Introduction and thesis

ThredUP (NASDAQ:TDUP) is a leading online thrift store and fashion resale platform founded in 2009. It operates in the secondhand fashion market, allowing consumers to buy and sell high-quality, gently used clothing, shoes, and accessories.

TDUP has managed to achieve strong growth and brand development through innovation in the apparel industry, utilizing technology and changes in shopping behaviors to drive traffic to its offering. Whilst this has propelled the company’s revenue trajectory, its bottom line financial development has been disappointing.

TDUP is not an attractive business for long-term returns in our view. The industry has far too many market participants and will likely normalize with a handful of monopolistic players, similarly to the broader marketplace industry (think eBay). Although we think TDUP is positioned well, there are external factors such as the ability to maintain marketing spending that we do not wish to gamble with. We do not see sufficient reward for investors to bet on TDUP being the “last man standing”.

With cash declining, macroeconomic conditions weighing heavily, and margins showing limited improvement, we suggest investors steer clear.

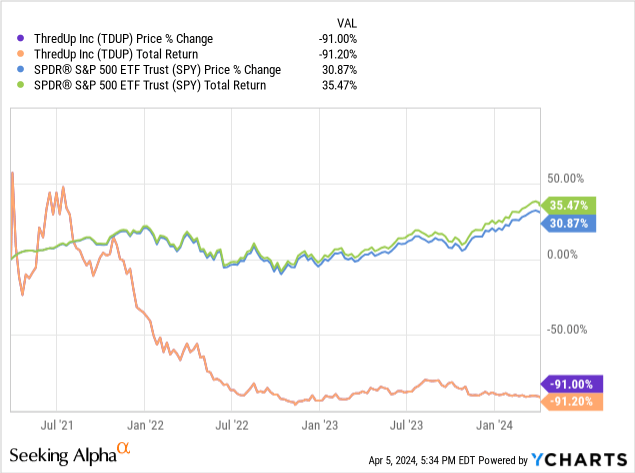

Share price

TDUP’s share price performance has been disappointing, losing over 80% of its value in a short period of time. This is a reflection of the wider market sell-off, particularly in discretionary industries, as well as poor financial development.

Financial analysis

Capital IQ

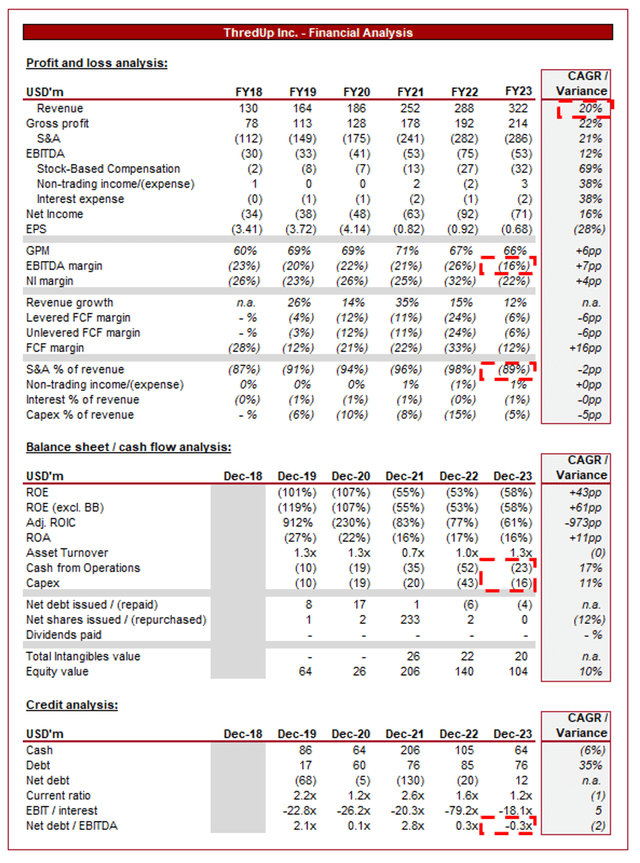

Presented above are TDUP’s financial results.

Revenue & Commercial Factors

TDUP’s revenue has grown well during the last decade, with a CAGR of 20% into FY23. Despite this, profitability has not developed as positively.

Business Model

ThredUp

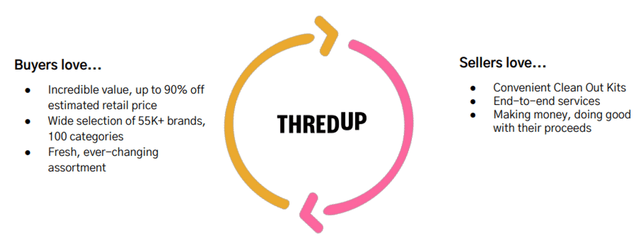

TDUP operates as an online thrift store and resale marketplace, focusing on the buying and selling of secondhand clothing and accessories. This model aligns with sustainability trends, catering to consumers looking for eco-friendly and affordable fashion choices.

