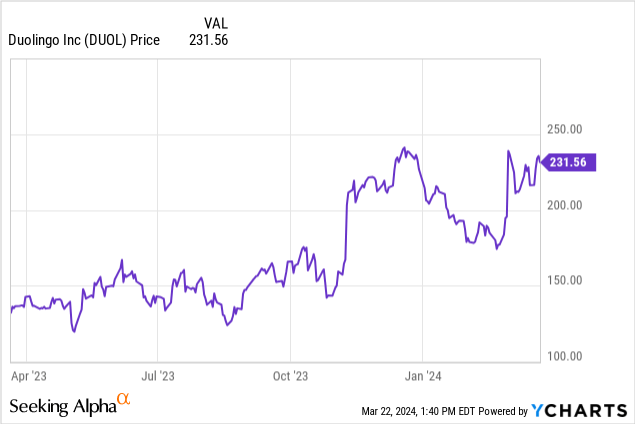

So far over the past year, the majority of the big rallies in the tech sector have been in the enterprise segment. Duolingo (NASDAQ:DUOL), meanwhile, has been a massive outlier amid consumer technology products that has managed to stoke impressive investor enthusiasm driven by its aggressive product portfolio expansion and strong bookings rates.

The language-learning app has seen its share price pop more than 70% over the past year; and enthusiasm in this trade renewed in late February when the company released strong Q4 results that showed an acceleration in bookings trends.

We can’t argue with terrific performance, but be mindful of price

I last wrote a bearish note on Duolingo in November, when the stock was trading closer to the $200 range. It was, admittedly, too early of a bearish call, as I had not expected the company to continue seeing accelerating results into Q4 (as well as report robust trends in the early part of Q1). Owing to this strong performance, I’m upping my viewpoint on Duolingo to neutral.

Now, full disclosure here: I’ve been a paid Duolingo user for several years, having used the platform to brush up on and teach myself two languages. I’m a big fan of the product and the way that Duolingo has revised its learning tracks to make language progression feel more natural (and make the experience nearly as enjoyable as a game). I do see a number of positives in this stock:

- Large global TAM of language learners. The company cites that there are 2 billion people in the world learning new languages. Duolingo has already proven itself as one of the most intuitive, enjoyable platforms to use for daily learning.

- Multiple routes to monetization. Duolingo generates the majority of its revenue from subscription fees. It also has an upgraded version of its “Super Duolingo” plan now called “Duolingo Max” which unlocks certain AI-powered features (another major reason why Wall Street has rallied behind this stock recently). On top of its subscription base, however, Duolingo also generates revenue from advertising, language certification tests, and a smattering of in-app purchases (mainly for non-premium users to refresh their “lives” to continue learning).

- Great growth versus profitability balance. The company’s operating expenses have barely grown despite aggressive top-line growth, yielding fantastic margin results.

So why then the pessimism amid such amazing fundamentals? Duolingo experienced a major growth spurt in 2023, but we can’t expect that growth to continue forever; and the company is expecting bookings growth to decelerate roughly 20 points in 2024. Writing in the Q4 shareholder letter, CEO Luis Von Ahn noted as follows:

2023 was an exceptional year, and yet even on that strong base we expect user growth to moderate only slightly in 2024. As we’ve said for several quarters, we can’t expect our user growth to accelerate forever. This makes sense given how rapidly we’ve grown over the past couple of years, going from about 10 million DAUs in Q4 2021 to nearly 27 million in Q4 2023. So far in Q1 2024, our YoY DAU growth is closer to the mid-50s than the 60%+ it was throughout 2023.”

Too much optimism for continued growth in the 40-50% range is priced into the stock at current levels, at least in my opinion. At current share prices near $230, Duolingo trades at a market cap of $9.93 billion. After we net off the $747.6 million of cash on the company’s most recent balance sheet, Duolingo’s resulting enterprise value is $9.18 billion.

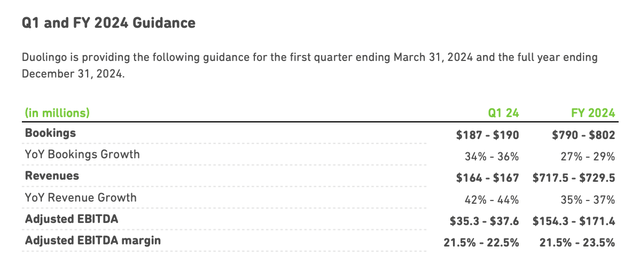

Meanwhile, for the current fiscal year, Duolingo has guided to $717.5-$729.5 million in revenue, or 35-37% y/y growth. Importantly, the company is expecting bookings growth to slow to the high 20s, from a 51% y/y growth rate in Q4. Note as well that its adjusted EBITDA range of 21.5%-23.5% implies no improvement from Q4’s 23.3% margin, despite the fact that there is little seasonality in Duolingo’s business:

Duolingo outlook (Duolingo Q4 shareholder letter)

This puts Duolingo’s valuation multiples at:

- 12.7x EV/FY24 revenue

- 56.3x EV/FY24 adjusted EBITDA

In my view, it’s difficult to believe in further upside when A) Duolingo is on a decelerating trajectory that may prove deflating to bulls, and B) its valuation leaves very little room for upward multiples expansion, especially in the absence of accelerating growth rates.

