Introduction

I think everyone really needs to consider adding some consumer staples to their portfolio. Consumer staples in general don’t have the nature to outperform but offer a safety cushion in uncertain times. In the dividend growth community consumer staples are also popular because of their stability and consistency. Companies in this sector are selling products that are always in demand, so their earnings are far more stable and predictable. This is also the reason that consumer staples are well presented in the list of dividend aristocrats and dividend kings. Think about companies like the Procter & Gamble Company (PG) , PepsiCo, Inc. (PEP) and the Coca-Cola Company (KO).

One of the most famous European consumer staple giants is Unilever PLC (NYSE:UL). On the 4th of December I wrote an article about the company and since this moment in time the broader market is up considerably. It has to be said that the overall consumer staple sector is unpopular at the moment. Most investors are looking at technology stocks and are neglecting stocks with a more defensive nature.

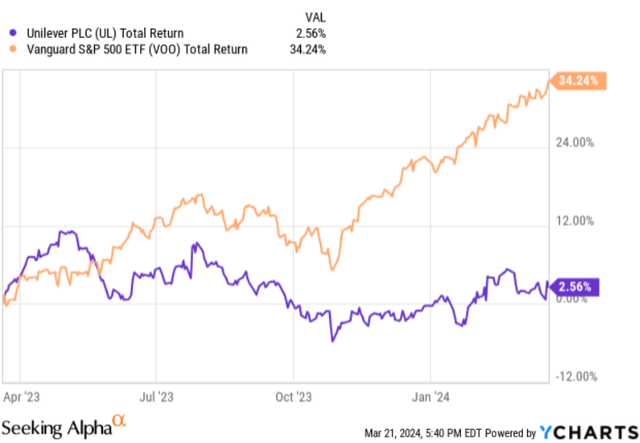

UL performance vs benchmark (YCharts)

From all the consumer staple stocks, it looks like people tend to stay away from UL. The company is really underperforming in the long-term compared to its peers and investors in general are unhappy to say the least.

However, I think UL is going to do things better in the future. The company is trying to reinvent itself and they have already taken several actions.

Today I want to update my investment thesis with the newest information to determine if the company is still attractively valued.

Let’s get started!

Full year overview

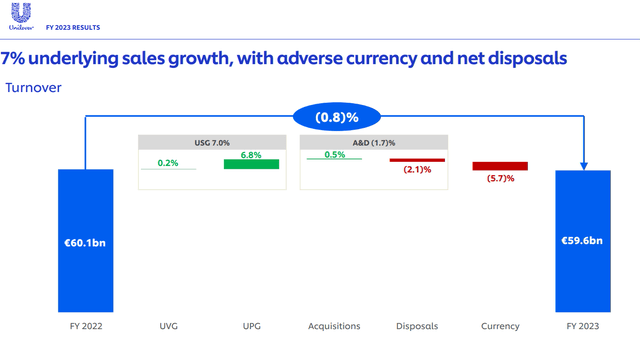

From a turnaround point of view the FY 2023 numbers were decent. Revenue was down 0.8% from €60.1 billion to €59.6 billion which was mainly due to significant negative currency impact (5.7%).

Pricing is clearly trending downwards because of easing inflation, while volume is slowly trending upwards.

In FY 2023, the company had an underlying sales growth of 7% which was primarily driven by higher prices (6.8%) and a bit more volume (0.2%). UL’s 30 power brands have performed relatively better with an 8.6% underlying sales growth and 1.6% growth in volume.

UL sales (Q4 and Full Year 2023 Results)

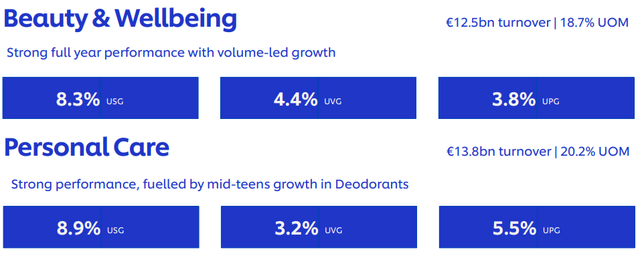

What I really like about the numbers is the underlying volume growth in Beauty & Well-being (4.4%) and Personal care (3.2%).