TDUP utilizes data analysis to curate its selection of secondhand items, ensuring a level of quality and style with dynamic pricing. This curation process partially involves a quality control team that evaluates and selects items based on brand, condition, and current fashion trends.

TDUP’s inventory is largely user-generated, as individuals can sell their gently used clothing and accessories on the platform. This is a highly important component of the industry as success requires the creation of the network effect. Consumers want to shop where there is vast choice, while sellers want a marketplace where sales will occur at an attractive price / time. We believe this will be the defining differentiation factor in the coming years, as none of its peers (in the fashion space) have reached a monopolistic position yet. One of the reasons for this is the inherent environment currently, with many participants.

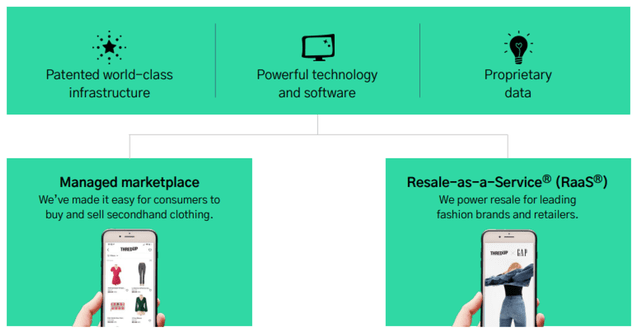

The company is expanding into the concept it has coined “Resale-as-a-Service”, essentially allowing fashion brands and retailers to create a resale marketplace and source stock from customers. The company already boasts clients such as H&M (OTCPK:HNNMY), Tommy Hilfiger (PVH), and J.Crew.

ThredUp

TDUP simplifies the selling process for individuals by providing Clean Out Kits. Sellers can fill these kits with their unwanted clothing, and TDUP takes care of the rest, including photographing, listing, and shipping the items. This again is a small factor that helps the company differentiate itself from its peers, reducing friction, which is key in a growth industry.

We like the company’s efforts to maximize its monetization and find new avenues for growth. The business discontinued a “Goody bags” offering a few years ago, which although failed, is the innovation required to succeed.

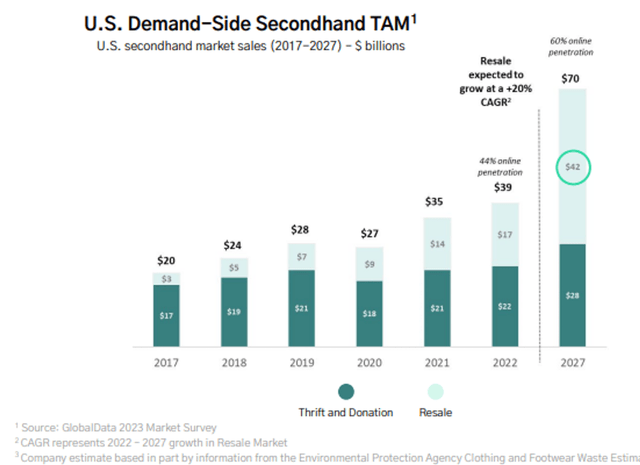

TDUP positions itself as a champion of sustainable fashion by promoting the reuse of clothing. The company emphasizes the environmental benefits of buying secondhand and contributes to the reduction of fashion waste. This is an important selling point alongside the widening wealth gap, both contributing to sustained growth in the second-hand market.

ThredUp

Financials

TDUP’s recent performance has slowed, with top-line revenue growth of (2.1)%, +4.4%, +8.2%, and +20.8% in its last four quarters. In conjunction with this, margins have improved.

The slowdown experienced is a reflection of the wider macroeconomic environment in our view. With elevated inflation and interest rates, consumers are experiencing soaring living costs as wages struggle to track proportionately. This has contributed to softening spending for many as they seek to protect their finances.

Unlike many in its segment, however (such as The RealReal (REAL)), TDUP has managed to keep growth broadly positive. This is a reflection of the products it sells and the segment it targets. As the company services both consignments of higher-end goods and thrift, it is positioned well for segments that are resilient. Despite the difficult macro conditions, consumers are arguably encouraged to thrift as they seek a discount.

Capital IQ

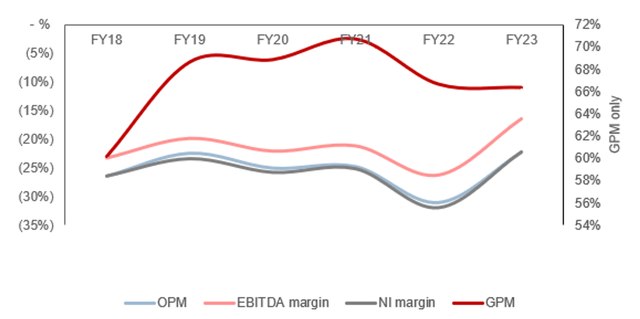

TDUP’s margin development has been non-existent, with EBITDA-M improving by only ~7% while revenue has almost tripled. The reason for this is difficult market dynamics.

