My Thesis

Since August 2021, I have published 4 bullish articles on Global Ship Lease, Inc. (NYSE:GSL), pointing out that the market was underestimating the company’s growth prospects, which has led to a sharp valuation discount.

Seeking Alpha, Oakoff’s coverage of GSL stock

Today, however, I am concerned that the current undervaluation may be justified, as new ships will soon be coming onto the market. The current dividend yield of 7% looks good but does not provide a sufficient margin of safety in my opinion. I have therefore decided to downgrade GSL to “Hold” and recommend that investors write call options or trim their existing long position.

My Reasoning

In early March, GSL reported its Q4 and full-year 2023 results, showing an operating revenue of $178.9 million in the last quarter, marking an 8.4% YoY increase. For the full year of 2023, GSL’s operating revenue reached $674.8 million, up 4.5% from the previous year. Adjusted EBITDA for Q4 2023 was $127.1 million, a significant rise of 27.1% YoY, while For FY2023, it was $462.1 million (+16.0% YoY). That is, GSL’s financial growth gained momentum in the last quarter compared to the full-year results. The management explained it by “geopolitical uncertainties and trade disruptions in regions such as the Red Sea and the Panama Canal, which led to a large-scale rerouting of container ships, resulting in a shortage of supply and demand for container ships.”

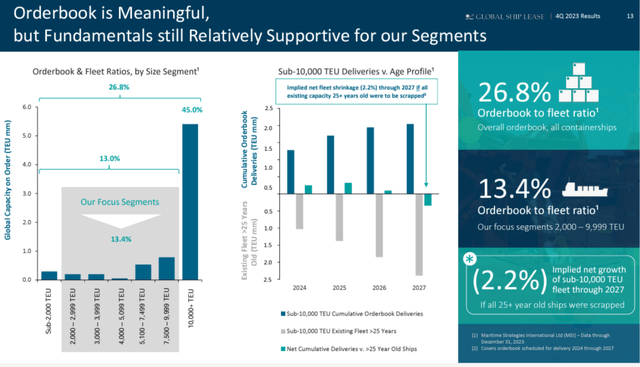

As I noted in my previous articles on GSL, the company’s focus on high-quality, mid-sized, and smaller containerships gives it an advantage over the rest of the market, as the clients (liner companies) get access to a more flexible tonnage, which is crucial during times of uncertainty and disruption (what we’re facing to date). Essentially, the mid-size vessel market niche is in a favorable position compared to larger vessels: as of today, there aren’t as many new orders for mid-size ships as there are for those over 10,000 TEU (Twenty-foot Equivalent Unit). So this means there’s a chance to patiently navigate through the slower parts of the business cycle. When disruptions in the market no longer have such a positive impact as they do now, being in this niche should still be advantageous, in my opinion.

GSL’s Q4 IR presentation

[Source – presentation]

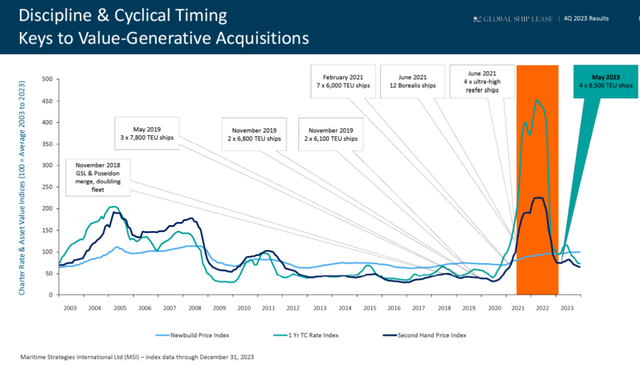

GSL ended the last quarter of 2023 with solid ground, benefiting from robust charter cover (2.1 years of TEU-weighted average contract cover). GSL also took strategic steps and invested in its fleet and financial standing: An important step was the acquisition of four 8,500 TEU vessels with attached charters, a decision driven by management’s confidence in their potential for risk management and return on investment.

