Introduction

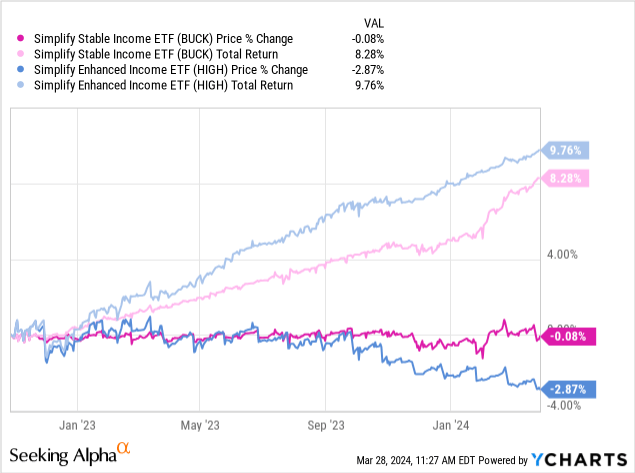

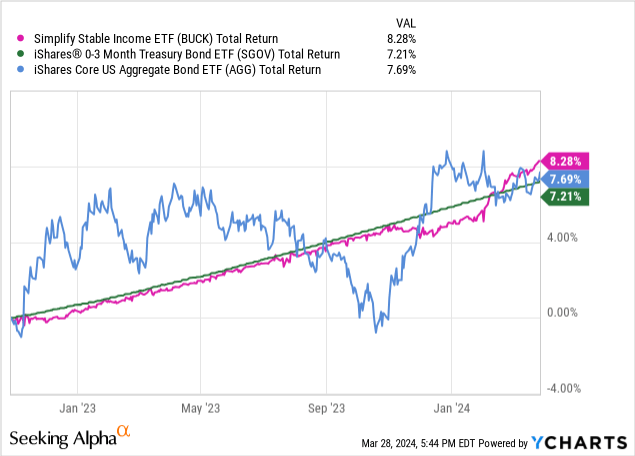

In October 2022, Simplify launched the Simplify Stable Income ETF (NYSEARCA:BUCK). This came out alongside the more popular (and higher risk) Simplify Enhanced Income ETF (HIGH). Both have performed very well since then.

Note that while HIGH has the higher total return, it has also eaten into its own principal, which is not something most cash investors can tolerate. This has earned HIGH a bit of ire in the comments section of an article I wrote on it recently.

In comparison, there has been almost no principal loss with BUCK, despite its 8% total return since inception. This has earned BUCK a reputation of being the safer of the two funds, and thus the better choice for conservative investors wanting to get a high return on their cash holdings.

Under the Hood

So, what is BUCK? Fundamentally, it is an ETF that holds T-Bills or TIPS and sells options spreads using the bonds as collateral.

The options overlay is designed to “juice up” the returns of the fund by exploiting low risk opportunities in the options market.

These options plays are chosen by an algorithmic trading model and then implemented by the portfolio manager, meaning that it is actively managed and subject to those kinds of idiosyncratic risks.

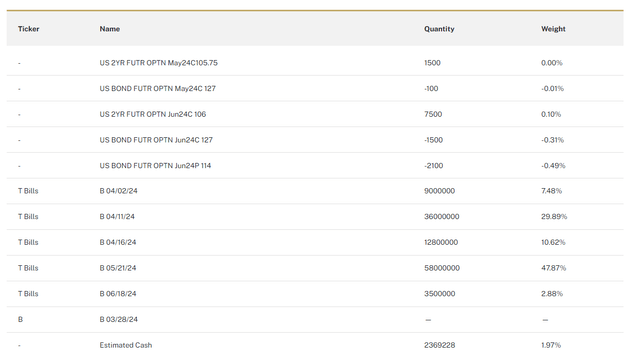

Currently, the fund is holding entirely T-Bills and has options positions open on bond futures.

Figure 1 (Simplify)

These options positions are short-term and may be rolled into other positions at a whim.

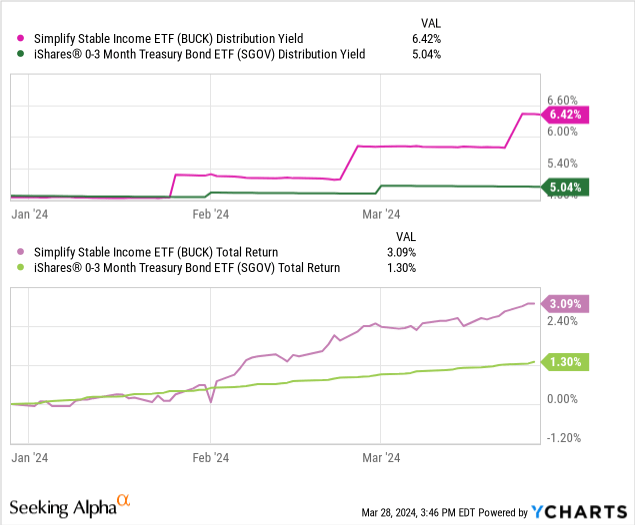

This overlay is what separates the yield that BUCK is able to sustain against directly holding T-Bills. It shows in the total return figures, too.

