Synopsis

Sonoco Products Company (NYSE:SON) specializes in sustainable packaging products worldwide and operates in three segments. Consumer Packaging, Industrial Paper Packaging and Others. Historical revenue growth has been increasing year-over-year but ended with negative growth in 2023. Despite all of that, margins have been robust in 2022 and 2023. The paper & plastic packaging products and materials industry has largely been affected by lingering inflation and destocking. But in the longer term, we can expect this industry to benefit from the demand for sustainable packaging and expanding e-commerce activity. My conservative relative valuation model brings me to a modest 7% upside potential, which lacks sufficient margin of safety. Therefore, I am recommending a hold rating.

Historical Financial Analysis

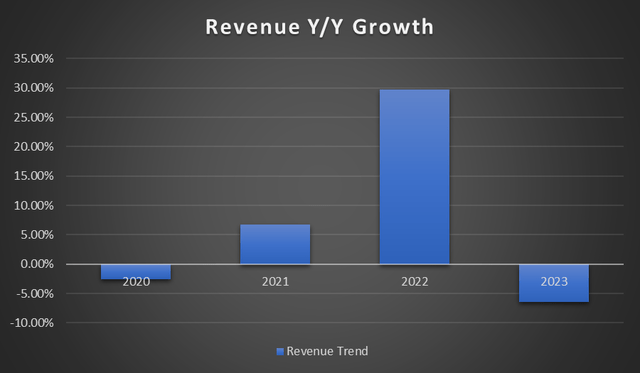

Over the last four years, revenue growth has shown a rising trend but ended with a drop in 2023. It has decreased by 6.47% year-over-year in 2023, generally due to low volume, even though acquisitions’ revenue has offset it partially. Net sales increased by 30% year-over-year in 2022 due to strong performance and the accretive impact of Metal Packaging acquisition, even though it was partially offset by lower volume in the industrial segment.

Author’s Chart

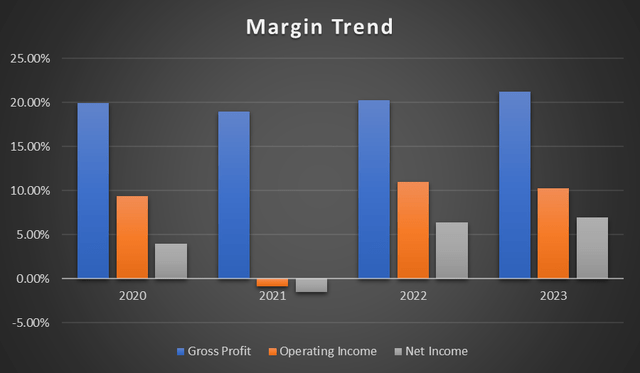

In terms of profitability, it has been robust throughout the years, except in 2021. The negative net income and operating income in 2021 are largely due to its pension settlement charges and after-tax loss upon its early extinguishment of debt. In 2022 and 2023 onwards, its margins have recovered and slightly surpassed 2020’s level. Overall, SON’s margins were robust throughout the year, despite fluctuating revenue growth.

