Investment Thesis

In my view, the BlackRock iShares Bitcoin Trust (NASDAQ:IBIT) is well-positioned for the upcoming Bitcoin halving, presenting a strong buy case. IBIT is an ETF (exchange-traded fund) which is designed to track the current price of Bitcoin. With the Bitcoin halving approaching, likely to be around April 20th, the daily Bitcoin supply created is expected to reduce from 900 to 450 BTC. This reduction is predicted to affect the supply-demand dynamics of Bitcoin, potentially increasing the price. When looking into the past, this prediction matches. Historical data concludes that after halving events, significant price surges are often observed, with Bitcoin rallying over 30% in the weeks leading up to halving events.

Since the launch of IBIT in January of 2024, their year-to-date inflow has reached $3.2 billion. The obvious demand for Bitcoin, coupled with the historical gains from past halving events showcases the likely price increase to come. With some projections estimating Bitcoin’s fair value could reach $148,000 post halving I believe IBIT presents a compelling investment opportunity as we approach the halving event.

Background

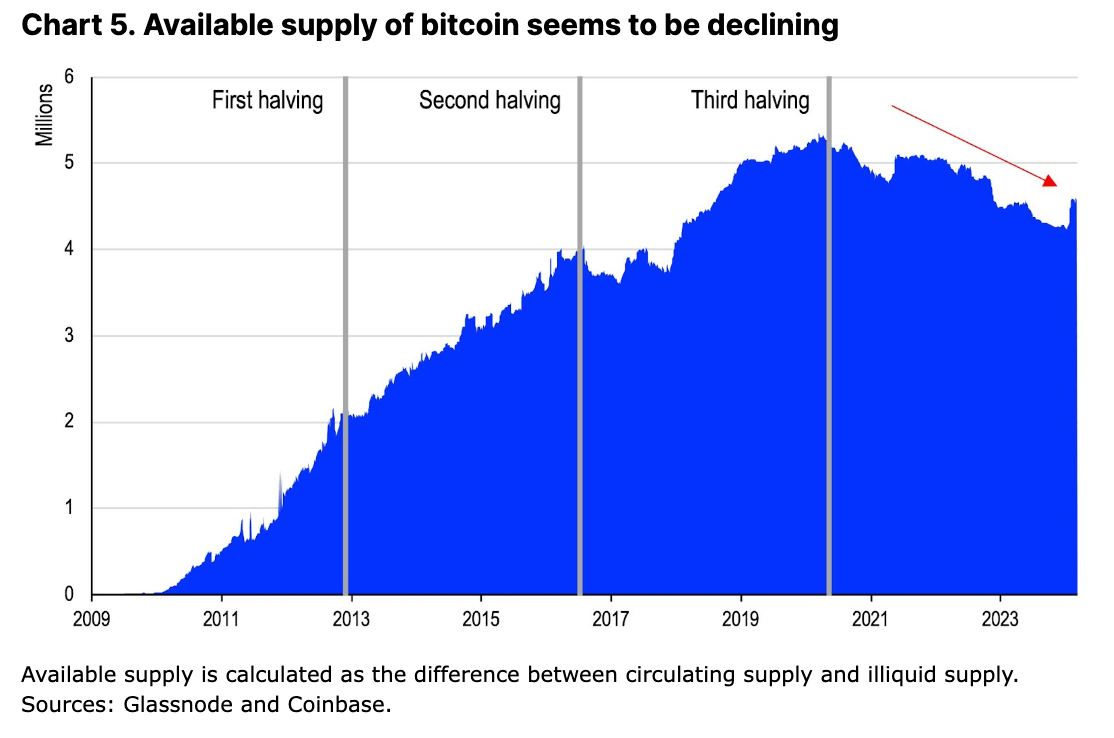

In order to understand why I think IBIT has such upside, it’s important to understand halving events. These events occur approximately every four years and are meant to reduce the number of Bitcoins generated per block by half. By doing so, the rate at which new Bitcoins are produced is decreased, therefore limiting supply. By limiting supply, this opens the possibility of an increase in price, assuming demand stays constant. The chart below demonstrates the already declining supply of Bitcoin globally, due to some Bitcoin that is purchased on exchanges being put into illiquid storage (sometimes called cold storage).

Available Bitcoin Supply (Glassnode & Coinbase)

As mentioned above, halving events have led to significant price increases. But to be more specific, substantial absolute gains were observed after the 2016 and 2020 halvings, attributed to factors like Brexit uncertainties and the pandemic-era low interest rate boom.