I’d continue to emphasize caution here and invest elsewhere.

Q4 download

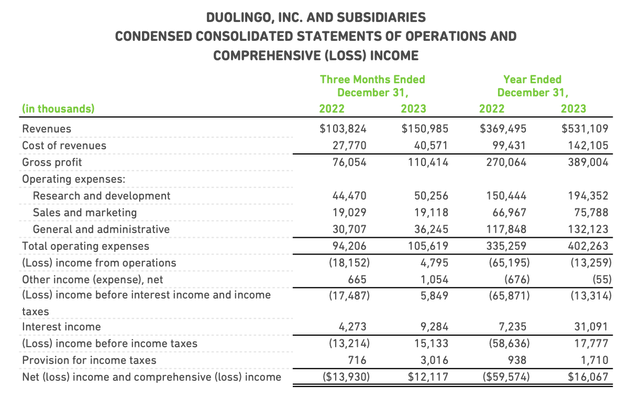

Let’s now go through Duolingo’s latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Duolingo Q4 results (Duolingo Q4 shareholder letter)

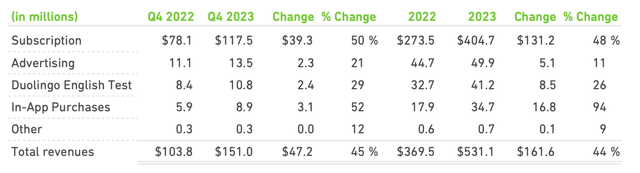

Duolingo’s revenue grew 45% y/y to $151.0 million, slightly ahead of Wall Street’s expectations of $148.4 million (+43% y/y) and accelerating as well over Q3’s 43% y/y growth pace. Bookings of $191.0 million also strongly outpaced revenue and grew 51% y/y, and also accelerated versus 49% y/y growth in Q3 – reflecting the strength of longer-term subscription plans and in-app purchases. It’s important to note that Duolingo expects this trend to reverse in FY24, where bookings growth slows down relative to revenue growth: reflecting the fact that Duolingo “loaded up” on new annual plan subscribers in FY23, which will get full revenue recognition next year.

The chart below shows the breakout of Duolingo’s revenue drivers. Subscription continues to be the dominant force behind the company’s growth, up 50% y/y to $117.5 million, or more than three-quarters of total revenue:

Duolingo revenue breakdown (Duolingo Q4 shareholder letter)

The company is continuing to expect strong free-to-paid conversion in FY24; in addition, attach rates of the company’s family plan (on which users have the ability to add up to 6 total members, and will save money as soon as 2 users take advantage of the plan) will continue to improve. Per Luis Von Ahn’s remarks on the Q4 earnings call:

For the full year 2024, we expect strong top line performance from rapid user growth and continued improvements in free-to-pay conversion. As an example of the work we’re doing around conversion and monetization this year, we’re experimenting with ways to help free users select the best subscription plan for them. We will test different names, appearances and packages to help users choose between our Free, Super and Max subscription tiers.

We’re also putting more resources behind our family plan, which has higher retention and increases our platform LTV. Today our family plan has grown to about 18% of our subscriber base. And this year we started a dedicated family plan team who will look to capitalize on its organic momentum.”

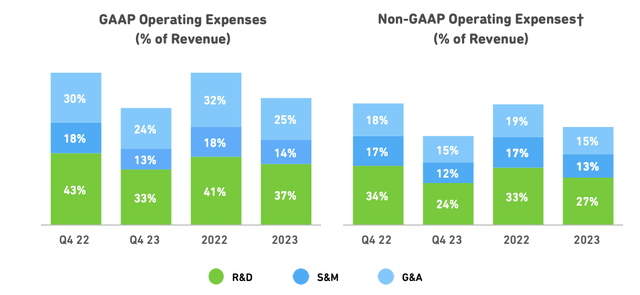

And from a profitability perspective, Duolingo managed to reduce all categories of its operating expenses as a percentage of revenue; opex in nominal dollars grew only 12% y/y relative to 45% y/y revenue growth in Q4:

Duolingo opex trends (Duolingo Q4 shareholder letter)

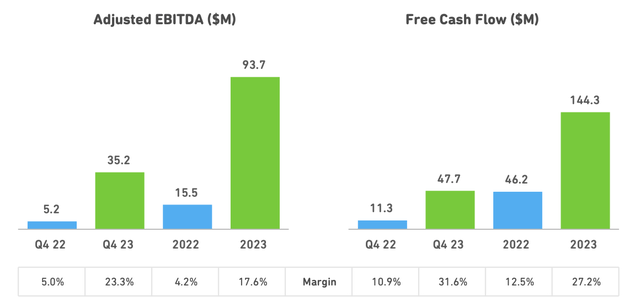

This has allowed for tremendous operating leverage, with adjusted EBITDA margins hitting 23.3% in the fourth quarter, an eighteen point y/y improvement:

Duolingo profitability (Duolingo Q4 shareholder letter)

Key takeaways

There’s no doubt that Duolingo continues to expand aggressively and capitalize on significant product platform improvements to drive incredible new subscriber conversions. At the same time, however, valuation multiples look incredibly frothy, so I’d err on the side of caution.

Read the full article here