Written by Nick Ackerman, co-produced by Stanford Chemist.

Special Opportunities Fund (NYSE:SPE) is off to a strong start for 2024 after coming off of a solid 2023 performance. This closed-end fund invests in a rather diversified portfolio, carrying exposure to a number of different investment structures and assets. That even includes other closed-end funds and business development company investments. The fund is run by Bulldog Investors, an activist group – though not nearly as active as Saba Capital. They took over this fund in 2009 as it was formerly the Insured Municipal Income Fund.

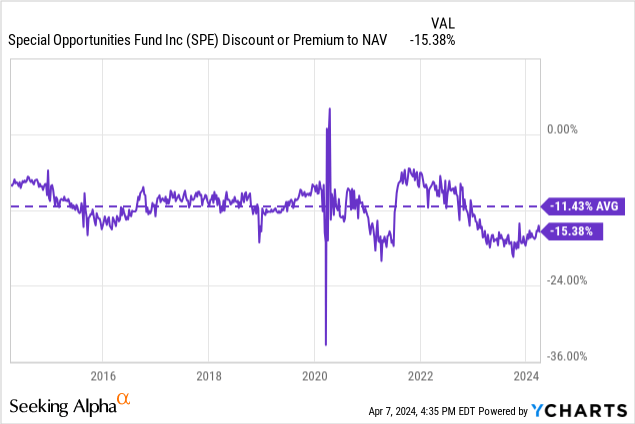

As was the case in our last update, SPE is actually trading at an incredibly wide discount to its net asset value – a discount wide enough that an activist group should ironically probably be attacking this fund for liquidation or increasing its distribution.

With that being said, the fund’s discount has narrowed a touch since our last update. While there is unlikely to be any specific catalyst on the horizon to see that discount close, I believe the fund is still a worthwhile investment. To be fair as well, in 2022, they did have a tender offer to repurchase shares as well. The fund’s discount, as well as providing a managed distribution policy that makes it predictable, are appealing characteristics of this fund currently.

Special Opportunities Fund

- 1-Year Z-score: 1.40

- Discount: -15.59% (based on 4/05/2024 reported NAV)

- Distribution Yield: 9.17%

- Expense Ratio: 1.95%

- Leverage: 25.93%

- Managed Assets: $217.4 million

- Structure: Perpetual

SPE:

employs an opportunistic investment philosophy with a particular emphasis on investing in discounted closed-end funds, undervalued operating companies, and other attractive special situations including risk arbitrage and distressed securities.”

The fund utilizes leverage through a publicly traded preferred offering, the Special Opportunities Fund 2.75% Convertible Preferred C (SPE.PR.C). This provides the fund with an incredibly low cost of leverage and, even better, a fixed-rate form of leverage. For that reason, they haven’t seen their interest expenses explode higher like many other leveraged CEFs.

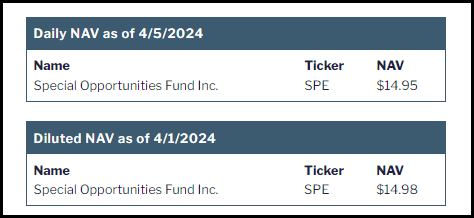

That said, it is a convertible offering, so it will be dilutive to the NAV upon conversion. The fund reports a weekly NAV, but that’s still frequent enough to give us a good idea of where NAV stands. They also provide the diluted NAV as well.

SPE NAV (Bulldog Investors)

Performance – Decent Results, Attractive Discount

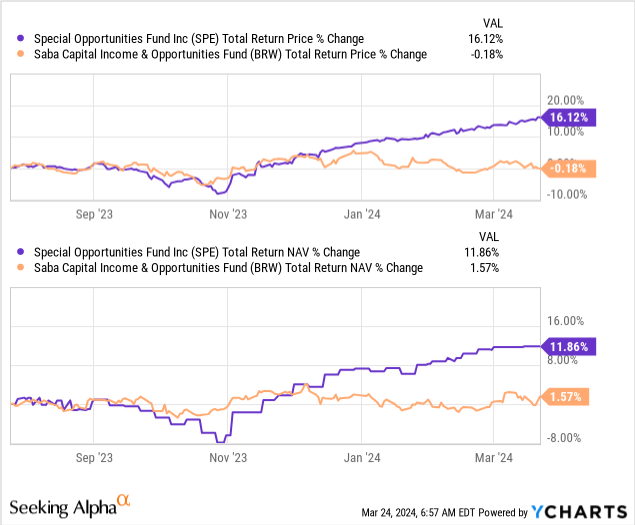

During our previous update, we also touched on the Saba Capital Income & Opportunities Fund (BRW). This is one of the now two publicly traded Saba Capital CEFs available to investors.

Since then, SPE has been able to outperform significantly during this period. Though each fund performed similarly for a while, 2024 has been much more kind to SPE’s underlying portfolio.

