Note: I previously covered Hafnia (OTCQX:HAFNF). In my last take, I discussed the clean tankers market and the company’s strengths (fleet, balance sheet, and attractive dividends). In today’s analysis, I dissect the last earnings report, update Hafnia’s valuation, and review its rating.

Fleet

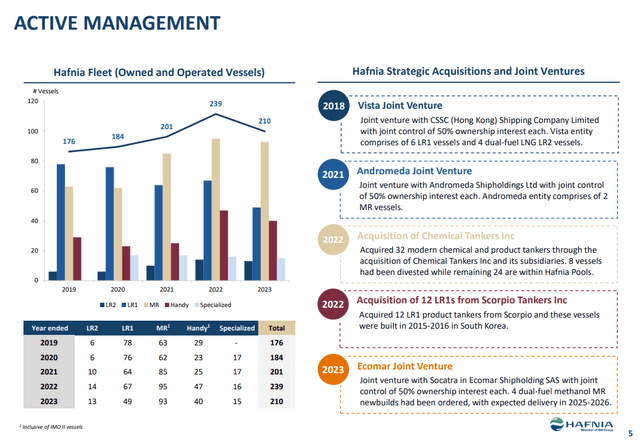

Hafnia owns 116 vessels (10 LR2, 31 LR1, 52 MR, and 24 Handy) and 14 chartered-in vessels (10 MRs and 4 LR1). The average age of its owned fleet is 8.3Y. Below 20% of the company’s fleet has vessels with scrubbers. Most scrubber-fitted vessels came after Hafnia purchased 12 LR1 tankers from Scorpio Tankers (STNG) in 2022. The chart below from 4Q23 presentation shows the development of the HANF fleet over the last five years.

Hafnia presentation

In 2023, Hafnia ordered 4 MR with dual fuel methanol propulsions as a part of the company’s JV Socatra. The vessels’ delivery is expected to occur in 2025-2026.

2023 results review

2023 is the best year in Hafnia’s history. The company delivered excellent results following a strong product tanker market. The table below summarizes HAFNF’s performance per segment.

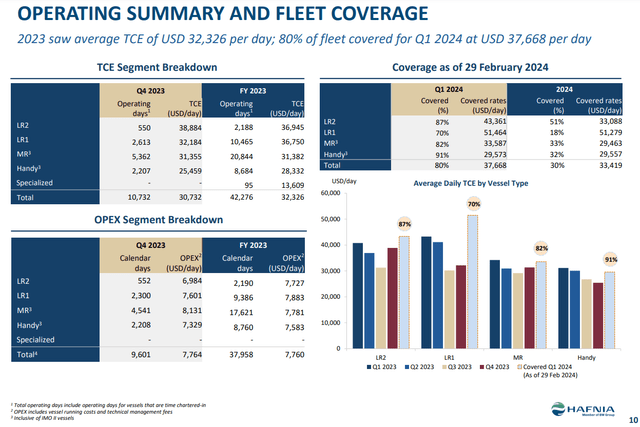

Hafnia presentation

In 4Q23, Hafnia employed its ships for an average TCE of $30,732/day. The FY23 average rate is $32,326/day. Digging deeper (the chart bottom right), we see that the best performer is the LR2 segment in 4Q23, which realized the best growth QoQ. In 2024, however, LR1 vessels lead the pack with the highest growth, 4Q23 vs 1Q24. For reference, Hafnia achieved a $30,274/day average TCE FY22 and $7,098/day OPEX FY22.

Hafnia delivered impressive financial results following the strong clean tanker market in 2023.

