International Paper Company (NYSE:IP) shows a 4.7% dividend yield and recent recommendations from investment banks. IP appears to be making significant transformations that include sale of assets and restructuring, which could accelerate with the recently elected CEO. In addition, I think that further repurchases of its own shares and reduction in the share count could bring significant demand for the stock. I did see some risks from failed reduction in the debt/EBITDA level, supply chain issues, or failed restructuring efforts. With that, I do believe that the company appears cheap at 8x EBITDA.

International Paper Company

International Paper Company has its own manufacturing capabilities across different continents, and is oriented towards the production of packaging and pulp products in general. It stands out for having production made from renewable fiber-based materials.

As per annual report, by the end of 2023, the company’s assets consisted of 23 packaging plants, 162 conversion plants, and 16 plants dedicated to materials recycling. In addition, through the use of renewable products, International Paper Company also manages a distribution business through six brands in the Asian continent.

The company’s activities are distributed in two segments, one that responds to the manufacturing of packages on an industrial scale and another that responds to the business from cellulose fibers, which currently represents a smaller percentage for the company, but it is expected to be the engine of growth in the long term taking into account the trends towards the reduction in environmental pollution and the regulations in national and international markets that exist.

The first of these segments has manufacturing positions in Europe and the Middle East in addition to the presence in the United States. If we count the amount of production only within the local area, we would be talking about approximately 13 Million tons per year. In turn, due to the magnitude of the operations in each of these continents, the segment activities are divided between those carried out in the United States and those carried out between Europe and the Middle East.

On the other hand, the segment oriented towards cellulose fibers maintains distribution of its products internationally, although it has production facilities only in the United States and Canada. It is estimated that the annual production of this segment is 3 million cubic tons of fiber pulp that is subsequently used to make other products.

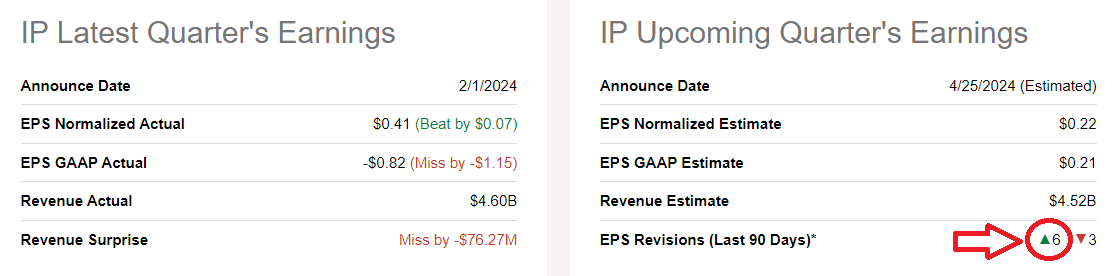

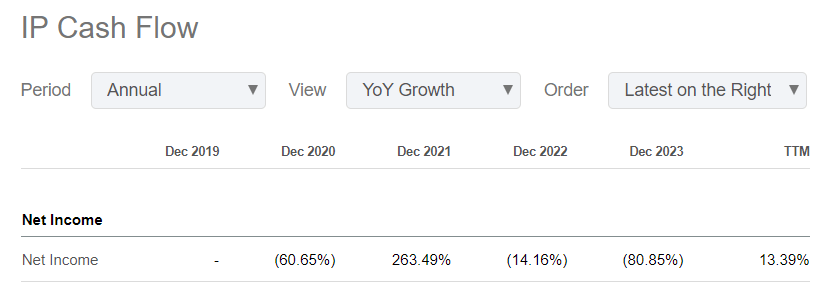

The recent earnings reported were lower than expected with both lower EPS GAAP and lower quarterly revenue than expected. With that, I believe that investors seem overall optimistic about the future earnings of International Paper Company. EPS revisions are expected to increase, a significant number of analysts increased their expectations for the new quarter.

