

Asia was down 1% to $1.2 billion, with a 5% currency headwind. China’s sales rose in low single-digits, while Japan rose double digits. While China did grow, this was still a weak result because there was easy comp due to COVID-19 cases rising last January. To only rise modestly against a COVID-impaired quarter speaks to ongoing softness. In particular, prestige beauty in China remains weak given low consumer confidence.

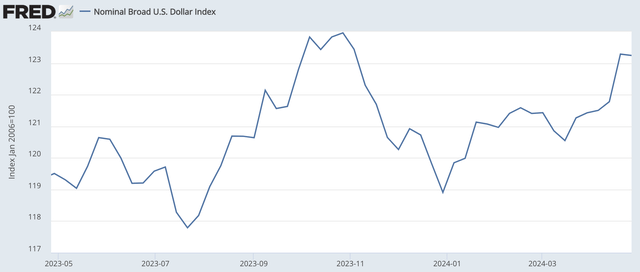

Because EL gets the vast majority of its sales from overseas, it is exposed to dollar strength, which reduces international sales when translated back into USD. During Q3, foreign currency was an 1.4% headwind, for a $0.05 EPS hit. The US dollar has continued to trend higher, so this will be an ongoing headwind. With US inflation appearing “stuck” above 2%, the Federal Reserve is unlikely to reduce rates soon in my view, whereas other central banks like the ECB may start cutting this summer. Relatively tight Fed policy is likely to keep the dollar elevated, and we have seen this most dramatically vs. the yen. With its outsized international presence, that will be a headwind.

St. Louis Federal Reserve

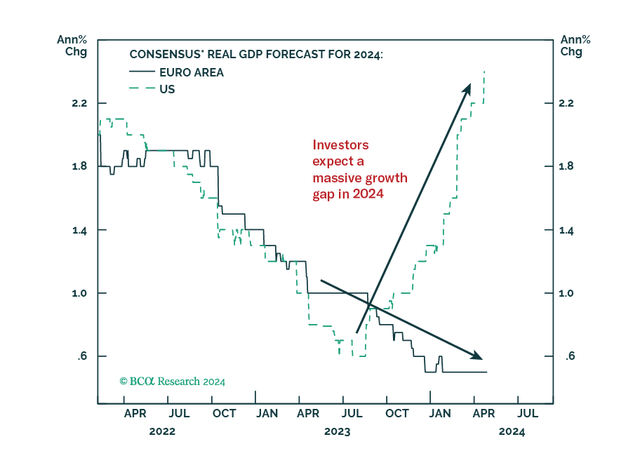

The Fed is able to hold rates high not only because inflation has been stickier, but because the labor market and growth have also held firm. Indeed, the US is defying many forecasters, who have been raising growth forecasts while cutting overseas growth estimates. As a result, the US is a clear global economic outperformer. This is a positive for companies that do substantial business in America, but with EL getting the majority of sales overseas, it is a smaller tailwind, particularly given the Americas region still loses money. EL would rather see Europe & China outperform economically than the US to boost its financial results.

BCA Research

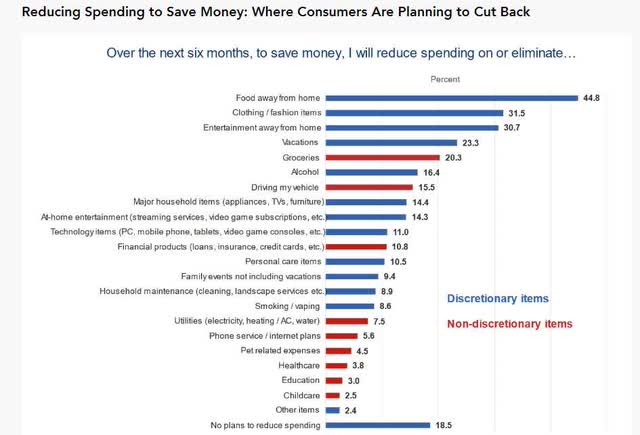

Additionally, even with growth positive, consumers are increasingly cost-conscious given the lingering impact of inflation. According to the Conference Board survey, consumers are looking to save money across a variety of products. EL largely sells personal care items, which are in the middle of the pack in terms of spending reductions. However, many of its higher-margin products are associated with travel, with vacations a larger focus of reductions. I would also argue its fragrances are more akin to “fashion” than personal care, which could create headwinds. If consumers also go out to eat less and travel less, they are likely to consume makeup more slowly, as that is worn more frequently when leaving the house.

Conference Board

Indeed, within segments, we are seeing better results in less discretionary items than more discretionary ones. Skincare sales rose by 8% to $2.06 billion, with operating income rising 74% to $468 million. Last year, operating income was negatively impacted by writing off obsolete inventory. Sales grew across every region, led by Europe. Skincare products are more likely to be used as part of a daily routine, making them less discretionary.

Makeup sales rose 3% to $1.13 billion and swung to a $66 million profit from a $5 million loss. Its travel business has recovered, and Latin America and South Korea rose by double-digits.

Fragrance sales were down slightly to $575 million with profits down 56% to $29 million while haircare fell 3% to $143 million and lost $25 million. Luxury fragrance sales have risen, while Estée Lauder branded sales were weak due to poor sales around the holidays. This divergence could point to middle and lower-income consumers becoming more cost conscious as savings have diminished. EL has increased marketing and investment, which weighed on operating income. Hair care was weighed down by weak North American salon sales as consumers may be cutting back by extending visits between haircuts.

While EL is facing mixed demand trends, it is controlling costs well. Aided by input cost disinflation, gross margins rose by 280bp to 71.9%. EL also held SG&A flat at $2.3 billion and is embarking on a cost cut plan aimed at bringing $1.1-$1.4 billion of incremental operating profits over the next two years. It aims to achieve about half of this in 2025.

After weak demand in late 2022-2023 led to bloated inventory, EL has worked this down with inventory of $2.3 billion, down from $3.1 billion last year. This should reduce the need for extra promotional activity to move product, which has aided gross margin. EL also has a solid balance sheet with $3.7 billion of cash against $7.8 billion of debt, including $500 million maturing within the next year. It can handle this maturity with cash on hand. Due to higher rates, interest expense rose to $94 million from $58 million last year. Given weak profits, free cash flow has been soft at $769 million of this year with $62 million of working capital tailwinds.

Given these mixed trends and global growth weakness, soft guidance does not surprise me. The company will be barely profitably, earning $0.18-$0.28, so for the full year, EL will earn about $2.19. This weak profit figure comes even as sales are forecast to rise 5-9% in Q4, with a 1% FX headwind. Israeli-related business disruptions expected to be a $0.03 headwind. Management believes H2 2024 will be an “inflection” point with cost cuts causing an upswing in profits next year, though slowing global growth creates a risk we see revenue decelerate in my view.

Even if EL achieves its cost cut goal next year with organic growth likely to slow as it passes easy China comps and overseas growth is weak, I struggle to see EL earning over $4-4.25 in fiscal 2025 as I expect 0-4% organic growth and a ~0-2% FX headwind. That leaves shares over 30x earnings. That is an expensive multiple for a business with no clear path to return to peak profitability and deeply exposed to a slowing overseas economy, not to mention the potential for worsening US-China relations. With weak margins and an expensive valuation, I struggle to see a bull case for shares to recover and believe they will continue to underperform. Even after this underperformance, I remain a seller.

Read the full article here