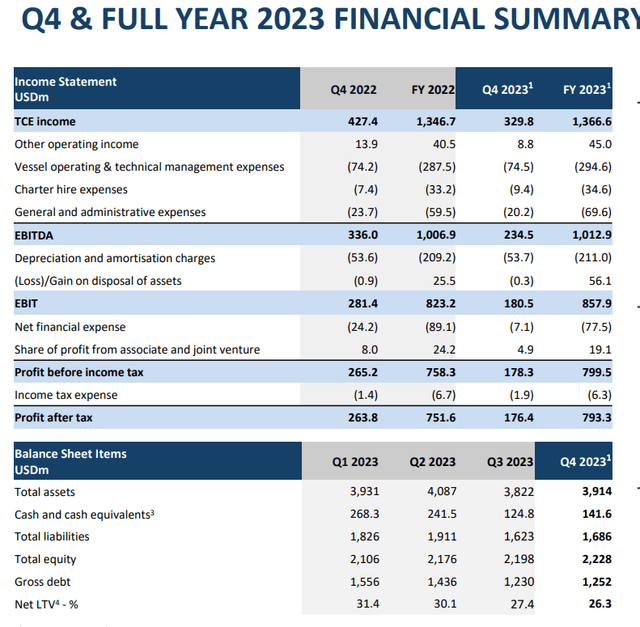

Hafnia presentation

Hafnia realized lower revenue (TCE income plus other income) and EBITDA in 4Q23 compared to 4Q22. However, the company achieved better figures in 2023. FY23, Hafnia delivered $1,366 million in TCE income, $45 million in other operating income (Hafnia’s commercial pool and bunkering business), and $1,012 million in EBITDA.

Operating expenses remained stable YoY, at $287 million for 2022 and $294 million in 2023. YoY net interest expenses declined from $84.1 million FY22 to $59.8 million FY23. Slightly improved revenues, stable OPEX, and lower interest expenses resulted in a $793 million profit after tax, or 5.5% higher than the 2022 figures. EPS (diluted) FY23 is $1.56/share vs $1.54/share FY22.

Though Hafnia realized some growth YoY, those numbers are not so impressive. We must look elsewhere. FY23 cash flows generated by Hafnia increased considerably compared to the 2022 figures. In 2023, the company delivered $1,064 million in operating cash flow and $876 million in FCF. In 2022, Hafnia achieved $775 million in operating cash flow and $323 million in FCF.

YoY Hafnia realized 139% growth in FCF. Hafnia scored high FCF growth YoY compared to its fierce competitors, Scorpio Tanker and TORM (TRMD). For comparison, STNG delivered $865 million FCF FY23 vs $769 million FCF FY22; TRMD delivered $295 million FC FY23 vs $382 million FY22.

2024 projections

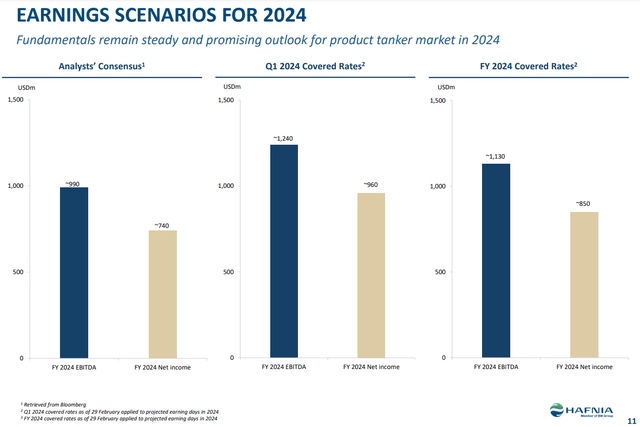

The chart below shows projected EBITDA and net income based on TCE rates for 1Q24 and FY24 achieved by Hafnia.

Hafnia presentation

Hafnia covered 80% of its fleet days in 1Q24 at an average rate of $37,668/day. For 2024, the coverage is 30%, and the average rate is $33,419. On the other hand, daily OPEX remained stable in 2023: the average FY23 is $7,760, compared to $7,764 in 4Q23.

If we pick 1Q24 TCE, FY24 EBITDA would reach $1,240 million, 24% higher than the 2023 figure. Net income would grow to $960 million, a 21% change YoY. Assuming FY24 covered day rates, the figures are also attractive, with 13% EBITDA growth and 7.5% net income growth. The FY24 figures are not far-fetched. Hence, I would be surprised if Hafnia achieves those results. From an investor’s point of view, this means more incoming dividends.

