Summary

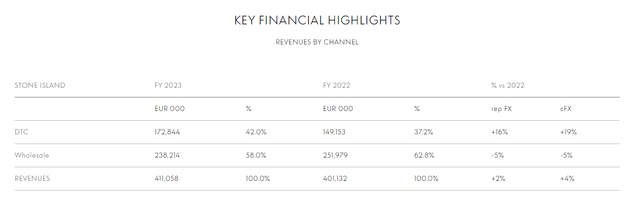

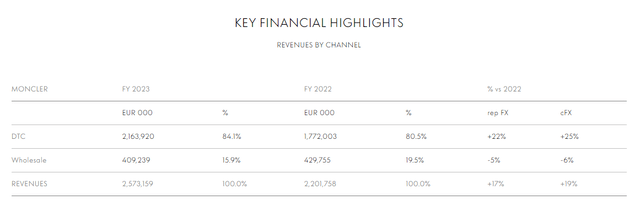

Moncler (OTCPK:MONRF) is a luxury brand retailer that serves a global customer base. The products they offer include multiple categories, such as outerwear, shoes, accessories, etc., for both women and men. Currently, MONC has two key brands: Stone Island and Moncler. The financial contribution between the two differs mainly in the split between DTC (direct to consumer) and wholesale. Stone Island is more weighted towards wholesale, while Moncler is weighted towards DTC. I am recommending a buy rating for MONC as I expect performance ahead to follow the same strength seen in FY23/4Q23.

MONC MONC

Comments

MONC is going to report its 1Q24 results in 2 weeks, and I believe MONC is going to report a strong quarter (and for FY24). My confidence stems from the strong momentum that MONC saw in 4Q23, where sales accelerated sequentially to 16% (900 bps acceleration vs. 3Q23). By numbers, 4Q23 sales grew to EUR1.178 billion. This effectively pushed organic sales growth [OSG] on a 4-year stack basis (4 years because it compares against pre-covid in FY19) to 74% (or 18.5% on average). Importantly, the growth was driven by MONC’s core brand, Moncler, which saw retail performance up 20% in 4Q23 (200 bps acceleration vs. 3Q23). I think what is more important here is that growth momentum was seen across all the growth drivers in the equation:

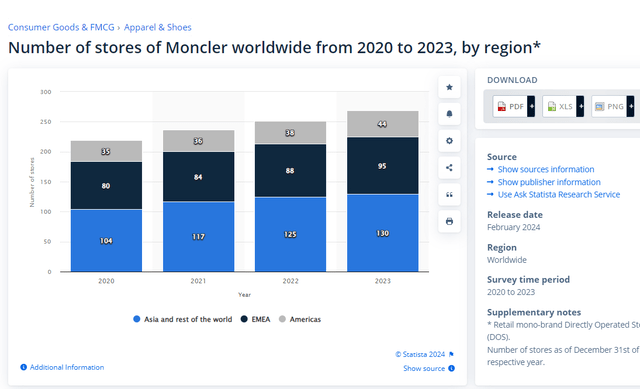

- MONC managed to continue increasing store space (by 2% in FY23).

- MONC managed to drive double-digit growth in traffic in FY23.

- MONC managed to convert this increase in traffic to transactions (with a higher value), both growing double digits in FY23 as well.

- Ultimately leading to sales density reaching a record of EUR38,000/sqm

What I can infer from this is that MONC has the right set of products for the ongoing fashion trend at the right price point, which enabled it to capture share in the luxury market. Based on management comments, where they noted a very solid start to the year and are very happy in all regions, this basically tells us that growth momentum has continued into 1Q24 (at least). Considering that Kering actually saw a 4% decline in sales, pulled down by Gucci, the confidence in management’s tone is very encouraging, which instills confidence that it should be able to grow the amount of space as guided (the guide was for 10–15 new stores in FY24).

Digging deeper into the underlying growth drivers, it painted an even more positive outlook for MONC. The biggest debate in the luxury retail space is that the weak Chinese economy will impact discretionary spending, and we can see this in the Gucci performance (dragged down by China). However, this is not the case for MONC. Revenue from Mainland China grew 21.4% on a constant currency basis and 22.7% on a reported basis, a stark difference vs. the leading brand Gucci. Even more notable is that management saw improvement in retention of the cohort and that new customers are continuously recruited, supported by a recovery in travel. Remember that MONC gave this update on February 28, 2024, which means they had 2 months of 1Q24 data already, effectively telling us that 1Q24 saw no slowdown in demand.