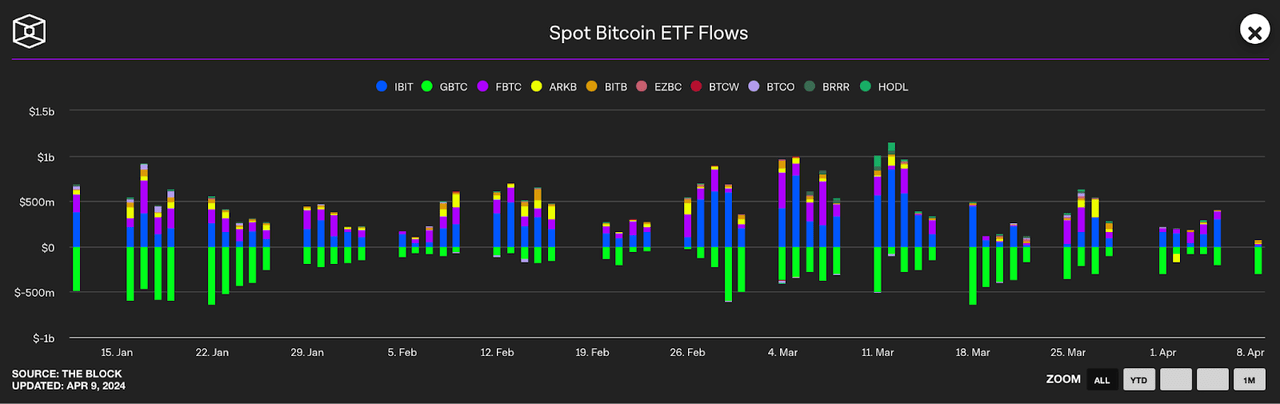

This time, the introduction of spot Bitcoin ETFs, such as IBIT, has added a new dimension to the market by providing institutional and retail investors (through normal brokerage and retirement accounts) with a regulated and accessible way for investors to invest in Bitcoin. Spot Bitcoin ETFs have been noted to alter the market dynamics in multiple ways, one being the increase in inflows to where they reach 5-7 times the daily new units of generated BTC. Since its launch, IBIT, among other Bitcoin ETFs like ARKB, GBTC, and FBTC have made their impact on the dynamics of the Bitcoin market by attracting substantial attention and investment. For example, Bitcoin’s price action has seen an impressive growth of 137.6% over the last year, with Bitcoin moving up 56.29% YTD alone as of the time of this writing.

Why IBIT To Play Bitcoin?