Source: Seeking Alpha

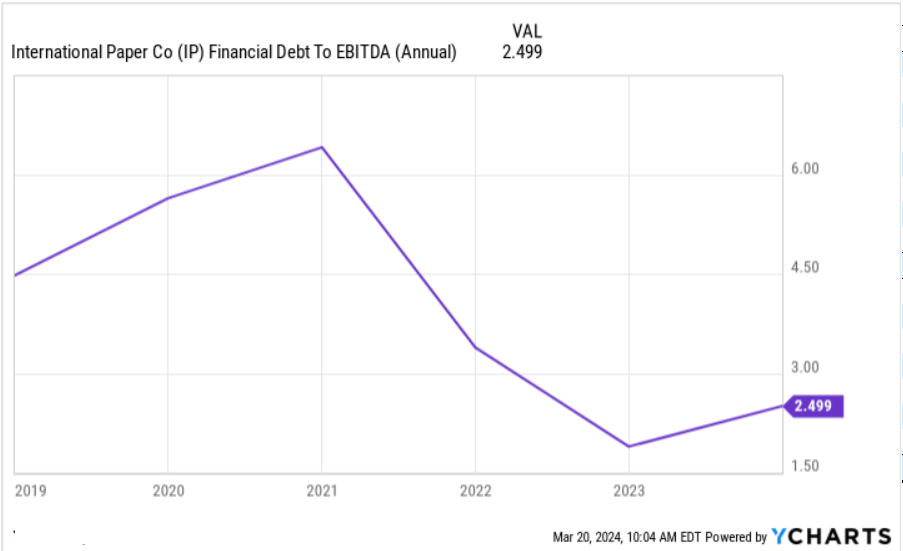

Balance Sheet: Recent Reduction In The Total Debt/EBITDA Level

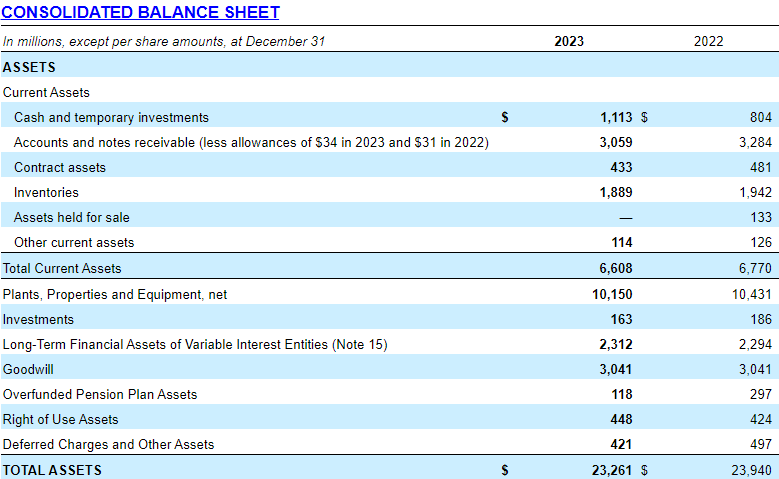

With a significant amount of cash, current assets/current liabilities larger than 1x, and an asset/liability ratio of more than 1x, I believe that International Paper Company reports a solid balance sheet. I do not believe that the company may report any liquidity issue in the coming years because of the total amount of property and equipment reported.

Source: 10-k

I do believe that investors may do good by having a close look at the total amount of debt, which is not small. The company made significant efforts to reduce the debt/EBITDA level, however I believe that further reduction in the ratio may lead to higher EV/FCF figures.

