Shares of RH (NYSE:RH), formerly known as Restoration Hardware, are up 23% from a year ago, but this hides what a bumpy ride it has been. Shares closed Wednesday about 25% below their 52-week high. After giving encouraging guidance, shares rallied by 8% past $320 Wednesday after hours. Even after this move, shares have still been more than cut in half from their 2021 highs above $730. While I believe there is a turnaround happening, I would not rush into shares.

Seeking Alpha

In the company’s fourth quarter, RH earned $0.72 in adjusted EPS, which was well shy of the $1.72 estimate as revenue was $40 million light at $738 million. That adjusted EPS result was down 75% from last year. For the full year, RH earned $6.87 from $20.06 in fiscal 2022. Revenue was down less than 5% in Q4, an improved pace compared to the full-year decline of 15.7%, as the comps become less difficult. 2023 was an extremely challenging year for the company as the elevated interest rate environment significantly slowed housing transactions. When someone buys a house is the moment they are most likely to buy furniture, and so a quieter housing market has been a significant headwind for the company.

These headwinds have significantly reduced the company’s operating leverage. Revenue fell by $34 million from last year while cost of goods sold rose by $14 million as input prices remained somewhat elevated but weak demand reduces pricing power. As a consequence, RH’s adjusted gross margin of 43.5% in Q4 was down 430bp year over year. As it continues to invest in its international expansion and works to broaden its brand’s reach, SG&A rose by $13 million and was 34.4% of sales from 31.2% last year. Because of all this spending, its Q4 operating margin of 9.1% was down from 16.6%. The adjusted operating margin was 13% for the year.

Rather than roll back costs during this downturn, RH has decided to push forward, hoping to use this period of market weakness to gain on rivals, at the expense of current profitability. This is a moderately aggressive strategy. On the plus side, it has also sought to control inventories to avoid bloat and forced discounting. Inventories are $754 million from $802 million last year, but this is the only place where caution is apparent.

In 2024, RH invested $295 million in cap-ex from $225 million a year ago. As a consequence, the company burnt $67 million in free cash flow. I would note this would have been a positive $188 million excluding working capital. While the decision to keep spending on the business has been fairly aggressive, RH’s financial policy over the past year has been extremely aggressive. It ended 2024 with $124 million in cash. That is down from $1.5 billion a year ago. That dramatic drop in cash was because the company spent $1.25 billion on share repurchases last year. As a result, its share count is down over 21% from a year ago.

Now, I will say there are many companies that have bought back shares near all-time highs only to reduce repurchases during bear markets. I give RH credit for buying back shares after they had fallen significantly from their highs. This has been a fairly large bet that the market has overreacted to the slowing in the housing market.

Simply because of the fact it has spent all of its excess cash, share repurchases will have to slow materially in 2024, particularly as the company already carries $2.4 billion in debt, and given ongoing uncertainty and the interest rate environment, a debt-fueled buyback is unlikely to prove as accretive. While buying shares back at $250-350 is much better than at $600+, it will take time to see whether the decision to spend down cash so dramatically was the best use of resources.

I would also note that even with no further repurchases, a lower share count will be ~8% tailwind to 2024 results relative to 2023 because its current share count is substantially below its full-year average. Now, given all of the negative numbers reported in the past quarter, it may be surprising that shares are higher after hours—this is due to the outlook.

In 2024, it is guiding to 8-10% revenue growth on 12-14% demand growth with operating margins of 13-14%. In his letter to investors, CEO Gary Friedman said he expects revenue to improve as 2024 goes on, even as the housing market remains a challenge. Demand growth is expected to exceed revenue growth as the company struggles to meet demand in some products as it updates inventory.

This essentially will push profits into 2025. Due to this, the company expects an increased backlog of $110-130 million this year as it transforms revenue, which will reduce margins by 140bp. There will also be a 200bp drag from investments to support international expansion. Based on this guidance, the company could earn $9.50-10.50 in EPS this fiscal year.

