Note:

I have covered SEACOR Marine Holdings Inc. or “SEACOR Marine”(NYSE:SMHI) previously, so investors should view this as an update to my earlier articles on the company.

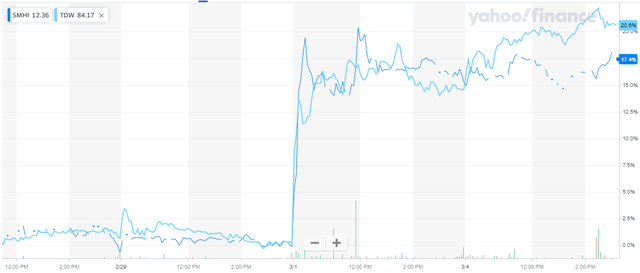

Last week, shares of leading offshore support vessel providers Tidewater (TDW) and SEACOR Marine Holdings rallied on perceived strong quarterly results and a very bullish outlook provided by Tidewater’s management on the conference call:

Yahoo Finance

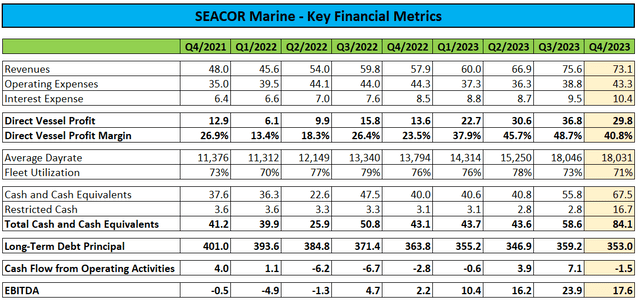

However, adjusted for $18.3 million in gains from the sale of two vessels, SEACOR Marine’s fourth quarter results looked rather unimpressive:

Regulatory Filings

To be fair, sequentially lower results can hardly be considered a surprise as the winter tends to slow down activities in the North Sea as well as offshore wind farm development on the U.S. East Coast.

In addition, the company is using the current winter season for scheduled maintenance and vessel repositioning.

Consequently, Q4 fleet utilization of 71% dropped to its lowest level since Q1/2022 and direct vessel profit margin (the company’s equivalent to gross margin) decreased by almost 800 basis points sequentially to 40.8%.

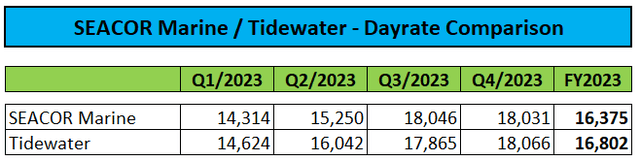

Average dayrate was down just marginally to $18,031, but up by more than 30% year-over-year.

While SEACOR Marine experienced negative free cash flow of $5.1 million for the quarter, the above-discussed vessel sales resulted in cash, cash equivalents and restricted cash increasing to a new multi-year high of $84.1 million.

The company finished the year with long-term debt of $353 million and net debt of $269 million.

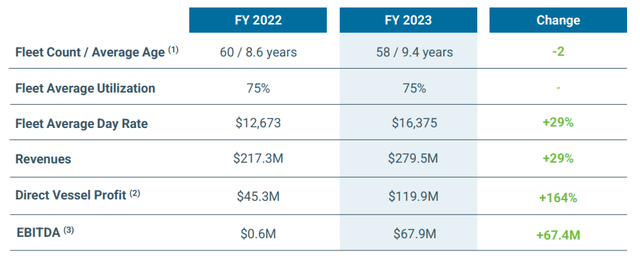

In sum, FY2023 represented a year of major progress for SEACOR Marine with revenues and average dayrates up by almost 30% thus resulting in a 164% increase in direct vessel profit. EBITDA jumped from a measly $0.6 million in 2022 to $67.9 million.

Company Presentation

Most importantly, the outlook provided in the press release was decisively positive (emphasis added by author):

Looking forward, we continue to see strong demand for our fleet in 2024. Recent announcements about project cancellations in the Middle East and U.S. wind are not expected to impact our vessels engaged in those areas, and we see growing demand from other regions.

(…)

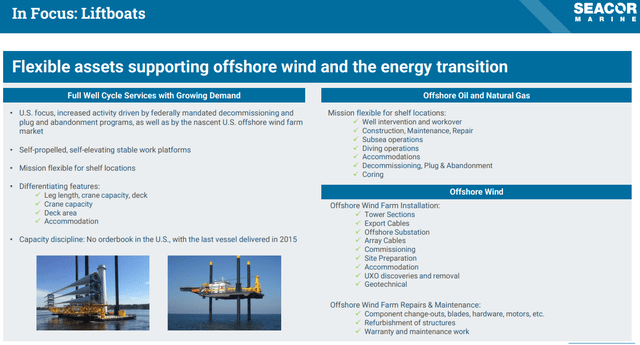

We expect to have all four large liftboats operating for most of 2024, which should be a meaningful contributor to our revenue generating capacity. Tendering activity remains high, particularly in international markets, and we expect to continue to charter vessels at improved terms and pricing as they roll off their contracts.