The same demand strength was not only seen in China. Even neighboring countries like Japan, Korea, Indonesia, Singapore, Hainan, and Macau all did well; other Asia grew 31.5% in 4Q23 on a constant currency basis. What is worth mentioning here is that MONC has managed to diversify its demand away from just the very wealthy Chinese nationals. The obvious implication is that MONC growth is not less volatile. The bigger implication, I believe, is that it implies MONC has managed to successfully penetrate a new cohort of customers (in other words, expanded its targeted market), providing it more room to grow.

It started by very healthy and wealthy a very wealthy Chinese, but now is broadening also, the fact that different countries have facilitated the emission of visa is clearly helping to restart the activities with Chinese outside of China. Source: 4Q23 earnings

Shifting focus to the western region, both the European and American regions also saw improvement, setting up well for 1Q24 performance. For Europe, MONC saw increased spending by the cohort, and for America, while it was flattish in the quarter, volumes had increased, which I believe can continue to grow ahead given the low penetration of its Moncler brand. For context, America has $25.44 trillion in GDP while Europe has $19.35 trillion in GDP, but in terms of stores, Europe has more than twice the number of stores vs. America. The growth runway is long ahead for MONC in the Americas.

Statista

However, while I am positive on top-line growth, margins should be flat in FY24 as management strategy moving forward is to continue reinvesting into growth – store openings, product assortment, etc. across both brands. Given the current growth momentum in Asia and the long runway ahead for the Americas, I think investing in the business is the right decision.

Financials / Valuation

MONC reported a very strong FY23 result in late February, growing revenue by 14.7% to EUR2.98 billion and EBIT of EUR893.8 million, representing a margin improvement of 19bps to 30%, mostly driven by the improvement in gross margin (which saw 69bps expansion to 77.1%). The key cause of the improvement in gross margin is the revenue mix shift towards DTC, which now accounts for 84.1% of sales. In terms of the balance sheet, MONC continues to maintain a net cash position, ending FY23 with ~EUR1 billion in cash and no debt (except operating leases).

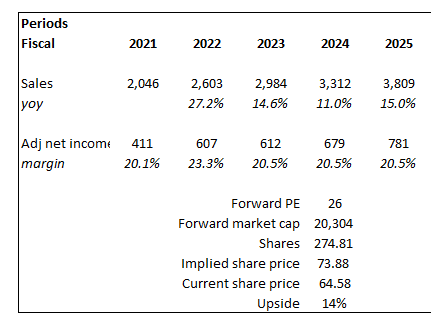

Based on author’s own math

Based on my view of the business, MONC should continue to see double-digit growth for FY24 and FY25, with FY24 dipping back slightly below the historical average of mid-teens growth given the high base in FY22/23, followed by a reversion to the historical mean. As I discussed below, margins are unlikely to expand as management is going to reinvest excess profits back into the business to drive growth, which I believe is the right decision. The key comps for MONC are Hermes International, LVMH, Prada, Kering, and Capri, which is trading at an average of 23.5x forward PE today. On average, peers are expected to grow high single-digits. Given my view that MONC should see low to mid-teens growth ahead and the strong relative performance vs. the leading brand, Gucci, I modeled MONC to continue trading at this premium (26x) vs. peers’ average.

Risk

On the flip side of MONC, identifying the right fashion trend is the key risk. Fashion trends have a lifecycle that is hard to predict, and if MONC is unable to extend this streak of figuring out the right trend, growth will be heavily impacted. Margins would see a similar fate, as MONC will likely need to depend more on wholesale to reduce inventories (which are unable to sell given they don’t feed consumers’ preferences).

Conclusion

I am recommending a buy rating for MONC. This past quarter saw continued momentum across all sales metrics, including store space, traffic, and transaction value. Importantly, management comments on a strong start to the year instills confidence as the timing of that comment was in end February. Notably, the performance in China was a major highlight when compared to Gucci. MOC expansion into new customer segments also provides further growth opportunity. Although margins may not increase in the short term due to reinvestment plans, I think it is the right decision to invest for growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here