Market volatility is back in full force as investors question the possible pace of Fed rate decreases. At this time, richly valued tech stocks are being pummeled more than the rest of the market, and companies with slowing fundamentals are top candidates to be culled from our portfolios.

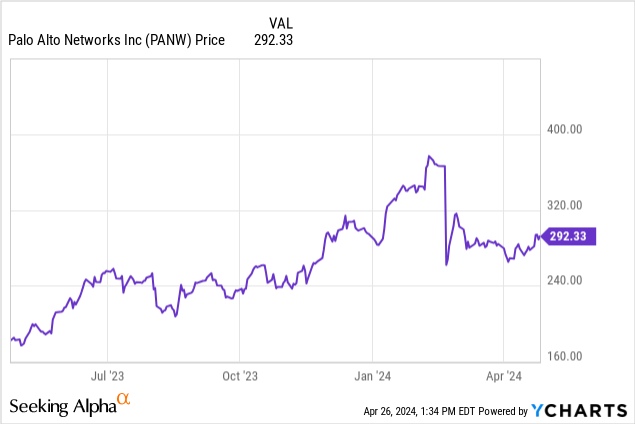

Consider especially Palo Alto Networks (NASDAQ:PANW), the cybersecurity company best known for its next-gen firewalls. A poor fiscal Q2 earnings release has basically wiped out all of Palo Alto Networks’ YTD gains; and unfortunately, I think there’s more downside to come ahead as we head into the fiscal Q3 (calendar Q1) earnings season for Palo Alto Networks.

I last wrote a bearish note on Palo Alto Networks in October, prior to the huge market rally and when the stock was trading in the ~$240 range. Now, especially with its slowdown in growth metrics, I fear Palo Alto Networks will continue to collapse back down to the low $200s, and I’m retaining my sell rating on the stock.

Here are the core red flags to be cautious of:

- Billings are slowing down. Part of it is macro driven, and part of it is execution driven. But when Palo Alto Networks is citing that billings will slow to a single-digit growth rate, we also have to expect that revenue growth will also soon collapse to a single-digit growth rate, which will call into question the stock’s massive valuation.

- U.S. government weakness. We’d usually think of companies that have large federal deals as having insulation and protection against volatile macro, in which corporate budget concerns and layoffs may sometimes drive deal flow. Unfortunately, Palo Alto Networks is also citing softness in this sector, removing that countercyclical protection.

- Technology risk. Palo Alto Networks made a name for itself for its on-premises firewalls. Though the company certainly has cloud-based products now, it’s not the thought leader in the space. In my view, companies like Zscaler (ZS) which are best-known for protecting data in cloud applications will continue to gain share over time.

The biggest risk for Palo Alto Networks, however, is its valuation. At current share prices just under $300, the company trades at a market cap of $94.37 billion. After we net off the $6.99 billion of cash and $1.82 billion of debt on the company’s most recent balance sheet, its resulting enterprise value is $89.20 billion.

Meanwhile, for the upcoming fiscal year FY25 (the year for Palo Alto Networks ending in June 2025), Wall Street analysts are expecting the company to generate $6.15 in pro forma EPS (+11% y/y) on $9.13 billion in revenue, or 14% y/y growth. I’d caution against these optimistic estimates, especially as Palo Alto Networks has cited billings and revenue growth dropping to single digits and low teens, respectively, in Q3.

Nevertheless, just taking consensus estimates at face value, we arrive at valuation multiples of:

- 9.8x EV/FY25 revenue

- 47x FY25 P/E

These are incredibly rich and opportunistic multiples for a company that is seeing slowing growth. There is “upside risk,” of course. Palo Alto Networks is a company that drives large cybersecurity deals, and a pickup in activity in large clients (particularly in the federal sector) may change its growth trajectory. I’d also consider cybersecurity to be an “evergreen” industry that will continue to see strong demand in spite of macro climates.

That being said, I think there’s more risk than reward priced in at current share prices. The next catalyst for Palo Alto Networks will be its fiscal Q3 earnings release, expected sometime in late May. I’d take the opportunity to sell off any position you have heading into earnings season.

