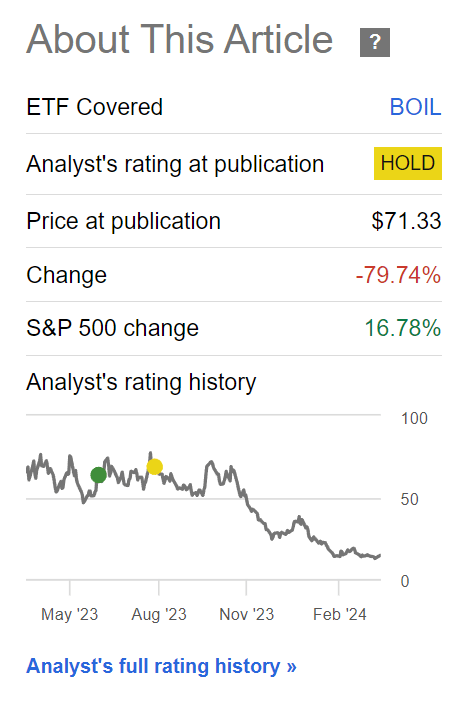

In August, I downgraded the ProShares Ultra Bloomberg Natural Gas ETF (NYSEARCA:BOIL) due to heightened roll decay heading into the winter. Since my downgrade, the BOIL ETF has lost an incredible 80% in value, demonstrating why I do not recommend the BOIL ETF as a long-term investment (Figure 1).

Figure 1 – BOIL has lost 80% in value since August (Seeking Alpha)

However, with the calendar hitting April, I believe we are once again entering favourable seasonality when speculators may want to consider the BOIL ETF for a trade.

Brief Fund Overview

First, for those that have not read my prior articles on the ProShares Ultra Bloomberg Natural Gas ETF, the BOIL ETF seeks to provide daily returns that are twice the return of the Bloomberg Natural Gas Subindex (“Index”). The index reflects the daily performance of a rolling position in front-month natural gas futures. As the futures contracts near expiry, the index mechanically replaces expiring contracts with later expirations in a ‘futures roll’.

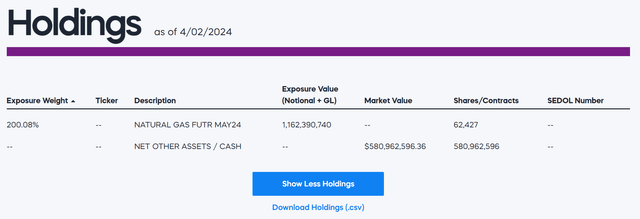

Figure 2 shows the current holdings of the BOIL ETF, which consists of 200% exposure to May 2024 futures and cash (Figure 2).

Figure 2 – BOIL portfolio holdings (proshares.com)

Heed The Warning; Don’t Hold For Long

To reiterate, the BOIL ETF is not suitable for long-term investors. The main issue with the BOIL ETF (and other futures-based ETFs) is that future prices tend to be in contango, where prices farther out in maturity are more expensive.

So every time one of the near month natural gas futures expire, the BOIL ETF must mechanically sell the expiring future at a low price and buy a more expensive futures contract as a replacement. This mechanical ‘roll’ process leads to the ETF suffering losses from ‘roll decay’ over time.

Compounding the issue for BOIL is the fact that it is leveraged. A levered ETFs has ‘positive convexity’ in the direction of its exposure and ‘volatility decay’ as it must rebalance its exposure every night.

For example, assume we had invested $100 in BOIL. If the underlying index returns 5% on day 1, the position will grow to $110 (2 times 5% return). If the index returns 5% again on day 2, the position will grow to $121. This is more than twice the theoretical 2-day compounded return of 10.25% or $120.50. This is ‘positive convexity’.

However, if the return experience is +5% followed by -5%, investors will end up with $99.00, significantly less than twice the 2-day compounded loss of 0.25% or $99.50. This loss in value is due to ‘volatility decay’.

While on a day-to-day basis, ‘volatility decay’ may appear small, when compounded over the long-run, ‘volatility decay’ can turn into very significant slippage, especially for a volatile underlying asset class like natural gas futures.

Traders looking at the BOIL ETF should make sure they fully understand the tracking error risks involved with levered and futures-based commodity ETFs by consulting these FINRA and SEC warnings.

