Early January this year, I wrote a bullish article on Blue Owl Capital (NYSE:OWL) establishing a clear buy rating considering the underlying focus on private credit space, which exhibits secular tailwinds.

Another driver behind the bull thesis here was the relatively attractive dividend of ~ 4% that in conjunction with resilient and growing asset base contributed to a truly enticing buy.

Since the publication of my article, some things have changed.

On the one hand, OWL has issued full year 2023 figures and sent several positive signals pertaining to its growth prospects.

On the other hand, the stock has experienced a notable multiple expansion, thereby bringing down the dividend yield and potentially making a less attractive entry point for investors, who want to go long OWL.

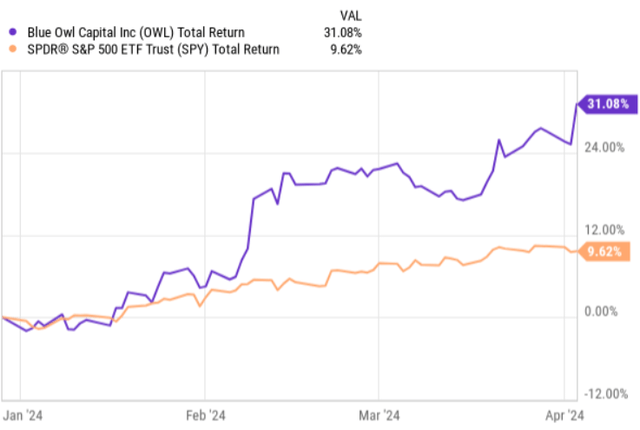

If we look at the chart below, we can see how OWL really went ballistics outperforming the S&P 500 by a huge margin on a YTD basis.

Ycharts

As a result of this, the dividend yield has dropped by more than 100 basis points and on a forward basis, factoring in the fact of ~ 29% dividend increase from 2022 level, the yield now lands at 3.03%.

Seeking Alpha

Let’s now dissect the recent earnings package to understand what the key drivers were behind this huge spike in the stock price, and, more importantly, whether OWL still remains an attractive investment play on a go forward basis.

Thesis review

In a nutshell, the market’s reaction to OWL’s Q4, 2023 earnings package and the repricing of the share price have been fully in line with the solid dynamics in the underlying result.

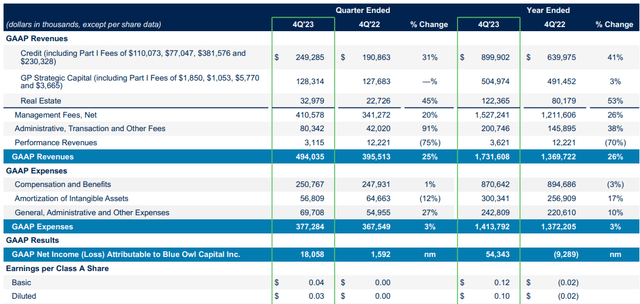

Year 2023 including the Q4 data have brought improved results across the board. OWL has successfully managed to grow the asset base in all of its three main segments: credit, GP strategic capital and real estate segments. For asset management businesses like OWL having a larger pool of capital in the portfolio increases the base from which the management and administrative fees could be charged to the clients.

As indicated in the table below, net management fee component (which is the key driver of OWL’s cash flows) has continued to tick higher in Q4, 2023, while the total expenses have more or less remained flat. This dynamics perfectly captures the beautify of OWL’s business, where there are significant economies of scale benefits as incremental flows into AuM per definition do not require much higher cost base, allowing the top-line (or management fees) to freely feed into the bottom line.

Blue Owl Earnings Deck 12.31.23

One of the major reasons why OWL has been so successful is the favorable momentum in the private credit space in combination with OWL’s bias towards this particular segment. In 2023, the credit portfolio accounted for ~ 60% of the GAAP revenues (and even higher share if we account for the exposures within the GP Strategic Capital segment).

Blue Owl has been one of the top fundraisers in both the non-traded BDC and rechannels with the gross flows of more than $1.9 billion during the fourth quarter (up by 65% relative to Q1, 2023). These inflows have been roughly six times greater than redemption requests. This could be deemed as a very positive sign considering that Q1, 2023 was already based on tough comparison and also taking into the account that the BDC space really exhibited a boom during H1, 2023, when bank financing was more constrained than it is now.

In terms of the real estate segment, OWL has played it nicely as well by carrying an exposure to real estate sectors that have not gone out of vogue. Namely, most of the exposure here lies in the real estate funds that are subject to on-shoring and e-commerce movements (i.e., industrial and manufacturing properties). Plus, OWL puts an emphasis on triple net lease strategy, where the credit has to be at investment-grade secured level, thus avoiding further the potential problems that currently sit in the overall real estate space (e.g., struggling office stock, capital outflows from low quality REITs that do not have access to sound financing etc.).

It is also worth highlighting Marc Lipschultz – Co-Chief Executive Officer – commentary in the most recent earnings call that reveals some further positives pertaining to the momentum in the real estate segment:

And so we have, right, at this point, our overall backlogs are really running at record highs in terms of all the things in our pipeline, over $10 billion. So we have plenty to focus on. And of course, also as we continue to extend that reach into Europe.

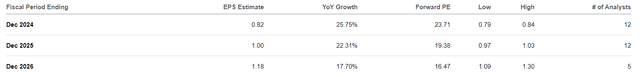

With all of this being said, the question still remains whether the magnitude of Blue OWL’s growth prospects justifies the current valuations. It is obvious that the prevailing multiples have landed in a relatively stretched territory and are significantly above the sector average.

Yet, we have to contextualize this with the future growth.

According to the consensus estimate, the 3-year earnings outlook looks quite strong with close to 20% in 2024-2026 period.

Seeking Alpha

Given OWL’s pipeline in real estate and private credit segments, delivering such figures seems not that impossible. Another nuance that has to be factored in is the benefits of scale, where really each incremental capital that OWL attracts generates higher net cash flows due to largely fixed cost base.

The challenge, however, could stem from the three following aspects:

- The ability to sustain above average management fees as the competition in private credit and growing real estate segments tightens.

- OWL’s success in successfully attracting large scale capital flows that with each quarter have to be larger to move the needle in terms of the EPS generation.

- Potential slow-down in booming private credit space once the capital markets come back into play and the interest rates start to normalize. During times of constrained capital markets activity and high SOFR, which accommodates higher yields for private credit loans that are usually based on variable rate component create very favorable environment for capturing solid returns.

The bottom line

In my opinion, the market’s reaction to OWL’s Q4, 2023 earning package by sending the stock price 30% higher on a YTD basis was largely justified. While the current dividend yield has dropped by ~ 100 basis points and the multiples have increased, the growth outlook seems strong enough to warrant solid returns going forward (e.g., emphasize to favored sectors, strong pipeline and the business model that benefits from scale).

However, investors have to recognize that now there are more aggressive assumptions baked into the cake that Blue Owl Capital has to meet to deliver enticing results. This also means that there is a smaller margin of error embedded in the Stock price, where if, for example, the private credit boom starts to slow down due to, say, reduced SOFR or the competition tightens too much causing OWL to revisit its above-average fee levels, the results would suffer accordingly.

Given all of the above and the ~ 30% Stock price appreciation, in my opinion, while Blue Owl Capital is still an inherently attractive investment case, it is worth de-emphasizing this position by either taking home part of the profits and reinvesting elsewhere or not adding more to this position.

Read the full article here