Q2 download

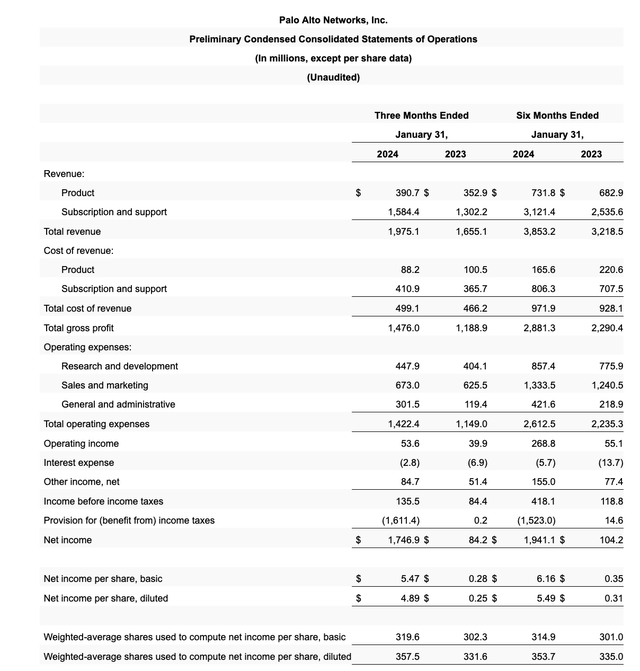

Let’s now go through Palo Alto Networks’ latest quarterly results to showcase the slowdown that the company has been experiencing. The Q2 earnings summary is shown below:

Palo Alto Networks Q2 results (Palo Alto Networks Q2 earnings deck)

Revenue grew 19% y/y to $1.975 billion, only barely beating Wall Street’s expectations of $1.971 billion (also 19% y/y growth) while decelerating from 20% y/y growth and 25% y/y growth in Q1 and Q4, respectively.

The bigger concern, however, is billings growth rates, which at 16% y/y growth in Q2 continued to lag behind revenue growth rates – a classic forward-looking indicator of deceleration.

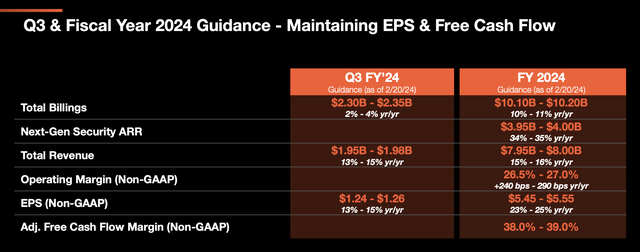

Unfortunately: it’s going to get worse before it gets better, if at all. Palo Alto’s guidance for Q3 implies billings growth slowing down to just 2-4% y/y:

Palo Alto Networks Q3 outlook (Palo Alto Networks Q2 earnings deck)

Furthermore, the company expects billings headwinds to sustain well into FY25. Per CFO Dipak Golecha’s remarks on the Q2 earnings call:

We saw weakness in the US federal vertical related to some specific programs. This US federal weakness was a meaningful headwind to our billings in Q2 after we saw a slow start in the year to Fed. The impact of these federal deals on our revenue is significant as they are relatively shorter than our average contract term. At the same time, we saw a decrease in our non-product backlog which offset this Fed weakness in our billings. We continued to see customers closely watching cash outlays around deals, which we discussed last quarter, although this trend played out largely as we expected 90 days ago […]

As Nikesh gave you the high-level trajectory on our pipeline, I wanted to help you understand how we think about the medium term. Our platformization offers to drive consolidation, effectively provide customers a period of the contract for free as part of their commitment.

We expect we may see a period of 12 to 18 months of pressure on our top line growth rates, notably billings. Some of our platformization programs embed deferred payments into deal structures, which we have spoken about in the past.

We expect this will persist through fiscal year 2025 as we anniversary the rollout of these programs and result in billings below the target we provided in August of 2023.”

Wall Street is famously short-term oriented, and it’s a big ask for investors to wait through FY25 for conditions to improve while also sustaining Palo Alto Networks at its presently high valuation multiples. Profitability is still improving, of course: pro forma operating margins expanded 580bps y/y in Q2, while nominal pro forma operating income dollars also grew 50% y/y. But even this is expected to slow alongside top-line growth, with margin expansion expected to compress to +240 to +290bps y/y in the third quarter.

Key takeaways

With a stubbornly high valuation multiple amid a serious U.S. federal deal contraction and billings slowdowns, I see very little incentive to remain invested in Palo Alto Networks. In my view, the stock will take another leg downward after it releases disappointing deceleration in Q3 results, so I’d take the opportunity to sell well before then.

Read the full article here