Summary

In my previous coverage on Bumble (NASDAQ:BMBL), I recommended a buy rating as I expected the business to continue growing for the foreseeable future, and even when attaching a conservative multiple, the upside was attractive. This post is to provide an update on my thoughts on the business and stock. I am downgrading my rating to a hold rating as I await more clarity on the growth trajectory of the business. The recent performance demonstrated really poor execution, which basically forces me to revise my positive view of the business. Alongside the weak macro environment, I am now a lot more uncertain about the near-term performance.

Investment thesis

BMBL reported 4Q23 revenue of $274 million, growing 13% vs. 4Q22, which was in line with management guidance for a $272 to $278 million guide. The same was for adj. EBITDA, which saw $74 million, growing 22% with a margin of 27%, coming in line with guidance for $72 to $75 million. The focus was on Bumble App revenue, which grew by 16% to $221 million, driven by net adds of 83k but offset by a 4% decline in ARPPU (average revenue per paying user). Badoo & Other Revenue saw 4% growth to $53 million. In my opinion, BMBL results were mixed, with the negatives overwhelming the positives. The weakness in performance and uncertainty in terms of guidance are the key reasons for my downgrade to a neutral rating.

On the positive side of things, Bumble net adds of 83k vs. 3Q23 showed that there is still room for adoption to go up. The positive comment around Badoo was also very helpful in shaping the growth expectations for this part of the business. Management has stated their intention to stabilize and resume growth through an improved user experience and a brand refresh. Lastly, BMBL did much better than expected on the profitability front (Adj EBITDA), indicating that the previous implementation of the transformation plan had progressed really well (now expecting $55 million of annualized savings) and management is not losing focus on managing costs.

On the negative side of things, bumble brand revenue growth has decelerated a lot, from 23% y/y in 3Q23 to 16% y/y in 4Q23. While some parts of the weakness can be attributed to macro weakness (consumer spending less, etc.), when compared to Tinder’s performance (4Q23 saw 50 bps acceleration from 3Q23 to 11% y/y growth), it is very concerning as it suggests that Bumble App is losing a lot of momentum. Notably, this deceleration occurred despite BMBL rolling out new features, indicating that the contribution was not meaningful at all; in fact, it worsened the customer-user experience. This also makes me cast doubt on the new CEO’s (who was supposed to be someone with experience in software) ability to drive innovations.

Over the past 18 months, we launched a number of new features in Bumble app, which, while individually promising, have promising having aggregate slowed the overall app performance and cluttered the user experience. 4Q23 earnings results call

I guess the biggest disappointment (which was supposed to drive growth) was that the high-end subscription tiers Premium Plus and Best Bees contributed less than anticipated. This is huge because it implies that the market is not willing to pay for that price level, essentially putting a “cap” on the pricing that BMBL can achieve over time. It also suggests that BMBL does not have a strong growth catalyst in the near term that can accelerate growth. The take-up rate was so bad that management is planning to relaunch the brand. This relaunch, while I think it is strategic (since it is not effective), also meant that BMBL would see further revenue deceleration in the near term. In addition, Bumble Brand has seen a slower start to the year in the US as the new top of the funnel remains soft, suggesting that quarter-to-date performance has not shown any signs of positive inflection.

Additionally, our new pricing tier introduced last December, Premium Plus, has also not had a clear enough product market fit. These are things we strongly believe are in our control to solve, and we’re doing so with four major steps. 4Q23 earnings results call

In terms of Bumble App’s guidance, management is calling for 1Q24 revenue growth of 9–11% y/y, which is reflective of the weak trends in the US. When compared to BMBL historical performance (1Q24 growth is expected to be the lowest since the company went public), I think this guide will also cause the stock to be at best rangebound in the near term as investors are likely to remain concerned about near-term growth outlook of the Bumble App.

All in all, I am just very disappointed with the execution so far, and the uncertain near-term outlook forced me to view the stock through a conservative lens.

Valuation

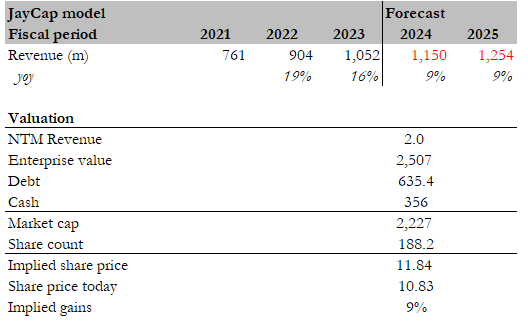

Own calculation

My target price for BMBL based on my model is $11.84 (or just 9% upside). My growth assumptions have been significantly downgraded from 18% to 9% to reflect the weakness in growth ahead (aligning with management guidance for 9% growth in FY24). The weak macroenvironment, poor execution in new feature implementation, rollback in premium tiers, and signs of weak momentum led me to take a conservative stance on modeling the business. The lower growth outlook also warrants a lower multiple than what I assumed previously. My thinking is that the stock is going to stay rangebound until investors gain more confidence in the growth trajectory (when will things recover, given that the Bumble App is expected to see further growth deceleration in 1Q24?). Hence, I am assuming the same multiple that the market is attaching to the business today (2x forward revenue).

Conclusion

My buy rating is now downgraded to a hold. Recent performance highlights concerning execution issues, particularly with new features hindering user experience and premium tiers falling short. This, coupled with a weak macro environment and decelerating Bumble App growth, suggests a very uncertain near-term outlook. Management’s guidance for 1Q24 reflects these headwinds, with the Bumble App revenue growth expected to be the lowest since BMBL went public. My take is that the stock needs a clearer picture of the growth trajectory before any positive sentiment will take hold.

Read the full article here