Article Thesis

ASML Holding N.V. (NASDAQ:ASML) is one of the most important companies in the wider chip industry. The company’s most recent earnings results, reported on Wednesday morning, were uninspiring, however, which caused a steep sell-off. For longer-term investors who believe in the chip story, this share price decline could be a buying opportunity, however.

Past Coverage

I have covered ASML Holding N.V. once here on Seeking Alpha in an article from early 2022. In that article, I argued that ASML was a nice growth and dividend growth investment, but that investors may be better off waiting for a better buying opportunity. Shares did, in fact, decline from the mid $600s to as low as $390 in the months that followed, which made for an even better buying opportunity. Now, around two years after my first article on ASML, it’s time to update my thesis and to incorporate new developments such as the impact of Artificial Intelligence on the broader chip industry.

What Happened?

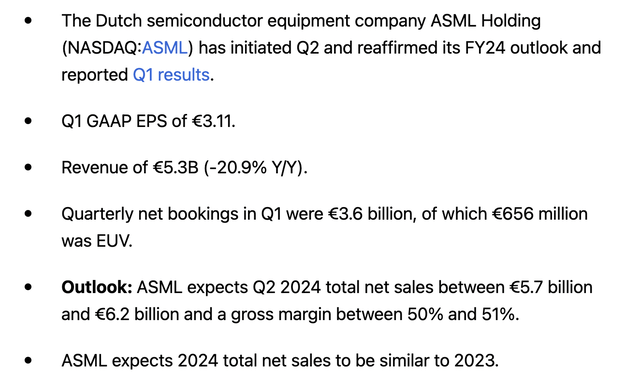

ASML Holding N.V. reported its most recent quarterly earnings results, for its fiscal first quarter, on Wednesday morning. The company’s headline results for the period can be seen in the following screencap:

ASML results (Seeking Alpha)

The company recorded a steep revenue decline of a little more than 20%, although that did not come as a huge surprise. The previous year’s quarter had been pretty strong, and a slowdown was expected.

Not surprisingly, profits were also down compared to the previous year’s quarter. The sales decline in combination with operating leverage working against the company made profits fall by a hefty 40% on a per-share basis.

But while Q1 results were rather unappealing, ASML’s guidance for the current quarter, its fiscal Q2, indicates that revenues will rise by double digits on a sequential basis based on the guidance midpoint being $5.95 billion — 12% more than the company’s revenues during the first quarter.

For the entire year, ASML is forecasting flat revenues. This isn’t a great result for a growth company like ASML, but when we consider the fact that revenues were down substantially during the first quarter, flat full-year results imply that revenues will, on average, be up during the Q2 to Q4 period, relative to the previous year’s Q2 to Q4 period.

Looking at how ASML performed relative to the analyst consensus estimate, we see that the company beat profit estimates easily, with earnings per share coming in $0.36, or more than 10%, ahead of estimates. Revenues missed the consensus estimate slightly — the combination of these two factors means that ASML generated significantly stronger margins compared to what the analyst community was expecting. For long-term investors, this isn’t too much of a surprise — the company has a history of outperforming profit estimates: Over the last ten quarters, ASML beat the consensus earnings per share estimate ten times. In the recent past, ASML thus has a very clean track record when it comes to performing better than what Wall Street is forecasting. This does not guarantee that the same will hold true in the future, too, but a serial outperformed such as ASML likely has a better-than-average chance of outperforming in the future, too. The revenue beat track record is positive as well, as ASML has beaten the consensus revenue estimate in 7 out of the last 10 quarters.

In the recent past, earnings estimates for the current year have come down slightly. According to Seeking Alpha’s data, the consensus earnings per share estimate for this year declined by 1% over the last month and by 2% over the last six months. This is, I believe, far from dramatic. With ASML’s track record of outperforming expectations, the company may very well produce better-than-expected results this year.

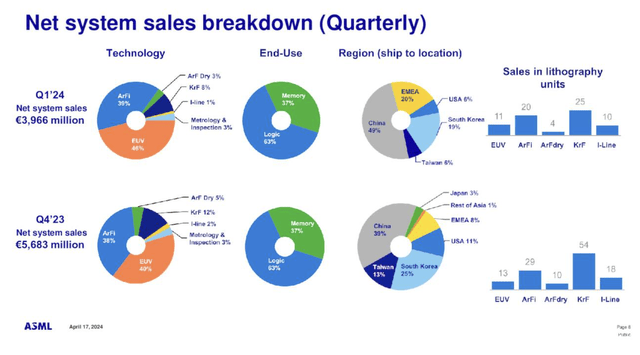

The breakdown of the company’s sales looks like this:

ASML presentation

We see that EUV machines made up roughly half of the company’s revenues. EUV machines do not make up a large portion of the company’s volumes, but they have higher average prices and are thus a huge revenue contributor. The fact that ASML has a monopoly in this space is very encouraging for investors — close to half of revenue being not at risk from competition at all de-risks the business considerably. On top of that, ASML is well-positioned to benefit from growing EUV sales demand in the long run.

