Written by Nick Ackerman.

For some background on this monthly publication, here is my view on dividend growth stocks:

Dividend growth stocks aren’t always the most exciting investments out there. They often aren’t grabbing the headlines, and they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. Trust me. There are yield traps out there – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all returned back into your pocket from that point forward.

All of this being said, it is important to understand my approach to dividend stocks and why screening dividend stocks can be important for income investors. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors, but earnings payout ratios, debt and free cash flow are among these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue, and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support possible dividend growth. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising yearly, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 399 stocks at this time from the 406 listed last month. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more. I then sorted the list by forward dividend yield, from highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

I will share the top 25 that showed up as of 03/03/2024.

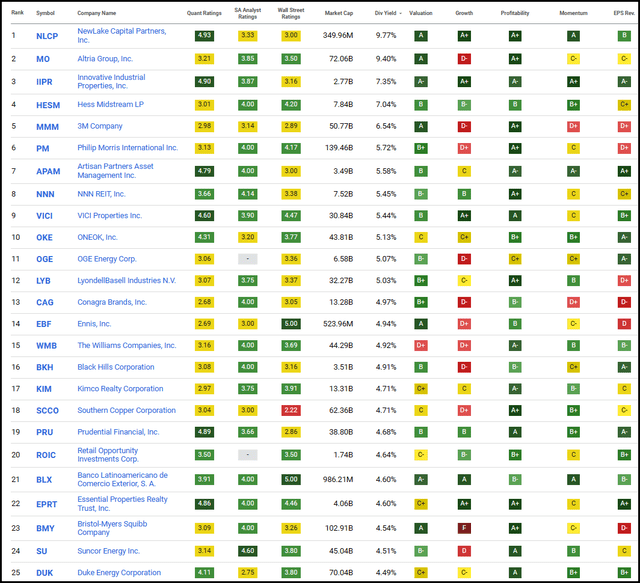

Top 25 Screening (Seeking Alpha)

The names recently covered in the last couple of months include NewLake Capital Partners (OTCQX:NLCP) and Innovative Industrial Properties (IIPR), so we will skip over those for this month.

With that, today we’ll be giving a look at Altria (MO), Hess Midstream (HESM), 3M (MMM), Philip Morris (PM) and NNN REIT (NNN).

Altria Group 9.59% Yield

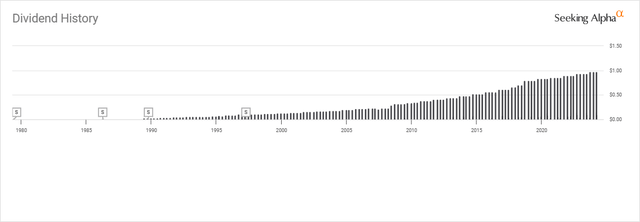

MO is a regular for this article, as we covered it just last December and many times before that as well. This is thanks to the strong yield that the company pays out to its investors and the dedication it is making to growing that yield as well. This company is a dividend king with over 50 years of consecutive dividend growth under its belt.

MO Dividend History (Seeking Alpha)

With a dividend payout ratio of around 77% based on the latest $3.92 annualized dividend and an estimated $5.05 in earnings for 2024, the payout ratio does look high. That said, this is actually quite normal for the company over the last decade, and it doesn’t suggest that it looks elevated at all. Analysts estimate that earnings should grow between 2 and 4.5% over the next four years, which suggests that dividend growth could continue without having to increase the payout ratio.