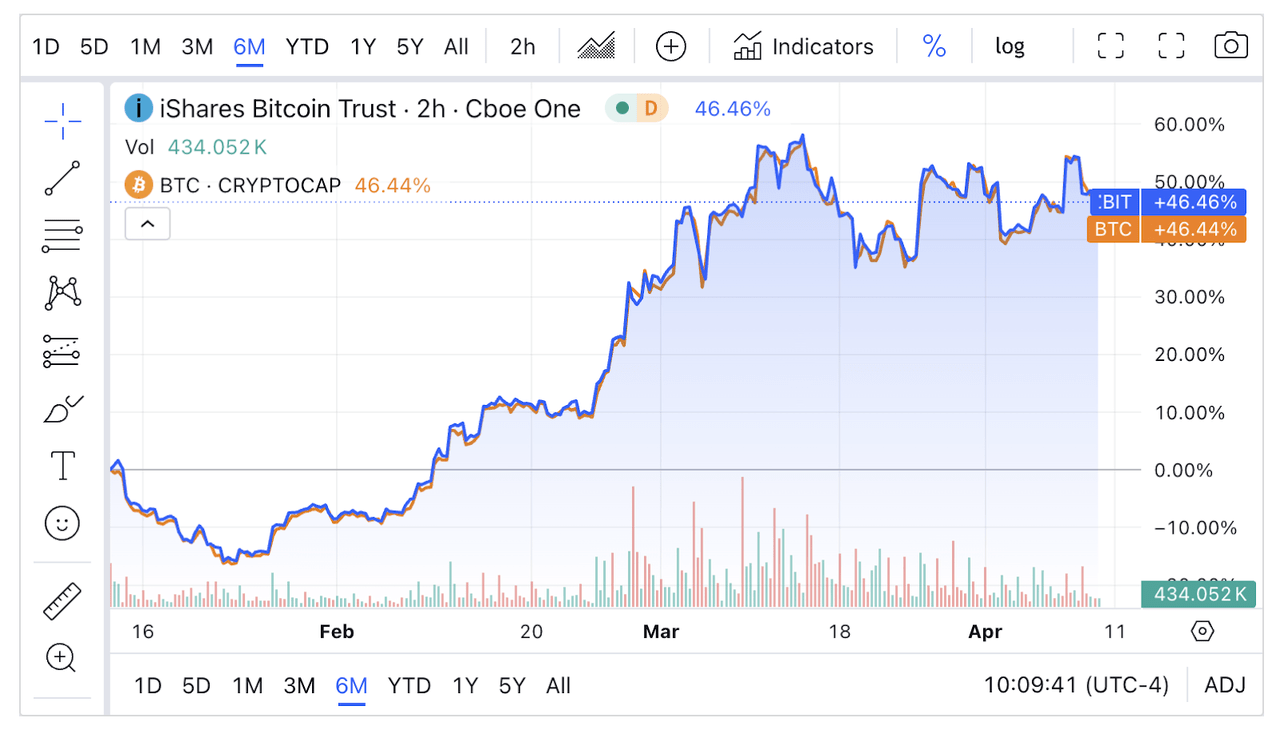

IBIT vs. BTC Trading (Seeking Alpha)

The power of IBIT is the way the ETF is designed, with the fund being over 99% allocated to Bitcoin. BlackRock (BLK), the fund’s sponsor, has set the fund up as an open-ended fund so it redeems shares from the open market for cash by selling Bitcoin and giving the cash to investors. The S1 filing notes:

The Trust issues and redeems Shares only in blocks of 40,000 or integral multiples thereof, based on the quantity of bitcoin attributable to each Share (net of accrued but unpaid remuneration due to the Sponsor (the “Sponsor’s Fee”) and any accrued but unpaid expenses or liabilities). A block of 40,000 Shares is called a “Basket.” -S1 Filing

Many ETFs follow this style so that the funds trade close to their NAV (as does IBIT; we can see this with its price performance compared to Bitcoin). While many of the BTC ETFs have this mechanism in place, I like IBIT due to Blackrock’s low fees (a sponsor fee of just 0.25%). This fee is, in fact, only 0.12% on the first $5 billion in AUM which means the blended fee is lower here.

In essence, IBIT is a great way to play the Bitcoin run-up due to its accessibility in traditional trading accounts + its close performance to Bitcoin given the fund structure (and compared to Grayscale’s Bitcoin fund (GBTC)).

How is BTC Doing Going Into The halving?

I believe the current performance of Bitcoin (BTC) as it approaches the halving event is promising. As mentioned above, Bitcoin has experienced significant rallies following pre-halving price corrections. In the past, leading up to the halvings in 2012, 2016, and 2020, Bitcoin prices experienced large drops but then turned around near or after the halving event. For example, in 2012, there was a 50.78% price drop months before the halving, followed by a massive surge. Similar patterns were observed in 2016 and 2020. Heading into this halving, Bitcoin is up 56.29% YTD as I mentioned before, suggesting a potential for a bullish market ahead. Such trends indicate that, despite a possible upcoming correction, a rally post-halving is highly likely.

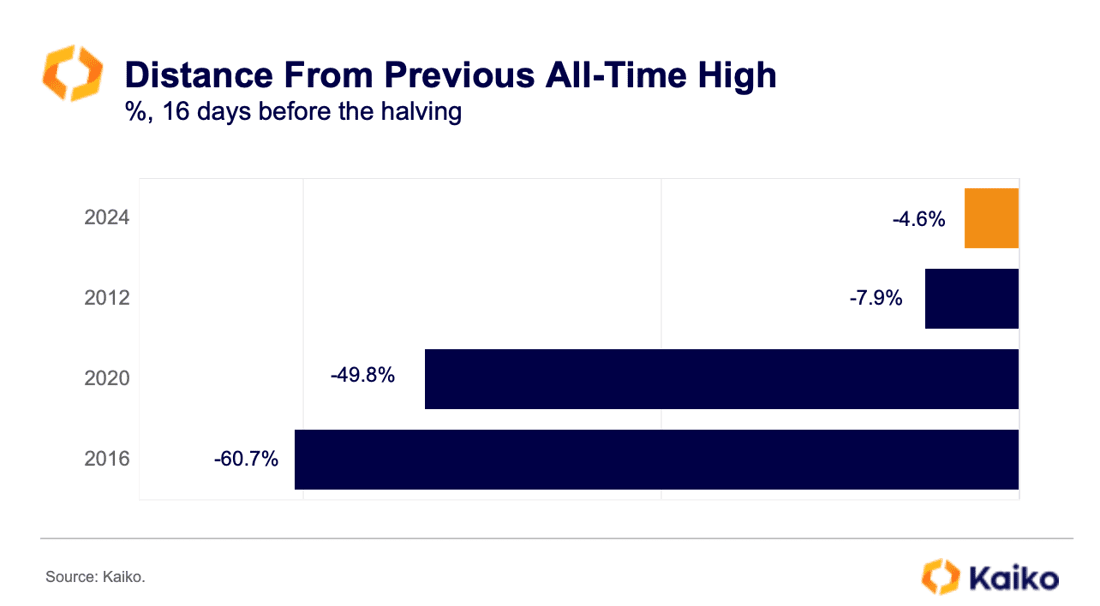

To substantiate this, I believe it’s important to look at where Bitcoin has been 16 days going into the halving. For this cycle, this is the best setup Bitcoin has seen going into the halving ever. Bitcoin, 16 days out, has always been down more (on a percentage basis from ATHs). I find this to be very bullish.

