Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the third week of April.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

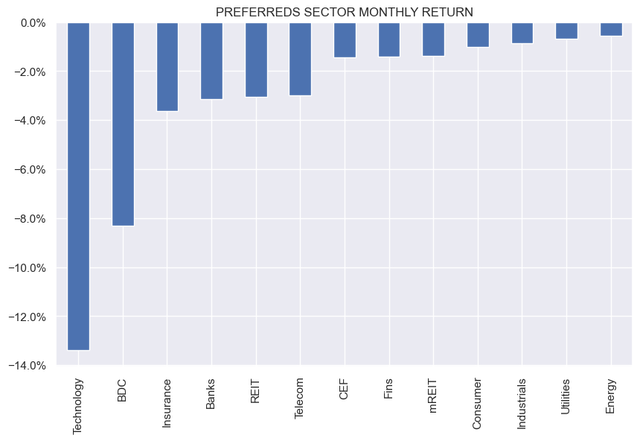

All preferreds sectors were lower on the week, extending losses in April. Utilities and Energy sectors have, so far, held in the best, though for different reasons.

Systematic Income

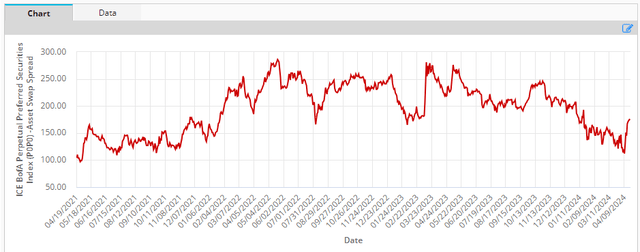

Spreads have finally bounced higher after a steady grind lower. Above 2%, the sector would become more attractive for new capital.

ICE

Market Themes

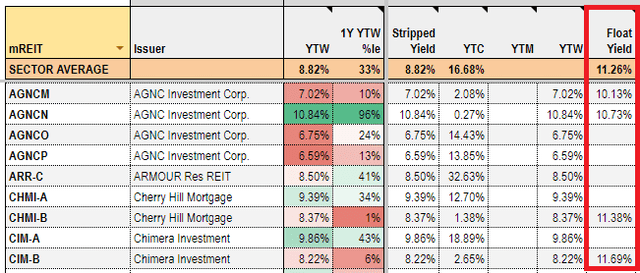

This week there was a question about the yield of the mortgage REIT preferred CIM.PR.B on the service. The stock recently floated to SOFR + 6.05% or roughly 11.35% for a yield of around 11.9%. Its previous fixed coupon was 8%.

Most investors track preferreds yields by their stripped yield. However, whenever a preferred changes its coupon, the stripped yield, which is based off the last coupon paid, becomes irrelevant until the new coupon is paid. This makes it more challenging to evaluate a given preferred, since you have to be aware that the preferred recently switched to a new coupon.

Until the stock pays its first floating-rate coupon, the stripped yield will be incorrect. Specifically, in the current environment of high short-term rates, the actual yield of a newly floating stock will be far above the fixed-coupon stripped yield.

The way we deal with the issue of the first floating-rate period is through something we call Float Yield. Rather than being based off the paid coupons, it simply calculates the currently accruing yield based on the current short-term rate (typically 3-month term SOFR). Once the new coupon is paid, the stripped yield would then make sense.

As it happens, AGNCM and CHMI.PR.B were in the same boat, having recently shifted to a floating-rate coupon.

Systematic Income Preferreds Tool

Market Commentary

Mortgage REIT MFA Financial (MFA) priced a new baby bond – the 9% 2029 (MFAO). Recall the company issued an 8.75% bond recently which now trades at an 8.9% yield.

MFAN is likely taking advantage of the broad-based rise in asset prices to add liabilities so as to keep leverage relatively flat. Prior to the two bond issues, its liabilities were all in financing agreements. Normally, issuing new bonds is not a good result for debt holders however new debt issuance shouldn’t necessarily raise the company’s leverage if it is accompanied by an increase in asset prices and two, issuing unsecured debt is preferable (for bondholders) to adding secured financing agreements (with the exception of non-recourse securitized agreements) as it reduces the claims of secured creditors (which stand ahead of those of unsecured bondholders) and frees up assets to be allocated to bondholders in a worst-case scenario.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Read the full article here