In today’s very expensive stock market, investors are demanding terrific results to justify valuation premiums; and in the tech sector where headcount reductions and sales slowdowns have become the norm rather than the exception, stocks have seen wild swings in in the Q4 earnings season.

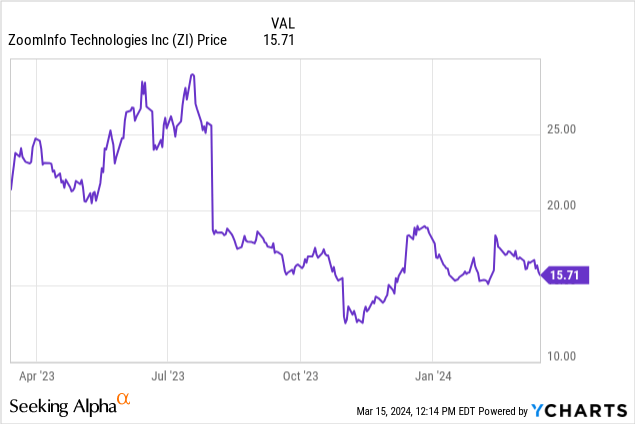

ZoomInfo (NASDAQ:ZI), a sales software platform that helps companies with lead generation, has seen its share price slide more than 10% this year, even as the broader market has risen almost that magnitude in reverse. The question for investors now is: is there any salvage value left in this name?

Minimal Growth Expected For FY24 Underpins Tremendous Risk For A Fallen Growth Star

I last wrote a bearish note on ZoomInfo in December, when the stock was trading closer to $18 per share. Since then, ZoomInfo has released dismal Q4 results that showed continued deceleration on the top line: while also indicating a very minimal growth path for the current year. And despite the slightly cheaper share price since the end of last year, ZoomInfo still isn’t enough of a value stock to warrant the additional risk. All in all, I remain bearish here.

As a reminder to investors who are newer to this name, here are the core red flags for ZoomInfo:

- Overexposure to the software industry. ZoomInfo’s core business is in selling to fellow software companies, which makes it even more exposed to the current macroeconomic situation which has deeply routed tech companies.

- Almost no growth left in the engine ZoomInfo is expecting only single-digit growth in FY24. After dramatically rising in the pandemic, ZoomInfo’s growth has decelerated sharply – exhibiting a lumpy growth trend versus the more stable growth patterns that mature, higher-quality software companies have been able to manage.

- Very competitive landscape for CRM software. ZoomInfo is one of many CRM-style products and competes with much more recognizable names such as Microsoft’s (MSFT) LinkedIn and Salesforce (CRM). These competitors also have the capability to cross-sell CRM solutions with other platform products, while ZoomInfo stands alone as its own solution. In an environment where many IT departments are trying to consolidate vendors and limit budgets, this may hurt ZoomInfo more than in the pre-pandemic period.

- Large debt load. Unlike many tech peers, ZoomInfo is in a net debt position, and its floating debt structure exposes it to high interest costs.

- Not making progress on profitability: Despite a slowdown in growth rates, ZoomInfo has not made much headway in turning its focus to improving operating margins – despite laying off ~120 employees in FY23.

From a valuation standpoint: at current share prices near $16, ZoomInfo trades at a market cap of $5.95 billion. After we net off the $529.3 million of cash and $1.23 billion of debt on ZoomInfo’s most recent balance sheet, the company’s resulting enterprise value is $6.65 billion.

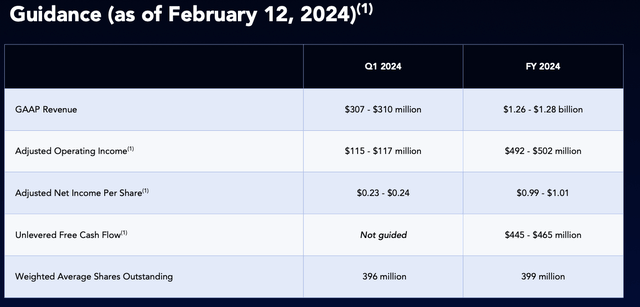

Meanwhile, for the upcoming fiscal year FY24, ZoomInfo is guiding to just $1.26-$1.28 billion in revenue, representing just 2-3% y/y growth; and a midpoint pro forma EPS of $1.00.