Safety

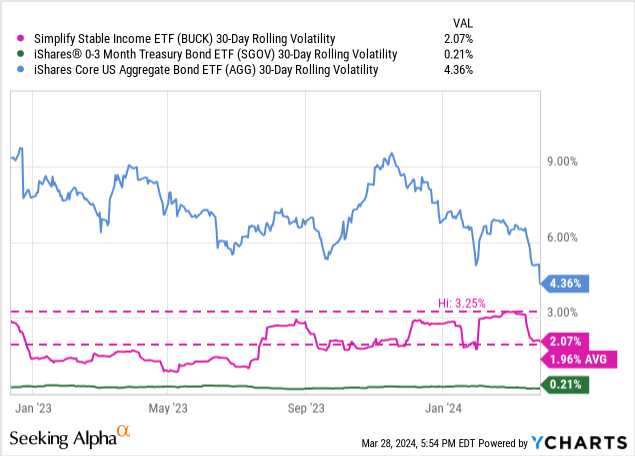

The most attractive characteristic about BUCK has to be its ability to stay stable, but stability is relative. This investment is aiming to contend with core short-term bond and core cash holdings, so we should expect to see BUCK’s volatility come in under 4%.

We can see this fairly clearly in its rolling volatility, which has never peaked above 3.25% and has an average of just under 2%.

BUCK’s volatility comes in between bonds and cash-like holdings, letting it fill the role of both asset. Its returns since inception have been around both assets, meaning that it carries a better risk/reward than aggregate bonds and has outperformed T-Bills alone.

Short Volatility Risk

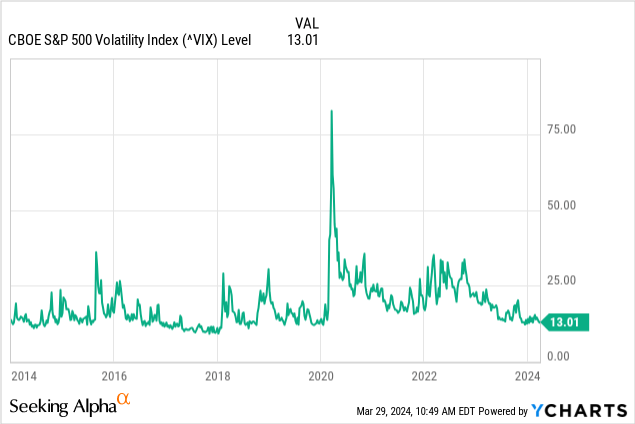

It’s important to note that sell options spreads typically results in a trader inadvertently being short volatility or having a negative Vega in “Greek speak.” This means that if volatility rises, specially implied volatility, the options spread will lose value.

There hasn’t been a spike in the VIX as bad as “Volmageddon” in 2018 or the March 2020 crash since BUCK was launched, so it’s unclear how the fund would navigate this kind of black swan. It could lead to heavy losses in BUCK while an alternative like SGOV would be untouched.

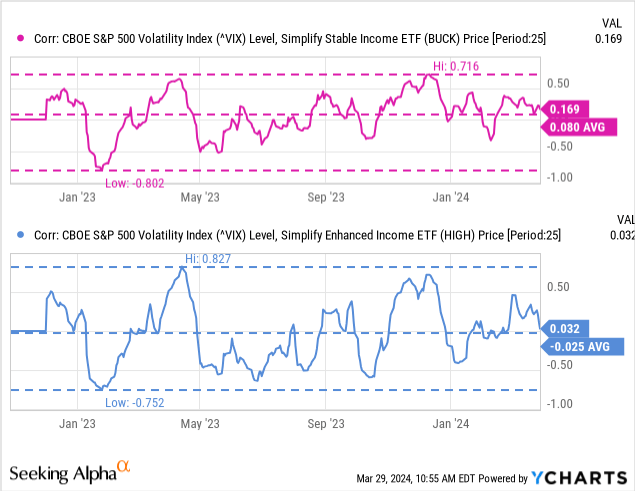

This is one of the advantages BUCK carries over HIGH, since it sells more conservative spreads, it is less exposed to this risk than the latter fund. We can see that clearly in their correlation to the VIX.

HIGH is more sensitive to movements in the VIX, as it has a steeper negative Vega due to its higher-risk options spreads.

Arguably, this risk is one of the most important to consider when approaching BUCK because it represents the worst-case scenario. A wipeout of a considerable portion of the fund with no real way to recover, would leave investors high and dry. In the past, short volatility funds have been destroyed by moments like “Volmageddon” in 2018.

Figure 2 (YCharts)

While this example is extreme, since XIV was directly short the VIX and not selling options on a small portion of its holdings, it represents the dangers of being short volatility at all.

Suitability

So who is BUCK for?

BUCK is designed for the conservative investor who wants to shy away from a core bond holding with a longer duration or for the moderately-aggressive investor looking for somewhere to park cash.

For very-aggressive investors wanting to park cash, I recommend HIGH still.

I would advise investors adding BUCK to a cash position to keep this allocation in check since it bears risks that most cash-like instruments do not.

- Conservative: <10% allocation

- Moderate: <15% allocation

- Aggressive: <25% allocation

Conclusion

The Simplify Stable Income ETF has been outperforming its benchmark in risk/reward since its inception and shows no signs of slowing down, despite present risks in being short volatility due to its options selling.

The extra income above T-Bills has been welcome by yield-hungry investors, but investors should make sure not to let greed get the better of them and keep BUCK to a reasonable allocation within their cash position.

For now, BUCK earns a “buy” rating from me and I am considering adding it to my cash allocation in place of traditional T-Bills but have made no moves as of yet.

Thanks for reading.

Read the full article here