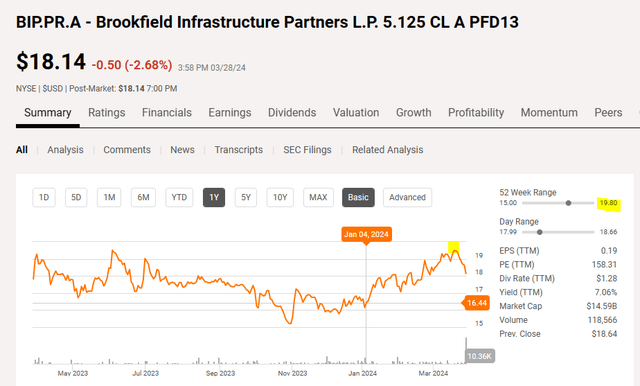

In our last coverage of Brookfield Infrastructure Partners L.P. (BIP), (BIPC), we highlighted some interesting opportunities in the secondary securities. In the US, there are two preferred shares listed. Brookfield Infrastructure Partners L.P. 5.125 CL A PFD13 (NYSE:BIP.PR.A) and Brookfield Infrastructure Partners L.P. 5.00% PFD A 14 (NYSE:BIP.PR.B). The two preferreds were on a tear after that and did well for investors as they corrected their immense undervaluation.

Seeking Alpha

They have retreated a bit off the highs but are nowhere near as undervalued as they previously were. For fixed rate exposure, we have other preferences and this would not be where we would put fresh money.

Making The Case For Another BIP Security

Fixed rate securities are generally the best for a steady or falling interest rate environment. They are more so when you can purchase them substantially below par. The falling interest rates can add a good deal of extra oomph to your returns. In the case of the two securities described above, the risk of being called is negligible. They were issued in the throes of ZIRP (zero interest rate policy) and their coupons on par, 5% and 5.125%, make an early call impossible today. Of course, even if one should occur, you would get such a massive windfall gain (the appreciation from the current price to $25), that you would not care.

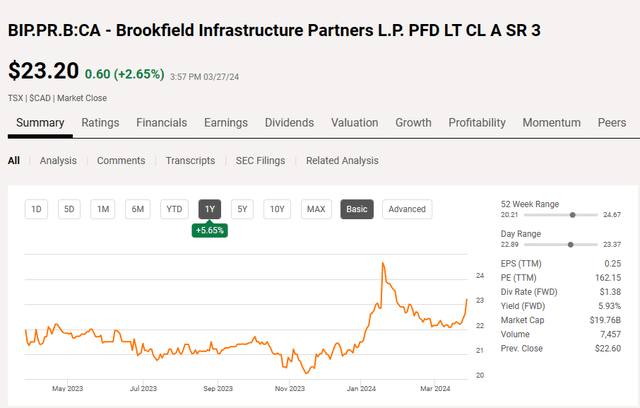

Now, we look at another way to play the BIP trade, while actually betting on the possibility and probability of an early redemption. The security is question has the same symbol as BIP.PR.B, but trades on the TSX. Brookfield Infrastructure Partners L.P. PFD LT CL A SR 3 (TSX:BIP.PR.B:CA), while having the same letters as BIP.PR.B is radically different. So before you start firing off trades (or comments), please note what we are referring to.

Seeking Alpha

BIP.PR.B:CA

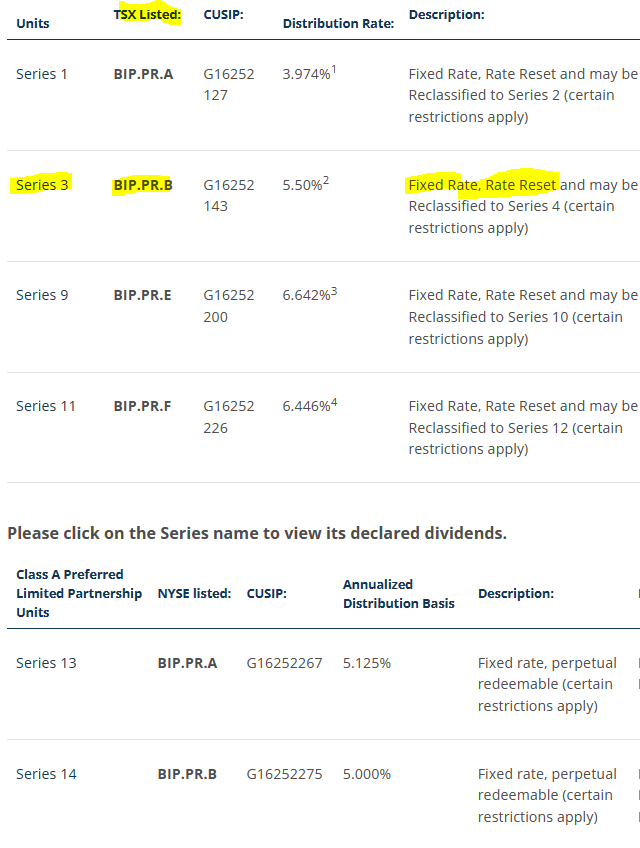

BIP’s preferred shares can be seen all shown together on their website. These are the Series 3 (the NYSE listed ones are Series 14) preferred shares which have rate reset feature and we will get to why that is so important in a minute.