Sales volumes for both the EUV business and the non-EUV business were down sequentially, which explains why revenues were down as well. Orders also were not overly strong, but orders were very high during the fourth quarter — it seems likely that some orders were pulled forward and squeezed into 2023, which is why order volumes in early 2024 were not very strong.

The sales mix was shifted towards logic chips, relative to memory chips, which can be expected, as this is a larger market and since logic chips, including for AI purposes, are seeing more pronounced growth versus memory chips. When it comes to orders, logic again beat out memory easily, with a roughly 60% to 40% mix.

The company’s commentary regarding the near-term potential for its EUV machines was encouraging. During the earnings call, CEO Christophe Fouquet stated [emphasis by author]:

Turning to our businesses. For EUV, we continue to expect revenue growth in 2024. We plan to recognize revenue on a similar number of EUV 0.33 NA system as 2023. In addition, we expect revenue from one to two High NA systems. On our 0.33 NA system, we shipped the first NXE:3800E this quarter for qualification at the customer. The NXE:3800E has the capability to deliver a significant increase in performance with a productivity of 220 wafers per hour, which is a 37% increase over the NXE:3600D in its final configuration.

This suggests that EUV systems will not only remain highly important for ASML going forward, but they will actually grow in prominence — with company-wide revenues being guided flat, while EUV revenues are forecasted to grow, the ratio of sales attributed to EUV will only rise. I believe that it is reasonable to assume that this trend will continue beyond 2024, with EUV becoming more and more important and being the major source of revenue growth for the company going forward. Due to the dominant market position in this space, the above-average performance for EUV is not surprising. With the first next-generation NXE:3800E system being shipped, a sales shift to even higher-power, higher-priced systems seems likely in the foreseeable future, I believe.

Long-Term Growth Potential

ASML produces and sells highly advanced machines that help chip manufacturers such as Taiwan Semiconductor Manufacturing Company (TSM) in producing semiconductors. While ASML does not produce chips itself, its growth is dependent on the global chip industry. When chip manufacturers such as TSM have high orders and want to produce a large number of chips, they need to increase their output capacity. This goes hand in hand with increased purchases of the machines that ASML produces, including extreme ultraviolet lithography machines, or EUV machines, where ASML has a monopoly due to being the only supplier of this type of lithography machine.

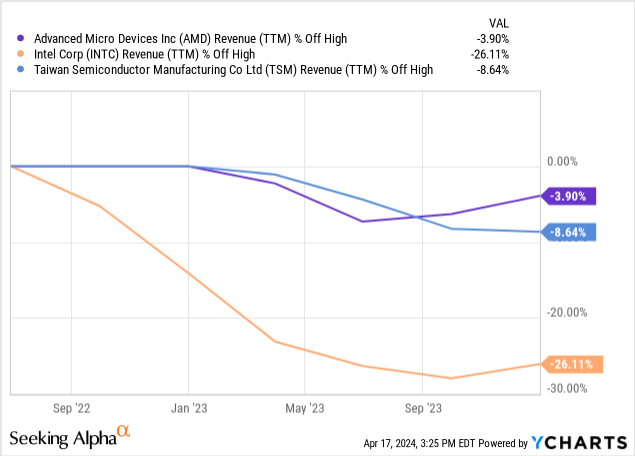

The global semiconductor industry has experienced a bit of a slowdown over the last two years, relative to the high times during the pandemic when global chip demand was extraordinarily high and when prices were driven upwards. The following chart shows that Advanced Micro Devices (AMD), Intel (INTC), and Taiwan Semiconductor Manufacturing Company (TSM) all saw their revenues dip (or, in Intel’s case: crash) in the recent past:

Nvidia (NVDA) is an outlier, as it has seen its revenues expand thanks to the ongoing Artificial Intelligence investments by many hyper scalers and other companies, but the broader semiconductor company has been experiencing a downturn. Not surprisingly, this has had an impact on ASML, as chip manufacturers have slowed down their growth spending in the recent past.

The fact that order intake during the first quarter was not very strong, at $3.6 billion and thus well below the revenues generated during the same quarter, is another indication that the global semiconductor industry is not in excellent shape right now.

But even though the chip industry can be cyclical, the long-term growth outlook is very appealing. Chips are essential for many of the products we use in our daily lives, both when it comes to our jobs and when it comes to our free time.

Chips are needed for smartphones, PCs, notebooks, tablets, and so on. In these product categories, there is some market growth, but not especially strong growth. But on top of this base demand with some growth, there are also higher-growth markets the chip industry can sell to, such as the automobile industry. Self-driving tech requires enormous computing power and with more and more companies seeking to establish themselves as robo-taxi or self-driving vehicle players, companies that sell vehicles to this space, such as Qualcomm (QCOM), are seeing significant demand growth.

Artificial intelligence will likely also be a long-term growth driver for the global chip industry, and could thus be beneficial for suppliers to the chip industry such as ASML.

ASML’s ongoing sales shift towards EUV systems should be positive for its revenue performance. Newer and more powerful systems have higher prices, and the fact that the company has no meaningful competition here means that it will benefit massively from ongoing market growth. With the installed base growing, ASML will not only be able to grow its product revenues over time. Instead, the company should also be able to grow its service revenue significantly — somewhat comparable to Apple’s (AAPL) service revenue growth thanks to a growing base of devices.

