Introduction and thesis

Sabre Corporation (NASDAQ:SABR) is a leading technology provider to the global travel and tourism industry. The company offers software, data, mobile, and distribution solutions to airlines, hotels, travel agencies, and other travel providers. Sabre’s products and services help streamline operations, enhance customer experiences, and optimize revenue for its clients.

Whilst we are not overly convinced by Sabre’s historical profile, the business does have attractive qualities. It is a leading player in its industry, which should exhibit 5-10% growth in the coming years, with a moat underpinned by technological capabilities and a network effect.

Alongside the post-pandemic drive for growth, we believe Sabre can progress well in the coming years, with cost efficiencies and scale-driving margins. We do not believe Management needs to do anything above-and-beyond attaching itself to industry growth to generate value.

Our issue is that there are substantial risk associated with margin improvement and economic conditions. Management does have some margin visibility due to cost-cutting, but the impact on growth is unknown, as is how economic conditions develop and impact demand.

For these reasons, we suggest investors remain patient and closely monitor Sabre. If it appears to be on course to deliver growth of high-single-digits in FY25 and an adjusted EBITDA-M of ~15-17%, we would consider the stock heavily undervalued. If, however, this progress is delayed, Sabre’s stock becomes dead money.

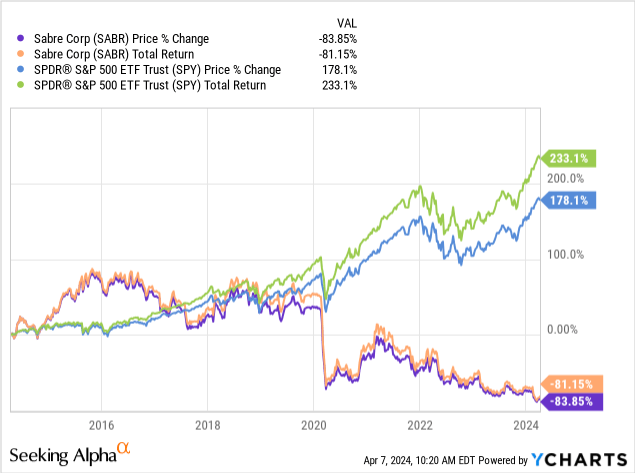

Share price

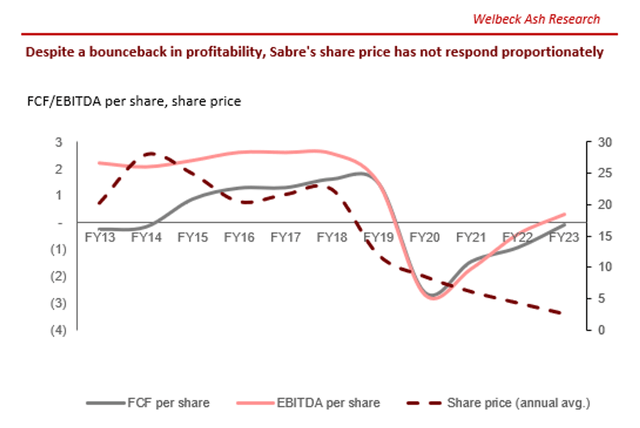

Sabre’s share price performance has been disappointing, losing over 80% of its value with a persistent decline during the last decade. The company has struggled financially, particularly during the post-pandemic period, as Covid-19 has had a lasting impact on the business.

Commercial analysis

Capital IQ

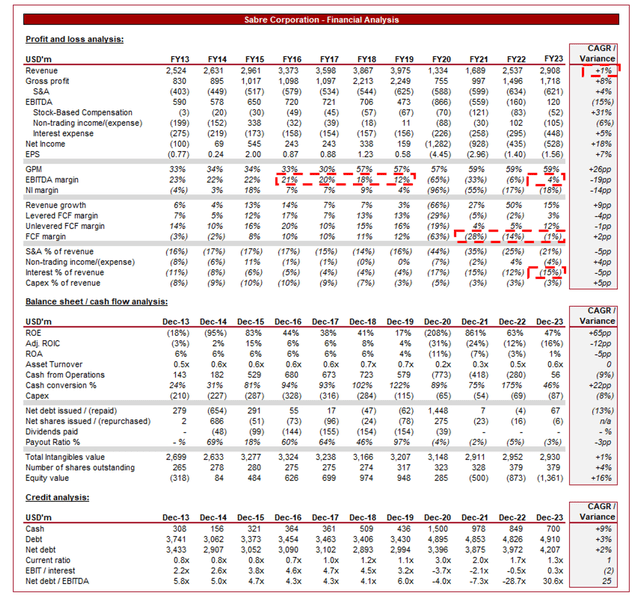

Presented above are Sabre’s financial results.

