Introduction

Gravity Co. (NASDAQ:GRVY) is going to report Q4 earnings on the 29th of March (according to Nasdaq), so I wanted to revisit the company since it’s been almost a year since I first covered the company, when I assigned it a buy rating citing continual success of churning out Ragnarök games and the formula seems to be working well. Now fast forward almost a year, and the company’s revenues skyrocketed due to the mentioned IP’s success in the mobile segment, however, the share price saw around 26% increase since then, which I think is too little compared to its revenue growth. The company’s financials are still outstanding, flushed with cash and no debt. Furthermore, the magic formula seems to be working still, with many new releases coming to China, which I think will perform very well and continue to generate amazing top-line results. I am sticking with my Buy rating and upping my price target to $108 a share.

Briefly On Performance

The latest figures we have right now are as of preliminary Q4 ’23, which ended December 31, 2023, published on February 14th. The company had around $344m in cash and short-term investments, against no debt. The company is still flushed with cash and has almost as much as its market capitalization as of writing this update. The company is in a great position financially, and the freedom to use this capital in growth opportunities should create value in the end. Let’s see how the company performed so far in 2023. Starting with what I think are the most important metrics, that is the margins.

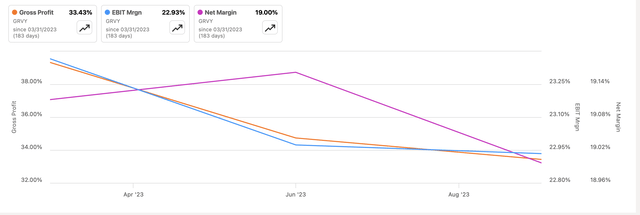

We can see a bit of a downtrend in profitability and efficiency in the three-quarters of ’23, which isn’t ideal, with the highest decline seen in gross margins, which saw around 600bps of deterioration throughout the year. The cost of revenue increase in every quarter was due to “increased commissions paid for mobile games services related to Ragnarök Origin in Southeast Asia, Taiwan, Hong Kong, and Macau, and Ragnarök X: Next Generation in Korea.” These increases can be attributed to the massive success of the mobile games segment, which saw a 120% y/y increase in Q1, 221% in Q2, and 95.7% in Q3. It is disappointing that the costs have increased slightly more than the revenues, hence the loss of 600bps in gross margins.

Margins (Seeking Alpha)

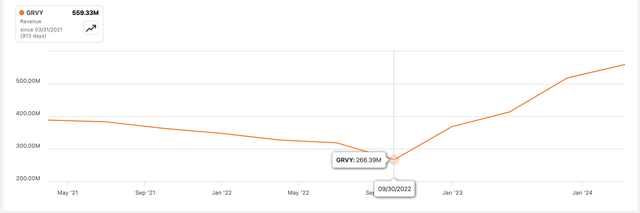

Speaking of revenues, looking at the last 4 quarters, the company saw over 100% increase in revenues due to the mentioned strength of the mobile segment. Triple-digit growth is outstanding, but it has slowed down a bit, so I don’t expect this sort of growth to continue for long. What is interesting is that the share price does not reflect such strong revenue growth. For example, when Nvidia (NVDA) and Super Micro Computer (SMCI) posted triple-digit growth, their share price skyrocketed, but we don’t see that with GRVY.

Revenue (Seeking Alpha)

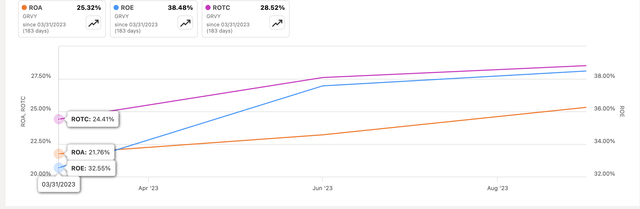

Going back to efficiency and profitability, the company’s ROA and ROE have steadily increased over the last year. These are some impressive numbers, and well above my minimums of 5% for ROA and 10% for ROE. The management is utilizing the company’s assets and shareholder capital efficiently, thus creating value. Furthermore, the company’s ROTC, which measures the company’s efficiency in generating profit from all the capital available, which in this case is all equity, is very high also and has improved by around 400bps in 2023 so far. Such a high ROTC also tells me the company is enjoying a competitive advantage and has a strong moat in the sector, which is a good reason to pay a premium for the company, in my opinion.

Efficiency and Profitability Metrics (Seeking Alpha)

Overall, the impressive growth in the mobile segment is a huge driver of the company’s performance, and the strong balance sheet doesn’t seem to be reflected in the company’s share price performance. With such numbers, I would expect the share price to skyrocket, but we have not seen that so far. The management is doing a commendable job of running the company, but I am a little cautious to see gross margins declining so much in 2023 so far.

What To Expect From Q4

The company has already released preliminary Q4 results back on February 14th, which showed a decrease in revenues from Ragnarök Origin in Southeast Asia. Tentative consolidated revenue for Q4 was 17.1% lower Q/Q and Y/Y. Unaudited consolidated revenue for 2023 came in at KRW726B, which is around $540m if we convert with spot prices as of writing this article (March 22nd).

These are just preliminary results so, I expect fully audited results to come out next week, with all the statements attached but we can see a bit of weakness in its top IP. As we saw above, the revenue growth has been slowing down from Q2 to Q3. This doesn’t tell us all that much about the company’s performance, but we can see that KRW 726B is around a 56% y/y increase, driven by the strong mobile game segment.