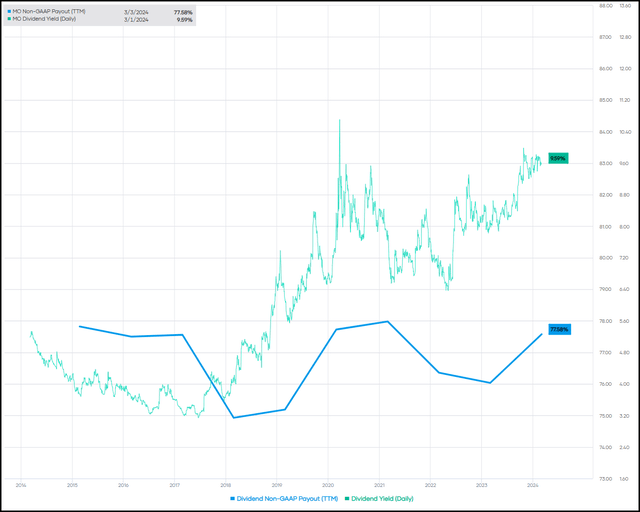

MO Dividend Yield Vs. Payout (Portfolio Insight)

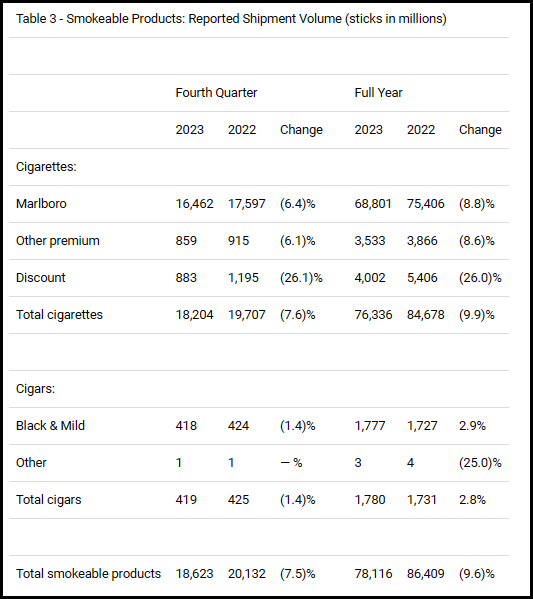

Of course, the biggest risk here is people quitting smoking without Altria really having any other plan that has worked to replace traditional cigarettes. Declining cigarette shipments showed up once again in the latest earnings report.

For the full-year results, total cigarette sales fell 7.6% in Q4 and 9.9% in 2023 from 2022. The declines were in all their categories. In fact, it was even worse for their discount category, but Marlboro didn’t fare well either.

MO Shipment Volume (Altria)

The company has experienced revenue and earnings growth due to increasing prices. As a shareholder, I really don’t see that as a long-term viable path forward. So, they don’t appear to be in too much trouble with the dividend yet, but they will eventually need another product to work out for them.

Hess Midstream 7.32% Yield

HESM is another name that makes its way on our monthly article on occasion. Though it has been a little while, with the last time we touched on this name was last October.

HESM is a midstream C-corp for tax purposes, so they will have a 1099 reporting and no K-1, which some investors prefer. The company describes itself as a “fee-based, growth-oriented midstream company that owns, operates, and develops a diverse set of midstream assets to provide services to Hess and third-party customers.”

With Hess Corporation (HES) looking to be taken over by Chevron (CVX), HESM’s main customer is looking like it will be set to be Chevron. Of course, that isn’t guaranteed to happen. Exxon Mobil (XOM) seems to be putting up a roadblock to the deal but Hess is confident the deal can still get done with CVX.

In their earnings call, they noted that CVX is expected to then also acquire Hess’s ownership in HESM and be able to appoint board members.

Hess midstream expects upon consummation of the proposed transaction, Chevron will acquire Hess’s 37.8% ownership in Hess midstream, including its right to appoint four directors to the board of Hess midstream. Hess midstream’s contract structure remains in place.

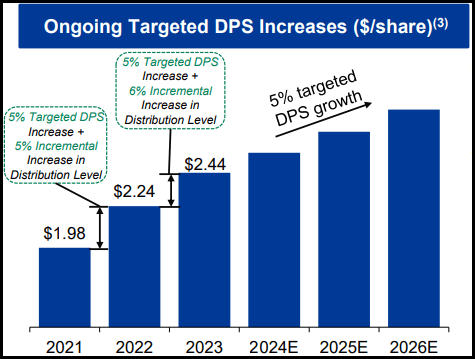

Given that the contracts are also in place, it would seem like this move is rather neutral for HESM and more like “business as usual” can continue. That should further keep them on target to continue growing their distribution to investors. This is a company that has been growing its payout every quarter, and it has a targeted DPS growth of 5% through 2026.