Source: Ycharts

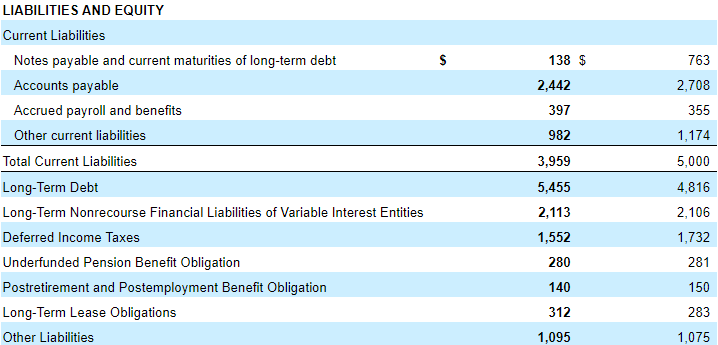

For the calculation of the net debt, I took into account the notes payable, long-term debt, and long-term non-recourse financial liabilities, but I did not include postretirement obligations.

Source: 10-k

The CEO Change Could Bring Transformation And Operating Improvements

I believe that 2024 could undoubtedly be a year of changes due to various factors, among which are the new CEO and the sale of shares of Ilim SA. There are analysts out there claiming that asset sales could accelerate. I agree. In addition, I think that the profile of the new CEO may be appreciated by shareholders, and may bring demand for the stock. We are talking about a professional with a lot of expertise in the private equity world and expertise in enhancing operating performance. International Paper Company could benefit from this know-how accumulated in other companies.

I do not think that new announcements have yet been made regarding the first measures that the new CEO will take, although it is expected that these will be aligned with the capital allocation strategy and the stabilization of the company’s credit lines.

Capex And Stock Repurchase Program Could Accelerate Demand For The Stock

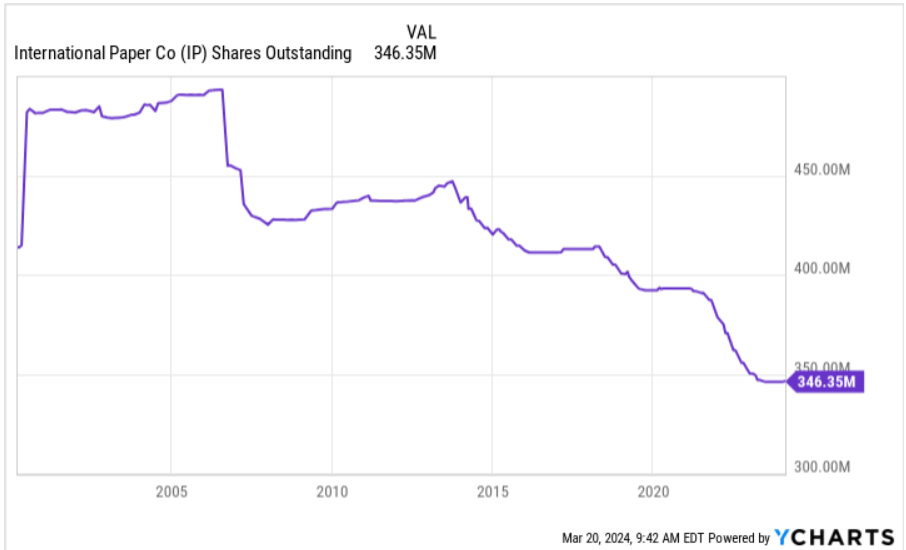

The company’s current concerns seem to be focused on capital allocation, the use of its liquidity, the levels of access to credit, and the return of payments to its shareholders. This is what the company reported in its latest annual report, where it specified that the share buyback program started in 2022 for $3 billion is still open and has no expiration date. Given the recent decline in the share count, I believe that new stock repurchases could bring demand for the stock and enhance the stock price.

Source: Ycharts

The company expects to make capital expenditures between $800 million and one billion dollars during the year 2024. This is in line with the current concerns of the company, which has suffered an uncertain international context with regard to economic activity in Europe as well as facilities, trade, and conflicts that may arise from supply and distribution chains.

