Elevator Pitch

I rate Full Truck Alliance Co. Ltd. (NYSE:YMM) stock as a Hold. Previously, I wrote about YMM’s near term financial prospects and its long term financial targets in my June 20, 2023 initiation article.

My attention turns to Full Truck Alliance’s latest quarterly results in the current update. YMM’s actual Q4 2023 operating income failed to meet the market’s expectations due to higher-than-expected sales and marketing costs. The company’s sales and marketing expenses could remain elevated going forward, even though its Q1 2024 revenue guidance was favorable. Taking into consideration both its top line growth guidance and its cost outlook, I leave my Hold rating for Full Truck Alliance unchanged.

YMM’s Q4 Operating Profit Miss Was Below Consensus Estimate

On March 7, 2024 before the market opened, Full Truck Alliance revealed its financial performance for the fourth quarter of 2023 with an earnings press release.

The company’s normalized operating profit decreased by -13% QoQ from RMB458.5 million for Q3 2023 to RMB398.8 million in Q4 2023 as disclosed in its earnings release. More importantly, Full Truck Alliance’s latest fourth quarter normalized operating income came in -13% lower than the market’s consensus forecast of RMB458.3 million (source: S&P Capital IQ).

Separately, YMM’s top line expanded by +25% YoY and +6% QoQ to RMB2,408.0 million in the final quarter of the previous year. In its earnings release, Full Truck Alliance cited “a rapidly growing user base and order volume” as the key reasons for the increase in its top line. The company had achieved a +5% revenue beat for Q4 2023 as compared to the sell side’s consensus sales estimate of RMB2,303.0 million as per S&P Capital IQ data. This suggests that Full Truck Alliance’s Q4 2023 operating income miss wasn’t driven by below-expectations revenue growth.

It was higher-than-expected expenses that led to Full Truck Alliance’s actual fourth quarter operating profit falling short of the market’s consensus projection. Specifically, YMM’s sales and marketing costs rose by +50% YoY and +45% QoQ to RMB421.0 million in the last quarter of the prior year. As a result of the sharp increase in sales and marketing expenses, the company’s Q4 2023 normalized operating margin of 16.6% turned out to be -3.3 percentage points below the analysts’ consensus operating margin forecast of 19.9% (source: S&P Capital IQ).

Full Truck Alliance explained at the company’s Q4 2023 earnings call that higher “investments in marketing to acquire new users” and “brand promotion to increase our brand awareness” contributed to the substantial growth in sales and marketing costs.

Good Q1 Revenue Guidance Was Overshadowed By Unfavorable Cost Outlook

YMM is expecting to deliver a top line of RMB2,135 million for Q1 2024 as per the mid-point of its guidance as indicated in its earnings release. The company’s revenue guidance implies that Full Truck Alliance’s sales are projected to increase by +25% YoY in Q1 2024, which is the same pace of YoY revenue expansion that it registered for Q4 2023.

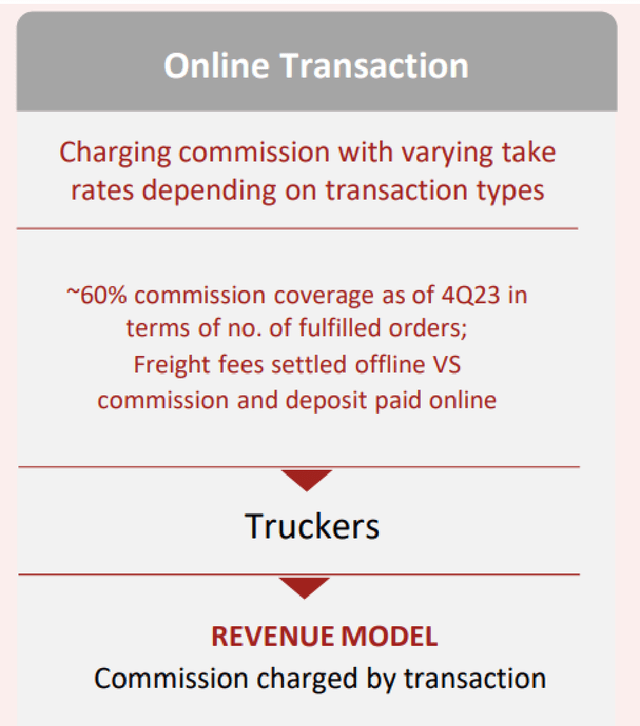

Transaction commissions were the fastest growing revenue stream for YMM in Q4 2023, and this is likely to be the company’s key top line driver this year.

In the fourth quarter of last year, the company’s transaction commissions grew by +44% YoY. In comparison, Full Truck Alliance’s revenue generated by freight brokerage services and freight listing services increased by +19% and +10%, respectively for the recent quarter on a YoY basis. Looking ahead, Full Truck Alliance guided at its Q4 earnings briefing that its 2024 “commission revenue growth” could be “potentially surpassing the growth rate that we achieved in the past year (2023)” considering that its “current commission rates are very conservative.”

Full Truck Alliance’s Transaction Commissions Revenue Model

YMM’s Investor Presentation Slides

On the flip side, elevated operating costs might continue to weigh on Full Truck Alliance’s future profitability.

At its fourth quarter results briefing, YMM outlined its expectations that it will “increase our user acquisition efforts (for 2024) in comparison with last year.” The company also indicated at its latest quarterly earnings call that “in the longer run, we anticipate a continued increase in sales and marketing expenses aligned with the expansion of new business ventures.”

Considering the company’s below-expectations Q4 2023 operating income and its forward-looking management commentary, it is reasonable to be concerned that YMM’s actual operating profit margins for short term and long run might not be as good as what investors are hoping for.

Actual Share Repurchases Fell Short Of Expectations

In its Q4 2023 earnings release, Full Truck Alliance disclosed that it spent approximately $200 million on share buybacks between early-March 2023 and early-March 2024. In other words, YMM’s historical one-year buyback yield was around 3%, which I deem to be decent but unappealing.

Notably, the company only completed 40% of its one-year $500 million share buyback plan that was initiated in mid-March last year.

Given that the company had cash and investments of $3.9 billion (or roughly 60% of market capitalization) on its balance sheet as of end-2023, it is realistic to think that Full Track Alliance has the financial capacity to be even more aggressive with its share repurchases.

More significantly, Full Truck Alliance’s conservatism with regards to buybacks might send the message that the stock’s current valuations at 12.9 times (source: S&P Capital IQ) consensus next twelve months’ normalized P/E are reasonable.

Concluding Thoughts

Full Truck Alliance’s prospects are mixed, which warrants a Hold rating.

On one hand, the company’s Q1 2024 top line growth guidance is good. YMM anticipates that it can record a strong +25% YoY increase in revenue for the first quarter of this year.

On the other hand, YMM expects to invest more in sales and marketing going forward. This indicates there is a meaningful risk that Full Truck Alliance’s actual Q1 2024 and full-year 2024 operating income and operating margins may not meet the analysts’ expectations.

Read the full article here