UL best performing segments (Q4 and Full Year 2023 Results)

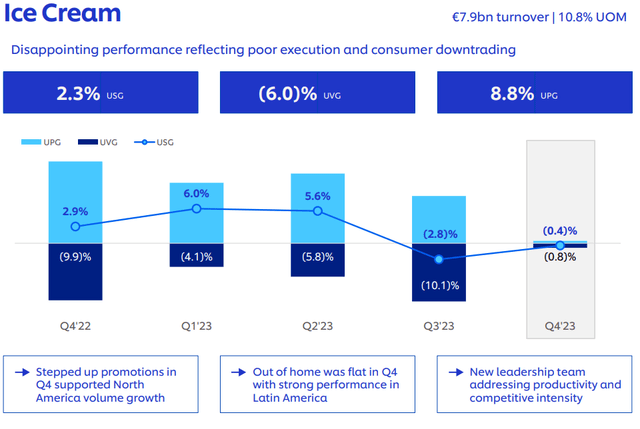

One of the least performing segments is nutrition, due to higher input costs and shrinking volumes (-2.2%). The ice cream segment is also performing badly.

UL ice cream performance (Q4 and Full Year 2023 Results)

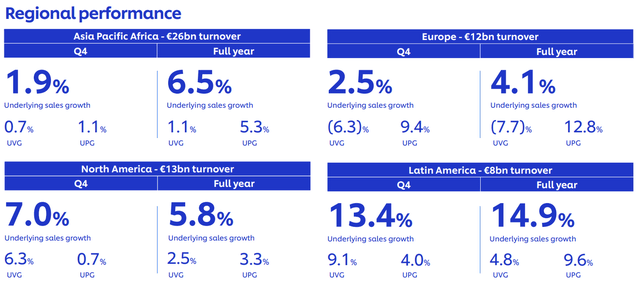

Looking at regional performance, UL did an excellent job in Latin America with 14.9% in sales growth and 4.8% volume growth. Despite the economic circumstances in Asia they managed to achieve underlying sales growth of 6.5% with a bit volume growth of 1.1% as well. Euro was really underperforming in terms of sales growth and a -7.7% in volume.

UL regional performance (Q4 and Full Year 2023 Results)

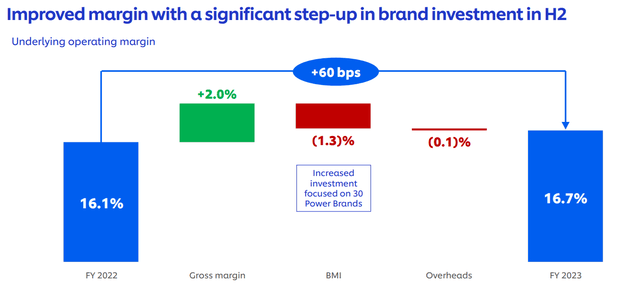

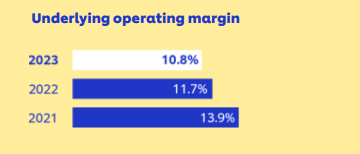

In terms of profitability things are improving for UL. What is good to see is that the underlying operating margin is increasing again (0.6%). Gross margin was up almost 2%, but it has been partly offset by increased investment into their power brands.

UL margins (Q4 and Full Year 2023 Results)

In FY 2023 the FCF was a lot higher compared to previous year €7.1 billion vs €5.2 billion. The FCF of FY 2023 was including €400 million linked to tax refund in India.

All in all I am happy about the numbers. Margins are slightly recovering and UL is performing pretty well in the personal care and beauty & wellbeing segment, which I believe will be their main focus in the years to come.