With respect to our capital allocation framework, we are targeting capital expenditures of $800 million – $1.0 billion in 2024 for general maintenance, cost improvement and to enhance capabilities in our box business. As previously mentioned, we returned approximately $840 million of cash to shareowners in 2023 including approximately $640 million of dividends. Source: 10-k

In my view, if the new capital expenditures lead to lower supply chain risks or capacity increases, I would expect lower net sales growth and FCF margin growth.

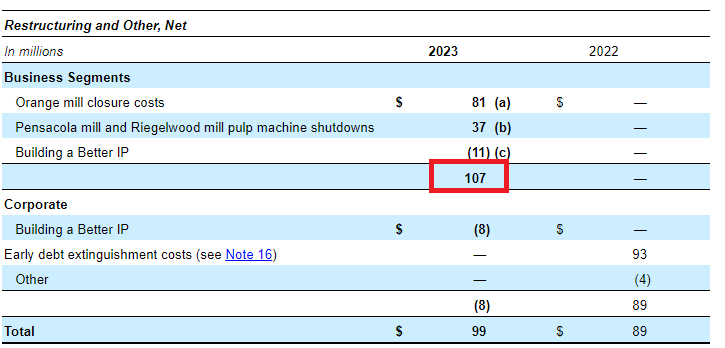

Restructuring Efforts Accelerated

International Paper Company made significant efforts that I did not see in 2022. They include mill closures, pulp machine shutdowns, and other efforts. In my view, if the efforts are successful, International Paper Company could enjoy new financial flexibility, FCF margin growth, and enhancement of the balance sheet. Management offered the following explanation in the last annual report.

International Paper continually evaluates its operations for improvement opportunities targeted to focus our portfolio on our core businesses, realign capacity to operate fewer facilities with the same revenue capability, close high cost, unprofitable facilities, and reduce costs. Source: 10-k

