Dear readers/followers,

In this article, I’ll give you my first article on the AES Corporation (NYSE:AES). The company is a US-based utility with a potentially fairly decent upside. Like many of the utilities around the globe at this time, the company is fairly heavily weighted towards becoming a champion renewable player. The company is headquartered in Arlington, and the abbreviation AES stands for Applied Energy Services – which also was the company’s name until the year 2000, with a founding 43 years ago back in the early 80s.

The company manages revenues of over $12B and a net income of about a quarter-billion on top-line sales. Now, AES is an international player. The company sells power in 15 countries, employs over 10,000 people and is also a member of the Fortune 500.

It’s not a yield monster, or even a high yielder, unfortunately. At this time, it yields 3.77%, which is actually less than my own savings account, which doesn’t exactly make for a strong investment argument at this time.

Let’s look at what AES actually has going for it, and why you may want to include this in your conservative dividend portfolio.

AES Corporation – Plenty to like, but only at the right price

So, AES has a few downsides. One of those downsides is actually that the company, unlike other utilities I invest in, doesn’t have all that great of a credit rating. The company has BBB- which compared to the BBB+ and the A-rated companies I typically invest in makes for a bit of a pause for me.

In order for this company to really become attractive, I would then need a far higher combined upside to this business – and one of the things I want to look at when I am looking at AES is if the company actually has or can justify this.

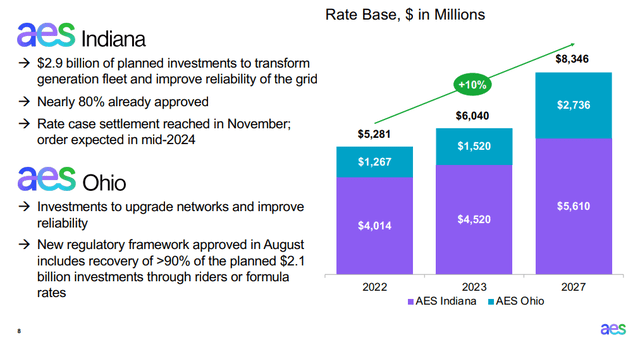

AES argues that it’s a core enabler and player in the renewable sector, with a growing 25-30 GW portfolio of solar power until 2027, and a growing expected 10% annualized base rate growth, which is among the highest in the US utility sector. So rather, as with most utilities which focus on higher income and stability, AES points to growth here. (Source: AES IR)

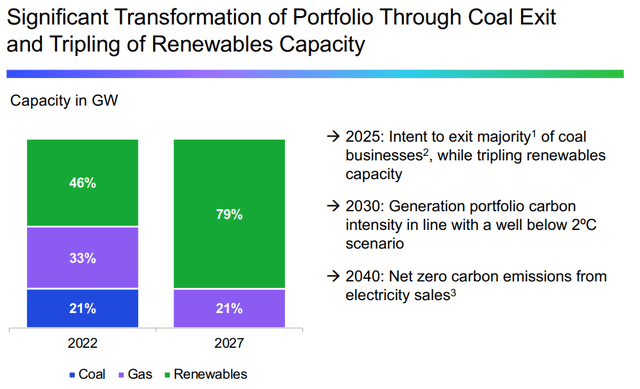

The company is also reducing its portfolio in thermal while growing the renewables pretty much exclusively. AES targets a coal exit in 2025E, less than 2 full years.

Looking at the company’s filings and material, we also find that the company has long-term USD-denominated contracts with multi-year partnerships on both the customer and the financial/supply side. The company has high confidence in the projected returns due to what is described as solid hedging of long-term financial costs and secured equipment pricing, as well as overall construction costs. (Source: AES IR)

AES is on track to bring another 3.5 GW to the market in 2023-2024, which is a doubling of the 2022 number – and it furthermore has a backlog of over 13 GW of projects with signed contracts that are not yet online, which does lend credence to the company’s claimed visibility of forward growth.

So, overall, I would say that AES does show tendencies for growth rates that are higher than the typical utility business, and it would not be surprising to see that double-digit base rate growth materialize, which would then have effects on company earnings. (Source: AES IR)

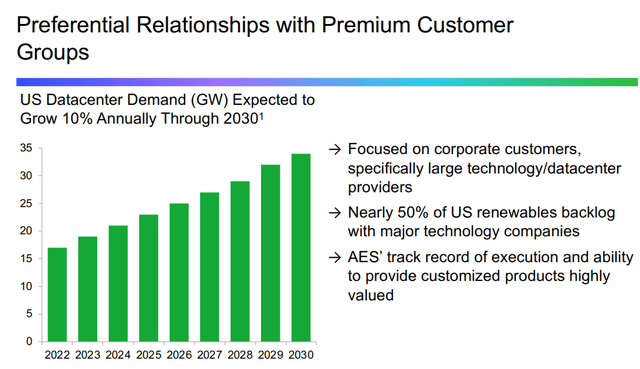

The company also has good relationships with some major customer groups.

AES IR (AES IR)

And unlike some utilities, the company’s exposure to rising interest rates is low – because all long-term debt the company has is at fixed rates. There’s also a comprehensive hedging program for refis over the next few years. The overall structure of the company’s finances means that a 100 bps movement in interest rates is less than a cent either way in 2024E, and less than 5 cents in 2025E (Source: AES IR). This is obviously a positive, and not a small one.

Also, the company’s growth rates are fairly confirmed.

AES IR (AES IR)

The company’s move from fossil fuels, in this case coal, which represented over 20% of the mix in 2022, to renewables is one of the fastest I have ever seen in this entire sector. If the company manages to do this, it will be one of the most impressive turnarounds in this sector. Almost too impressive – it leads me to ask questions about just what the “cost” of this overall move is for the company, and what risks we’re looking at – because lately, many renewable businesses, especially related to onshore/offshore wind, have not exactly been doing well.