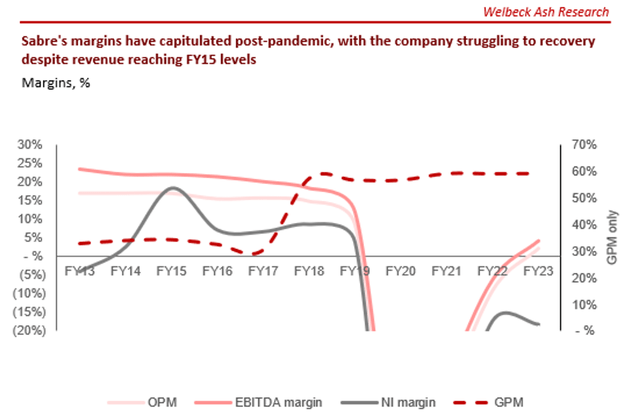

Sabre’s revenue has technically grown at a CAGR of +1% during the last decade, albeit with a linearity to time of 0.0, reflecting wild volatility. Revenue declined -66% in FY20, with its FY23 levels currently in line with FY15.

Business Model

Sabre operates one of the world’s largest global distribution systems, connecting airlines, hotels, car rental companies, and travel agencies. Through its GDS platform, Sabre facilitates the distribution of travel-related information, reservations, and transactions, serving essentially as an intermediary between travel providers and travel agents, receiving a share of bookings.

Sabre operates a travel marketplace where travel suppliers, such as airlines and hotels, can distribute their inventory to travel agencies and online travel agencies (“OTAs”). Travel/experience sellers benefit from Sabre’s offering by being able to reach a broader audience, maximizing sales. 79% of Sabre’s current revenue is considered recurring, reflecting its deep relationships with sellers.

In addition to its marketplace, Sabre offers a suite of software solutions tailored for these various travel segments. These solutions include reservation systems, revenue management tools, customer relationship management (“CRM”) software, and data analytics platforms. The company’s objective is to deeply ingrain itself within the sales generation part of the transaction lifecycle, creating the optionality to upsell clients.

Competitive Positioning

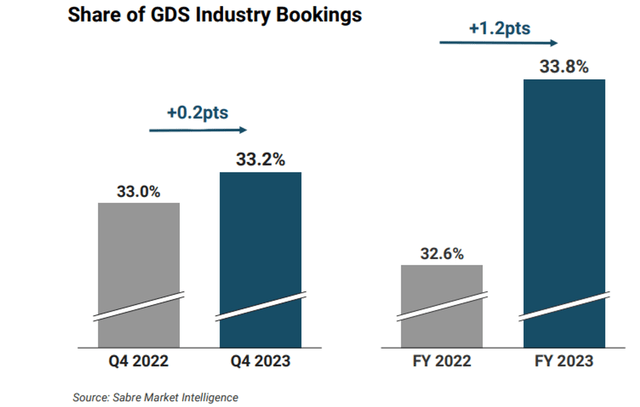

Sabre has a strong competitive position, primarily due to its high market share. The company has consistently outgrown its peers, even during a difficult decade for many in the travel industry. This market share creates a “network” effect, with a more active marketplace that encourages new entrants, and the ability to extract more value from each booking.

This market share has been built on execution and a quality software offering. The company has incrementally improved its offering and acquired smaller peers / related capabilities to ensure a continued expansion of its broader offering. Clients who are seeing period improvements and sales as expected are unlikely to churn or look elsewhere.

Strategy

The company, like so many in its industry, was materially impacted by the Covid-19 pandemic. Given Sabre has yet to recover to its pre-pandemic levels, this is clearly a key objective of Management.

Management currently highlights the following as their strategic imperatives (alongside our comments on each):

- Deliver sustainable growth – Management is seeking to achieve this through a combination of market share gains, industry growth, and further penetration in the Hospitality segment. We believe this should be broadly achievable. Travel has fundamentally bounced back, albeit to varying degrees across segments. This wave should lift all boats, and Sabre has shown an ability to generate ~37% more revenue. Further, the company has shown an ability to gain meaningful market share despite its substantial existing position. We would be more hesitant to suggest outperformance is possible once its revenue normalizes.

Sabre

-

Drive innovation and enhance value – Management is seeking to utilize AI, through its collaboration with Google (GOOG), to launch new products. Further, it is seeking to expand its distribution and retailing capabilities. We are less convinced by Sabre’s ability to execute. If we look historically, the company invested considerably in growth (~10% of cash on capex plus P&L R&D investment) and only achieved organic growth in the mid-single-digits. Now, the company is having to cut costs and capex is only 3% of revenue. We do not see enough market to capture with this without materially moving out of its core area of expertise.

