Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of April.

Market Action

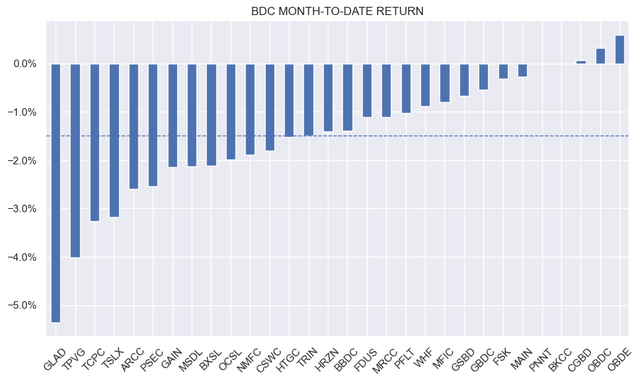

BDCs were down on the week, in line with the rest of the income space. Higher-than-expected inflation, once again, buffeted nearly all income sectors. Over the week, Gladstone Capital Corp (GLAD) outperformed, though it remains well down on the month.

Systematic Income

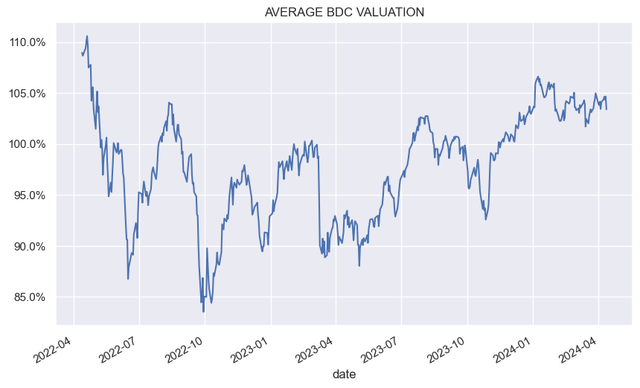

The average valuation of BDCs in our coverage has come off its recent highs but remains elevated, slightly above its long-term level.

Systematic Income

Market Themes

There is some excitement about a recent study of private credit (e.g. BDC and other private credit funds) returns. A new paper argues that the excess risk-adjusted returns generated by private credit are roughly equal to the management fees. In other words, once the risk profile of the underlying asset class (i.e. private credit) is taken into account and fees are taken out, investors do not generate any alpha, as any excess returns go to pay management fees.

One reason for this is that the risk profile of private credit is quite a bit above that of public credit as private credit portfolios both carry high levels of leverage and significant exposure to equity.

There has been some criticism of the study methodology. For one, the period in question 1992-2015 is not particularly representative of what private credit is now, given its previous focus on high-risk loan tranches, second-lien lending, HY corporate bonds and distressed lending vs. today’s focus on first-lien loans.

Two, fees have come down significantly – recall that BDCs are coming to market with base fees of 1% or less – below the previous range of 1.5-2%.

Three, even if private credit offered no excess returns (which has been questioned by private market investment adviser Cliffwater, among others) it offers diversification. A lack of excess returns is very clearly not a reason to avoid a sector as sustainable excess returns are pretty much impossible to maintain.

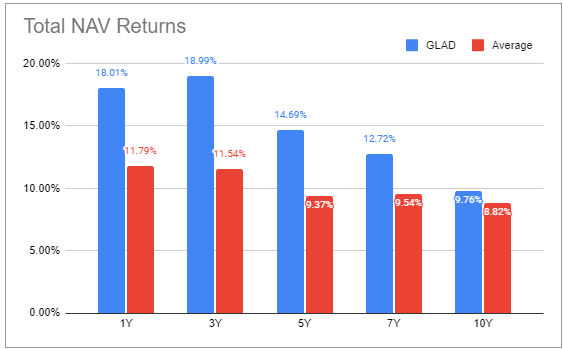

Finally, as they say, you can’t pay bills with risk-adjusted return, so absolute longer-term returns is a focus for most and here BDCs have done exceptionally well. Many investors want to complement their equity holdings with “credit” and if a part of that credit allocation contains a small pocket of warrants and common shares, then that’s OK for most.

Investors less comfortable with embedded equity risk in their BDC holdings can easily choose BDCs with de minimis equity allocation such as BXSL, MSDL and others. Overall, many BDCs have not only generated high absolute returns and superior returns vs. public credit, they have been resilient through market shocks – an essential feature of a core income holding.

Market Commentary

BDC Main Street Capital Corp (MAIN) funded $155m of new investments. This is spot on vs. the average of the last 3 quarters of $154m. Overall lending activity in the BDC sector has been fairly slow over the past year which has resulted in a downtrend in leverage. This is likely due to private equity players sitting on the sidelines. The hope was that the new year will bring a rise in activity, alongside a boost in fees. Given the improvement in risk sentiment this could still happen, but it could take more time to play out.

Stance And Takeaways

At the start of the week we added a position in GLAD, a high-performing BDC whose valuation has, unusually, fallen (briefly) below the sector average level. This situation where a stock’s valuation is out of sync with its historic performance often signals an opportunity. A couple of risks to watch out for is a relatively large allocation to second-lien loans and a relatively undiversified portfolio.

Systematic Income BDC Tool

Read the full article here