Investment Thesis: I take the view that adidas AG is likely overvalued at this time, given pressure on net sales and a high EV/EBITDA ratio.

In a previous article back in November, I made the argument that adidas AG (OTCQX:ADDYY) needs to see substantial growth in earnings to justify further upside going forward.

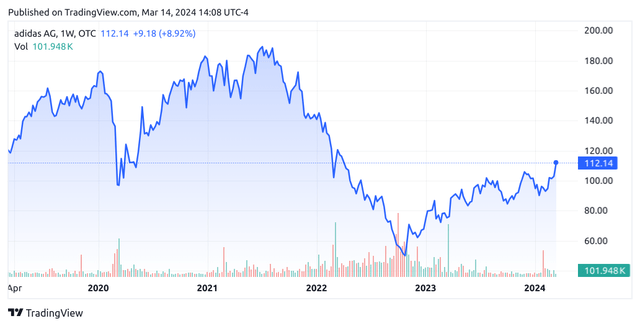

Since then, the stock has ascended to a price of $112.14 at the time of writing:

TradingView

The purpose of this article is to assess whether adidas AG has the ability to see continued growth from here, taking recent performance into consideration.

Performance

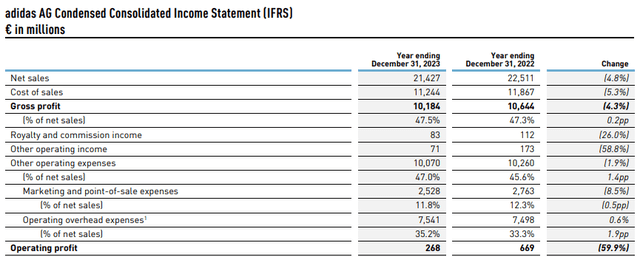

When looking at the most recent earnings results for adidas AG as released on March 13, 2024, we can see that net sales were down by 4.8% as compared to the prior year, while gross profit was down by 4.3%.

adidas AG Press Release: Q4 2023

Earnings per share saw a strong drop to -€0.67 from that of €1.25 per share in 2022, but this was primarily due to a net loss of €58 million in 2023 – which reflected a very high tax rate. For context, net income came in at €254 million in 2022.

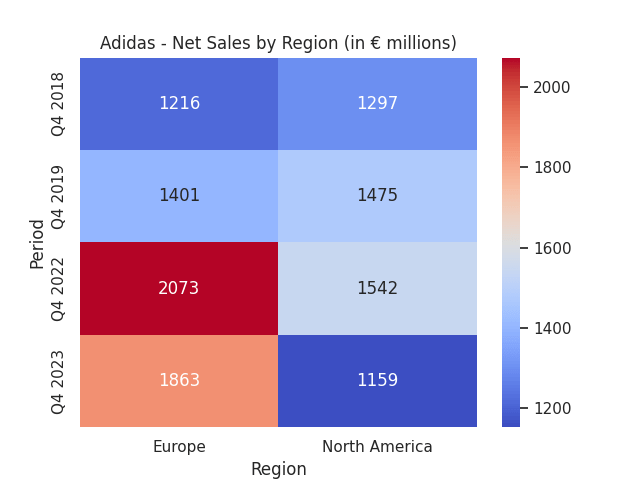

Moreover, when looking at net sales by region for Q4 (with 2020 and 2021 excluded due to the effects of the COVID-19 pandemic), we see that sales across both Europe and North America have fallen as compared to the prior year quarter – down by 10% and 24% respectively.

Figures sourced from Q4 2019 and Q4 2023 adidas AG Press Releases. Heatmap generated by author using Python’s seaborn library.

The reason for the substantial drop in sales across North America relates significantly to the impact of weak Yeezy sales. In my previous article, I had cautioned that, in spite of adidas having managed to sell a significant portion of its Yeezy inventory, the company could still be looking at a €300 million write-off of its remaining inventory.

While adidas has managed to make significant sales of such inventory – operating profit reflects what the company describes as a “double-digit” million euro amount of Yeezy related inventory write-offs. Going forward, adidas expects to sell its remaining inventory “at cost,” which would be expected to result in sales of €250 million in 2024, which is substantially lower than that of the €750 million recorded for 2023.

From a balance sheet standpoint, we can see that while the quick ratio is up slightly from that of last year – the same still remains below 1 owing to a decrease in total current assets as well as inventories still remaining above that of 2021 levels in spite of the decrease that we saw over the last year:

| Dec 2021 | Dec 2022 | Dec 2023 | |

| Total current assets | 13944 | 11732 | 9809 |

| Inventories | 4009 | 5973 | 4525 |

| Total current liabilities | 8965 | 9257 | 8043 |

| Quick ratio | 1.11 | 0.62 | 0.66 |

Source: Figures sourced from adidas AG Q4 2021, Q4 2022, and Q4 2023 Press Releases. Figures are provided in € millions, except the quick ratio. The quick ratio was calculated by the author.

Moreover, when looking at long-term debt to total assets, we can see that while long-term borrowings have seen a fall over the last year, this was accompanied by a fall in total assets over the same period, which resulted in little change to the long-term debt to total assets ratio.

| Dec 2021 | Dec 2022 | Dec 2023 | |

| Long-term borrowings | 2466 | 2946 | 2430 |

| Total assets | 22137 | 20296 | 18020 |

| Long-term debt to total assets ratio | 11.14% | 14.52% | 13.49% |

Source: Figures sourced from the adidas AG Q4 2021, Q4 2022, and Q4 2023 Press Releases. Figures provided in € millions, except the long-term debt to total assets ratio. Long-term debt to total assets ratio was calculated by the author.