Source: 10-k

My Base Case Scenario Implied A Valuation Of $47 Per Share

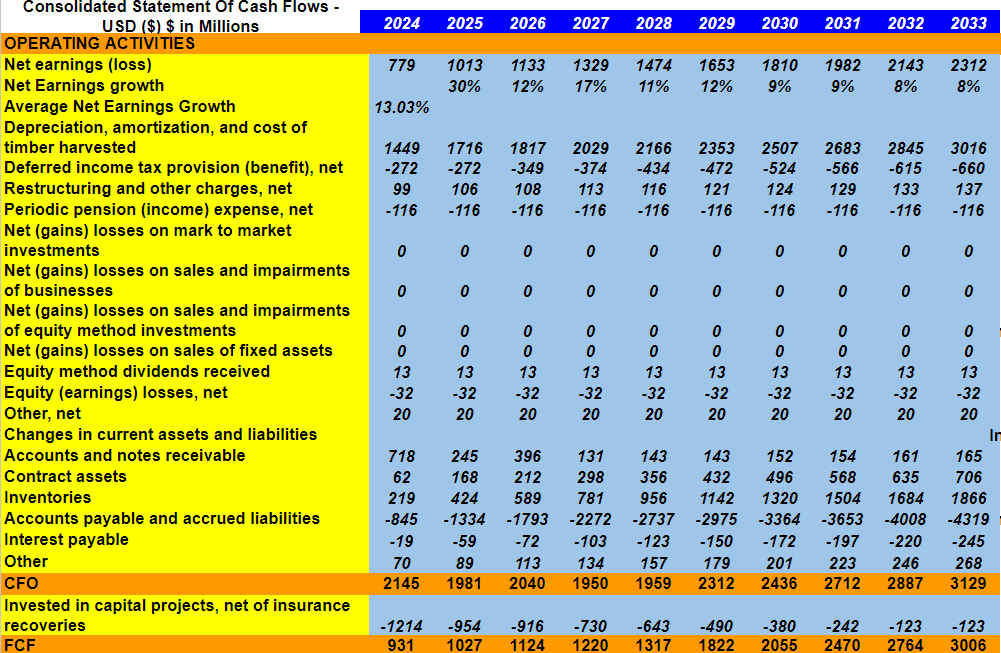

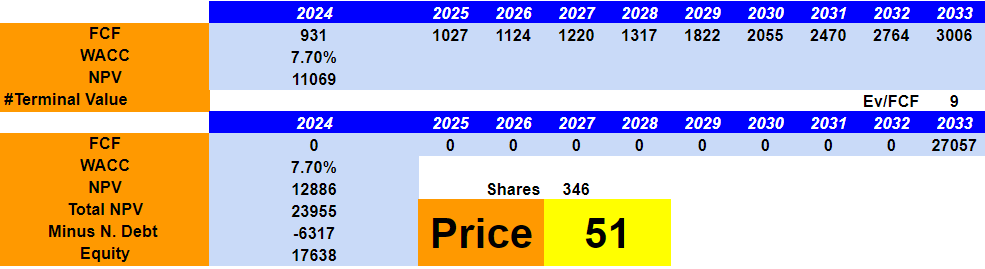

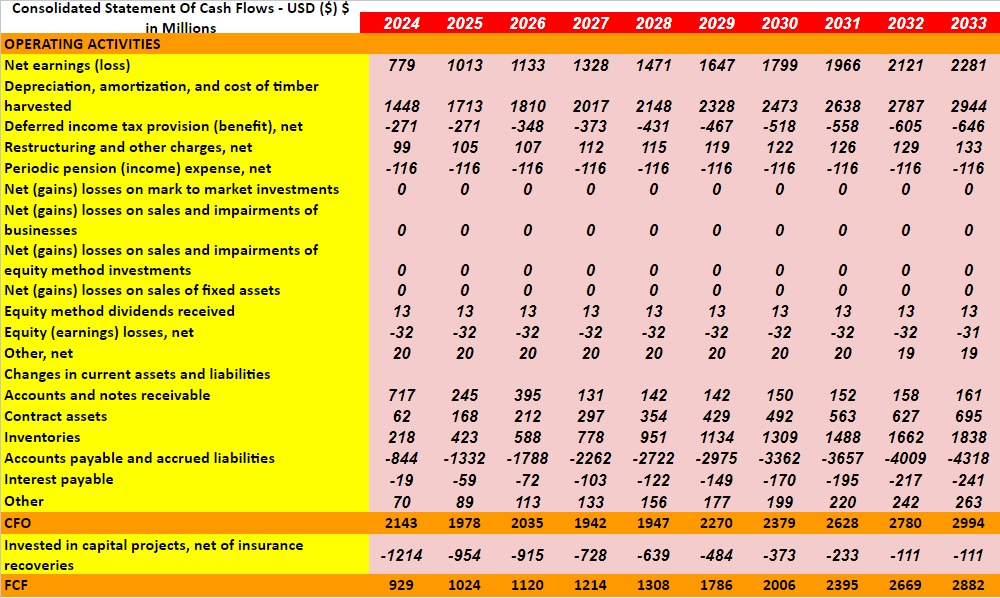

Under this case scenario, I took into account previous cash flow statements. I also assumed that the work of the CEO could bring net income growth and FCF growth. Net income growth is not very different from what I saw in previous financial statements, but I also added my own assumptions with regard to changes in working capital, capex, changes in accounts payable, and FCF growth. I believe that my figures are very conservative.

Source: Seeking Alpha

There are several items usually included in the cash flow statement that I did not include because I don’t think they are recurrent parts of the cash flow statement. I did not add losses on mark to market investments, net losses on sales and impairments of businesses, losses on sales and impairments of equity method investments, or losses on sales of fixed assets.

My numbers included net income growth so that 2033 net earnings would be close to $2311 million. In addition, with 2033 depreciation, amortization, and cost of timber harvested of close to $3015 million and deferred income tax provision of -$660 million, I also obtained restructuring and other charges of close to $136 million.