Dividends

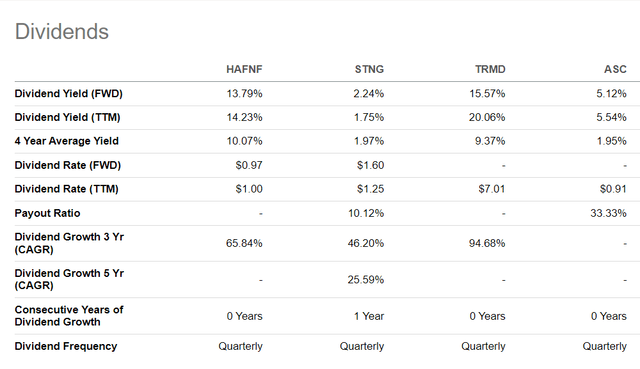

Hafnia and TORM are the best dividend stocks in the product tanker niche. Both distribute dividends with yield in the high teens.

Seeking Alpha

Hafnia will pay a $0.2431 quarterly dividend, which is equal to a $1.00 TTM dividend rate or 14.2 % TTM yield. In FY23, the company returned $508 million in dividends to its shareholders. The average payout is 64%, so the dividend is safe.

Balance sheet

Hafnia has $141.6 million cash, $398 million long-term debt, and $1,292 million total debt (including $626 million lease agreements). Over the last few years, the company has improved its capital structure by paying down its debts. Given the numbers from the previous report, Hafnia scores 58% total debt/equity and 43.1% total liabilities/total assets. The company maintains ample liquidity, considering its cash flows and net interest expenses (FY23 is $59 million).

Valuation

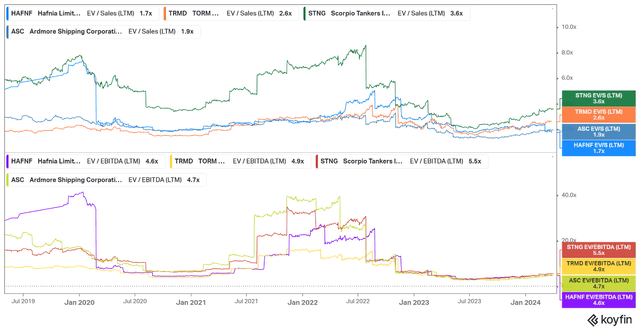

To value Hafnia, I picked its prime contenders, STNG and TRMD. I added Ardmore Shipping (ASC) because its fleet only has clean tankers, although ASC owns only MRs and Handys. The graph below shows EV/Sales and EV/EBITDA for the last five years. All figures are LTM.

Koyfin

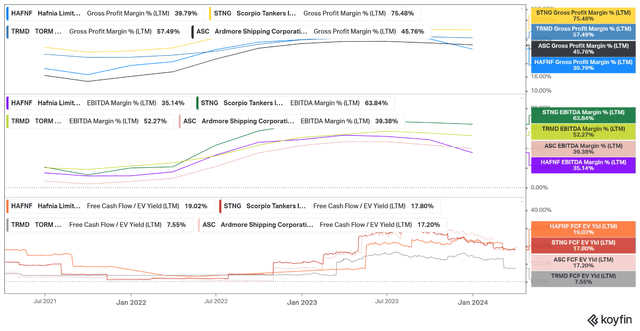

STNG trades at the highest multiples, while Hafnia is at the lowest. TRMD and ASC hold second and third place. The differences come from the fleet specs. Scorpio and TORM have the best fleets, considering the percentage of scrubber-quipped ships. This directly translates into better margins, as seen in the chart below.

Kofyin

STNG commands significantly higher margins, 75% Gross margin and 63% EBITDA margin. TRMD falls behind with 57% Gross and 52% EBITDA margin. Nevertheless, profit margins give part of the picture. As pointed out earlier, Hafnia outperforms its peers, measured in FCF. Its FCF yield is almost 20%. In my opinion, a 19% FCF yield at a reasonable price is more than attractive.