YCharts

One of the main factors at play here appears to be that BRW is shorting a wide basket of different investments. As the broader equity market continues to head higher, that’s negating the upside potential that BRW could otherwise have. This is an example where hedging can seem to make sense with a market that appears quite stretched. However, hedging always comes with a cost, and that cost is a drag when it isn’t paying off.

Should the markets reverse, these hedges could start to work, and BRW could start performing better on a relative basis than SPE. We saw a hint of that last fall in the October market correction where BRW flatlined through, but SPE was dropping on a total NAV return basis.

SPE remains trading at an attractive discount level relative to its longer-term history – even if we saw a deeper discount through most of the last year. The current discount levels are near where they were trending after the Covid pandemic.

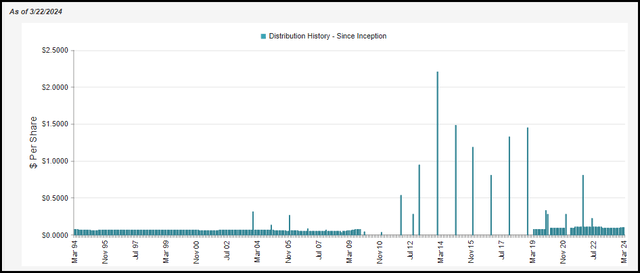

Distribution – Managed 8%, Monthly Pay

SPE has a fairly rocky history in terms of its distribution policy. Of course, when it was a muni CEF, it paid a monthly distribution, which was pretty regular. However, when Bulldog initially took over, they went to an annual distribution policy. I’d feel comfortable in saying that most CEF investors don’t enjoy annual distribution policies. So, switching back to a monthly distribution policy was a positive event, in my opinion.

SPE Distribution History (CEFConnect)

They now have an 8% managed distribution policy based on the NAV that resets annually. Last year, thanks to the strong results the fund provided, we saw a distribution increase. In fact, if the reset was based on today’s NAV, we’d see another bump. Of course, we still have 3 quarters left of this year, and a lot can happen during that time.

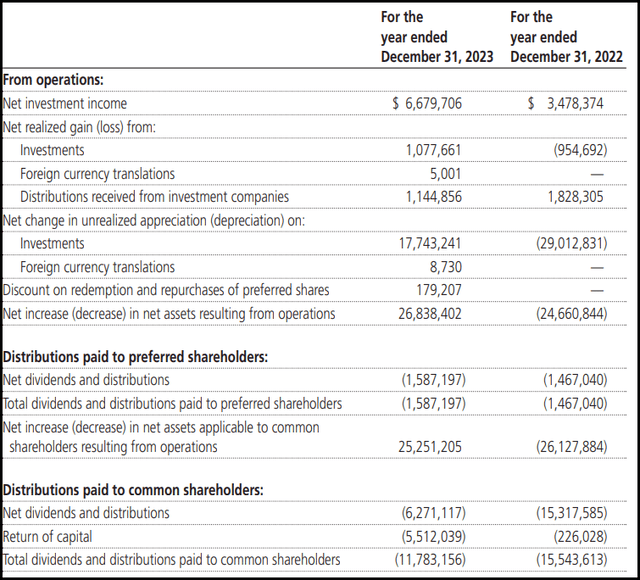

The fund was able to see a significant increase in net investment income year-over-year.

SPE Annual Report (Bulldog Investors)

One of the reasons for this is that the fund holds a meaningful weight for special-purpose acquisition companies. They have some capital invested in money-market funds as well. Essentially, until a SPAC finds a merger opportunity, they are like a money-market themselves. They are invested in cash, cash equivalents or short-term risk-free Treasuries.

When the Fed was raising rates aggressively, these cash positions started paying much more. Basically, going from near-zero returns on cash to now 5%+. Therefore, the total investment income for SPE rose materially, which translates into higher NII.

On the other hand, the fund will still require capital gains to fund its ~8% targeted managed distribution. That isn’t that surprising, given that the fund is still invested meaningfully in equities.

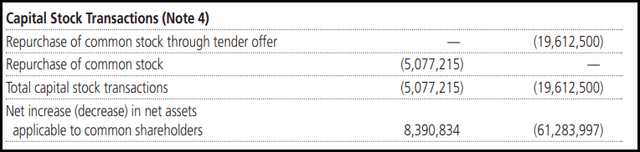

In an effort to reduce the fund’s discount, the fund has repurchased some shares. Even further, in 2022, they did conduct a tender offer. Tender offers are generally only a short-term tool for reducing a fund’s discount. Post-offer, the fund usually slumps back to a wide discount.