In addition, with periodic pension expenses of about -$116 million, I also assumed equity method dividends received worth $13 million and equity losses of -$33 million. Finally, with accounts and notes receivable worth $164 million, changes in contract assets of $705 million, and inventories of $1865 million, I also took into account accounts payable and accrued liabilities of -$4320 million. Finally, with interest payable of -$245 million and investments in capital projects of -$123 million, 2033 FCF would be $3006 million.

Source: CFO Expectations

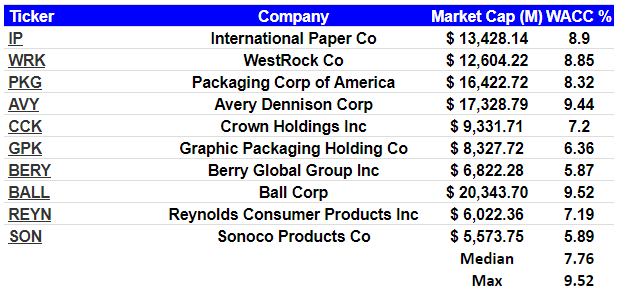

For the assessment of the cost of capital, I took a look at the WACC reported by other peers, and obtained a median WACC of about 7.7% and a maximum WACC close to 9.5%. With this in mind, I assumed a cost of capital of 7.7% in my base case scenario and 9.5% in the worst case scenario.

Source: Gurufocus

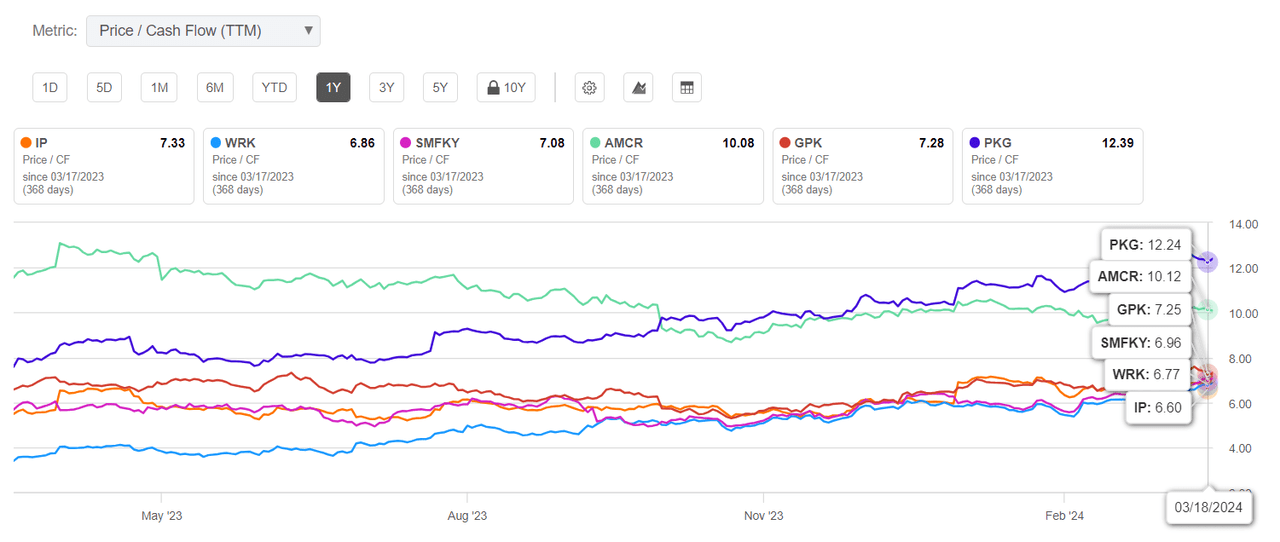

According to Seeking Alpha, peers are trading at close to 6x-12x. Hence, under my best case scenario, I used an exit multiple of 9x, whereas under my best case scenario, I assumed a multiple of 5x. I believe that these figures are very conservative.