GSL’s Q4 IR presentation

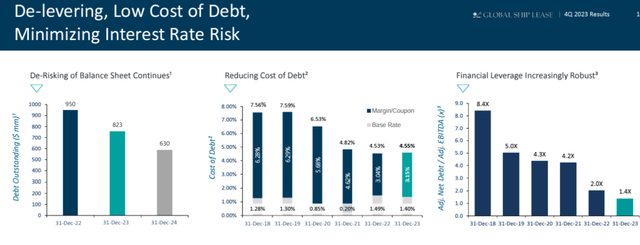

In general, fleet expansions and investments seem appropriate today, given the state of the company’s balance sheet and its ability to generate cash flow. GSL’s gross debt decreased from $999.5 million in 2022 to $823.2 million in Q4 2023, while cash amounted to $294.7 million (including the restricted portion). Net debt to adjusted EBITDA now stands at 1.4x – times less compared to what we could have seen just a couple of years ago:

GSL’s Q4 IR presentation

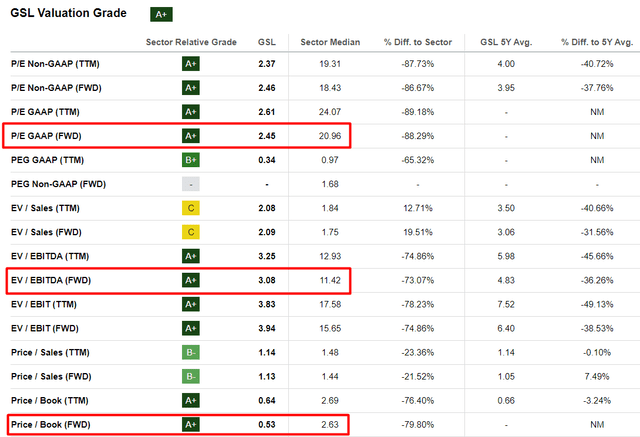

By the way, the current market capitalization is ~$752 million, so cash is ~39% of the market cap, which is a lot. With a P/E ratio for the next year of 2.45x and an EV/EBITDA (also forwarding) of slightly more than 3x, the company’s valuation indeed seems very favorable to me:

Seeking Alpha, GSL’s Valuation, Oakoff’s notes added

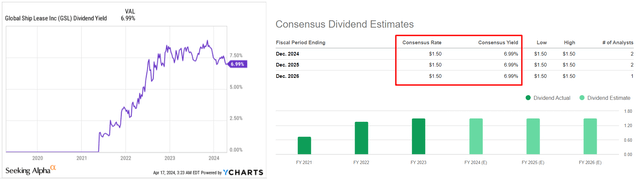

At the same time, the company continues to buy its shares from the market – since the third quarter of 2021, GSL has already bought $54.5 million worth of shares, representing >7% of its current market capitalization. In addition, GSL has maintained its quarterly dividend of $0.375 per share – the FY2024 dividend yield is now ~7%, and consensus expects the yield to remain the same over the next 3 years:

YCharts, Seeking Alpha, GSL, Oakoff’s notes added

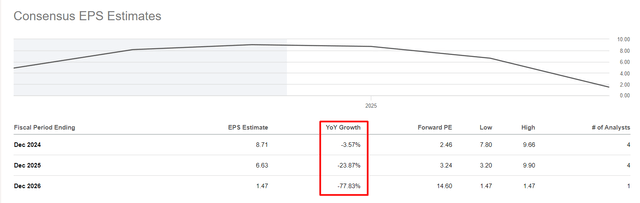

So far in my story, GSL has looked like an obvious “Buy”, but there are some nuances to consider. First, the situation around the trade disruptions seems too unpredictable. It’s still a tailwind for now, but if it suddenly subsides, we will very likely see what the consensus estimates are warning us about today: the decline in revenues as the supply of new ships continues to increase.

Seeking Alpha, GSL, Oakoff’s notes added

This means that by the end of 2026, the currently favorable P/E ratio should be around 14.6x – that is a big difference to my thesis.

Secondly, looking at the dividend yield of 7% for the next 3 years, I can’t bring myself to call GSL’s shareholder return sufficient, even taking into account the share buybacks. In my opinion, this 7% indicates limited upside potential. Of course, with the current transportation crisis still ongoing (and judging by the geopolitical situation in the Middle East, there is no end in sight), it is unlikely that dividend forecasts 3 years ahead will prove to be the ultimate truth. But relying on the ongoing uncertainty as an upside catalyst in this situation is not very sensible in my opinion.

Your Takeaway

I like the way Global Ship Lease’s financial situation looks at the moment: The balance sheet is strong; the leverage is steadily decreasing, and the contract revenues are sufficient for solid FCF generation in the coming quarters. You can call me too demanding, but I don’t like that GSL’s dividend yield is only 7%, considering the risk of the new supply of vessels coming to the market soon – the yield should be higher for GSL to be called “cheap”. The price/earnings ratio is low today, but as we can see from the consensus forecasts, it should rise significantly in 3 years. All this confuses me a little – so I have decided to downgrade GSL to “Hold” today.

While geopolitics is playing into the hands of the bulls, I think it makes sense to sell short-term call options and collect the premium on an existing long position. But before you enter the options market, I highly recommend you study this topic in more detail (I am not an expert in derivatives trading).

Good luck with your investments!

Read the full article here