SPE Capital Stock Transactions (Bulldog Investors)

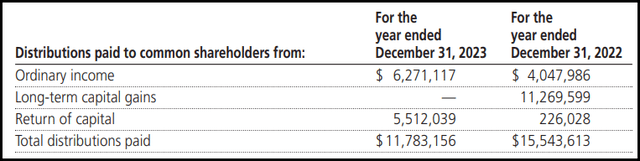

For tax purposes, the distributions have been quite mixed in terms of characterization. There was a significant change from 2022 to 2023, which is one of the reasons why CEFs can be quite difficult when it comes to tax planning. Return of capital distributions can be beneficial for deferring tax obligations, while long-term capital gains can be helpful in being more relatively tax-friendly compared to ordinary income.

SPE Distribution Tax Character (Bulldog Investors)

SPE’s Portfolio

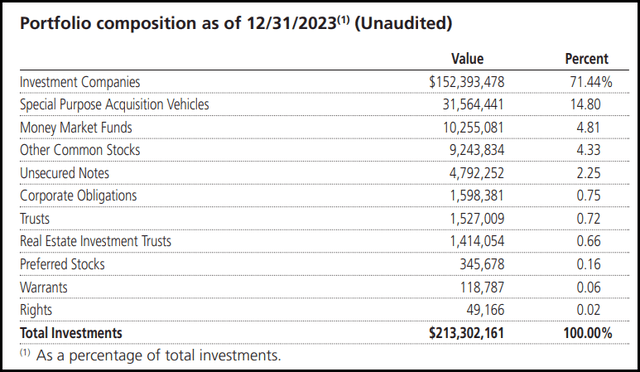

As mentioned, SPE’s portfolio is quite mixed. The largest allocations are to other investment companies, and that includes CEFs and BDCS. That means there are fees on fees but also the potential for discounts on discounts.

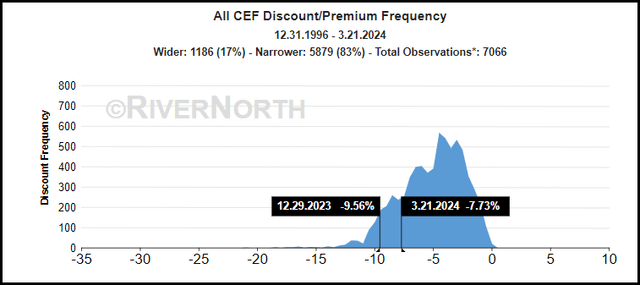

In general, CEF discounts are still at historically attractive levels, more broadly speaking.

CEF Premium/Discount History (RiverNorth)

However, they narrowed some of the widest discount levels that we saw last year. In 2023, we saw historically wide discount levels.

SPE Investment Composition (Bulldog Investors)

Just like SPE’s own portfolio is quite mixed, the underlying CEFs also invest in a broad mixture of assets as well. Looking at the largest holdings for the fund, the last report had SRH Total Return Fund (STEW), General American Investors (GAM) and Texas Pacific Land Corp. (TPL) as the largest three holdings. Interestingly, these were actually the largest holdings at the end of 2022 as well.

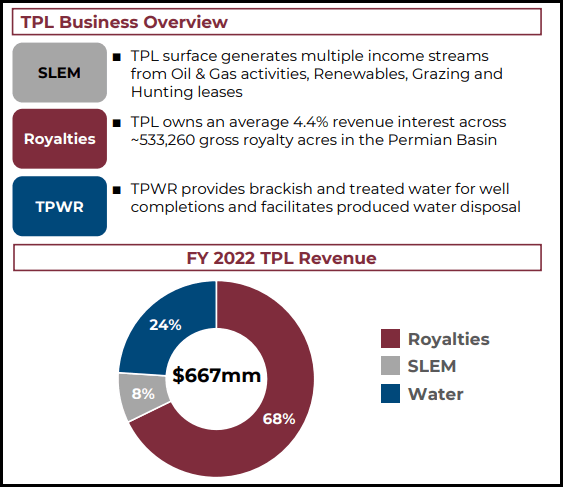

Those who are familiar with CEFs probably noticed that STEW and GAM are other CEFs, but we also have TPL as a large holding. This is quite an interesting holding as it is an energy company, but they don’t appear to operate like any normal energy company. Instead, the largest revenue source for the company is royalties, with another meaningful source coming from their water business supporting the energy industry.

TPL Business (TPL)

On a side note, the company recently announced a stock split of 3-for-1. That became effective as of March 27, 2024. That doesn’t make any fundamental difference for the company, but it’s generally still viewed as a positive event, at least psychologically.

Conclusion

SPE provides investors exposure to a broad basket of investments thanks to its broad type of holdings. The CEFs and BDCs, in particular, are the largest allocations of this fund, but they tend to be incredibly diversified as well. CEFs and BDCs present more fees on top of SPE’s already fairly high expense ratio, though some of the opportunities to negate that also come from the discount on the discount that we get exposure to. Further, the fund has been performing quite well, and that’s reflected in the increased distribution we saw this year. The fund has continued to perform well into the start of 2024 as well.

Read the full article here