Source: Seeking Alpha

With the previous assumptions, I obtained an implied enterprise value of $23.9 billion and an equity valuation of $17 billion. The implied price would be close to $51 per share. I do believe that there is significant upside potential in the stock price.

Source: CFO Expectations

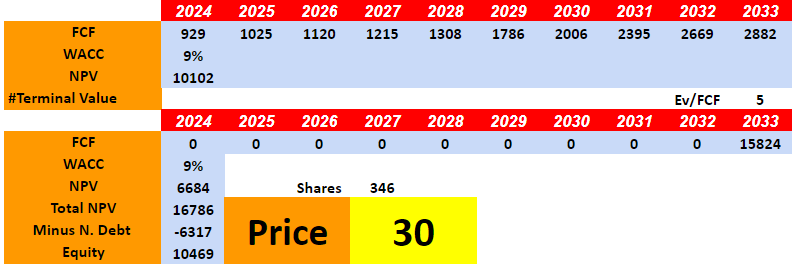

My Bearish Case Scenario Implied A Valuation Of $30 Per Share

Under my bearish case scenario, my net income expectations are a bit lower than that in the previous case scenario. Additions to net income including changes in working capital, changes in inventory, and other assets and liabilities are a bit more pessimistic than that in the previous case scenario. The numbers don’t really change a lot as compared to the previous case scenario because International Paper did not show a lot of net income volatility or FCF volatility in the past.

My assumptions led to the following figures for the year 2033. Net earnings would stand at close to $2280 million, with depreciation, amortization, and cost of timber harvested worth $2944 million, deferred income tax provision of -$647 million, restructuring and other charges of about $132 million, and periodic pension expense of about -$116 million.

I also assumed equity method dividends received of close to $12 million, with equity losses of about -$32 million and changes in accounts and notes receivable of about $161 million.

Also, with changes in contract assets of about $695 million and changes in inventories worth $1837 million, I also included changes in accounts payable and accrued liabilities of close to -$4319 million. Finally, with interest payable of about -$242 million, I obtained a CFO of $2993 million, with 2033 FCF of $2882 million.

Source: CFO Expectations

My results include a total enterprise value of $16 billion, with equity valuation of close to $10 billion and an implied stock price of about $30 per share. Given these results, I believe that there is more upside potential than downside risk in the stock price.

Source: CFO Expectations

Competitors

Competition is given by companies that offer similar products both internationally and regionally in different markets. The competition also extends in some cases to other manufacturers of products related to wood exploitation. The news of hiring of a new CEO is a key factor as he is a professional, and has accumulated a lot of expertise while working in other companies. The restructuring of the Packaging Industry is also a key factor as in recent years many companies have emerged of innovations for specific products and with special manufacturing conditions that have significantly changed the projections within the competitive environment.

Risks

From what has been analyzed here, I believe that the greatest risk, which the company experiences, is aligned with the concerns to which it is giving greater importance. This risk comes from general cost margins and the use of liquidity for the assembly of future projects such as plant improvement or product development.

Much of this is still in a potential state since it will depend on the actions that Andrew Silvernail takes upon his arrival to the leadership of the company, which will serve in principle to avoid another year of decline in sales and achieve sales growth for his company.

Conclusion

International Paper Company recently reported a new CEO coming from the private equity industry, which may accelerate the company’s business transformation. This is great news, however I believe that it is worth noting that the company was already making a lot of efforts in 2023 and 2022 with restructuring initiatives and sale of shares of Ilim SA, which may have a positive effect on future FCF growth. In my view, if the new announcement to sell securities is also successful, and there is sufficient demand for the stock, the stock price may go higher. There are some risks from the total amount of debt, failed restructuring efforts, or supply chain issues, however the company appears quite undervalued at 7x-8x cash flow.

Read the full article here