ZoomInfo outlook (ZoomInfo Q4 earnings deck)

This puts ZoomInfo’s valuation multiples at:

- 5.2x EV/FY24 revenue

- 15.7x FY24 P/E

Certainly not an expensive valuation by any means, but not cheap enough to justify such poor fundamental performance. Steer clear here and invest elsewhere.

Q4 Download

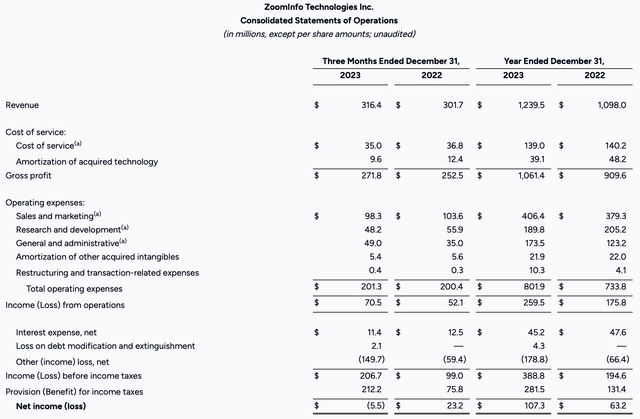

Let’s now go through ZoomInfo’s latest quarterly results in greater detail. The Q4 earnings summary is shown below:

ZoomInfo Q4 results (ZoomInfo outlook)

ZoomInfo’s revenue grew only 5% y/y to $316.4 million, ahead of Wall Street’s expectations of $310.5 million (+3% y/y) but sliding versus 8% y/y growth in Q3.

ZoomInfo’s growth slowdown has been proportional to the challenges seen in the software sector, which is ZoomInfo’s biggest sales segment. Software companies devote a lot of their opex to hiring sales teams – which, in turn, use CRM engines like ZoomInfo to chase leads. Over the past year, austerity measures in Silicon Valley have greatly trimmed sales headcount – which has hurt ZoomInfo’s own sales in a vicious cycle. ZoomInfo’s leadership, however, has noted that non-software sales have held up better. Per CEO Henry Schuck’s remarks on the Q4 earnings call:

That being said, since early 2022, we have been managing through the challenges of a weaker macro environment, which has particularly impacted the software industry, our largest vertical.

Overall, software has contracted while all other industries are growing. New business has performed well while NRR has declined as the pullback in the software vertical has disproportionately impacted our existing customer base, resulting in fewer upsells and more seat downsells. However, our demand and sales velocity for new business was our best ever. We closed the most new logos on record in Q4. Our in-month create and close win rate for December was the highest we’ve ever had in a single month, and our median sales cycle shortened significantly year-over-year.”

Notably: ZoomInfo reported that net revenue retention was 87% in FY23, indicating that the company has suffered more churn and downsells/seat contraction than it has achieved seat expansion and upgrades. This is a rarity in the software sector, many of which are still reporting NRR above 100% in spite of the tougher macro climate. Given ZoomInfo’s own investment into its sales force to close recurring-revenue deals, it does count on strong expansion trends to drive operating leverage over the long term. The company’s FY24 guidance assumes that NRR trends do not improve this year; while the low end of the range assumes that it declines.

Another red flag in CFO Cameron Hyzer’s remarks on the Q4 earnings call: the company has faced a collections issue in the smaller segments of its business.

This part of our business grew approximately 15% in Q4 relative to last year. Write-offs continue to impact us in Q4 as many of our smallest customers remain to challenge in their ability to pay. In addition to the increase in bad debt associated with write-offs, we’ve experienced a similarly sized impact to revenue. Our expectation is that the impact from write-offs will attenuate over time as our mix of revenue continues to shift to enterprise customers and we roll out more product-led functionality for smaller customers, which is paid at checkout.”

Deleverage from declining expansion trends and poorer sales also reduced ZoomInfo’s adjusted operating margins to 40%, a two-point decline from 42% in the year-ago Q4.

Key Takeaways

ZoomInfo has a very challenging setup heading into FY24, with declining expansion trends, weakness in its most important sales sector, and accruing uncollectible receivables from smaller clients. With seemingly no light at the end of this tunnel, I continue to be inclined to stay away from this name.

Read the full article here