In keeping with my continued coverage on bonds and bond funds, thought to have a quick look at treasury-inflation protected securities, or TIPs. These securities have broadly similar characteristics to normal treasuries, with effectively zero credit risk, moderate rate risk, and reasonably good yields, albeit below-average. Unlike normal treasuries, TIPs are somewhat protected against inflation, seeing higher coupons when inflation increase, and vice versa.

Right now, TIPs yield around 2.5% plus inflation, and should outperform normal treasuries with inflation rates higher than 2.4%. With inflation running higher than 3.0%, and with no short-term catalysts for a significant drop in inflation, TIPs look marginally stronger than normal treasuries. I continue to prefer high-quality CLO debt tranches, though, as these have higher yields and broadly lower volatility.

I’ll be focusing on the iShares TIPS Bond ETF (NYSEARCA:TIP) for the remainder of this article, but everything here should apply to other TIP funds in roughly equal measure.

TIPs – Overview and Explanation

TIP is an index ETF investing in TIPs. As these are somewhat niche, uncommon securities, thought to start the article with a quick overview of these. Feel free to skip this section if you already know all about TIPs, or if you’ve read my previous articles on the subject.

TIPs are treasuries, issued by the U.S. treasury and backed by the full faith and credit of the U.S. federal government. Treasuries offer investors ultra-safe, albeit low, dividends, with effectively zero credit risk.

TIPs have the added benefit that their dividends, capital, and returns, are somewhat protected against inflation.

Specifically, their face value and coupon rate payments are indexed to the Consumer Price Index, or CPI, an inflation index, for positive values of said index. So, higher inflation means higher bond values and coupon payments. The opposite is technically true as well, although deflation can never reduce face values below their initial level, just erode prior increases.

Let’s explain the above with a quick example.

Say you invest $1,000 in TIPS at a 2% yield, equivalent to an interest payment of $20 per year.

If inflation increases to 10%, so would the value of your investment and interest. Your investment would increase in value from $1,000 to $1,100, while your interest payment would increase from $20 to $22.

Total returns would be equal to $100 plus $22, effectively equivalent to inflation plus interest rate (10% + 2%). Returns are generally distributed to investors in the form of dividends, with higher rates of inflation leading to greater gains and dividends.

Deflation can impact the value of your investment and dividends, but can never cause these to decrease below their original level. In the example above, deflation of 10% could cause your investment to drop in value from $1,100 to $1000, but not from $1000 to $900. In other words, deflation can reduce gains, but never lead to net losses.

With the above in mind, let’s have a look at TIP itself.

TIP – Basics

- Investment Manager: BlackRock

- Expense Ratio: 0.19%

- Yield: 2.17% plus inflation

- Yield to Maturity: 4.64%

TIP – Overview and Analysis

Credit Risk Analysis

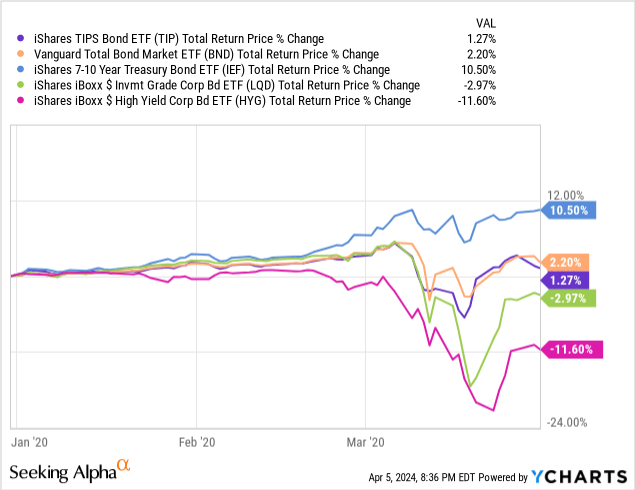

As mentioned previously, TIPs are treasuries, and so have effectively zero credit risk. Expect approximately zero losses during downturns and recessions, as was the case during early 2020, the onset of the coronavirus pandemic. On the other hand, TIPs tend to underperform normal treasuries during these downturns, due to a lack of flight-to-quality effect plus lower inflation.

Data by YCharts

TIP’s low credit risk is a significant benefit for the fund and its shareholders, although treasuries are much stronger in this regard.

Interest Rate Risk Analysis

TIP focuses on treasuries, and so has broadly similar interest rate risk and duration to these securities, a bit lower.

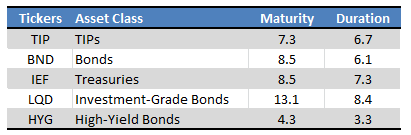

Fund Filings – Table by Author

Due to the above, TIP should see average losses when interest rates rise. On the other hand, interest rates are generally hiked to combat inflation, and the fund’s underlying securities are somewhat protected against inflation. The fund’s interest rate risk and inflation protection are sometimes at odds, and somewhat cancel each other out.