Analysts believe that ASML will grow its revenues by 15% to 16% through 2028. To me, this growth rate seems achievable, thanks to new product introductions (at higher average sales prices), growing service revenues, and due to overall market growth when it comes to chip-making machinery. The fact that analysts have a tendency to underestimate ASML’s growth adds could mean that the analyst estimate might be too conservative — but that is not guaranteed.

Shareholder Returns

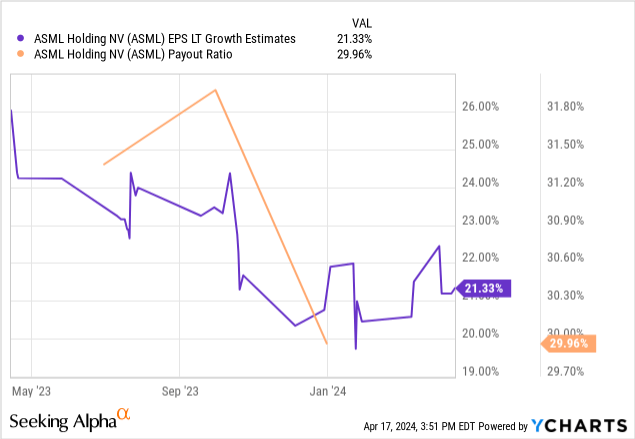

ASML Holding is not a classic income pick, as the dividend yield is relatively low, at less than 1%. But in the long run, ASML has significant dividend growth potential due to a high expected earnings per share growth rate in combination with a relatively low dividend payout ratio:

ASML is forecasted to see its earnings per share grow by more than 20% per year in the foreseeable future, at least according to the consensus Wall Street analyst estimate. With a payout ratio of 30%, ASML has substantial room to increase its payout ratio. Over the last ten years, ASML has grown its dividend by 25% per year on average. Over the last five years, the company has grown its dividend by an even faster 30% per year on average. While there is no guarantee that the company will keep the dividend growth rate this high going forward, a 25% per year dividend growth rate seems quite achievable. If ASML hits the analyst consensus estimate and grows its earnings per share by 21% per year going forward, and if the dividend is increased by 25% per year, then the dividend payout ratio would climb to the high-30s over the next five years. That would still be a far from high dividend payout ratio and would be very sustainable, I believe. When investors buy into ASML, they can thus expect that the dividend will rise substantially in the foreseeable time — for someone who doesn’t need a high dividend yield right now, that could be an attractive proposal.

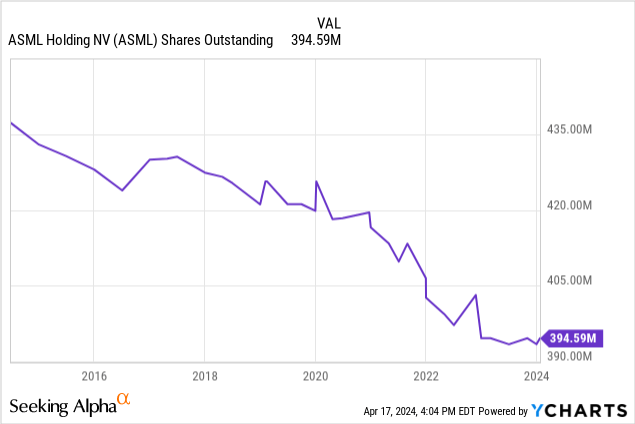

ASML also returns cash to its owners via share repurchases, which have been reducing the share count relatively consistently over the last decade, as we can see in the following chart:

This is net of shares being issued to management and employees. With a declining share count, ASML’s earnings per share are seeing a small additional tailwind — that alone is not a reason to buy, of course, but it will add up nicely for long-term holders when combined with ASML’s underlying strong business growth.

Valuation And Takeaway

ASML Holding is forecasted to earn $20.30 per share this year, which means that the company is currently being valued at 44.7x forward earnings. Following ASML’s earnings results on Wednesday, shares declined by 7% — this pullback is already accounted for in the above earnings multiple.

A mid-40s earnings multiple is far from low, but when it comes to a high-quality company with strong margins, an excellent market position, and growth tailwinds, one can make a case that this valuation is reasonable. Next fiscal year, ASML is forecasted to earn $30.90 — the earnings multiple thus drops to 29 when we look at 2025 instead of 2024. While far from a bargain valuation, investors who want chip exposure and who are bullish on the broad chip industry may find the prospect of buying ASML at a high-20s 2025 earnings multiple quite appealing.

The chip industry will always be cyclical, which means that suppliers to this industry, including ASML, will also experience some cyclicality. But in the long run, the chip industry should grow quite a lot, and ASML is positioned to benefit from this growth.

Q1 results were not especially strong, but the guidance implies that Q2-Q4 will be better again. With shares having declined by 7% and with them now trading 15% below the recent high, ASML has become more attractive again. At less than 30x 2025’s earnings, ASML could be a solid investment, although we might see a better buying opportunity in the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here