Citigroup (NYSE:C) finds itself in an odd place within the American banking industry. It’s a household brand and certainly in the too-big-too-fail camp. Shares have also appeared to be one of the cheapest options within the banking sector for many years.

In 2022, the value appeal grew even stronger as Warren Buffett’s Berkshire Hathaway (BRK.B) took a big position in Citigroup shares. This came at the same time Berkshire was selling out of Wells Fargo (WFC), perhaps signaling that Citigroup was finally ready to reassert itself as a bank worthy of a more impressive valuation multiple. When Buffett speaks, people listen.

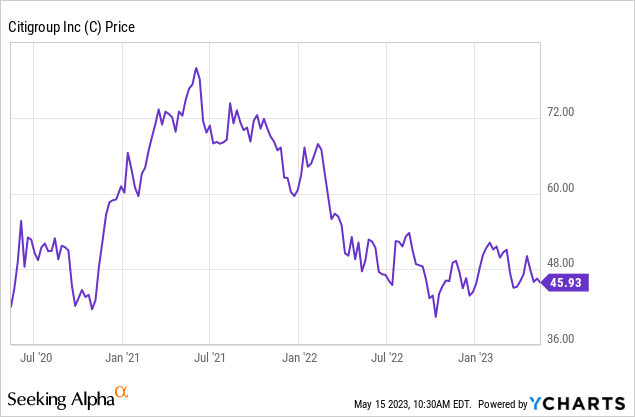

And yet the stock continues to flounder at prices near 3-year lows:

To be fair, the bank sector has had plenty of issues lately. Citigroup shares are up slightly year-to-date, which is a fine relative performance, in fact. In the bigger picture, though, Citigroup stock has continued to be a disappointment. What are the odds of that changing going forward?

The Bullish View

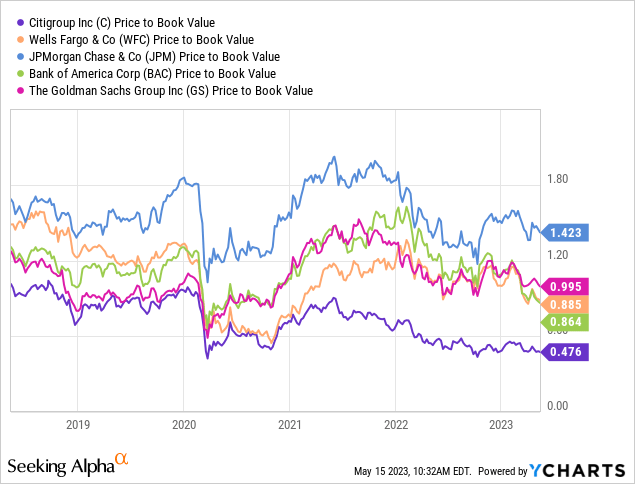

The overarching bullish argument for Citigroup is that it is far cheaper on a price-to-book basis than most of the other major American banks:

Citigroup has been near the bottom of the peer group for the entirety of the past five years. And even given the big declines we’ve seen in other bank stocks lately, most of the big American banks are still trading not all that far away from 1.0x book value, if not above that in the case of JPMorgan Chase (JPM).

And Citigroup specifically has now tumbled to even below 0.5x book value, matching the worst levels it hit at the onset of the COVID-19 pandemic.

Over the past decade, Citigroup has produced a median return on equity of 7.1%, which is indeed fairly meager and suggests that the stock should trade at a discount to book value. But normally a bank with a 7% ROE would trade in the 0.7-0.8x book value range, all else being equal, instead of under 0.5x.

Also, higher interest rates and a growing economy were providing some spark for Citigroup specifically. It managed to get its ROE above 10% in 2021, which was a welcome development, though its ROE has trended back down as of late.

Regardless, Citigroup’s operational results haven’t been that bad. The firm’s net interest margin has ticked up reasonably over the past few quarters, and the bank isn’t terribly positioned for the current interest rate environment. The financial metrics still point to this being a decidedly unimpressive bank, but at this valuation, there should still be a margin for safety. Shares also yield 4.5%, paying investors generously for their patience in holding Citi shares.

Banamex Sale

Last week, reports surfaced that Citigroup is prepared to sell most of its Banamex Mexican banking arm to Grupo Mexico for $7 billion. In the context of Citigroup’s $88 billion market cap, this is a significant sum, amounting to almost 10% of the firm’s overall market cap. Citigroup will also retain a minority stake in Banamex which it can later sell or IPO.

On the one hand, bulls could view this as a positive, as it fits with Citigroup’s larger strategy of exiting most international markets. Citigroup no doubt overextended itself with its global financial empire ambitions twenty years ago, and there’s an understandable appeal to simplifying the firm and focusing on its core competencies.

But I’ll take the opposite view. Citi was supposedly going to get close to $8 billion for this unit, as of a February report. It’s disappointing that the ultimate price was significantly lower, especially as the Mexican stock market has been on a massive winning streak over the past 18 months. There should be no rush to exit out of the Mexican unit at a mediocre price when Mexico’s economy is one of the bright spots in the global economy now. Further to that point, Citi sold to Grupo Mexico, which is not a firm known for overpaying for assets. It seems Citi got picked off here by smarter local money.

Also, the $7 billion of fresh capital isn’t quite as good as it might seem. Given the related drop in profitability associated with disposing this unit, this sale will actually hurt Citigroup’s capital levels in the short term, and Citi is refraining from restarting its buyback program in association with this sale in order to let its capital levels rebuild.

In summary, while I understand the broader framework for making Citi a leaner and more focused operation, this sale feels like a rushed and inopportune exit from a high-quality asset. At minimum, I feel Citi should have pursued an IPO instead of a direct sale for the asset, given the general optimism in Mexican equities at this time. Over time, a firm earns its low valuation multiple by leaving money on the table in transactions such as this one.

Citigroup Stock’s Bottom Line

At the end of the day, I am sticking with my bullish view on Citigroup, simply due to valuation. It’s hard to be too negative on a bank trading at less than half of book value, after all, as long as it is fundamentally sound and reasonably profitable. Citi at 7.5x forward earnings certainly hits that mark.

Morningstar’s Eric Compton, for example, sees fair value way up at $75 versus a last close of $45, showing the massive gap between Citigroup’s assets and the poor sentiment currently plaguing the stock and broader banking industry. Especially in a time where the regional banking problems should provide a tailwind to too-big-to-fail banks like Citigroup, I can’t be too downbeat.

That said, Citigroup has a well-earned negative reputation among market participants. It’s not just the headline-grabbing blunders, though things like the mistaken Revlon bond payment certainly are hard to forget. More broadly, though, investors continue to question the firm’s capital allocation, and moves such as this recent Banamex sale add more fuel to the fire on that front.

Ideally, Citigroup would be doing whatever is necessary to buy back stock as quickly as possible to close the gap to fair value. Until that happens to a much greater extent, I’m inclined to sit on a tepid buy rating — the valuation is certainly compelling, but we’re still looking for a catalyst to get the stock moving.

Read the full article here