The stock market has been acting strange for the last 2-3 weeks

The truth is, the market has been acting strange for longer than that. We have seen the volatility index trading under 15 for weeks, yet in the last 2 weeks, we are in a range from 16 to almost 20. The volatility index measures the 30-day forward projection of volatility, the higher the VIX the more volatility is projected in the near term. It is often called the fear gauge because it moves up when more individuals start to hedge. We’ve had low volatility for months, and that jibes very well with what we are experiencing now.

The current sell-off seems so unreal because we haven’t had even a 2.5% sell-off in about a year. The S&P 500 fell for a third straight week, posting its biggest weekly loss since March 2023 (-3.05%), and now is 5.46% below its record close from March 28, 2024. I find it interesting that the Nasdaq fell the most, down 319 points and 2.05%, yet the Russell outperformed both the S&P500 and the Nasdaq, closing up .24% if this was about interest rates then the Russell should have been hit the hardest. If this was a true individual investor trader-led, or even institutions-led sell-off, all the indexes would be uniformly down. What I find especially notable is that many of the stocks that I follow that have gone up the most are the ones that sold off the hardest. Now this often happens at the end of a real 10% correction, and when stocks fall in a panic, then even the biggest names get sold.

In this case, this week it seems that the best-loved names sold the hardest and sold first. I am not about to do a statistical analysis, but exhibit “A” is NVIDIA (NVDA), down 10% on no news on Friday. Also, look at Eli Lilly (LLY), another name that has been a high-flier, this week it sold off 2.63% on Friday and lost a lot of points last week, it opened at 760 on Monday and hit a low of 722 on Friday before closing at 726, that’s a loss of 5% with more than half that lost on Friday, another high-flying name is the new GE Aerospace (GE) which closed down nearly 3.2% on Friday as well. These are 3 of the strongest names on the stock market with unassailable narratives and in widely disparate sectors. The point I want to make here is that they were targeted precisely because they had the most accumulated alpha. This is my opinion, of course, but if you look around, all the names with the biggest losses this week were the ones who had the biggest gains this year.

Let me remind you that the usual way this goes is that when there is the slightest sell-off because of interest rates going higher, it is the biggest names in tech that attract buyers. This is because they are not what is called long-duration assets. Tech stocks that don’t have high cash flow or profits get sold off because they are funding their growth with debt, and since debt becomes more expensive, the value of future revenue streams and profits are worth less. What I am getting to here is that I am making the case that this is not your usual sell-off. This was not led by traders running for the exits because interest rates were too high, or that there would be no rate cuts this year. Though Powell’s statement may have kicked off the selling, think it was more of an algorithmic sell-off. How do I make such a statement? Look at the trading volume for the S&P 500 the average volume is 4.06B (using Yahoo Finance), and Friday’s volume ended with 2.7B shares traded. This wasn’t a “get me out at any price” kind of sell-off.

So how did NVDA drop 10%, NVDA had more volume on Friday, about 50% more, and here, I think there was some actual motivated (though misguided IMO) selling, the reason was an odd one, and it has to do with Super Micro Computer (SMCI). SMCI has been tied up with the NVDA story as both their revenue and profits grew with H100 adoption. In the beginning, for whatever reason, SMCI had the lion’s share of H100 AI chips that NVDA makes to sell their servers. Until last quarter, SMCI dominated this space, and then Dell Technologies (DELL) started reporting torrid growth in AI servers. SMCI announced their earnings date which will be April 30th, over the last several times they announced the earnings date they also announced that they will beat whatever expectations there were for earnings. This time they made no such statement and the stock dropped 23%. The assumption is that if SMCI is not beating their expectations, something is wrong with NVDA. I can’t tell you that NVDA is going to beat expectations, but a less-than-expected showing in any form by SMCI in no way means that the reign of NVDA as the AI colossus is over. Even if Barron’s trots out an article saying as much, Nvidia Won AI’s First Round. Now the Competition Is Heating Up. If you read the article, it states that NVDA’s virtual lock on AI will be challenged, and of course, it will, just not now. The closest real competition is Advanced Micro Devices (AMD) which also lost a lot of points this week. Yet, their offering is targeting the H100, which will be if not obsolete, then 2nd tier relatively shortly when the new AI GPU Blackwell debuts. Don’t get me wrong, I expect AMD to do well with the MI300, but no one is expecting AMD to steal a significant share from NVDA anytime soon. I am not saying anything new here, just that while the article is interesting for what it is. NVDA is still king of the hill. SMCI might not be shooting the lights out, but that is very likely because Hewlett Packard Enterprise (HPE) and DELL are getting the AI chips they need to sell their AI servers to their customers.