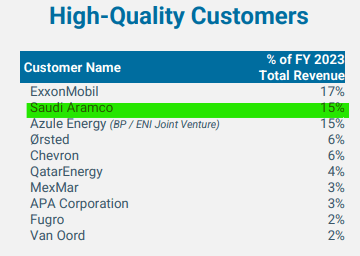

Given the fact that 15% of the company’s revenues last year were derived from Saudi Aramco (ARMCO), market participants likely breathed a sigh of relief after management anticipates no impact from the government ordering Saudi Aramco to maintain daily production capacity at 12 million barrels and no longer pursue an increase to 13 million barrels.

Company Presentation

In addition, following an extended period of out-of-service time for one of the company’s large liftboats, management now expects all four premium liftboats to operate for the majority of 2024.

Company Presentation

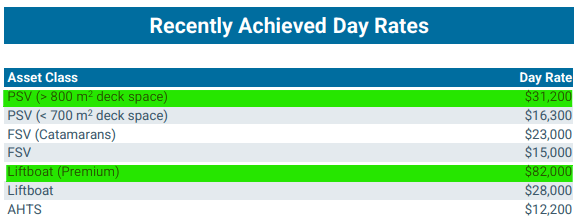

At dayrates above $80,000 and assuming 80% utilization, these vessels could contribute an aggregate $100 million in annual revenue at direct vessel profit margins well north of 50%.

Company Presentation

In addition, large platform supply vessels (“PSVs”) are currently contracted at dayrates above $30,000. SEACOR Marine owns 11 of these premium PSVs of which 7 are equipped with hybrid power systems and the remainder expected to be retrofitted in the next winter season. Again assuming 80% utilization, these vessels could contribute another $100 million in annual revenues.

But as evidenced by the Q4 average dayrate of just above $18,000, the majority of the company’s fleet is still locked into low-margin legacy contracts thus resulting in a more gradual transition to prevailing dayrates.

However, much larger peer Tidewater expects average dayrates to increase by almost 25% on a year-over-year basis and there’s no reason to believe that SEACOR Marine won’t be close behind given the companies’ similar dayrate trajectory in 2023:

Company Press Releases and Presentations

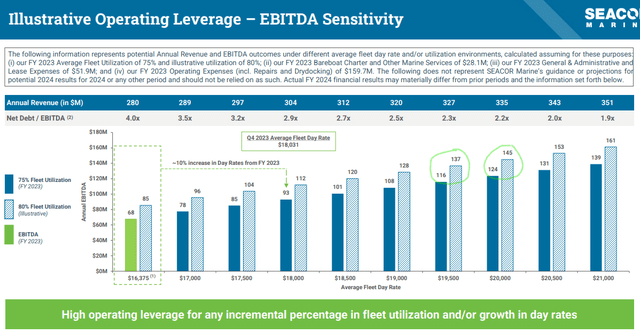

Cautiously assuming the company’s average dayrate to increase by 20% to $19,650 this year would result in EBITDA more or less doubling from 2023 levels, depending on fleet utilization:

Company Presentation

Please note that in contrast to closest peer Tidewater, SEACOR Marine expenses all maintenance and drydocking costs rather than capitalizing parts of them on the balance sheet, which understates the company’s margins and profitability relative to Tidewater.

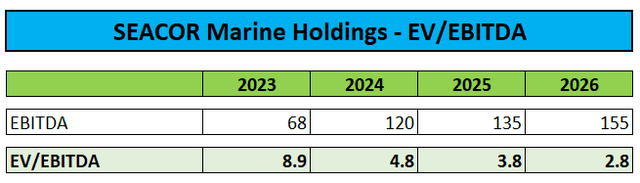

Based on my assumptions outlined above, I have raised my profitability expectations for SEACOR Marine:

Author’s Estimates

On the flip side, I am no longer assigning a premium EV/EBITDA multiple to the company despite EBITDA being negatively impacted by expensed drydocking and maintenance costs relative to Tidewater.

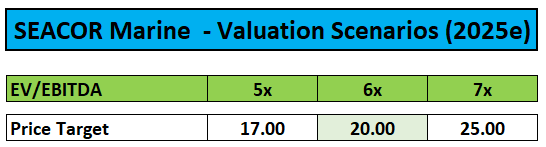

But even at 6x EV/EBITDA, my price target goes from $16 to $20 thus providing for more than 60% upside from current levels and this is still based on rather conservative assumptions:

Author’s Estimates

However, investors should be wary of the rather limited trading volume and the fact that the company recently entered into a $25 million “At Market Issuance Sales Agreement” (“ATM-Agreement”) with a division of B. Riley Financial (RILY). So far, SEACOR Marine has raised just $0.1 million under the agreement at an average price of slightly above $13 per share.

But given the massive upside in the shares, I am raising my rating from “Hold” to “Buy“.

Bottom Line

While SEACOR Marine Holdings’ fourth quarter results benefited from sizeable one-time gains, 2023 as a whole represented strong progress for the company and 2024 should see another sizeable step up in margins and profitability.

Based on expectations provided by larger peer Tidewater on Friday’s conference call, I have increased my EBITDA projections for both 2024 and 2025 and raised my price target for the shares from $16 to $20.

Please note that this target is still based on rather conservative assumptions, with the potential for further upside revisions over the course of this year and going into 2025.

Consequently, I am raising my rating on the shares from “Hold” to “Buy“.

However, investors should be wary of the limited trading volume and potential ATM-Agreement overhang.

Read the full article here