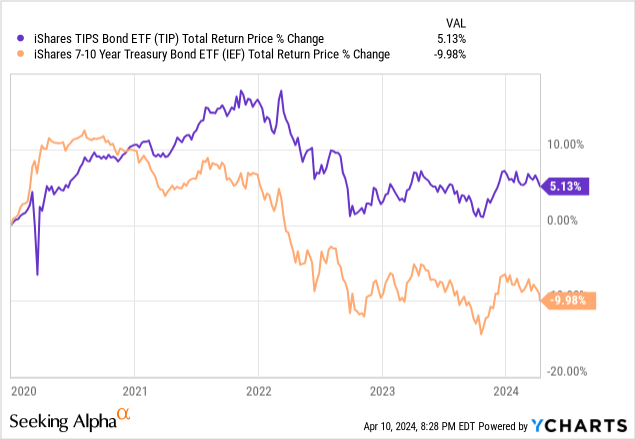

In practice, the interest rate risk seems to matter more, with TIP seeing some losses since early 2021, prior to rates skyrocketing in 2022. TIP did see much lower losses than most bonds and treasuries, due to inflation rising.

Data by YCharts

Inflation Protection

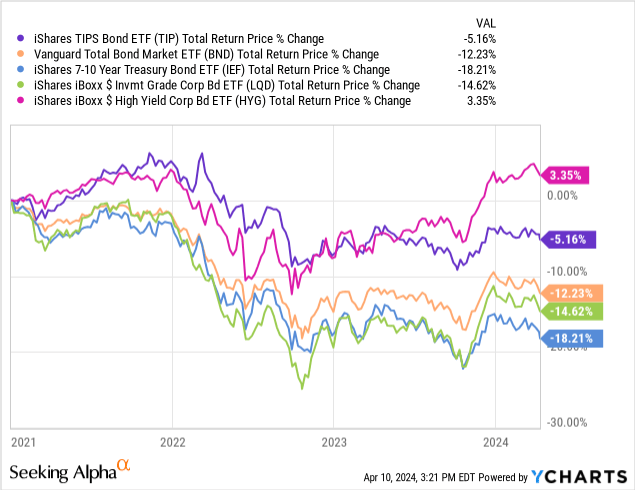

TIP’s underlying holdings are protected against inflation, with the fund seeing higher dividends as inflation rises. As an example, fund dividends almost quadrupled from 2020 to 2021, as inflation skyrocketed.

Seeking Alpha

Higher dividends allowed the fund to outperform from 2021 to 2023, a period of elevated inflation, as can be seen above. The fund was still down though, as the impact from higher rates ended up being more impactful.

Considering the above, it seems that TIP’s interest rate risk serves to significantly reduce the actual inflation protection on offer by the fund. In my opinion, this is a significant negative, insofar as it blunts TIP’s investment thesis / overall value proposition. Less of a reason to invest in an inflation-protected ETF that sees losses when inflation rises, albeit below-average losses.

Dividend Analysis

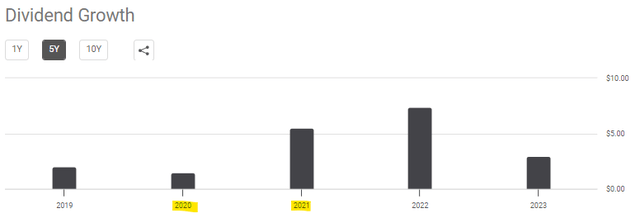

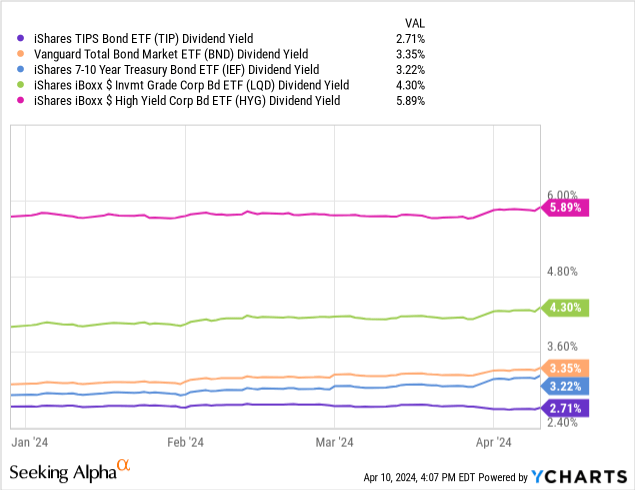

TIP currently offers investors a 2.7% dividend yield, quite low on an absolute basis, and lower than most bonds including treasuries.