BIP Website

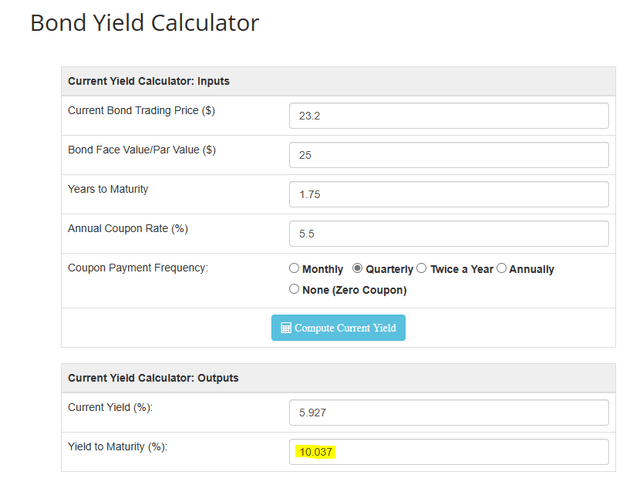

Currently BIP.PR.B:CA, does not yield that much, only 5.93%. That is certainly not much to get excited about. Some may compare this to the Fed Funds rate, but since this is a Canadian security, the Bank Of Canada’s overnight rate is the first thing you should look at. That latter number while a bit lower, still does not make this very impressive. Why do you want a 5.93% yielding preferred share? Well, the reasons for us at least, lie in the conditions.

BIP.PR.B:CA is a sleepy security listed in the heart of ZIRP in December 2015. The first reset happened in December 2020. That was still with the world in ZIRP mode and no one really cared what the conditions were as the rate remained the same as before. What were those conditions?

Commencing on March 31, 2016, the holders of the Series 3 Preferred Units are entitled to receive quarterly fixed cumulative preferential cash distributions, as and when declared by the general partner (the “General Partner”) of Brookfield Infrastructure Partners L.P. (the “Partnership”) payable quarterly on the last day of March, June, September and December in each year at an annual rate of C$1.375 per Series 3 Preferred Unit until December 31, 2020. The annual fixed distribution rate (the “Annual Fixed Distribution Rate”) for each subsequent 5-year fixed rate period will be equal to the greater of: (i) the sum of the Government of Canada Yield on the 30th day prior to the first day of such Subsequent Fixed Rate period plus 4.53%, and (ii) 5.50%.

Source: Series 3 Prospectus (emphasis ours)

The Government Of Canada (GOC) yield referenced there is the GOC-5, i.e. the 5 year bond yield. There are two remarkable things here. The first being that you have a very huge spread for an investment grade preferred share. BIP is rated BBB+ and the preferreds are rated BBB-. So getting a 4.53% spread is in line more with mid level junk securities. On top of that, you have a floor rate of 5.5%. We have previously played the Pembina Pipeline Corporation (PBA) minimum rate preferred shares with great results and this falls in a similar category. The distinctions with that one are that the floor is higher and the spread is higher as well.

Outcomes

The GOC-5 trades near 3.5% today and is already discounting multiple rate cuts by Bank of Canada. This is an obvious conclusion as the overnight rate is 5% currently. Of course one could argue that the GOC-5 goes higher if sticky inflation prevents a lot of rate cuts. If we assume though, the rate stays at 3.5% around December 31, 2025, the preferred shares will reset to an yield of 8.03% on par. That would be 8.65% on the current price. We will argue here, that this is just too high for BIP to pay on preferred equity. BIP.PR.C:CA which had a GOC-5 + 4.64% setting was redeemed in 2021. The spread for BIP.PR.B:CA is the highest among the resetting preferreds in BIP’s capital stack and they likely can issue something cheaper down the line. So the return profile here, over two years is still impressive. What is more important here is the relative safety feature here as if you don’t get this redeemed, you will have a very high effective rate for the next 5 years. Let’s not forget about the floor protection if ever ZIRP makes a comeback. Unlike many other resetting preferred shares which will get destroyed in that climate, BIP.PR.B:CA’s 5.5% floor on par (5.92% on current price) will hold up well.

Verdict

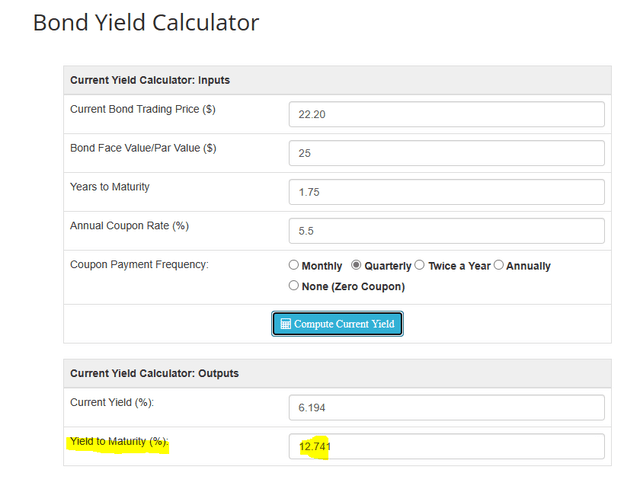

We recommended these at $22.20 and they offered a 12.2% yield to call at the time.

DQYDJ

The current yield to call is lower.

DQYDJ

One of our other large holdings, Brookfield Renewable Partners Series 15 (BEP.PR.O:CA) was also called recently and it has very similar conditions. While that one does belong to Brookfield Renewable Partners (BEP), the mothership, Brookfield Corporation (BN), makes the decisions for both. Both BIP and BEP share the same credit ratings. While valuations have risen across the spectrum for preferred shares, there are few select bargains to be had. With the current FOMO, they may not last either. Investors interested in these securities should explore the tax consequences for BIP in general here and for the Series 13 specifically, over here.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Read the full article here