HESM DPS Increase Targets (Hess Midstream)

This growth isn’t just supported by hopes and dreams either. They note that they expect free cash flow growth of greater than 10% in each of 2025 and 2026 to help support that distribution growth while leaving cash for CAPEX.

3M 6.58% Yield

MMM is another dividend king to make the list this month. This name hasn’t been a frequent one that we touch on, but this is now the second time it has come up. The first was last September.

The company is looking to spin off its healthcare division, named Solventum, on April 1, 2024. MMM will retain some ownership over the company with a 19.9% stake, but this is going to be a sizeable portion of its business being spun off as an independent company. In Q4, the healthcare business was around 26.5% of the company’s adjusted net sales, with the operating income similarly around a 23% portion of the business.

For that, we could roughly see a 25% adjustment to the dividend. They even increased their dividend right on schedule to keep the dividend king status recently. However, I also believe the company will take this time to make an even larger cut to the dividend.

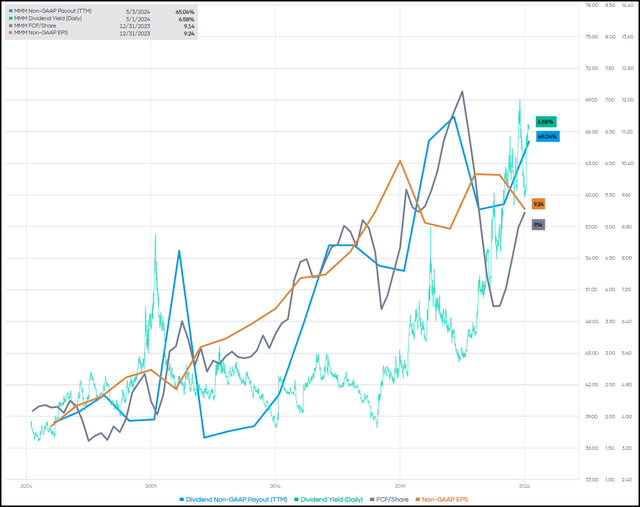

The problem isn’t just the spinoff but the litigation this company has been having to deal with. Its payout ratio isn’t necessarily absurd at this time, but it has been trending higher over the last 20 years as earnings haven’t been keeping up with the increases. Earnings and free cash flow have been moving sideways, but they kept increasing the dividend. At some point, one or the other would have to give way: the company would need to see earnings growth, or the dividend becomes even harder to sustain.

MMM Dividend Payout And Dividend Yield (Portfolio Insight)

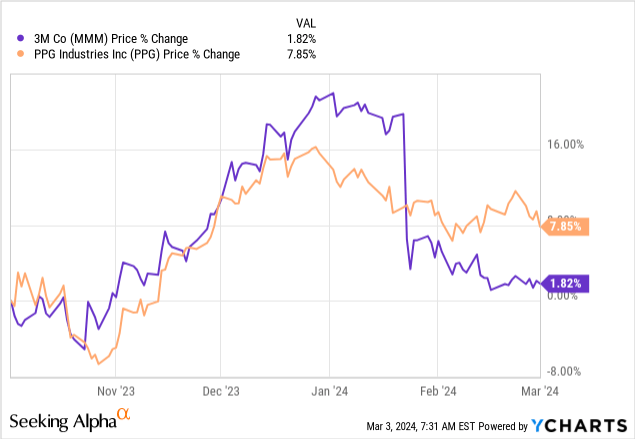

Only time will tell. I continue to hold my MMM position, but I reduced it last year. I swapped out the position in favor of adding a different dividend king, which was PPG Industries (PPG). Since that time, PPG has performed better in terms of share price, but it did take MMM’s post-earnings plunge to get it there.