Despite its growing scale, GPM has essentially remained flat post-FY19, suggesting the business is operating close to its peak unit economics. Any further improvement can only come from rejigging its pricing structure, which comes with the potential for unintended consequences.

With a GPM of ~66%, the business should have no issue with being profitable, and yet this is not the case. Due to the heavy level of competition and the growing nature of the segment, businesses need to spend significantly on marketing. TDUP is currently spending an enormous 90% of revenue on S&A spending and in spite of this, revenue is still slowing. The problem we see is that the development of a moat is incredibly difficult. Differentiation will come from the creation of the network effect, essentially having a large number of buyers and sellers, making it an attractive marketplace to attend.

Realistically, we struggle to see how TDUP can transition to profitability. With GPM fairly rigid, significant improvement can only be delivered on an operating level, which we struggle to see without completely derailing growth and losing market share.

TDUP is currently burning through cash, with an FCF margin of 15% in the LTM period. This is a reflection of its heavy investment to grow the company, with the recent decline only due to softening capex spending. The underlying issue of profitability will continue to keep FCF negative.

With ~$(48)m spent in the LTM period and a cash balance of $74m, TDUP will need to raise debt or equity in the near future to remain afloat. Given the inability to approach EBITDA parity, it is likely shareholders will need to fund this.

Capital IQ

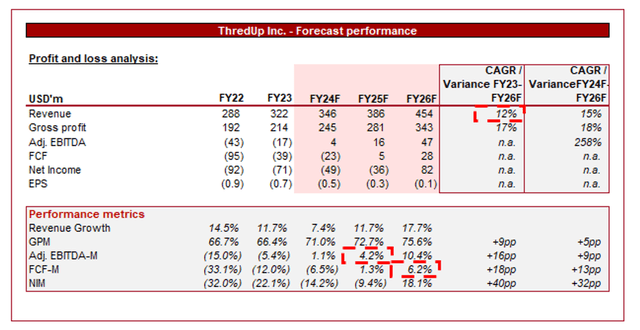

Presented above is Wall Street’s consensus view on the coming years.

Analysts are forecasting a continuation of growth, with a CAGR of 12% into FY25F. In conjunction with this, margins are expected to sequentially improve, reaching adj. EBITDA positivity in FY24F and FCF positivity in FY25F.

Rarely do we flat out disagree with analysts but we are currently strongly skeptical. In order to drive margin improvement, growth spending must essentially cease, which will inevitably contribute to a revenue slowdown. It is difficult to see how the company can maintain close to double digits.

Further, it is difficult to see how margins can step down so rapidly given the limited improvement historically, particularly as its EBITDA-M in its most recent quarter was (12.2)%.

Valuation

Capital IQ

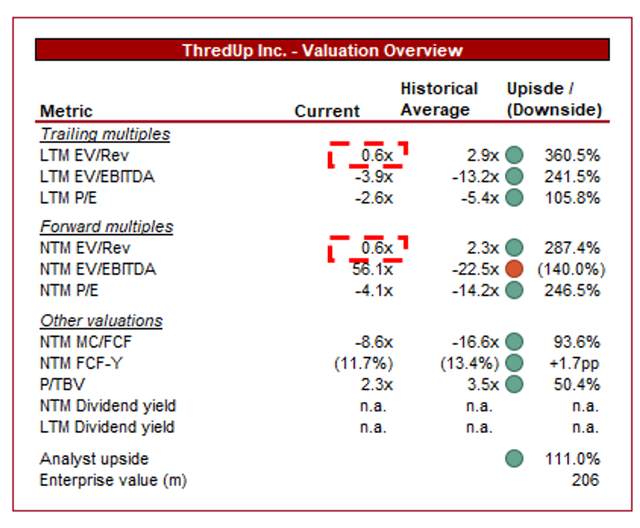

TDUP is currently trading at 0.7x LTM Revenue and 0.6x NTM Revenue. This is a discount to its historical average.

A discount to its historical average is undeniably warranted, owing to the limited margin improvement and softening growth trajectory.

Given the material uncertainty associated with TDUP achieving profitability, we believe it must trade at <1x revenue, which is the case currently. We expect growth of ~MSD if costs are cut rapidly, with ~HSD if costs are laddered down more gradually, suggesting this multiple will see a fairly quick contraction. For this reason, despite the negative view of the company, we are not of the view that it is overvalued.

Key risks with our thesis

The risks to our current thesis are:

- [Upside] A takeover.

- [Upside] Growing interest in sustainable and affordable fashion.

- [Upside] Expansion into new markets and strategic partnerships.

- [Downside] Counterfeit scandal.

- [Downside] Intense competition not subsiding.

Final thoughts

TDUP has a lot of potential. Management seems to be more switched on than other teams we have looked at within this industry, while the stock trades at a bigger discount. The industry is highly competitive and we expect many of its peers (potentially TDUP) to fall away in the coming decade as the segment moves toward scale and consolidation.

We see no reason to take a risk on the company, however, with mountains of losses ahead alongside slowing growth and minimal margin improvement.

Read the full article here