Perhaps the less-than-perfect reports of these 2 chip stocks spooked some investors on NVDA

I must give one fundamental type reason for NVDA being somewhat weak. The earnings report for ASML Holding (ASML) and Taiwan Semiconductor (TSM) came out this week, and both sold off on the report. I bought some equity in ASML on the weakness after the report because while they missed somewhat on revenue, they still confirmed their full-year revenue. ASML builds the most sophisticated chip-making equipment in the world. Each unit is the size of a bus and costs $100M a pop. So the revenue is chunky, and the delay of shipping one unit can strongly influence quarterly revenue. I also want to start accumulating TSM, but I am waiting for it to break below 127 to start,

So here’s the big question, NVDA being down 10% isn’t it going to fall further?

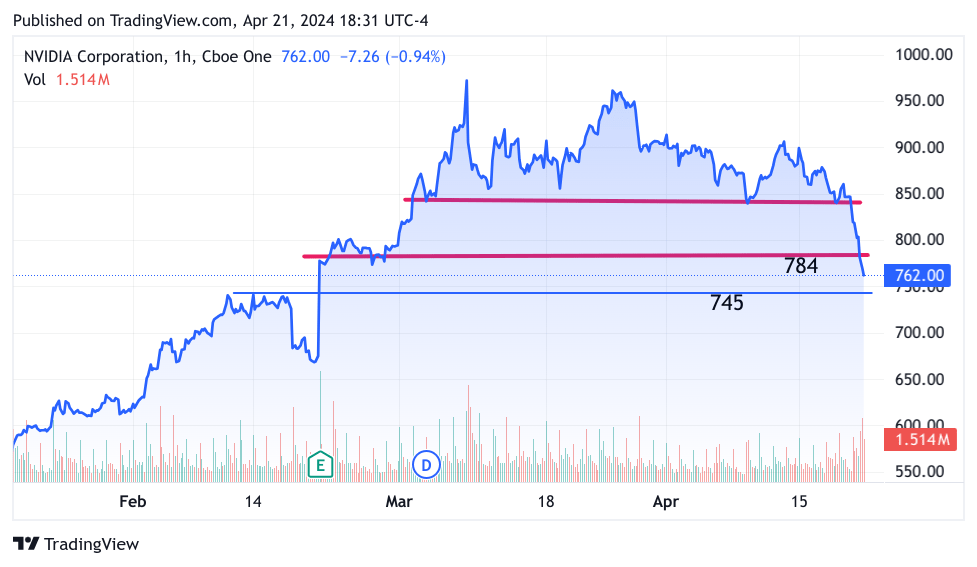

Well, perhaps, though it is down 210 off of its all-time high of 974 according to Yahoo Finance the average price target for NVDA is 1003 the high estimate is 2762.12. Don’t ask me what the 12 cents is for, and no, I can’t imagine that NVDA more than triples from here. However, the current rise has been shocking to me as well, so I have decided to have an open mind as to how much NVDA can appreciate going forward. NVDA comes to this price level, honestly, its leap in revenue and profits has been astounding. It keeps beating expectations by a wide margin. Does that mean that now it won’t? Hard to know, but at this point, being down 22% from its all-time high and nearly half of it in just one day – this past Friday, I think it is a very good risk. I started accumulating this name already and will continue to do so since this is for an investment and not a trade I am buying in gradually. So if NVDA falls another 5% this week, it will only excite me more. It does make sense to see where support it for the stock, and maybe if I do see strong support, I will try to trade it as well. So let’s start with the 3-month chart and see what we can see.