YCharts

Perhaps I swapped at the wrong time, just when MMM was on the mend, but my goal is to generate growing cash flow over time. I feel the total returns will work themselves out in the end. With that, I just didn’t feel so comfortable with MMM being able to maintain its dividend going forward. While PPG is also a cyclical company, they are on firmer footing on the dividend front, in my opinion.

Philip Morris International 5.79% Yield

Interestingly, but perhaps not surprisingly, we see PM show up again this month along with MO, which we touched on above. Similar to MO, we also touched on PM last December, as this is another name that has been delivering a solid and growing yield.

It doesn’t quite have 50+ years of dividend growth itself, but that’s because the company was spun out of Altria in 2008. Though some still count the former companies’ dividend streak if the spin-off keeps up with the increases.

PM has been able to do that, delivering regular dividend growth, but it continues to face the same headwinds that MO does in declining smoking rates.

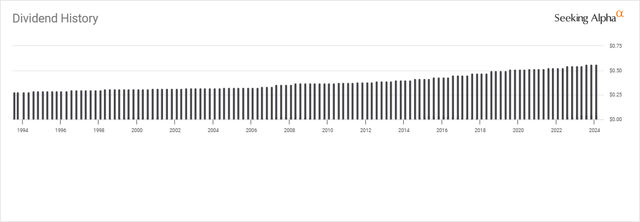

PM Dividend History (Seeking Alpha)

With PM’s international business, they’ve been able to keep the business a bit more stable. Earnings growth for PM is expected to outpace MO by a rather large factor, seeing earnings growth between 6.5% and 9.6% over the next four years.

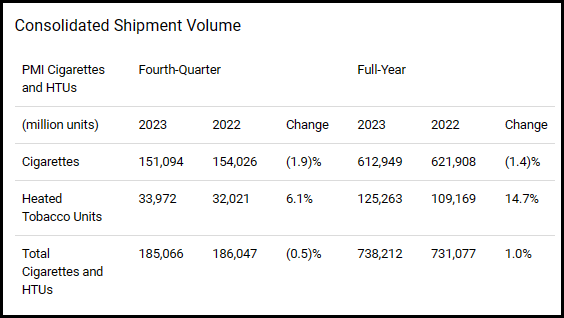

Cigarette volume was only slightly down for the company in Q4 and the full year, holding up significantly better than MO. They’ve also seen significant growth in shipment volume for their heated tobacco product. That growth was enough to offset the declines in cigarette shipments and increase the company’s total shipment volume.

PM Shipment Volume (Philip Morris)

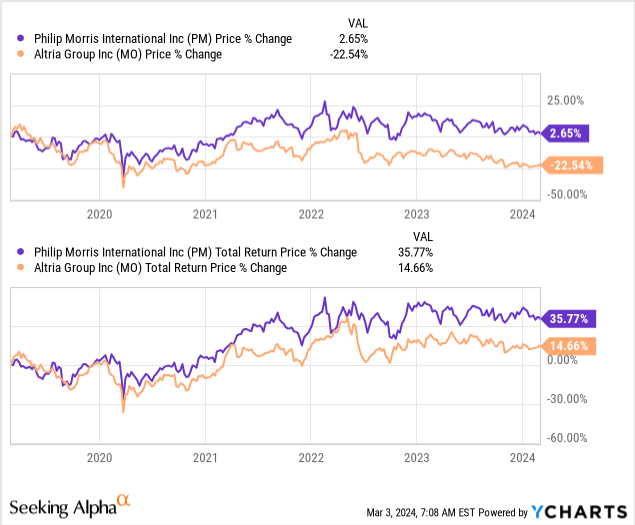

This has all been reflected in the company’s share price and total return performance. Over the last five years, neither has done particularly well, but relatively speaking, PM has done much better.

