Dear readers/followers,

In the past few months, about half a year, I’ve been pushing money to work in a new undervalued sector of the market – that sector being the utilities sector, specifically US utilities that show undervaluation. European utilities, such as Enel (OTCPK:ENLAY) have shown significant undervaluation for quite some time – but that is now also the case with their American counterparts. This undervaluation has now also become quite pronounced over the past few months. The company which I am going to review here has in fact dropped over 20% for the past year.

There are reasons for this. We’ll go through them here. But I want to make it clear that I have been investing more capital into companies like Black Hills (BKH), Ugi Corp (UGI), Evergy (EVRG) and other utilities – even bought back some Fortum (OTCPK:FOJCF) at below €11/share.

Utilities and cheap, qualitative telecommunication stocks continue to make up a solid portion of my investment portfolio – because while I do invest a fair amount of money into “riskier” plays, the absolute majority of my investment capital goes into very conservative and risk-adjusted dividend stocks with 10-17% annualized upside with a solid dividend.

In this article we’ll look at Northwest Natural (NYSE:NWN).

Northwest Natural – Why this is a great utility to invest in

Utilities are interesting companies. I have been covering them since I started writing on Seeking Alpha many years ago, and I continue to make them a substantial part of my coverage.

This particular business is not in fact a huge one. Northwest Natural, or NWN, is an A+ rated (the first positive) company with a sub-50% Long-term debt (the second positive) in its fundamentals, and a dividend yield of over 5.4% (the third positive) that is covered with a very conservative payout (the fifth positive).

So already going into this business, you can see that there are plenty of things to like about Northwest Natural.

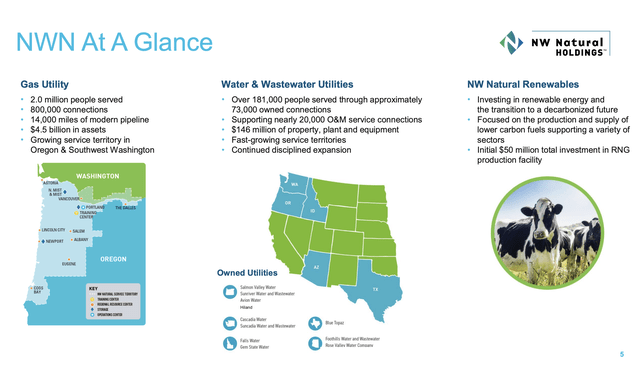

NWN is categorized as a gas utility. As a company, it serves 2 million people with 800k connections, managing 140k miles of pipelines.

Where exactly does the company do this?

Mostly in the Oregon and Southwestern Washington state areas.

But this is not all the company does.

Northwest Natural IR (Northwest Natural IR)

The company also owns substantial assets in Water & Wastewater, with as you can see, hundreds of thousands of customers across an even larger geography – and much like other water companies, this business is growing these service areas with the acquisition of new businesses where this is possible, adding inorganic growth to its profile.

So – a very interesting mix of gas and water.

I mean, the company also does have a renewable arm, as you can see with the natural renewables segment – but at a $50M investment this is so small that I don’t believe it is more than worth mentioning. So that out of the way, let’s move on.

Being a water and gas company, NWN is subject to very stable margins in the water sector, with somewhat more volatility in the gas utility sector. In gas, the main effects are weather, decoupling, and environmental costs as well as recovery mechanisms and the automatic adjustment clauses for renewable gas in some states, like Oregon. The company views its relationship with the operating regulators as constructive, and over the past few periods has mostly managed to get its wishes and demands through in a good way.

This is extremely regulated as a business, and while water is still small in terms of revenues (only 5% as of yet), the customer profile is very attractive, with most of the customers (over 60%) residential.

Like many of the companies in the residential space, NWN targets an annual rate of EPS growth between 4-6% – mid-single digit. It’s also something that many of these companies don’t have an issue managing, which also gives them the ability to pay a growing and attractive dividend.

NWN grows, as I would say, slower than the average, with less than 1%. This is a combination of inorganic additions through the water segment at a slow rate, as well as operating in areas that aren’t necessarily among the most attractive in the US to live in. We’re not talking about Texas or Florida, we’re talking about Oregon and Washington.

The company has a going capital plan of between $1.4-$1.6B which doesn’t sound like much compared to something like Enel, but is much when you consider that the company doesn’t have a market cap above 1.4B USD.

Most of the company’s investments are earmarked for investing in new Meters for gas, facilities for Gas, safety and reliability for the gas network, and regulated RNG investments. Only a small amount for the next few years is estimated to be put into the water segment.

In terms of its capital situation, NWN has access to over half a billion dollars, which explains its A+ rating, with the senior unsecured debt even at an AA-/A2 rating.

NWN has a history of 165 years of service. It’s the largest distribution company in all of the Pacific Northwest, and it has good customer satisfaction scores (Source: J.D power).

The business model for a utility like this is incredibly resilient. Headwinds from the overall levels of interest rates are sort of over at this time, with the lows coming last year and last summer.