For FY 2024, UL is expecting 3-5% of underlying sales growth. The company is also expecting a higher contribution to volume growth compared to FY 2023 and an improvement in operating margin for the full year.

When it comes to capital returns UL stays committed to an “attractive and sustainable” dividend. In other words, no growing dividend. In addition to the dividend there will be a €1.5 billion share buyback program in 2024.

The strengths of Unilever

Looking at the last 5 years, I can fully imagine that investors are unhappy with UL’s performance. Especially if we compare the company to its peers there are some serious gaps to close and the “new management” is going to try that. Investing isn’t about looking back at the past, it’s about looking for future possibilities. In my opinion there are still a decent amount of opportunities where UL can benefit from.

UL is still a great business but wasn’t managed optimally to create meaningful shareholder value. The company still has an impressive portfolio of high-quality brands. There are over 3.4 billion people all over the world that are using products of UL on a daily basis. We, as a family, are using a lot of UL products ourselves each and every day.

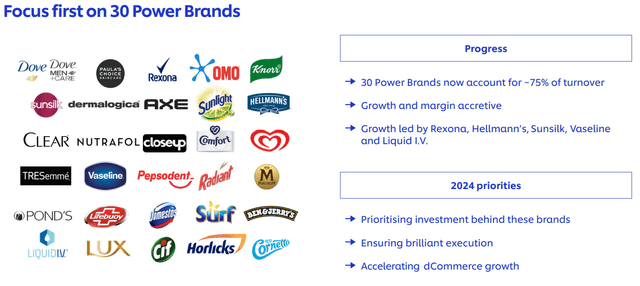

Especially their power brand portfolio is impressive. These brands account for 75% of total revenue and were accounting for 90% of total growth.

UL power brands (Q4 and Full Year 2023 Results)

UL has also dominant presence in emerging markets, such as Latin America, Asia, and Africa. Based on their 2023 annual report, 58% of total revenue already comes from emerging markets and there are certainly opportunities here to achieve further growth.

The company is shifting more towards the most profitable brands/ business segments and wants increasing exposure in the “premium segment.” This is also part of their Growth Action Plan, which is initiated by management.

Management actions

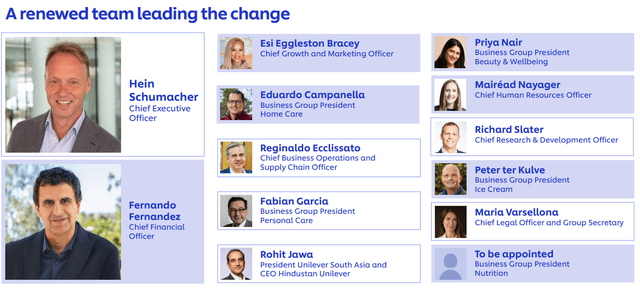

Since Hein Schumacher has joined UL, many positions in management have changed. Personally, I really didn’t like the management style of the former CEO Alan Jope and I was happy that things were changing. However, it must be noted that most of the people in new positions have already worked for UL.

Changes in management (Q4 and Full Year 2023 Results)

The Growth Action Plan should lead to faster growth, higher productivity, and a less complex business. At the moment UL is surely taking actions to make the business mean and lean. On the 19th of March the company has announced its plans to spin off its ice cream division. There is no clarity yet about the process, but from this news item it seems that UL is talking with various banks about possible private equity interest.

From an investment point of view, I like this decision. Because ice creams were more of a standalone segment compared to their others. The ice cream segment also lagged far behind when it comes to operating margins.

Margins ice cream segment (annual report 2023)

Especially, if we compare this to personal care (20.2%) and beauty & wellbeing (18.7%) in FY 2023, this is a lot less profitable.

UL is also going to launch a productivity programme. This is what the company itself says about it:

Building on the early momentum of GAP we have identified additional efficiencies that can now be accelerated. In addition to the portfolio changes, Unilever intends to launch a comprehensive productivity programme, driving focus and faster growth through a leaner and more accountable organisation, enabled by investment in technology.