AES IR (AES IR)

Growth through transformation – this is the company’s mantra here. I don’t consider this a “bad” target overall, and it’s completely in line with how the company has been allocating capital. The company’s parent investment capital has been almost exclusively allocated towards the renewables sector in 2023 and will continue to do so until 2027 – with around 80% expected to be in the US as well. (Source: AES IR)

The company has averaged impressive near-double-digit growth rates in adjusted EPS, FCF, and a 6% dividend growth here. So while it’s not an impressive dividend, it’s impressive growth for a company that typically does not provide growth if we look at the sector.

For the latest year, the company’s positives are plentiful. AES managed to exceed all of the strategic or financial objectives, signing over 5.5 GW of new renewables in long-term PPAs, with the completion of 3.5 GW worth of construction during the year, while meeting the EBITDA target midpoint at 2.8B+ USD for the full year. The company also exceeded its EPS target range by one cent, ending at $1.76, and just over $1B in free cash flow.

This has resulted in AES raising the bar in terms of its growth target, now to 5-7% from 3-5% – and frankly, if it only expected 3-5%, then I might as well have invested in any of the other utilities with better credit rating and better dividend yield. (Source: AES IR)

I like the company’s focus on the corporate sector. A focus on large tech companies will mean that these are likely to be even more demand-resilient than other customers. This is also part of why the company is expecting an increasing rate of return, now at 12-15% compared to 10-13% prior, due to strong project demand.

What makes AES different – at least to the company’s own estimates – is the construction execution. When they sign a PPA, the company locks in, at the time, all major equipment, EPC, and all financing. This obviously means that, unlike other players, AES has a very good project RoR visibility – something I expect other companies to adopt if they haven’t already.

Overall, the 2023 returns were solid.

What risks I would point to here are, as usual when it comes to ESG-heavy utilities, the risk that these high returns don’t turn out as well as expected. When it comes to AES, I will also clearly state that the company has higher-than-typical leverage, coming to over 70% long-term debt to capital, which is also very likely a reason why the company’s credit rating is only at BBB-. (Source: AES IR)

What impresses me is the execution and the quality of the company’s projects – as well as its customer base.

It leads me to be able to put a valuation on this business and tell you whether I would invest here or not.

Valuation for AES – It’s attractive, and the upside here is double-digit.

So, AES is a good/decent company. The two major downsides to this business are the renewable focus, where I maintain and point to sector averages and peers that there is uncertainty in the forecasts for these returns.

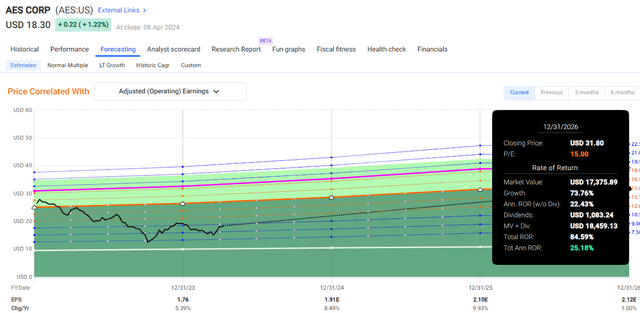

However, the current company valuation is a very attractive one. The company is trading at less than 10.5x P/E, which even on a peer average for utilities, and even with the BBB- considered is still attractive. The company typically trades around 13-14x P/E, so at a slight discount.

So that the company trades at a 10x P/E, that’s a significant discount. In this case, it’s also during a time when the company is actually growing. During the past 9 or so years, the company has averaged an average earnings growth rate of almost 8% on an annualized basis (Source: F.A.S.T Graphs/FactSet).

That means that we have a very impressive upside. Even on a 15x P/E basis, the company has a reversal potential of 25% annually for the next 3 years, which would be a market-outperforming sort of return.

AES Upside (FAST Graphs)

So, you might see why I consider this company as actually having a very significant overall upside.

In fact, even in the case of a full 20-year normalization to a P/E of 13.5x, the company has an annualized upside of 21%, which comes to over 68% TSR in 3 years if this materializes.

As such, AES is in no way a “bad” potential investment. Because this is a market-outperforming potential investment, we also need to look at what likelihood there is for this company to actually outperform. The best indicator we have there – because we do not have a crystal ball – is historical trends. And when it comes to AES, we have the company hitting its targets over 90% of the time, which as I view it qualifies for a “high accuracy” in terms of this company’s reliability.

Now, some might say that past performance is no indicator of future performance. I would want to adjust that a bit and say that “Past performance is not necessarily an indicator of future performance” – a small adjustment, but a significant one. Because I do believe, and many of the investments I invest in back this up with data, that if a company has outperformed 10/10 times, the likelihood is higher for this company to continue to do this than for a company that has failed to do so 10/10.

With that said, I view AES as a “BUY” here. I see many utilities as fundamentally attractive here, and would not necessarily over-invest in any of them, but I am continually putting money to work and this is one of the companies I will consider for investment going forward.

Thesis

- AES is a solid, investment-graded utility with a great portfolio and a very solid customer base. The company is primarily exposed to large, corporate customers with an attractive demand profile. While a somewhat sub-standard yield, the company makes up for this with an attractive growth profile.

- The company is, as I would see it, valued at least at a 15x P/E, and this 15x P/E, which is a significant discount to historical values, means that the company could generate 25% annualized upside at this time.

- Because of this, I view the company as a “BUY” with a price target of at least $25/share at this time, despite the low yield.

- I would be comfortable buying the company here.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills every single one of my criteria, making it relatively clear why I view it as a “BUY” here.

Thank you for reading.

Read the full article here