-

Reduce cost base and reposition resources to growth – Management sees annual savings of ~$200m as possible (~7% of revenue). Whilst we do believe this should be deliverable, there is a fine line between cutting costs through technological advancements and efficiency (which is partially what is being done through technology upgrades), and cutting costs that impact the top-line. We fear Management could be scared of its slow post-pandemic margin recovery and thus focus too heavily on sweeping cuts.

Capital IQ

- Generate FCF and de-lever its balance sheet – If points 1-3 can be delivered without downside (i.e. margin improvement while not impacting growth, and innovation contributing to market share growth and a widening TAM), Sabre will naturally see FCF gains which it can use to deleverage. The issue is that it seems unlikely they can do 1-3 without downside or issues. A factor not yet discussed is its restrictive debt balance, which will limit 2 and draw away the potential for shareholder returns.

Overall, we believe Sabre’s strategy is the correct one, but we have strong reservations as to if they can be achieved. We believe Management should focus wholly on returning to its pre-pandemic size, namely driving growth. This will deliver margin improvement through the leveraging of its tech stack. The fear with cost-cutting is that Sabre will normalize as a smaller business and lose its scale economies relative to FY19.

Travel Industry

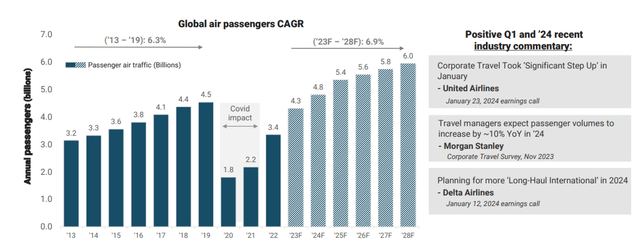

The Travel and tourism industry is forecast to grow at a CAGR of 5.8% into 2032, driven by a combination of economic development, population growth, and the lasting bounce back from the pandemic.

A key component of this for Sabre is air travel, which is expected to experience solid growth in passenger numbers, with a CAGR of +6.9%.

With the scope for further market share growth, but underpinned by a market-leading position, Sabre appears well primed to capture this growth. Beyond innovation and new products, a razor-focus on its core offering and ensuring protection against any disruptive innovation, we see the potential for respectable growth that Management should not lose sight of.

Sabre

Taking a quick step back, it is worth contextualizing how Sabre got to where it is now, which can almost entirely be explained by industry factors.

The travel distribution industry, particularly the GDS segment, has become increasingly competitive and saturated over the years. This has followed the travel industry as a whole, which has moved from being a luxury and an “experience”, to a utility. Prices have declined considerably with supply, and considers have become increasingly price conscious. This has negatively impacted many of the participants within the industry, particularly airlines.

Further, the rise of online travel agencies and direct booking platforms has shifted the distribution landscape away from traditional GDS systems. Many airlines and hotels now prioritize direct distribution channels to reduce distribution costs. Consumers can now easily book flights through comparison websites and any other product (such as accommodation) separately, knowing they will have a cheaper overall package. The key is the growth in transparency and increased power to consumers.

Whilst all this was restricting Sabre’s growth potential, then came the global COVID-19 pandemic, which significantly disrupted the travel industry due to widespread travel restrictions. Nevertheless, we would not have expected the company to struggle to this degree with returning to its pre-pandemic levels, albeit it likely shows how much disruption was caused. Many see the airlines and hotels profiting heavily from inflation as evidence of a complete bounce back.

Sabre faces competition from other global distribution system [GDS] providers such as Amadeus (OTCPK:AMADF) and Travelport, as well as from emerging online travel agencies and technology startups.

Financials

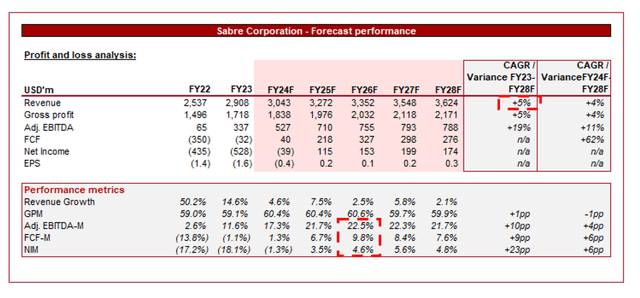

Sabre’s revenue growth has been strong, reflecting its continued ramp-up during the post-pandemic period, with top-line growth of +27.0%, +12.2%, +11.6%, and +8.9% in its last four quarters. Alongside this, margins have improved, with FCF positivity on an adjusted basis in FY23 (excl. restructuring and other one-off costs).