BTC Performance 16 Days To Halving (Kaiko)

Market observers have noted Bitcoin’s tendency to rally significantly in the weeks leading up to the halving.

Valuation

Considering the increase in ETF inflows and expected supply reduction, the valuation of Bitcoin (BTC) points towards promising potential for growth. Initial conservative estimates set BTC’s fair value at $74,600, based on a monthly inflow of $1 billion into Bitcoin ETFs. However, recent trends have shown inflows exceeding this, with over $1 billion weekly, meaning that these estimates might be too low. In terms of inflows, IBIT quickly became one of the top five ETFs, reaching $3.2 billion shortly after launch, alongside Fidelity’s Wise Origin Bitcoin Fund (FBTC). These inflow results demonstrate the increasing demand for Bitcoin, suggesting a bullish market sentiment, supporting a higher BTC valuation, potentially reaching as high as $148,000 per coin according to some research estimates.

Spot Bitcoin ETF Flows (The Block)

Given the increase in inflows entering the Bitcoin ETFs, thus the increasing demand, along with the predicted price increases from post-halving and limited supply, the market could see valuation increases for Bitcoin and related ETFs like IBIT. Based on these numbers, this implies a 2.15x upside in the Bitcoin ETF (assuming that BTC was trading at $68,956 when this piece was written).

Why I Think This Price Estimate Is Reasonable

In previous halving cycles, Bitcoin rose anywhere from 320.9% in the 2020 cycle 250 days later, 78.7% higher in the 2016 cycle (after 250 days), and a whopping 760.5% upside in the 2012 cycle after only 250 days. This is impressive.

In essence, if we take an average of these gains 250 days after the halving, we get an average gain of 386.7% gain in only 250 days. The gains I am arguing are possible post this halving is a 114.629% gain. While this gain is still impressive, this would be the second worst post halving gain since Bitcoin’s inception.

Risks to Thesis

The main risk that comes with investing in Bitcoin through IBIT, comes from regulatory pressures. For example, recent legal challenges have been imposed on cryptocurrency exchanges such as Coinbase. In the SEC’s lawsuit against Coinbase, the exchange was charged with operating as an unregistered securities exchange, broker, and clearing agency. A federal judge recently ruled against most of Coinbase’s motion to dismiss the lawsuit, finding that the SEC had presented a plausible case for the exchange’s operation as an unregistered entity. This ruling allows the lawsuit to proceed.

In response, Coinbase has contested the SEC’s jurisdiction, arguing that the digital assets on their platform fall outside the regulator’s purview. This defense is the perfect example of the broader industry debate over the classification of cryptocurrencies as securities and the SEC’s regulatory authority over them. Despite these challenges, some in the industry view these legal developments as potentially stabilizing over the long term, as they could lead to clearer regulations and standards for the cryptocurrency market. The reason this is a major risk to IBIT even though this ETF filed an S-1 when it went public is because Coinbase custodies the Bitcoin behind the fund, meaning that if Coinbase is forced to stop being an exchange, then custodying issues will arise.

In short, I am not concerned about this. I wrote about Coinbase last month, and I believe that the exchange has a solid defense against the SEC. On top of this, other firms, such as Bank of New York Mellon, are now custodying Bitcoin as well, meaning that worse case there are other places for Blackrock’s fund to be placed.

Takeaway

As the Bitcoin halving event approaches, I believe IBIT emerges as a compelling opportunity. The ETF’s strong market performance, combined with the historical impact of halving events on Bitcoin’s price, suggests a favorable outlook. The increase in ETF inflows, specifically into IBIT, represents the increase in demand for Bitcoin amongst investors. With increased investors dollars and demand in mind, the valuation of Bitcoin may even reach as high as $148,000 per coin by some estimates. This price increase post halving would prove to be conservative compared to other price increases post halving. Given these dynamics, IBIT represents a strong buy opportunity, with the halving event expected to result in significant upward pressure on Bitcoin’s price, despite the ongoing regulatory uncertainties.

Read the full article here