According to company estimates, this programme should lead to €800 million in cost savings over the next three years. This should more than offset estimated operational dis-synergies from the separation of the ice cream business segment. The investment in technology is still a bit vague for me, but it seems clear to me that approximately 7500 office-related jobs will be cut. The positive thing about this is likely that it gives Unilever more flexibility to invest in growth.

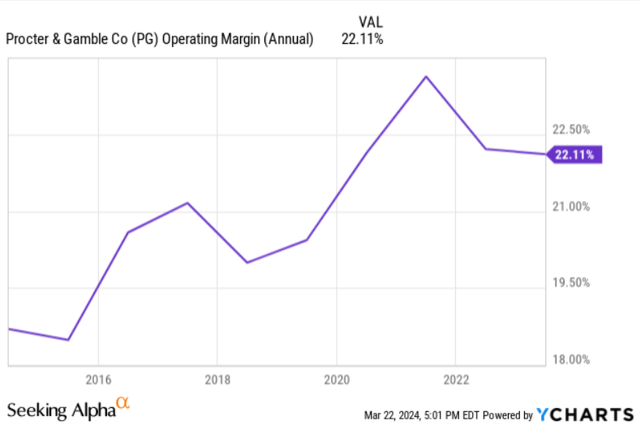

I wouldn’t be surprised if this action is fully supported by Nelson Pelz, because similar actions happened after he joined the board of PG in 2017.

Margin improvement PG (YCharts)

So, if things are going to be the same for UL, we can expect some further portfolio streamlining and cost cutting in the future to increase margins.

Capital allocation

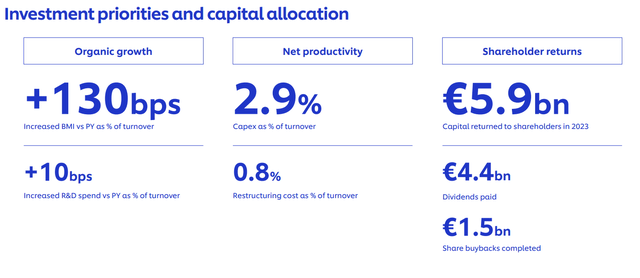

The growth action plan also has impact on the capital allocation strategy of the business.

Capital allocation priorities (Q4 and Full Year 2023 Results)

Since growth is their priority, UL is going to invest more in brand & marketing and R&D. They are going to focus on their power brands, which I think is a wise thing to do.

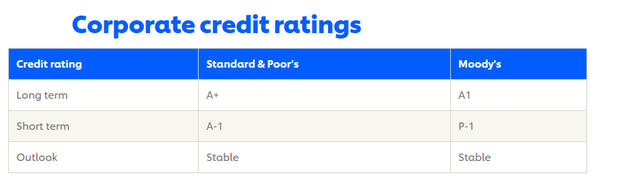

When it comes to their balance sheet, UL is trying to maintain their net debt/EBITDA radio around 2x, so this will be in line with their current debt profile of 2.1x. This is fine in my opinion and UL has also an excellent credit rating.

UL credit ratings (UL investor relations)

As stated in their FY 2024 outlook, a share buyback program of €1.5 billion has been announced. With a market cap of around €122 billion this will be 1.2% of total share count. Add this to a dividend of 3.7% and were talking about a total shareholder yield of almost 5%.

UL is a very consistent dividend payer. The company has started paying a dividend in 1929 and from that moment in time, they continued to do so. Only during the second world war UL wasn’t been able to pay a dividend.