My Perspective and Looking Forward

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, it is evident that net sales have come under significant pressure in the most recent earnings quarter.

Moreover, adidas AG is now expecting that the remaining Yeezy inventory will be sold at cost throughout 2024, which means that we could see further headwinds to growth in the short to medium-term.

In particular, I take the view that, in spite of the recent growth that we have seen in the stock, it is quite possible that adidas AG is overvalued at this time.

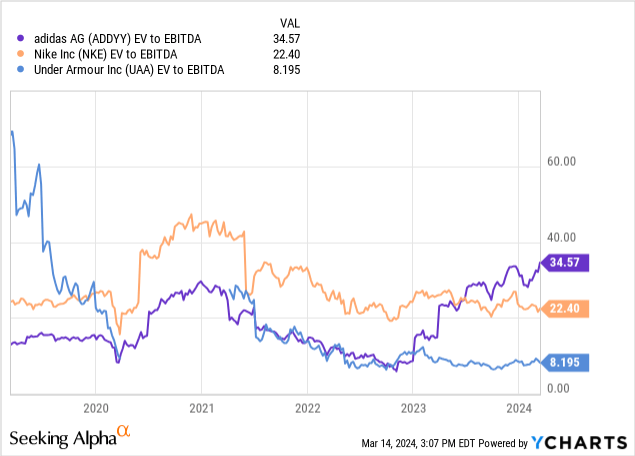

Here is a range for the EV/EBITDA ratio and EBITDA per share since September 2020:

| Date | EV/EBITDA | EBITDA per share |

| 14/09/20 | 25.84 | 6.37 |

| 14/03/21 | 28.65 | 6.21 |

| 14/09/21 | 15.95 | 10.55 |

| 14/03/22 | 11.3 | 9.534 |

| 14/09/22 | 8.311 | 8.317 |

| 14/03/23 | 15.42 | 5.566 |

| 14/09/23 | 26.9 | 3.654 |

| 14/03/24 | 34.57 | 3.315 |

| Median | 20.895 | 6.29 |

Source: P/E ratio and EPS figures sourced from ycharts.com. Median EV/EBITDA and median EBITDA per share were calculated by the author.

When looking at the above, we can see that the current ratio of 34.57x is higher than the median of 20.895x over the given period. In this regard, I take the view that if the stock were to tend back towards the median EV/EBITDA ratio of 20.895x and EBITDA per share were to remain at the current level of $3.315, then $69.26 would represent fair value for the stock at this time (20.895*3.315).

Additionally, we can see that since the beginning of 2023, adidas AG has gone from having the lowest EV to EBITDA ratio as compared to NIKE (NKE) and Under Armour (UAA) to having the highest ratio:

YCharts

As mentioned, we have seen a significant rise in price since last November. One of the reasons for the growth in price was due in significant part to a rally in the stock back in January as a result of a ‘reassuring’ pre-close earnings call ahead of full-year results this month. Specifically, shares were up by 4.8% as a result of the call – and while the specifics of the pre-close earnings call are not clear, the rally in the stock indicates that investors were clearly expecting encouraging news with respect to growth in net sales and earnings for this quarter.

However, this has not been the case, and we have seen the company come under pressure on both of these metrics.

From this standpoint, I take the view that the market is likely overvaluing the stock at this time and adidas may not be able to sustain the current price of $112 without seeing a significant rebound in earnings growth.

Risks

In terms of the potential risks to adidas AG at this time, we have seen that the Yeezy brand was clearly an important part of the company’s sales strategy – particularly across North America. There is a longer-term risk that once the brand has sold off its remaining inventory, the company may have more of a challenge keeping its brand relevant across the North American market.

In this regard, the company is focusing more intently on its reputation for producing quality footwear, with brands such as Samba and Gazelle having sold quite well to date. Additionally, the setting of a marathon world record last year by Tigst Assefa at the Berlin Marathon while wearing the Adizero Adios Pro Evo 1 super shoe has helped to substantially boost brand awareness of both this and other offerings across the adidas footwear line – and this year will be a significant indicator as to whether the company can ultimately boost sales of its broader footwear offerings following a significant dependence on the Yeezy brand.

Specifically, the United States market will be quite important in this regard, as adidas could have the capacity to position its footwear brands to be of superior quality to that of Nike, in spite of the fact that the latter company has a much stronger brand presence in the USA. This year will be a significant telling point as to whether we can see a significant boost in demand for adidas footwear brands across this market – with the Adizero Adios Pro Evo 1 super shoe having significantly raised brand awareness for the company. As we head into the summer months, the company could have the capacity to see a significant boost in footwear sales owing to seasonal demand.

However, if we ultimately see that sales of such brands remain lower than that historically seen by the Yeezy brand, then this may give investors pause.

Conclusion

To conclude, adidas AG has seen pressure on net sales in the most recent quarter. While the company has the potential to rebound and bolster its reputation across its broader array of footwear brands, I take the view that the stock still remains overvalued at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here