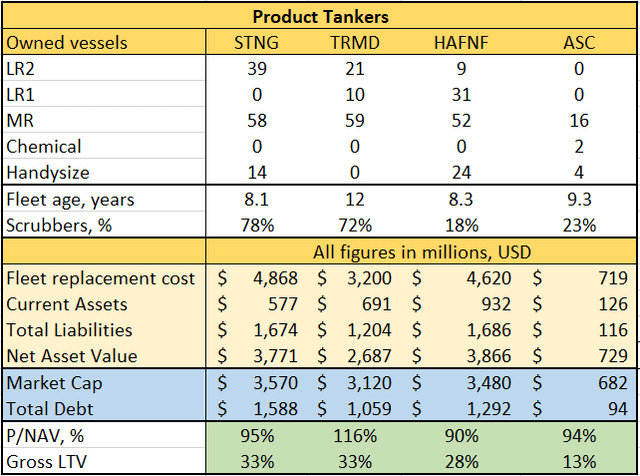

Now, let’s see how Hafnia performs in the context of the shipping investors’ triad: fleet specs, value, and leverage. The table below presents fleets, PNAV (Price to Net Asset Value), and LTV (Loan to Value).

Author’s data

Hafnia trades at 97% PNAV and has 33% gross LTV. At the present stage of the shipping cycle, my favorite clean tanker stock pick is STNG. However, Scorpio does not pay dividends, though it returns value to its investors via regular share buybacks. So, my second pick is Hafnia.

Investors Takeaway

Over the last two months, I started to build positions into Capesize bulk carriers, OSVs (offshore support vessels), and crude oil VLCCs. Meanwhile, I reduce the exposure to clean tankers.

In my opinion, the product tankers are ahead in the expansion phase of the shipping cycle compared to crude tankers, OSVs, and bulk carriers. Although not as far as LPG and LNG carriers. So, there is still some Alpha to harvest. In my clean tanker portfolio, I have STNG, and over the last months, I gradually added some Hafnia shares.

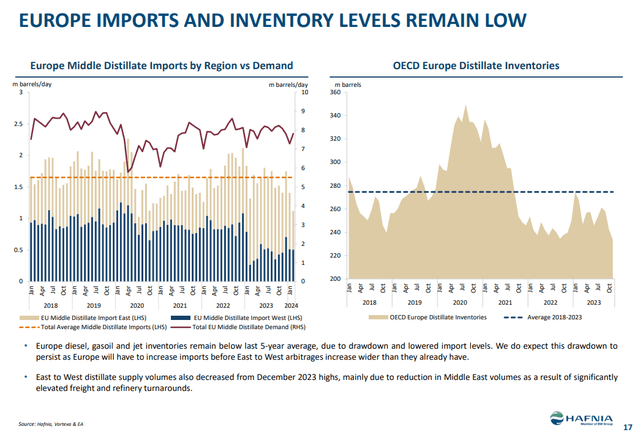

The only certain thing about the markets is uncertainty. So, it’s time to discuss the risks for Hafnia. The prime one is a declining demand for CPP (clean petrol products) freight. Looking at the numbers, this is not a very probable scenario. For example, EU inventories are below their 5Y average values.

Hafnia presentation

The average is about 270 million barrels, while present figures are below 240 million barrels. The geography of the CPP freight shifted due to the Red Sea crisis, so the supply from the Middle East declined, partially compensated for by imports from Western refineries.

The supply side for tankers (clean and dirty) has been widely discussed. The prime constraints are the record low order book, aging fleet, and shipyards’ limited capacity. So, I expect the demand for clean tankers to remain strong over the next 12 months.

The Red Sea crisis remains a decisive factor impacting global supply chains. The most affected ships are containers, followed by tankers (clean and dirty). Given the recent events, I do not see the crisis being resolved any time soon. On April 1, during the attack on Damascus, Syria, the Iranian consulate was destroyed, killing a few high-ranking Iranian officers. The Houthis are Iran’s proxy. So, the Red Sea will remain almost closed (except for Chinese and Russian ships) for the foreseeable future.

The company-specific risks are financial and operational. Hafnia maintains a prudent capital structure and has excellent liquidity. On the other hand, its fleet has an average age of 8.3 years, comparable to STNG and much lower than TRMD. So, the operation risk is moderate.

Rising CPP demand, constrained supply, and broken supply chains still make clean tankers a reasonable idea. I am a happy shareholder in Hafnia and plan to add more in case of a significant pullback. I give Hafnia again a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here