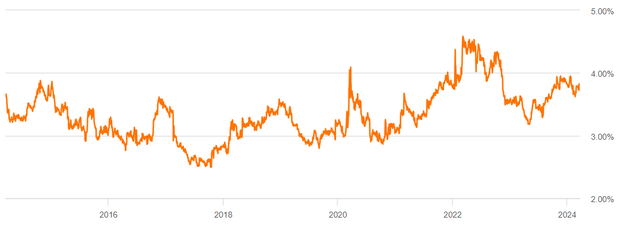

At the moment the company has a dividend yield of 3.7%, which is a lot higher compared to its sector median of 2.69%. Looking at the company’s own history it is on the high side as well.

dividend yield development (Seeking Alpha)

Unfortunately, the dividend isn’t growing anymore. Over the last years the dividend per share went nowhere and it looks like this is going to be the case for the next years as well. My first article about UL was all about the company as a dividend turnaround play, but I think that Unilever’s focus is certainly not on the dividend at the moment.

In the FY 2023 results they talk about an attractive and sustainable dividend. In other words, I don’t think UL will grow its dividend in the short-term. Given the improvement in FCF, there would certainly have been room for a dividend increase. Personally, I don’t care as much, because I am not a dividend growth purist, and if management has better alternatives to allocate capital I can understand this decision. If UL is getting more profitable in the future and their growth action plan is gaining momentum, I expect the dividend to grow again.

Valuation

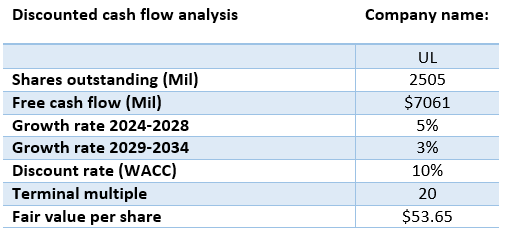

I used discounted cash flow analysis to calculate a fair value for UL. In FY 2023 the FCF of UL was almost €7.1 billion. For my calculations, I subtract the €400 million tax refund from India. The company is also going to increase its CapEx. Based on their Q4 earnings call transcript they are going to increase CapEx from 2.9% of revenue to around 3% or a bit higher. This could also impact free cash flow for a few hundred million so I have adjusted my used FCF for this. Based on these assumptions, I used an adjusted FCF of €6.5 billion ($7.061 billion).

I think a 5Y FCF growth of 5% is reasonable. UL itself is aiming for a multi-year underlying sales growth of 3-5%. If the company manages to achieve this and their margins are also improving, 5% FCF growth is in my opinion achievable. and I used a 3% growth for the 5 years thereafter, because it is more difficult to make accurate assumptions over longer periods of time.

At the moment UL has a PE of 17. I used a PE of 20 as a terminal multiple, because this is in line with UL’s historical average and I think this multiple can be justified.

Finally, I used a discount rate of 10%. This is my personal hurdle rate and the minimum annual return I demand from my investment in UL.

DCF analysis (Google spreadsheets)

If we do the math this comes down to a fair value of $53.65 per share. Compared to the current share price of $49.99 it looks 7.3% undervalued right now.

Conclusion

Given the latest business results and recent actions from management, I am getting a bit more positive about UL. I already had a BUY rating for the company, but given the improvement of the underlying fundamentals, the risk reward has become better.

For the dividend growth investor purists out there, dividend aristocrat like growth still seems far away, but if the growth action plan bears fruit, I expect dividend growth again. The improvement in FCF in FY 2023 does give management room to invest more into further growth and it is better not to distribute everything to the shareholder.

There are certainly investment risks for UL. The company has often made plans to give their business a positive twist but has also failed several times. The first actions of the new management are in my opinion wise, but it’s just the beginning and a lot of work needs to be done. Despite the fact that there appears to be an upward trend in volume growth, it is still too variable to speak of a structural improvement. It will probably take years for the plans to take full effect. Schumacher indicated in the last earnings call that he expects an initial impact in the second half of 2024.

I also think that with the current valuation things don’t have to be perfect. I expect UL to be a good addition to a diversified dividend portfolio, with a nice starting yield of 3.7%, combined with share buybacks and possible share price appreciation.

Since it is a turnaround play, I will provide an update after the future half-year numbers.

Happy investing everyone.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here