Comments On The Outlook

The weakness in their most successful game so far, Ragnarök Origins is somewhat alarming, however, we need to see more numbers of other games that they have produced to get a bigger picture overall. Maybe it’s the lack of interesting updates to the game that drove lower revenues, in which case, this can easily be fixed. Ragnarök Origin: ROO was recently launched at the end of February, so we will have to wait for the next quarter to see how this game performed at launch but so far, it has 4.2 stars and over 1m downloads on the Google Play store, and similar numbers on the Apple App Store. So, the weakness can be explained by the sequel coming out, as more people decided to wait for it instead of spending money on the previous title.

The mobile game segment is here to stay and will continue to perform well in the many years to come. The company has plenty of cash that it can utilize to continue churning out more updates and sequels to the beloved Ragnarök franchise. In the same preliminary report, the company has a big game to be released in China, which is Ragnarök X: Next Generation. The company received an ISBN code from the Chinese government at the end of the year, so I expect solid numbers when it is released, we just don’t have the specific release date yet. Furthermore, Ragnarök Origin will also hit the Chinese app stores in the first half of 2024, so I would expect a rejuvenation of revenues of the game.

The company has many other titles to be released in the Ragnarök universe, all around Asia, so the company will continue to generate massive top-line growth going forward.

I would like to see the company focus mostly on the mobile segment as that is the way to generate the most revenue in my opinion. Furthermore, continue focusing on the region it has, as this region mostly plays mobile games. The Western world is more into the PC and console entertainment.

It looks like the dependence on its flagship IP is paying off handsomely in 2023, and continuing innovations with the mentioned IP will play a large role in generating revenues going forward. It is basically a “if it ain’t broke why fix it” situation, and I am fine with that.

I am a little worried that the company’s gross margins are taking a hit while the company saw higher revenue growth in the year. Cost of revenues outpaced revenue growth, which if it cannot tame, I would expect to see further deterioration, however, it looks like the deterioration doesn’t trickle down to the bottom line too much.

Valuation

It’s been a while since I did a DCF valuation for the company, and a lot has changed since, however, I am going to keep it rather conservative still to give myself more room for error in these estimates.

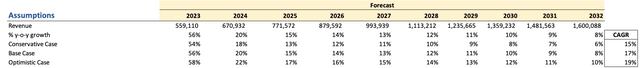

For revenue, I went with around 17% CAGR over the next decade, with 56% growth in 2023 and much lower growth going forward. I also modeled a more conservative case, and a more optimistic case, to give myself a range of possible outcomes. There is not much coverage of the company at all, so I have to approach it conservatively and these are all my assumptions, which may vary dramatically, so bear that in mind. Below are those estimates and their respective CAGRs. I went with these estimates mainly because I would like to be on a more conservative end of things and not overhype the success of their IPs. This way I am getting more margin of safety if I stick to somewhat muted expectations.

Revenue Assumptions (Author)

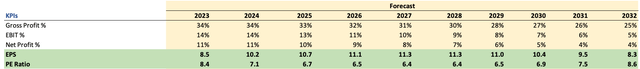

For margins, I decided to approach this very conservatively and I modeled continual deterioration in gross margins, around 900 bps more over the next decade, which if the company cannot take hold of, then it may continue to deteriorate. The reason for such harshness in margins is, again, I would like to be conservative, which will give me even more margin of safety. Sort of a worst-case scenario. If the company’s valuation comes out undervalued even under these conditions, then I know it’s a good deal.

Margins and EPS Assumptions (Author)

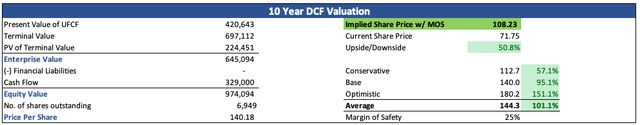

For the DCF analysis, I am using 12% as my discount rate, which is 20% higher than what I usually do, just to be even more conservative. I am also using a 2.5% terminal growth rate. Furthermore, just to be a complete pessimist, I am adding another 25% discount to the final intrinsic value calculation, with that said, the company’s intrinsic value is around $108 a share, which means it is trading at around 50% discount to its fair value.

Intrinsic Value (Author)

Risks And Closing Comments

Even with such pessimistic assumptions (in my opinion), the company is trading at a massive discount to its fair value. I am having a hard time believing that over the next decade, the company is going to lose another 10% of gross margins, however, it is not impossible since just a few years ago, the company did see such margins.

Is the company a hidden gem and eventually investors will recognize its revenue potential and bid up the share price? It is hard to tell. No matter how excellent the growth prospects of the company are, if there is no buzz around it and it is not covered on the Street, the true potential may never be attained, and the money invested will not grow at the expected rate.

The triple-digit growth didn’t make the company’s share price skyrocket, which is unbelievable in my opinion. I mentioned NVDA and SMCI earlier, and I would have expected a similar price spike as those companies, however, no one seems to care about GRVY, but there may come a time when its potential is recognized, it will probably take a long time, however.

The upcoming releases may flop and may not contribute much to the top-line growth, especially if the costs exceed sales, which will in turn depress the company’s gross margins, and it may even trickle down to the bottom-line deterioration.

I don’t think it’s a bad time to start a position with so much upside, however, I wouldn’t be against holding off until we get the full-year picture and more on the games that it had released, and how successful they were. The company has a magic formula that seems to be working very well, and I don’t see it stopping any time soon unless people just get bored of Ragnarök. I will be opening a small position after we get the full picture in a week, but only if I see that the long thesis is still intact.

Read the full article here