Author’s Chart

Segment Overview

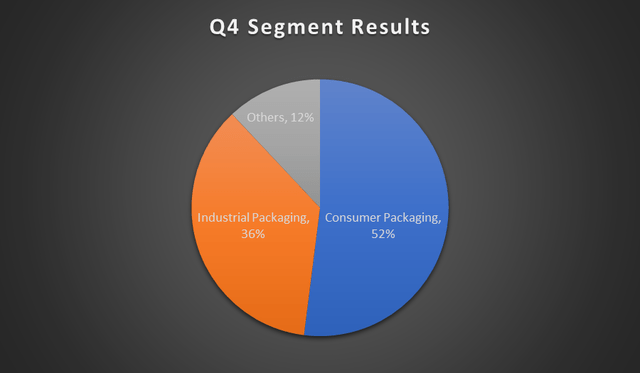

Author’s Chart

Consumer packaging segment accounts for 52% of Q4 net sales; 36% comes from industrial packaging, while the remaining 12% falls under Others. Consumer packaging segment consists of ~80 plants worldwide as of December 2023. Their products include rigid and flexible packaging, mainly targeted at the consumer staples markets, focused on food, drinks, household, and personal products. Rigid packaging [paper, plastic, and metal] consists of thermoformed plastic trays and enclosures, mainly used for fresh produce, pre-packaged foods, and condiments. Flexible packaging is mostly plastic packaging for food and personal products. In 2023, its rigid paper containers were the firm’s top revenue-producing groups, representing 21% of year-ended net sales. Industrial paper packaging, on the other hand, serves its market via ~190 plants across 5 continents. Their products comprise paperboard tubes, cores, reels, spools, uncoated recycled paperboard, and many others. They provide for multiple end markets, including consumer staples, consumer discretionary, and industrials. Tubes and cores products come in second in the largest revenue-generating group of products, accounting for about 19% of its year-ended net sales.

4Q23 Segment Performance and 2024 Outlook

Consumer packaging’s net sales were down 3% in 4Q23 as compared to 4Q22. Volume has continued to be impacted by lower consumer purchases for food and household goods due to retail price inflation. The company attributes the decline in volume to being caused by customer retail destocking over the year. In terms of operating profit margin, it was flat year-over-year as lower volume was offset by pricing initiatives.

For industrial packaging, net sales were down by 1% in 4Q23 year-over-year. This segment’s weaker performance can be attributable to weakness in demand, lower pricing, and unfavorable volume/mix. Operating profit has fallen by 3% to 10% from the previous period’s 13% due to low volumes and price/cost pressures.

For 2024, management has expected the first quarter’s volume to continue to be flat and anticipates low single-digit growth for the full year due to lower consumer spending as a result of retail price inflation. Industrial segment volumes are expected to see limited recovery, with ongoing challenges from higher input costs and index-based pricing. On the bright side, Fitch Rating anticipates a falling trend for the price of raw materials such as plastic resin, metal, and other key materials from its pandemic high. This will at least allow for some improvement in SON’s profit margins.

Lingering Inflation and Destocking

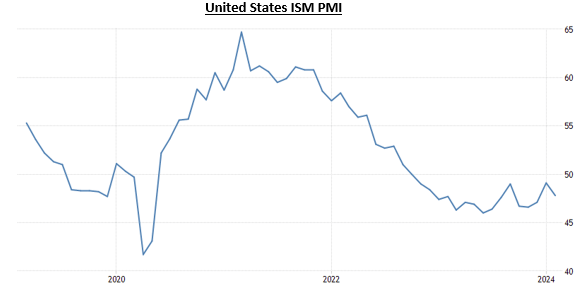

Although destocking generally started during the COVID pandemic supply chain disruption, this issue has continued to impact the industry in 2023, and it is evident in both SON’s consumer and industrial segments. Customers continue to manage their existing inventories more closely as consumer demand from inflationary pressure slowed, which impacted packaging sales as a result. Most firms would predict the destocking to wind down, but the effect has stayed longer than expected. Even if we can expect volume to improve modestly in 2024 as firms settle most of their inventory overhang, we need to remain cautious as weaker consumer demand may still raise an issue due to high costs from inflationary pressure. It is expected that real consumer spending growth will fall from 2.2% in 2023 to 1.8% in 2024 and 1.6% in 2025. This is also the case for industrial demand, as the PMI is still under 50, implying weak industrial demand.

Trading Economics

Future of Packaging

Putting aside the challenges faced in the packaging industry, the rising trend in e-commerce activity is an opportunity for SON. Global industrial packaging market is expected to hit $132.80 billion by 2032, reflecting a 6.8% CAGR from 2022. This is largely fueled by the rapidly expanding e-commerce activity and the growing needs in supply chains. In addition, sustainability is a notable trend in packaging, and it is estimated that 70% of consumers would prefer to pay more for sustainable packaging solutions. SON has the commitment and expertise to produce sustainable packaging serving multiple end-markets. With a rapidly expanding market for online retailing, consumers are buying more online, and this trend will continue through 2028. This will translate into a rising demand for solutions for corrugated packaging. Not to mention, there is a rising trend in the consumption of food and beverages on-the-go. This would lead to rising demand for convenient and portable packaging, which benefits SON’s flexible packaging segment.