Seasonality Heating Up

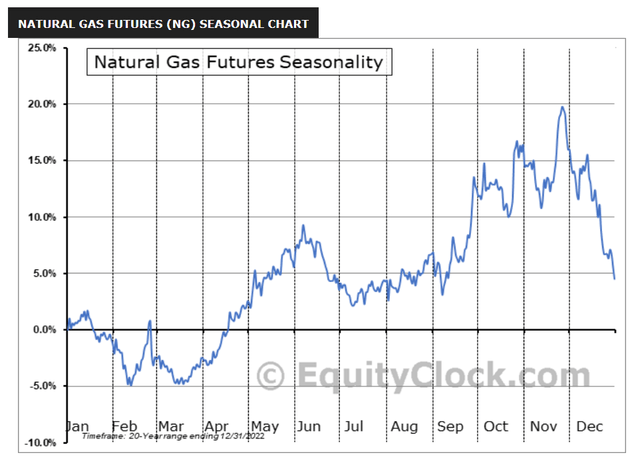

To be honest, natural gas prices have been disappointing in the past year, with spot gas prices recently touching multi-year lows at $1.52. However, according to seasonality, natural gas prices should be on an upswing to June (Figure 3).

Figure 3 – Natural gas seasonality (equityclock.com)

As I have explained before, natural gas exhibits strong seasonality because the demand for natural gas is driven by speculation around the summer cooling season and the winter heating season. Typically, speculators start to bet on cooling demand around April, and speculative frenzy reaches a peak in June as actual cooling demand is realized. Similarly, winter heating speculation starts in September, and reaches a peak in December as actual heating demand is realized.

2024 Looks To Be Another Doozy

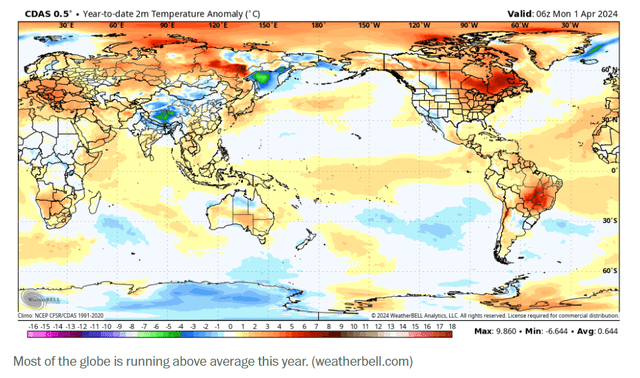

Recall, last summer, I had warned of potential record temperatures due to an El Niño phenomenon, and 2024 looks to surpass that as the National Oceanic and Atmospheric Administration (“NOAA”) believes there is a 45.1 percent chance that 2024 will be the warmest year on record, surpassing 2023, and a 99.9 percent chance that it will rank among the top five warmest years ever (Figure 4).

Figure 4 – Global temperatures above average (washingtonpost.com)

Inventories Well Stocked Due To Record Production And Mild Weather

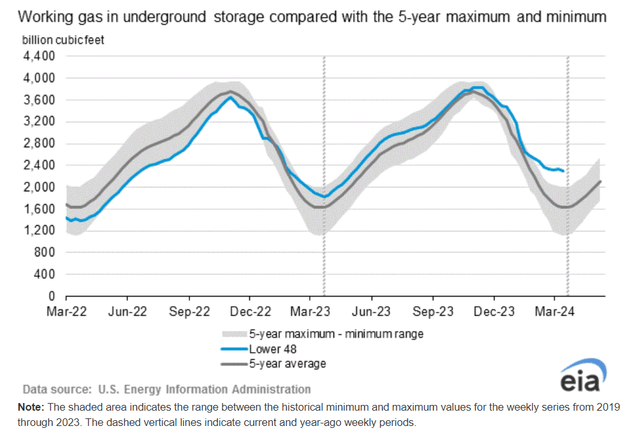

However, one pushback against higher natural gas prices is that storage is also well above normal due to the relatively mild winter we just had plus record production from U.S. shale producers (Figure 5).

Figure 5 – Gas storage is well above seasonal (eia.gov)

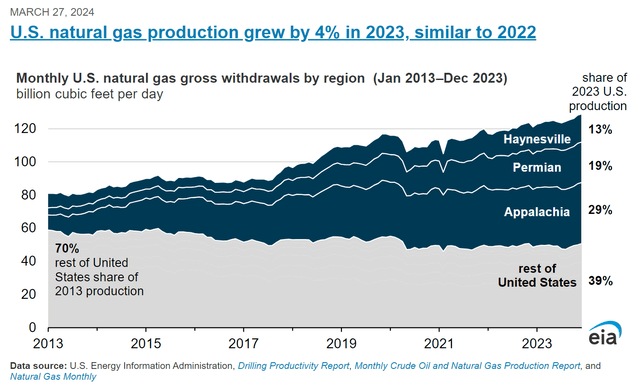

If U.S. production continues to be strong in 2024, there may be limits to how high gas prices can rally despite record cooling demand, similar to last year (Figure 6).

Figure 6 – Shale gas production reaching new highs (eia.gov)

Conclusion

I believe it is that time of the year when speculators begin to bet on summer cooling demand for natural gas. Typically, gas prices rise until June, so nimble traders can consider the BOIL ETF for a swing trade. However, I must stress that the BOIL ETF is not suitable for buy-and-hold strategies, so caveat emptor.

Read the full article here