The primary challenges to this utility come in two forms, as I see it. First, the company isn’t growing as fast as it has. It’s in fact slowing further, with only sub-1% growth rates, and the company is clearly communicating that this is in part because of a population decline. This is never a positive. Secondly, it’s infrastructure CapEx and hardening expenses are coming out of a slower-growing rate base, which has necessitated tapping debt. The company isn’t massively highly leveraged, but it’s more indebted now than it was in the past. To that we need to consider risks like weather and such things – but these are things that affect every utility, not just NWN (even if NWN’s operating areas might see warmer weather).

Investing in utilities has for the longest time not been a very popular sort of avenue. The reasoning has been solid – easier growth and income have been available, and valuations were somewhat stretched given what was available. That is no longer the case with the companies trading down, and NWN is one of them.

As things stand though, I consider NWN to be a company with a low valuation and a good upside for the longer term at this price, and I’ll show you why here.

Why Northwest Natural makes for an appealing investment here.

To be clear, I view it as a potential investment in a basket of utility stocks where I am already at full exposure to companies like Enel and Fortum. If I wasn’t, I would probably buy more of those companies. This is because I always compare businesses to one another as investments.

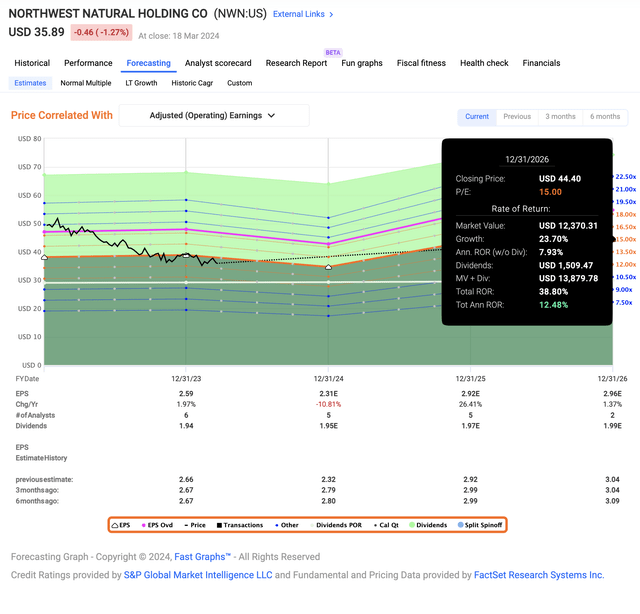

Conservatively speaking, I would say that NWN has an upside of around 12.5-15% per year, which is good, but not great (but excellent given the safety of the company).

Now, what makes me say this, and give these targets?

My estimates are always a mix of my own estimates, which in turn are based on a mix of sector-average growth, company forecasts and historical growth patterns for the business, along with my own assumptions. Now, this company has historically always, with a 20% MoE, hit its targets 100% of the time for the past 10 years or so. However, given the environmental and demographic factors of the area, I would assume that the customer growth rate is going to hover at or about the 1% level, which doesn’t lead me to believe that this company should trade much above a 15x P/E baseline. This is below the company’s 5-year and longer-term averages, where the company has managed to trade at between 20x P/E, a significant premium.

If these forecasts hold, then you should expect around 12.5% annualized RoR at a 15x P/E based on how things look now. This is a fair expectation and a conservative one. It would take very low multiples – below 10x, for you to lose money here – so I view that as unlikely for the longer term.

F.A.S.T graphs NWN Upside (F.A.S.T Graphs)

A more bullish case for the company would include estimating at about 16-17x – a good midpoint here is the 16.5x estimate, which comes to an annualized rate of return of 16.5% – above the market by a decent margin if you look at normalized market returns.

I would not estimate the company at any higher multiple than this. This is due to the fairly negative growth estimates, which even the factor grades at Seeking Alpha have rated a D-. Valuation and safety is the key here. The company’s dividend comes at a forward payout ratio of less than 75%, and while the company’s DGR on a 5-year basis has been abysmal at 0.52% per year, the company is closing on the 25th year of consecutive dividend growth. Also, at that yield, I don’t believe you can do a lot of “wrong” things here.

I rate the company an attractive investment if your other utility investments which are “better” are full – which mine currently are. I say that a 16.5% annualized RoR is very good, and something I am willing to put money into here. I say the company is worth at least $44/share, or around a 15x forward P/E considering 2026E growth and valuation estimates. This is above analysts’ estimate. 5 analysts from S&P Global (Source: S&P Global) have the company at a range starting at $36 on the low side to $61 on the high side, with an average of $42.6, making it an upside of around 18.7% at this particular time with the company’s share price at $36.37.

The main risk to the thesis as this stands is the company’s sub-par growth rate and weather effects. However, at below $40/share, I believe these risks are even excessively discounted, and I am ready to invest in this company here and make it part of my “basket” of utility investments that generate above-risk-free rate income for me.

Here is my introductory thesis for the business.

Thesis

- NWN is a regulated gas/water business with a very good valuation. The company offers A+ safety, with a solid 5.4%+ yield. This company offers a very solid upside of over 15% even at a conservative estimate, meaning an estimate well below the valuation of this company’s 20-year average.

- I’m a frequent investor in utility stocks, looking for new stocks to add to my utility portfolio – and this company is one I’ve had my eye on for some time. I did not consider it appealing above $45/share, but I do consider the company attractive at below $40/share.

- I give the company a conservative long-term PT of $44/share and rate the company a “BUY” for the first time here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Read the full article here