Acquisition of a leading flexible packaging firm in Brazil

SON’s has recently completed a ~$59.2 million acquisition of Inapel, an industry-leading flexible packaging firm, in December 2023. It is a producer of mono- and multilayer materials, primarily for flexible packaging. This strategic move will add to SON’s existing operations in Brazil, where its Sonoco Graffo site has been one of the biggest converters of foil-based flexible packaging and one of the leading manufacturers of high-quality rotogravure printing and lamination. This strategic decision will expand its presence in Latin America and its flexible packaging capacity to address the growing demand of new and existing consumers. Not to mention its $330 million acquisition of RTS Packaging in September 2023, the acquisition bolsters SON’s position in the field of producing 100% recycled fiber-based packaging in the consumer market in wine, spirits, food, and healthcare. This allows SON to expand its presence across the US, Mexico, and South America.

Relative Valuation Model

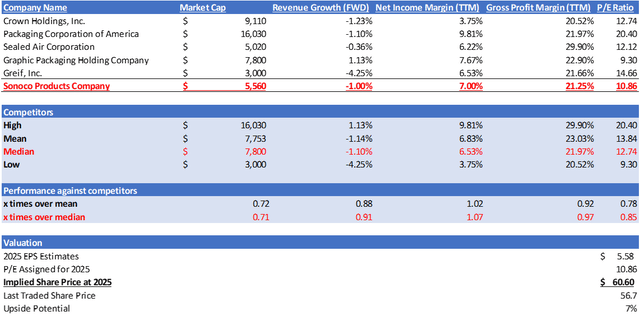

Author’s Valuation

SON is in the paper & plastic packaging products and materials industry. Across its competitors, the majority of its FWD revenue growth is negative, as the industry has been facing headwinds from weaker consumer demand and inflationary pressure. However, SON’s revenue growth stands at -1.00%, slightly lower than its peers’ median. Moving on to its profitability, SON’s gross profit margin of 21.25% is slightly lower than the median but has a higher net income margin of 7.00%, higher than its peers’ median.

Currently, SON’s forward P/E ratio of 10.86x is lower than its peers’ median of 12.74x. Given that its forward revenue growth and net income are mostly in line with its peers, it should be trading at its peers’ median P/E ratio. However, given the industry’s headwind, I argue that it is prudent to apply a lower P/E ratio in order to stay conservative. Therefore, by applying 10.86x to its 2025 EPS market estimate, I have arrived at a target price of $60.60, which represents a modest 7% upside potential.

Risk

The upside risk to my hold rating would be in relation to a turnaround from destocking and inflationary pressures. If destocking were to end sooner than expected or inflation were to cool down, these would generate demand for the packaging industry. In this scenario, if SON’s were to report a better than expected result in the upcoming quarters, it might lead to an upward revision to its forward revenue growth rate, which is currently negative. Under a grueling macro environment with high interest rates, there were limited mergers and acquisitions, despite SON’s recent acquisition of RTS Packaging and Inapel. As the market is anticipating 3 to 4 rate cuts in 2024, we may expect larger deals to go through and help bolster its negative revenue growth.

Conclusion

In summary, despite the decline in revenue growth in 2023 due to low volume, the acquisitions have helped to mitigate the impact, and the company has demonstrated resilience through a robust profitability margin. SON has faced pressures from destocking and inflation, but strategic pricing initiatives and the potential for falling input costs provide a hopeful outlook for improvement in profit margins. In the longer term, the rapidly expanding e-commerce activity and a growing consumer preference for sustainable solutions present a significant opportunity for SON to bolster its position in the industry. My relative valuation has brought me to a modest 7% upside, but this lack of margin of safety has led me to recommend a hold rating for SON at the moment.

Read the full article here