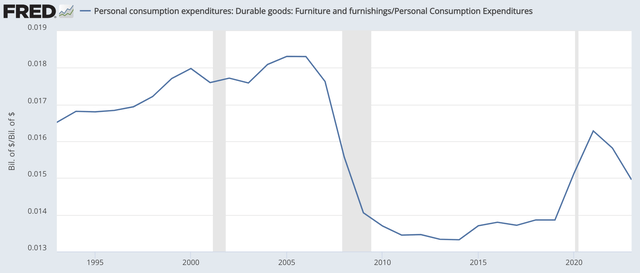

The question is whether this kind of recovery is a plausible base case. Barring a recession (which I do not expect), I believe it is. As you can see below, spending on furniture surged in 2020 and 2021 as the housing market boomed, people moved, and invested in home offices. Then last year, it retraced to still better than pre-COVID levels. Still, spending on furniture was much more robust before the housing crash in 2008, and levels are depressed relative to long-term averages, a testament to how weak the construction market was in the 2010s. I would expect furniture spending to rise at least in line with overall consumption in 2024, pointing to mid-single digit nominal spending growth.

St. Louis Federal Reserve

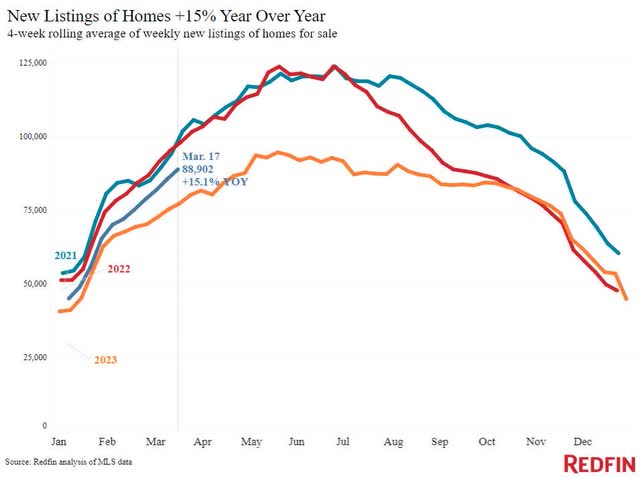

As noted, people are most likely to buy furniture when making a move, and there are encouraging signs that transaction activity should improve this year. As you can see below, new listings of existing homes are running much better than last year, and increased supply should support more transactions. Still, listings are running below 2021 and 2022’s pace. This would be consistent with furniture sales improving vs 2023 but not returning to their post-COVID peak.

Redfin

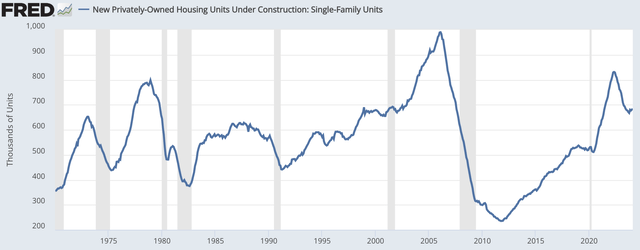

Similarly, the number of new homes under construction has appeared to bottom, though we are below the post-COVID peak. As these homes are completed and sold, that is a natural point for homebuyers to purchase furniture, a tailwind to RH’s business. This chart also makes clear how weak the housing market was in the 2010s, which is why furniture spending was so anemic.

St. Louis Federal Reserve

We appear unlikely to return to a booming housing market, and so I do not expect RH to get back to record earnings anytime soon. However, we appear likely to see more transactions this year than last year, and so I agree that we should see sales rise throughout the year. I am a bit cautious that interest rates will stay elevated for longer, denting the magnitude of the recovery, which likely means revenue growth is closer to the 8% than the 10% figure, as I would look for furniture sales to rise ~5%, and RH to outperform that by 200-400bp given its higher-end customer base, which is less pressured by diminished excess savings.

That still means RH should earn about $9.50 in 2024 and generate about $230-250 million in free cash flow, holding working capital constant. Then in 2025, as it fulfills its backlog and has less international spending pressure, earnings could move back to about $15 and free cash flow move towards $325-360 million.

Shares have about a 6% 2025 free cash flow yield, which I view as fair for a company with a reasonable balance sheet and a history of solid execution. However, this means the next two years have to go as planned to grow into this multiple, as shares are over 30x 2024 earnings. Essentially, the market is now pricing in much of the recovery. Ultimately, RH is a second-derivative play on housing. With first derivative plays like Lennar (LEN) and Toll (TOL) trading 9-11x earnings with ongoing buybacks, RH is a relatively expensive way to play this theme. On a stand-alone basis, with results set to improve, I view RH as a hold, but considering I rate many of the builders a “buy,” I believe investors would be best served allocating capital elsewhere.

Read the full article here