Data by YCharts

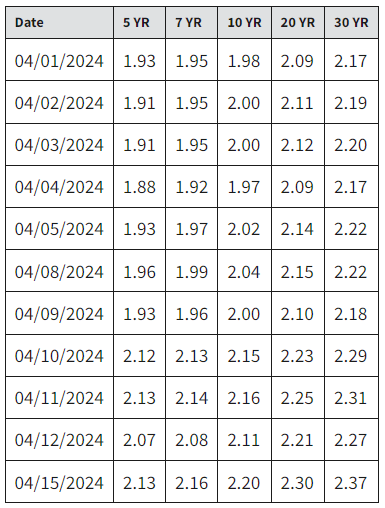

TIP’s current dividend yield seems inconsistent with prevailing interest rates and market conditions. Specifically, treasury inflation-protected securities currently yield 2.1% – 2.4% plus inflation:

U.S. Treasury

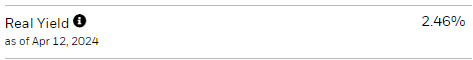

With TIP’s underlying holdings yielding 2.5% plus inflation:

TIP

With inflation currently running at 3.5%, that should result in a 6.0% dividend yield, more than twice TIP’s actual 3.0% dividend yield. The discrepancy is quite likely due to complications with these securities, and the vagaries of ETF distribution requirements. Importantly, the actual expected returns of these securities is closer to 6.0%, at current inflation rates, and dividend yields notwithstanding. These returns look particularly attractive relative to treasuries, which brings me to my next point.

Breakeven Inflation Rate

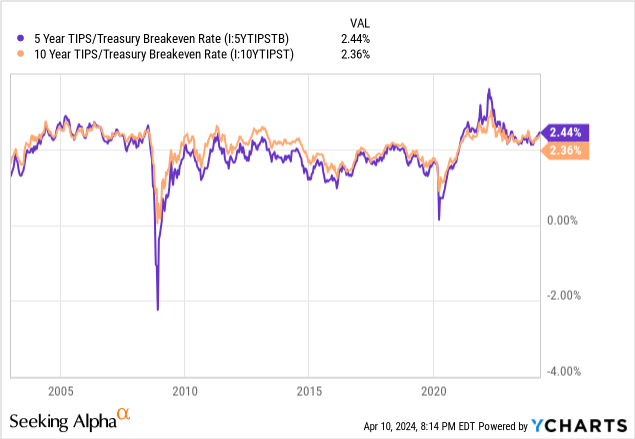

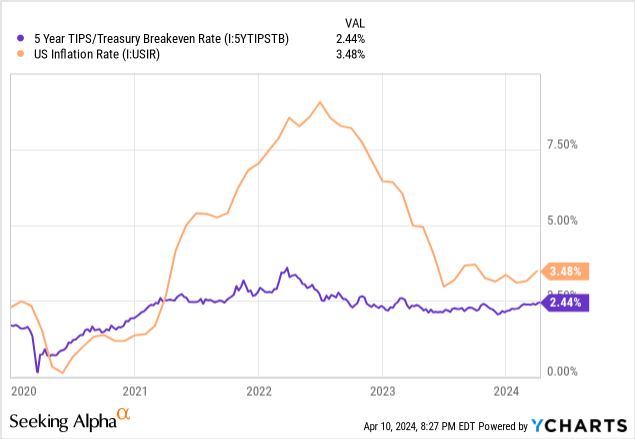

Breakeven inflation rates currently stand at around 2.4%.

Data by YCharts

The implication of the above is that if inflation averages higher than 2.4% in the coming years, TIPs should outperform. If inflation averages lower, normal treasuries should outperform. As an example, treasuries outperformed during 2020 and early 2021, as inflation was (mostly) below breakeven at the time. TIPs outperformed afterward, as inflation went above breakeven. The relationship does have some volatility, especially in the short term.

Data by YCharts Data by YCharts

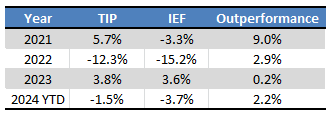

As inflation remains above breakeven, and with no signs of inflation decreasing for over a year, TIPs seem stronger than treasuries right now. They have outperformed since inflation started to increase in early 2021, and for every year since.

Seeking Alpha – Table by Author

In my opinion, and considering the above, TIPs seem quite a bit better than treasuries right now. I’m much more bullish on high-quality CLO debt tranches, though, due to their higher yields and stronger performance track-records. Lots of differences between these asset classes, though.

Conclusion

TIP’s underlying holdings currently yield 2.5% plus inflation. At current inflation rates, TIP is likely to outperform treasuries. As inflation remains stubbornly stuck at slightly elevated levels, I believe the fund to be a superior investment to treasuries.

Read the full article here