YCharts

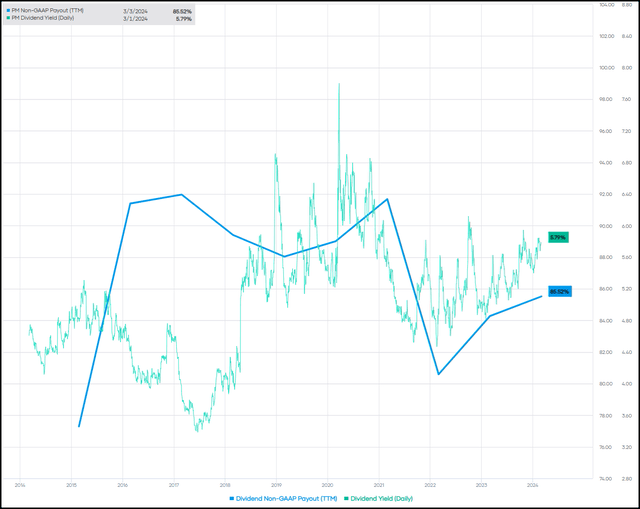

That said, PM’s dividend payout ratio is higher than MO’s, but it also has been trending that way for the last decade. At the same time, PM’s yield is meaningfully lower, and that’s another reflection of the share price holding up better on a relative basis.

PM Yield Vs. Payout Ratio (Portfolio Insight)

NNN REIT 5.48% Yield

Finally, a new name to make it to the discussion portion of this monthly screening article is NNN. However, the REIT is far from new to me, as I hold this as a position in what I consider my Core Portfolio. This is a retail-focused REIT and, along with most REITs, has seen its share price get wrecked due to higher interest rates.

Higher rates mean a higher cost of capital when looking to grow in terms of borrowing and using those borrowings to put to work buying more properties. Further, a lower share price means that issuing new shares to raise capital that way also now becomes less attractive.

As REITs often are associated with a more income-oriented type of instrument due to their requirement to payout 90% of their taxable income, it isn’t just higher borrowing costs impacting them negatively. It is the rates rising on risk-free Treasuries that also make REITs a bit less appealing to some income investors.

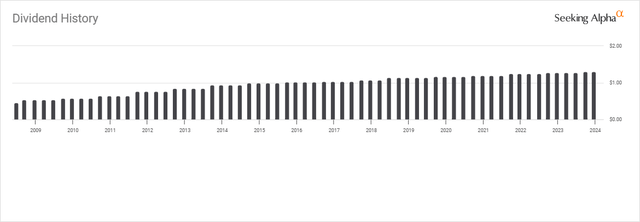

That said, one of the main appeals is a growing dividend that Treasuries just don’t provide. NNN has been able to deliver a growing dividend for over 30 years now. With an FFO payout ratio of 68.7% based on next year’s estimates, coverage seems more than ample. The company also provided AFFO estimates of $3.29 to $3.35, which also bodes well for coverage.

NNN Dividend History (Seeking Alpha)

FFO is expected to grow going forward, albeit at a very slow rate, but that could quickly change when the Fed starts cutting interest rates. We are expected to see rate cuts later in 2024 and 2025, which should help NNN and all REITs. Of course, inflation also remains one of the key risks for this space, which is that inflation will reverse and start trending higher. That would see higher rates for even longer.

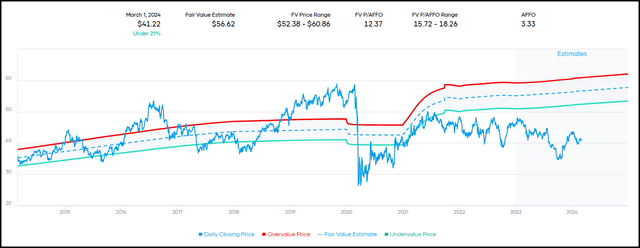

In terms of valuation, NNN is looking quite beatdown and trading well below its fair value price range. However, that’s because it is reflecting those risks of now higher rates and the fact that rates may need to stay higher for much longer.

NNN Fair Value Range (Portfolio Insight)

I’m willing to take that risk and view NNN as an attractive investment opportunity in this market.

Read the full article here