TradingView

Not a great chart. The first red line was quickly broken and this was very strong support for about 6 weeks. Then the next support level was also broken at 784, the next level at 745 offers the same moderate support as the previous. It’s hard to imagine that this stock, which has so much growth ahead of it, could fall further. Their chips are not the only advantage they have, their CUDA software development platform is what every engineer is training on right now. Barrons lists the cloud companies that are the biggest buyers of NVDA chips as competition. That means though that if a CIO wants to build in Microsoft Azure and use their proprietary chips, that means they will be locked into that vendor. AI processing is very expensive and training an LLM in the cloud with corporate data to be able to build an enterprise inference engine, I am not so sure that is going to fly. Right now, engineers are loyal to CUDA, but that doesn’t mean there aren’t opportunities for others to take a piece for themselves, and perhaps this retreat in NVDA shares is inevitable, but I have been nibbling shares, I started at 841, have been spacing out my purchases, I will be adding more very slowly my last purchase was 780. NVDA is going to report the 3rd week of May, and there could be more volatility coming. Though at this level, I believe NVDA when it recovers will be well above where it closed on Friday.

It’s not only NVDA that I am looking to add to long-term positions, either.

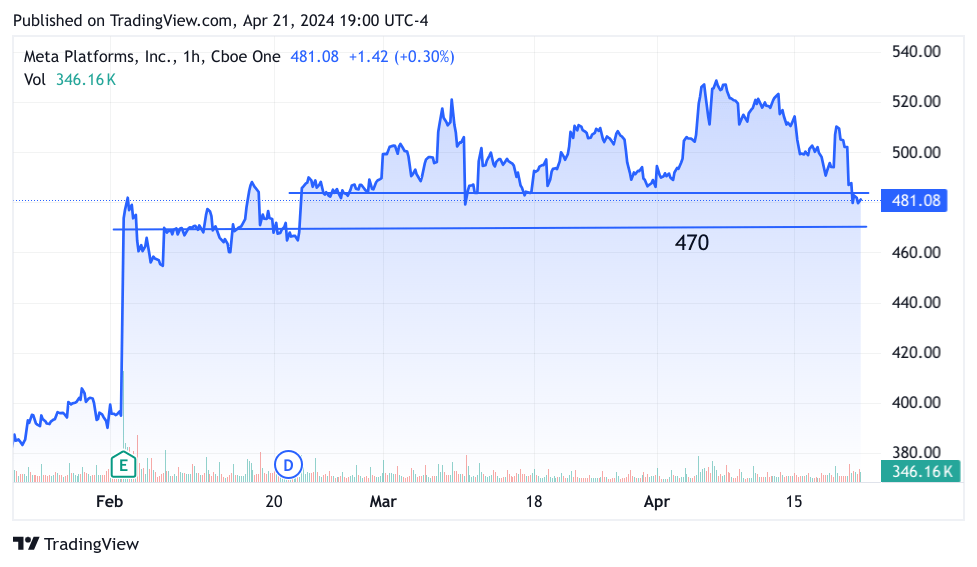

Of all the big-cap tech names, it looks like Meta Platforms (META) fell the most. I think they offer the possibility of a nice bounce too. They report this week on the 24th, by then the Senate should ratify the new military aid funding bill with the ban of TikTok mixed in with the funding. That alone should boost META because of Instagram “REELS” competes with TikTok. So I am going to want to buy a little going into earnings and, no matter what, buy after the earnings are announced. This is for my long-term investing, so I don’t mind adding a bit beforehand in this case, since it is now 10% below the 52WH. Let’s take a quick look at the 3-month chart to see where the support is. Though, again, I expect positive news flow from the legislation supporting this name.

TradingView

It looks like META is breaking through some strong support that has been there for the last 2 months. The next level down is 470. Still, I am going to buy a bit tomorrow before the Senate bill gets passed, and then if there is any delay it might affect the stock price. I would use further deterioration as a buying opportunity.

Ok, let’s summarize: I have started accumulating NVDA shares for an investment. If I see that it is finding a level of support, I might trade it as well. I also invested in ASML this week because I felt it was unduly punished for what I see as a small hiccough and not a sign that chip consumption is slowing. Quite the opposite, I believe that this unexpected drop in such great stocks offers a great opportunity. I haven’t yet started to add more META this time around, but now that the house passed a bill that essentially bans TikTok, I think this is a great time to add META shares to my investment account.

As far as trading, last Wednesday I wrote about the refiners – I Like Oil, But I Love The Refiners! I am waiting for WTI to break under 80 per barrel, and I think that I will get it this week. If oil does not come in, I am not going to execute the trade. I still love $SLV I Love Gold, But I’m Buying Silver. Silver has been trading uncorrelated to stocks and has been very resilient. It is contesting with the 29 level, but I think it moves higher. So I am still long $SLV.

Ok, good luck everyone!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here