As touched on, the majority of this growth is purely through volume. The company has seen total bookings up +18 YoY in FY23, while the average booking fee grew +8%. With inflation subsiding and economic growth becoming increasingly precarious, we will likely see booking growth soften. Importantly, the volume trajectory is sufficient that any slowdown should be clear.

Looking ahead, we conservatively suggest growth will fall into the single-digits, in part due to Q4 and also due to the macro-environment. This should not be overly concerning for Sabre, so long as it can continue to gain market share. This said, it is clear now that a return to pre-pandemic levels will not be a realistic target in the near-term.

Margin visibility is far less clear. Management believes an adjusted EBITDA of ~$500m can be delivered, which implies an EBITDA-M north of 15%. ~$250m from cost efficiencies, which Management should have visibility of, and a further $215m from growth. Whilst we do believe this can be delivered, there is considerable uncertainty.

Our views are broadly aligned with analyst estimates, which see growth of +5% and margin improvement from FY25F.

Capital IQ

Balance sheet & Cash Flows

Sabre is heavily indebted, with interest payments currently comprising 15% of revenue. This will restrict its ability to reinvest in growth while sucking cash. The company is not expected to generate meaningful cash in FY25, which means this balance will not be brought down to a manageable level for a number of years.

Industry analysis

Seeking Alpha

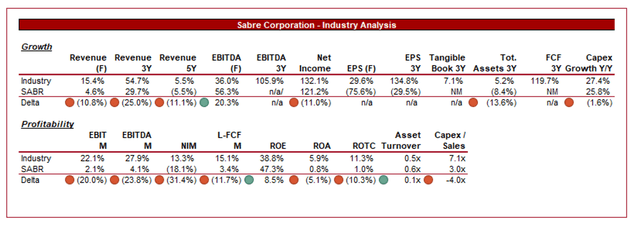

Presented above is a comparison of Sabre’s growth and profitability to the average of its industry, as defined by Seeking Alpha (28 companies).

We will not spend too long on this section. Sabre’s performance relative to its peers is woeful. The company has considerably lower margins and growth, which reflects its slower bounce back following the impact of the pandemic.

Valuation

Capital IQ

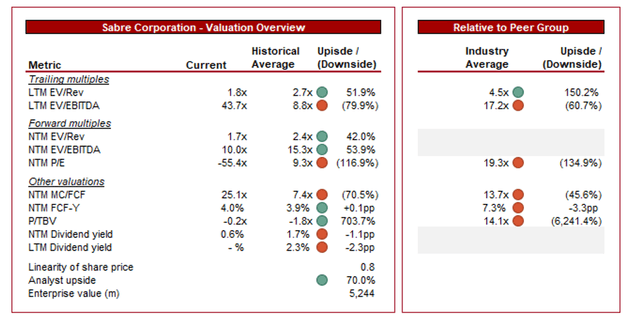

Sabre is currently trading at 44x LTM EBITDA and 10x NTM EBITDA.

Given the considerable disruption to Sabre’s financial performance, any LTM metric is not too useful in our view. This said, there is also uncertainty associated with its NTM metrics due to the ability to realize margin improvement.

We believe the least risky metric to assess is its NTM FCF margin, as analysts are only expecting a margin of ~1.3%, which is not too unreasonable, particularly as rates fall. At this level, we believe Sabre is likely very undervalued.

FCF margin can likely push toward ~10% without material upside factors playing out. This can potentially generate over $1bn across a 5-year period, against a market cap of ~$1b. The reason this does not immediately scream buy is that these cash flows must be utilized to de-leverage, and debt exceeds $4.5b.

Capital IQ

Key risks with our thesis

The key risk to our “wait and see” thesis is that the “see” contributes to rapid share price action. Sabre’s biggest uncertainty, we feel, is its ability to lift margins and where they will normalize. How and when this occurs will drive the value for shareholders.

Final thoughts

Sabre has been considerably disrupted during the last decade, contributing to a collapse in its share price. Whilst the company is clearly now on an upward trajectory, it is facing considerable risks associated with wholly delivering a return to its pre-pandemic levels, coinciding with economic disruption.

We do believe Sabre is significantly undervalued but believe investors should be patient, at least for a single quarter. Greater visibility on margin improvement and how growth is developing will be incredibly important to assessing how quickly its value can be realized. For this reason, we rate Sabre a hold.

Read the full article here